The following article contains thoughts, inferences & opinions that are entirely those of Peter Epstein of Epstein Research. I own none of the stocks mentioned in this article. I have never owned any of the stocks mentioned. I have no prior or existing relationship with any company discussed below. I am not currently, and have never been, short (or long put options) on any company in this piece.

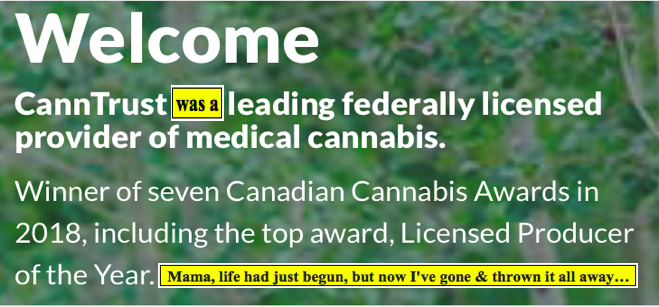

The very unfortunate news about CannTrust Holdings, Inc. (TRST.T) / (CTST.NYSE), mainly that it grew cannabis in rooms that were not sanctioned by Canadian regulatory bodies and allegedly hid plants from inspectors, could be good news for the rest of the industry. Not good because it takes product off the shelves, good because it will force companies to double-down on their compliance, personnel & corporate governance functions.

That can only make the industry more transparent, adding to its legitimacy. Which, in turn, will make cannabis stocks investable to a wider universe of institutions, endowments, pension funds, etc.

CannTrust board should step down….

I imagine the fallout from CannTrust could slow the approval of new licensed producers, which would help existing producers. I say, “remaining” because I don’t see how CannTrust can possibly survive in its current form. To be clear, I don’t mean to say that the stock is going to zero, just that the company should be sold to a larger player, of which at least 9 are potentially good fits.

CannTrust’s assets (real estate, facilities & brands) and sales contracts are now worth considerably more in the hands of stronger company.

Boards of directors have fiduciary responsibilities to their shareholders. CannTrust’s assets are losing value by the day, the Company is losing customers and they’ve lost the “Trust” of investors & regulators. Brands have little value without the trust of consumers!

The board should resign, not one or two members, all of them. I can’t believe none have resigned already! The share price is down 45% and it could get worse the longer the board tries to ride out this unmitigated diaster. Deeper corporate pockets are required to fix this mess.

The board may have no choice. Regulators might tell them they have to sell, or make the road ahead so difficult, that they are effectively forced to sell. This is a black eye on a giant Canadian industry, I think it’s in everyone’s best interest for the scandalous headlines to cease.

Hire bankers, announce an auction, and move on

The board should announce that a sales process has commenced and name the investment banks retained to run the process. What alternative do they have? Seriously, this is the only honorable exit strategy, and it would maximize shareholder value.

Actually, just announce an auction, invite bids from any company or group that can prove it has the financing to back up its bid.… then open up the books for qualified buyers (and their entourages of investment bankers, lawyers & accountants).

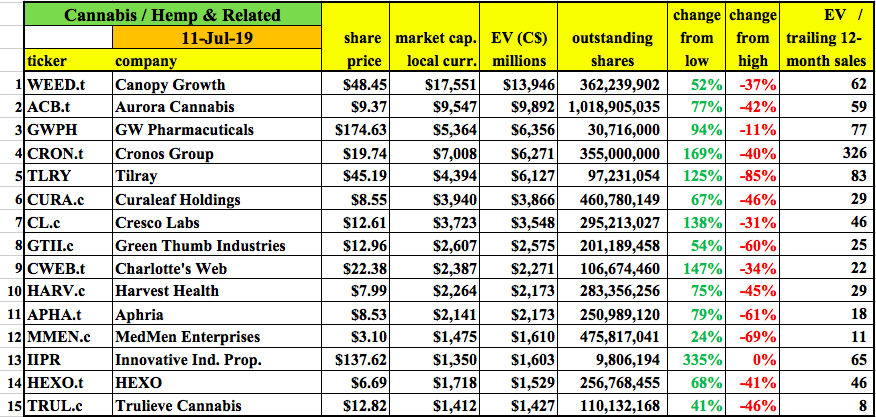

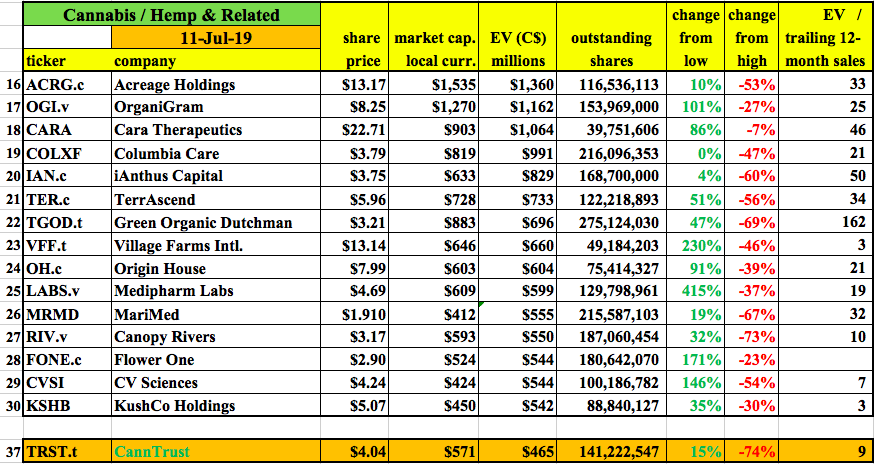

The board owes it to shareholders to do the right thing and hand over the keys. I track 320 #cannabis #hemp #MSO #CBD names in an excel spreadsheet. The top 30 are shown below in 2 charts.

9 large companies are potential acquirers of CannTrust

The 9 companies that should be looking closely at this special situation are, in order of Enterprise Value (“EV“) [market cap + debt – cash], Canopy Growth (WEED.T), Aurora Cannabis (ACB.T), Cronos Group (CRON.T), Tilray, Inc. (TLRY.NASDAQ), Aphria Inc. (APHA.T), Hexo Corp. (HEXO.T), OrganiGram Holdings (OGI.V), TerrAscend Corp. (TER.C) and The Green Organic Dutchman Holdings (TGOD.T).

These 9 range in size from $700 million to nearly $14 billion. Investment banks would be (will be?) fighting over mandates from CannTrust to find a buyer! Just think of the investment dollars that would be thrown at prospective suitors. A 5-year unsecured loan at 5%? Sure, how much do you want, are you sure you don’t need more?

The above-listed names are very much like CannTrust, licensed producers mainly focused on Canada. Could other large players be interested? Good question. Thank you. Among the top 30, I rule out U.S. listed names (except Tilray), like GW Pharmacuticals plc (GWPH.NASDAQ), Innovative Industrial Properties (IIPR.NYSE), Cara Therapeutics (CARA.NASDAQ) and MariMed (MRMD.OTC). For regulatory reasons, U.S. listed companies could have a tough time trying to acquire CannTrust.

Other companies that I cross off the list are the multiple-State operators (“MSOs“). I don’t think they would be interested. They have plenty of exciting growth opportunities and deal flow in the U.S.

That eliminates Curaleaf Holdings (CURA.C), Green Thumb Industries (GTII.C), Harvest Health & Recreation (HARV.C), MedMen Enterprises (MMEN.C), Trulieve Cannabis (TRUL.C), Columbia Care (COLXF.), iAnthus Capital Holdings (IAN.C) and Flower One (FONE.C).

Cresco Labs (CL.C) and Origin House (OH.C) are merging and Acreage Holdings is being acquired, so they’re out. KushCo Holdings (KSHB.NASDAQ) is a CBD-infused beverage company, not a good fit (and it’s U.S. listed). Canopy Rivers (RIV.V) is an interesting one. With the help of its BIG brother Canopy Growth, it could bite off, chew and swallow CannTrust, but I think that the company is more focused on international growth.

That leaves Medipharm Labs (LABS.V) and Village Farms Intl. (VFF.T) as dark horse stalkers, but the initial list of 9 are so much more likely, that I won’t go any further with these 2 names.

In the end, it’s very hard to say who the buyer might be, although I’m highly confident that buyers will emerge. However, the largest suitors, the ones with the greatest financial wherewithal, might find too many overlapping locations or jurisdictions.

On the other hand, maybe that’s the reason why they would want to buy CannTrust, to thwart competition. In other words, I’m just not sure what synergies and economies of scale are available to prospective buyers.

Regarding the smaller of the 9 companies, for them a transaction would really move the needle, so perhaps they are more inclined to make a move? Again, access to debt financing opens the door to companies with EVs under $1 billion. [TerrAscend and TGOD]

Wait, what’s that? I have to pick who I think should acquire CannTrust? Ok. I don’t have a single name, I have two top contenders. First is The Green Organic Dutchman, they have low revenue compared to peers. TGOD has an EV/trailing 12-month revenue multiple of 166 times. The company also had $174 million in cash and only $2 million of debt on March 31st.

My second pick is Cronos Group, they have even lower revenue relative to their size. Cronos has an EV/trailing 12-month revenue multiple of 335 times. Yikes! Like TGOD, Cronos has ample cash and minimal debt. Overly simplified math suggests that Cronos could go from a 335 times EV/trailing 12-month revenue multiple, to 98 times by taking out CannTrust.

I believe that all roads lead to CannTrust being acquired. The larger the acquirer, the easier it would be to manage the lawsuits, penalties, fines and losses of existing / future business. This will take a year or more to truly fix, making it too big a challenge for the incumbent board of directors.

Implications for the rest of the sector?

As mentioned, I believe this should end up being good news for the players who follow the rules. Still, the presumed increased scrutiny of the remaining companies (more costly and time consuming to operate ?) in the aftermath of this fiasco, is driving the entire sector down.

However, what’s bad for large and medium-sized cannabis & hemp names is great for smaller players. And, companies with U.S. based assets should not be getting hit nearly as hard. There are some very compelling opportunities.

Interestingly, only 5 of the top 30 (16.67%) listed above are EBITDA positive on a trailing 12-month basis (according to YahooFinance}.

Profitable industry participants with strong revenue growth and clean balance sheets, will be highly sought after, we could see bidding wars!

Readers, please consider keeping an eye on my website, Epstein Research, for articles and CEO interviews on small cap #cannabis, #hemp, #CBD, #MSO companies. For example, there’s a company I’ve written about that is proposing to propagate high CBD-content, feminized seeds, which currently sell for up to twice their weight in gold! Check it out.

If you care about metals, mining and minerals, there’s even more to enjoy, free of charge.

![Epstein Research [ER]](http://EpsteinResearch.com/wp-content/uploads/2015/03/logo-ER.jpg)