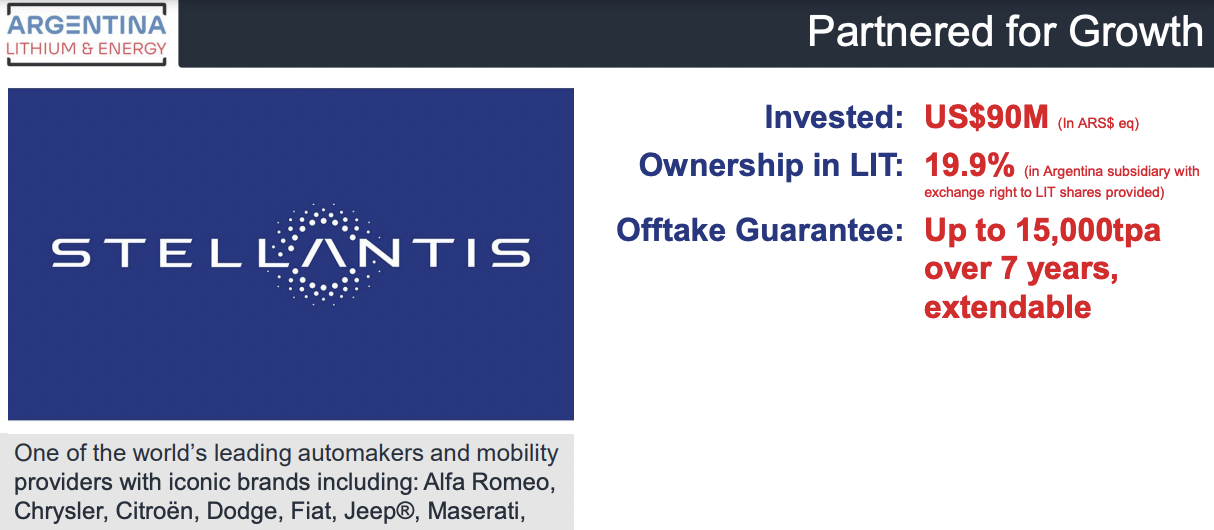

Preamble — 31.5 million shares of Argentina Lithium (TSX-v: LIT) / (OTCQX: PNXLF) traded in Canada alone in the eight days to Oct. 6th. Shares tripled to an intra-day high of $0.60 the day it was announced that Stellantis would invest US$90M (in Argentinian pesos), and as low as $0.385 since then. On October 5th, the transaction closed, cash changed hands, and the share price ended at $0.53. Readers should expect the stock to remain quite volatile. Essentially, the US$90M gives Stellantis a 19.9% stake in Argentina Lithium, plus valuable off-take rights. Please see new October corp. presentation.

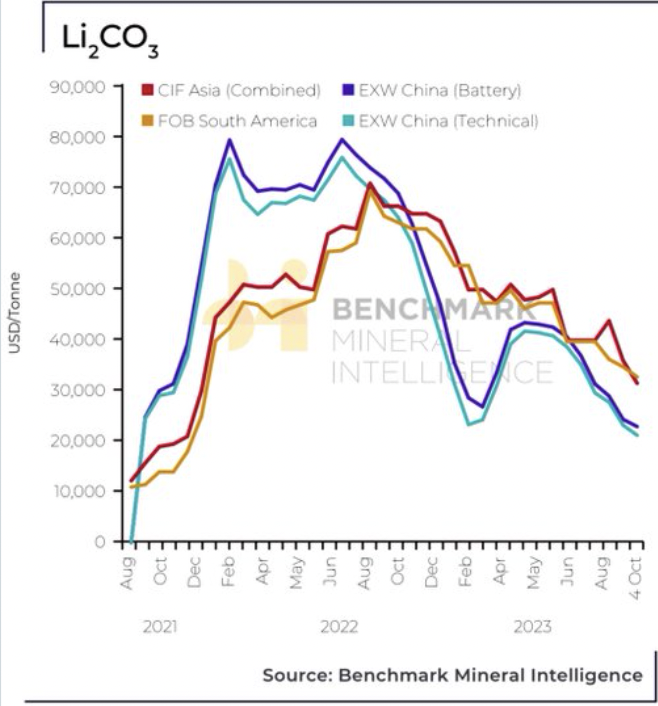

Lithium (“Li“) juniors have had a dismal year. Dozens of good-quality names are down 50%-80% from 52-week highs. The reason for the carnage? A steep two month decline in the battery-quality Li carbonate spot price (in China). In this Benchmark Mineral Intelligence chart, the China price is in the low US$20k’s/tonne, but other prices are ~$9-$10k/t higher.

One might think EV sales are falling off a cliff. The opposite is true. EV-Volumes.com expects 2023 sales to be 14M, up +33% over 2022, which was up +65% on 2021. If COVID-19 couldn’t forestall the paradigm shift to EVs, what will?

EV companies are coming to the alarming realization that there might not be enough Li to go around. Albemarle estimates 3.7M tonnes of Li Carbonate Equiv. (“LCE“) will be needed in 2030, 4x current demand. Bank analysts agonize over possible oversupply in 2024-2025, CEOs worry about supply from 2026-27 on when EV penetration is much higher.

Some of the world’s leading OEMs including; Volkswagen, BYD, Stellantis, Tesla, Toyota, Ford & GM have invested directly, or signed off-take agreements, with Li companies. In the past three years there have been at least 10 substantial deals for Argentinian Li assets.

Acquirers included; Rio Tinto, Ganfeng Lithium, Zijin Mining, Tibet Summit Resources, POSCO, TECPETROL, Lithium Americas, Tsingshan Holding Group and Orocobre ltd. (subsequently acquired by Allkem).

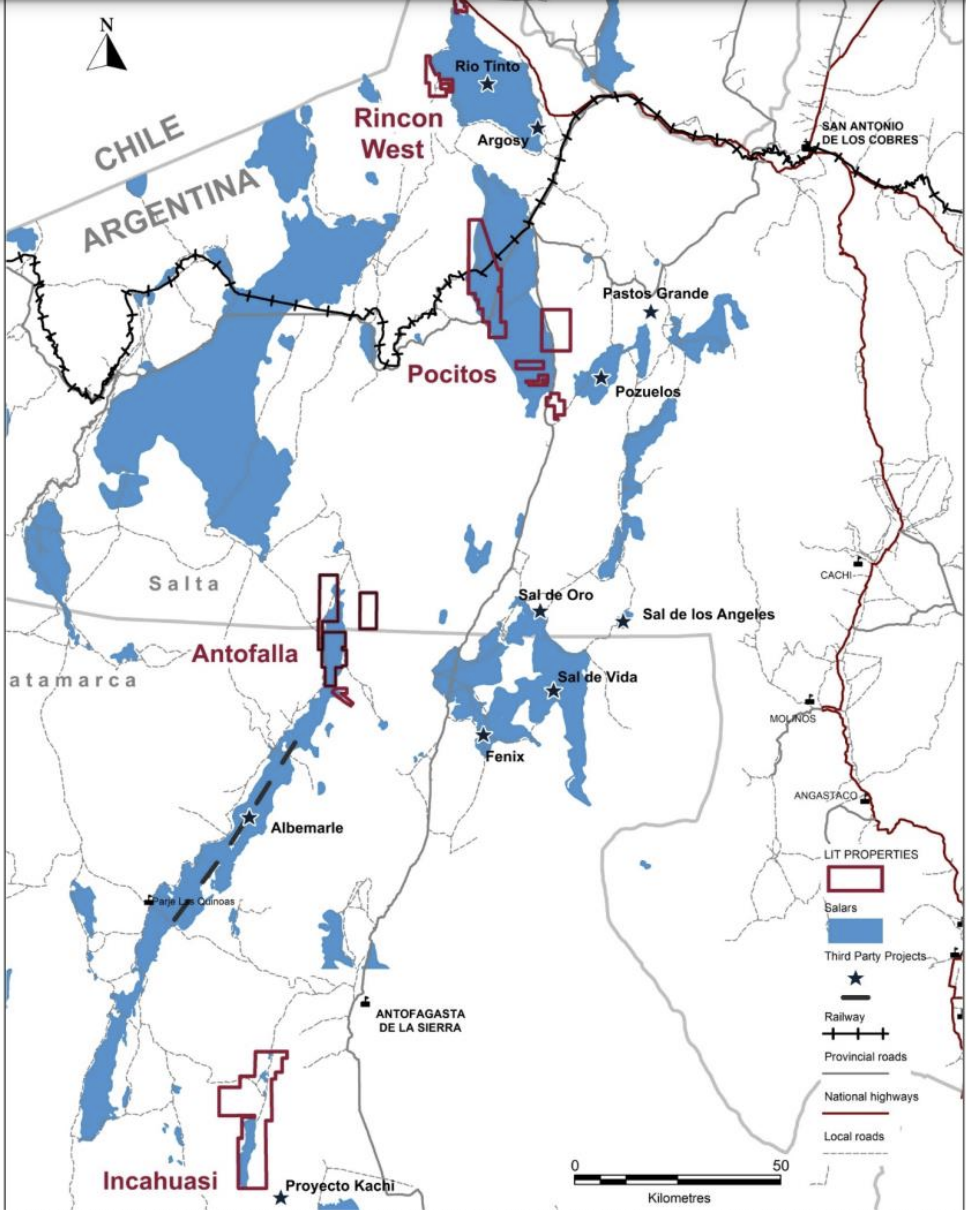

Rincon West to benefit from both Rio Tinto and Argosy Minerals entering production next year

The most recent transaction in Argentina took the world by surprise. Stellantis, a top global EV OEM, closed on a 19.9% interest in Argentina Lithium & Energy (TSX-v: LIT) / (OTCQX: PNXLF) for US$90M.

NOTE: The US$90M [in pesos] will be converted to US$ & C$ in the coming weeks. This will not be easy or inexpensive. Fees + commissions + lawyers + financial advisors could result in slippage of (my guess) ~20%. Management did not provide guidance on this issue. I assume the Company will net C$100M.

This unfortunate slippage doesn’t change the read-through valuation for Argentina Lithium of ~C$600M. It would be impossible to overstate how much this event de-risks the Company’s prospects. Remember, the cash injection has been paid in full.

Strategic investors typically insert a number of terms & conditions. Often, cash is disbursed in installments, subject to hitting milestones. There are no such constraints here, the entire investment has been deployed! This doesn’t mean the Company is worth C$600M today, but it’s fully-funded for at least 3-4 years AND still owns / controls 100% of its properties.

Some have expressed concern over a possible overhang of options & warrants. The fully-diluted share count assuming ALL contingent shares are issued, including 53M shares to Stellantis would increase to ~266 million.

However, the Company does not need to issue another share (unless for accretive acquisitions) for years. In addition to the roughly $100M (net) that has landed, the exercise of all warrants & options would deliver another $35M.

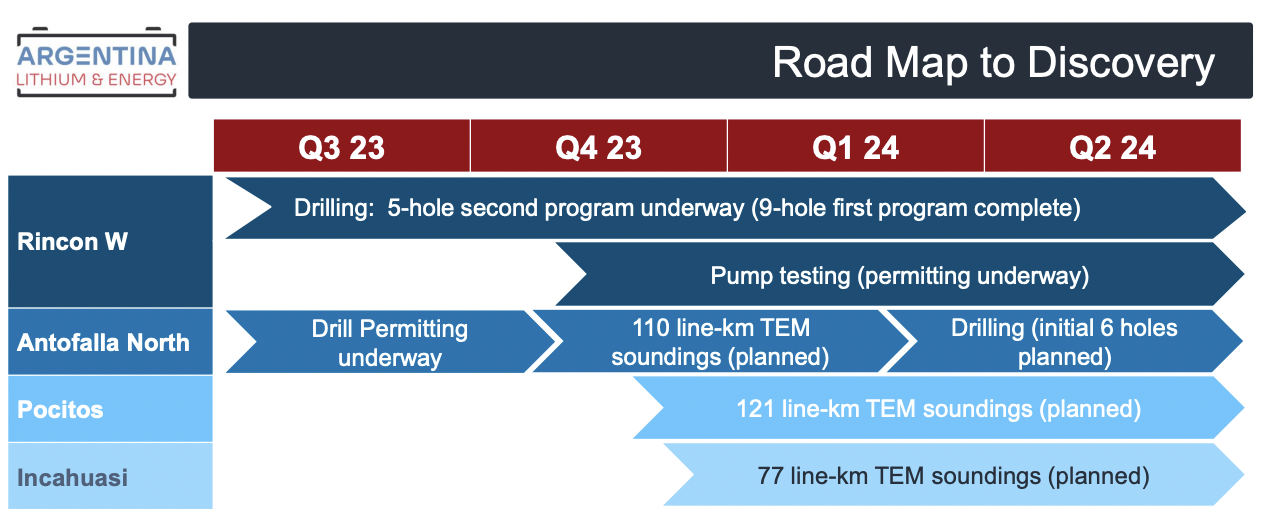

A combined $135M is enough to move full speed ahead on both Rincon West [“RW”] & Antofalla North [“AN”]. As options & warrants are exercised, there might be cash earmarked for acquisitions. With Stellantis’ backing, a small amount of capital could be leveraged to acquire additional prospects.

Readers might be wondering why such a large sum was paid relative to the Company’s market cap. I agree that Argentina Lithium secured an extraordinary deal, but Stellantis is getting much more than just 19.9% of the Company.

It has entered into an off-take agreement for 15,000 tonnes LCE/yr. for seven years, with an option to extend upon mutual consent. Pricing is based on the market, minus a modest discount. Assuming 5%, at US$30,000/t, the savings to Stellantis would be 15,000 x $1,500/t = $22,500,000/yr. for seven (or more) years.

And, it now has its ear to the ground, via its proactive partnership with Argentina Lithium. New brine targets pursued by the Company could benefit both parties. DLE companies should be all over Argentina Lithium, they need to work with companies that can reliably advance projects.

Stellantis did extensive project-level due diligence over a six-month period, carefully studying precedent transactions — and the Company’s standing in Argentina — with assistance from mining engineers, geologists, lawyers & other consultants. I imagine that Stellantis considered other companies, but they chose Argentina Lithium.

Even though RW & AN are early stage, the substantial cash injection helps ensure timelines progress at a decent pace. And, it’s important to recognize that Argentina Lithium is a member of the Grosso Group, a private management company that was one of the first to explore Argentina 30 years ago.

The Grosso Group has made meaningful discoveries and is well respected, with strong connections in Argentina and across S. America. That well-earned reputation has been elevated even further with this blockbuster news… News that should be well received by provincial agencies & officials.

Stellantis recently invested US$155M into a giant copper project in Argentina, an economy that urgently needs foreign investment.

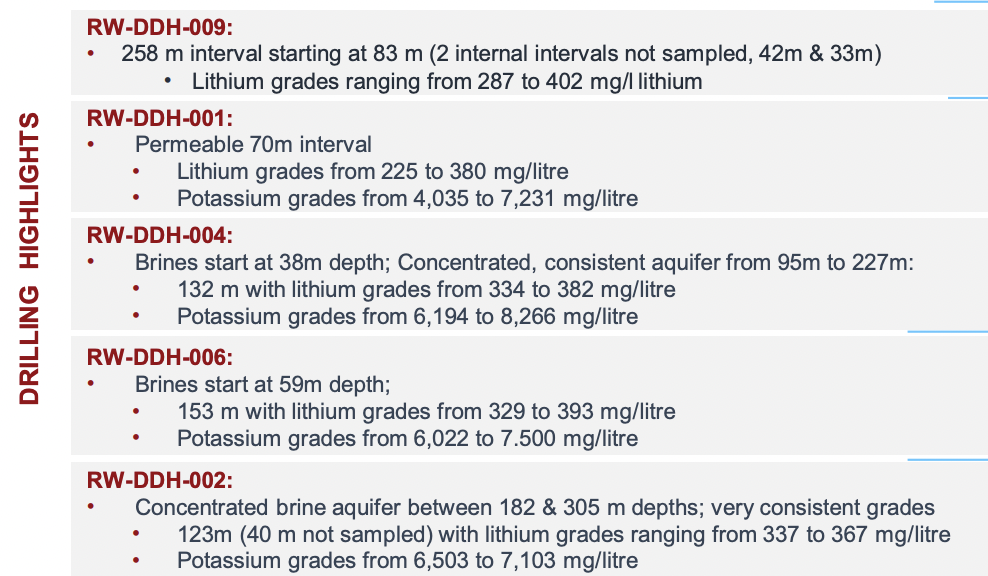

The 3,742 hectare RW concessions are small, but 34% larger than Argosy Minerals’ flagship project. Argosy has booked ~245,000 tonnes LCE, but is expected to double or triple that amount by year end in a long-awaited resource update. Does that imply RW could eventually have 500,000+ tonnes? No one knows, but Stellantis presumably likes the odds.

RW’s initial drill results show a grade profile as good or better than Argosy Minerals, Lake Resources, Alpha Lithium, Eramet’s 50/50 JV with Tsingshan & Rio’s Rincon project.

The largest interval returned 287 to 402 mg/l Li, with 183 continuous meters (of 258 m total, not all meters sampled) averaging 355 mg/l Li. Rio’s Rincon project next door was purchased for US$825M. It had an average grade of ~260 mg/l Li when acquired in Dec. 2021. Ford has signed an off-take with Rio on this project.

Rio is currently building a battery-grade Li carbonate plant with a capacity of 3,000 tonnes/yr. near RW. Work will include a power line, associated substations, construction camp and airstrip. Regional infrastructure deployed by Rio will presumably be accessible to surrounding communities and to Argentina Lithium.

In addition to RW is the AN project with a larger land package of 10,050 ha that could host a multiple of RW’s potential resources. While RW is next to Rio, AN is next to Albemarle’s only asset in Argentina. Years ago Albemarle expressed high hopes for its giant Antofalla project, but has said very little since.

Both of Argentina Lithium’s primary prospects are near projects entering commercial production next year, drawing a lot of attention and investment to the region.

There are > 35 publicly-listed juniors with one or more Li assets in Argentina. Many are on life support, in a brutal junior mining sector, because they don’t have a Major OEM backing them! Argentina Lithium has graduated to the next level — fully funded for years — with an ideal strategic / off-take partner, still owning / controlling 100% of its projects.

Please see new October corp. presentation.

Disclosures / Disclaimers: The content of this article is for information only. Readers fully understand and agree that nothing contained herein, written by Peter Epstein of Epstein Research [ER], (together, [ER]) about Argentina Lithium & Energy, including but not limited to, commentary, opinions, views, assumptions, reported facts, calculations, etc. is to be considered implicit or explicit investment advice. [ER] has never been, and is not currently, a registered or licensed financial advisor or broker/dealer, investment advisor, stockbroker, trader, money manager, compliance or legal officer, and does not perform market-making activities. [ER] is not directly employed by any company, group, organization, party or person. The shares of Argentina Lithium are highly speculative, not suitable for all investors. Readers understand and agree that investments in small-cap stocks can result in a 100% loss of invested funds. It is assumed and agreed upon by readers that they will consult with licensed or registered financial advisors before making investment decisions.

At the time this article was posted, Argentina Lithium is an advertiser on [ER] and Peter Epstein owned shares in the Company.

Readers understand and agree that they must conduct their own due diligence above and beyond reading this article. While the author believes he’s diligent in screening out companies that, for any reason whatsoever, are unattractive investment opportunities, he cannot guarantee that his efforts will (or have been) successful. [ER] is not responsible for any perceived, or actual, errors including, but not limited to, commentary, opinions, views, assumptions, reported facts & financial calculations, or for the completeness of this article or future content. [ER] is not expected or required to subsequently follow or cover events & news, or write about any particular company or topic. [ER] is not an expert in any company, industry sector or investment topic.

![Epstein Research [ER]](http://EpsteinResearch.com/wp-content/uploads/2015/03/logo-ER.jpg)