I’ve been holding back somewhat on writing articles on junior miners in this very difficult market, a market decimated by high interest rates, exacerbated by horrific developments in the Middle East. However, when a company has really good news, it can’t wait — in fact, it’s required to report it.

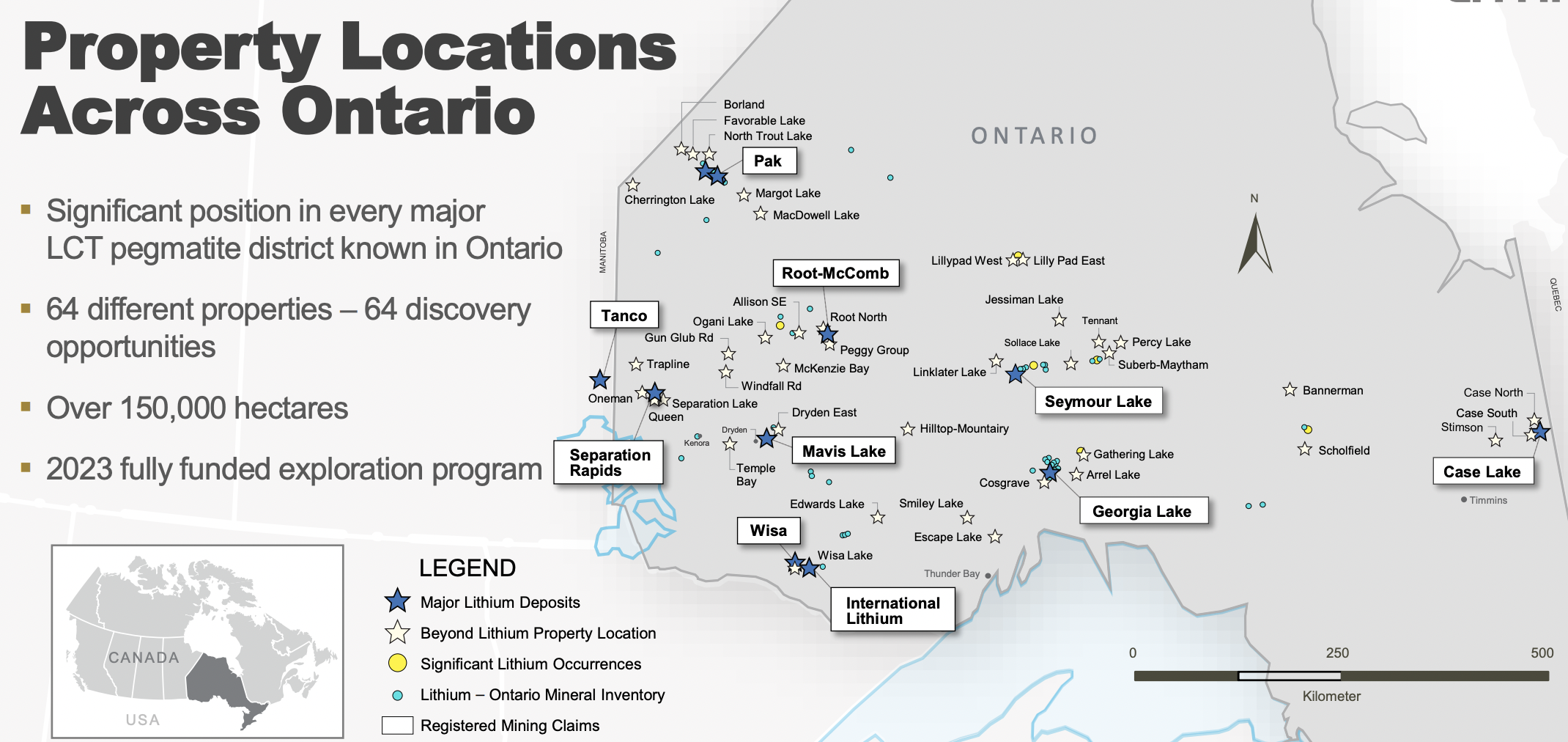

So, here’s some uplifting news… It regards a tiny company named Beyond Lithium (CSE: BY) / (OTC: BYDMF) that has amassed ~195,000 ha in Ontario, including today’s announcement of securing an option from Bounty Gold Corp. & Last Resort Resources Ltd. to acquire 100% of the 7,873 ha Victory and 8,808 ha Victory West properties.

Importantly, this news comes on the heals of other meaningful announcements; Sept. 21st, [Expansion of 3 projects & acquisition of new property] Sept. 17th, [Discovery of new spodumene-bearing pegmatite zone at Ear Falls], and Aug. 1st. [Discovery of LCT Pegmatites at Cosgrave Lake]. Please take a moment to read the bios of key mgmt. & board members below.

Let’s be brutally honest, having a lot of land means nothing unless lithium is found, which is a process that takes time. It’s too early to know what Beyond Lithium might have, but the Company is off to a great start in finding that out, and has a tiny valuation and tight share structure.

Victory & Victory West (together the “Victory Project”) is ~40 km east of Kenora and ~70 km west of Dryden. It enjoys reasonably good nearby infrastructure, easily accessible through the Trans Canada Highway & logging roads.

As per today’s press release, “Beyond Lithium has a district-scale foothold (68,307 ha) in the Dryden-Ear Falls region which is emerging as a lithium hub with a favorable geological setting for lithium, cesium, tantalum (“LCT”) pegmatites.” This morning there’s a new corporate video on YouTube {the 5:40 mark is where commentary on the Victory project begins}

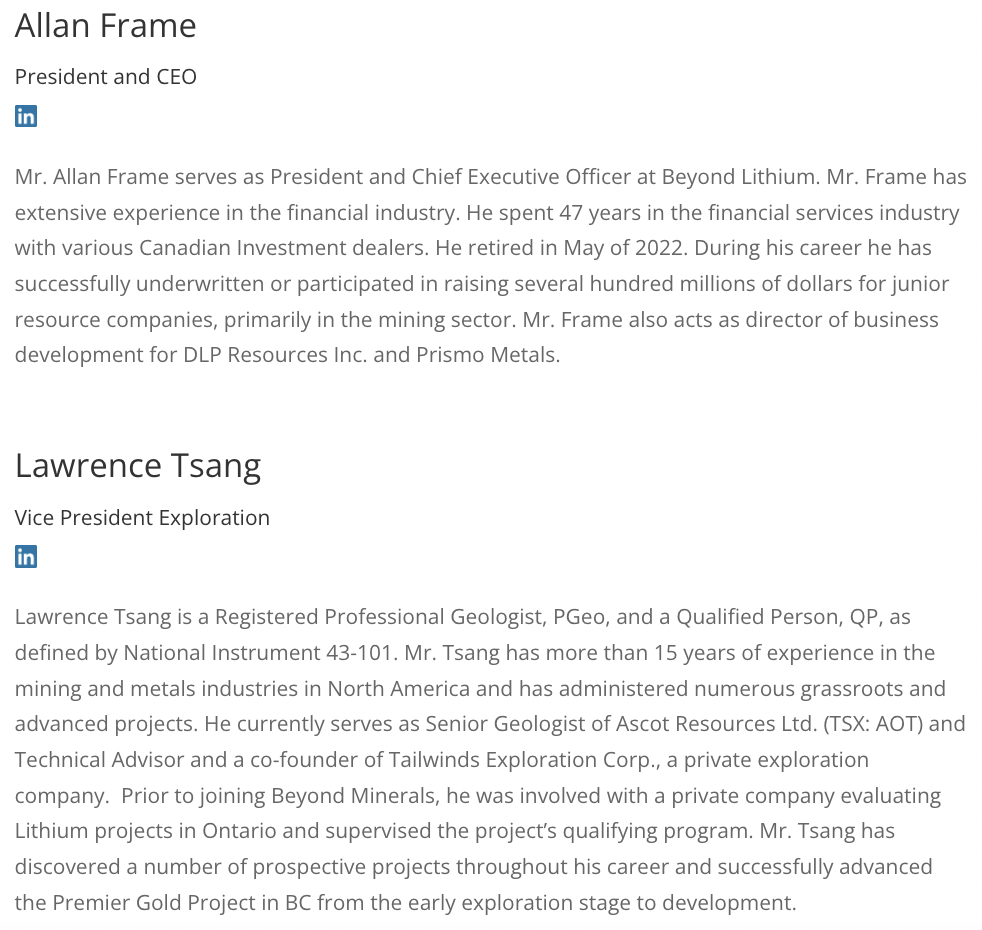

President & CEO Allan Frame commented,

“We have now moved 17 projects to phase 2 exploration and expanded three properties. Given the work done to date, we have identified several projects which we believe will be attractive for exploration companies wanting to establish a footprint in Ontario for lithium exploration, we are about to ramp up our efforts to find partners to advance select projects and provide non-dilutive capital for our company.”

In certain areas, spodumene mineralization has been observed to cover up to 50% of the pegmatites. A 6-km long structural corridor supports the potential for discovering additional spodumene pegmatites.

Based on Ontario Geological Survey’s geological maps, 140 mapped pegmatites have been identified. Beyond Lithium has only prospected a small portion of them, but two spodumene-bearing pegmatites have been discovered.

Management will carry out detailed mapping & sampling over the next several weeks and apply for a stripping / trenching permit, and a drill permit from Ontario’s Ministry of Mines.

The Victory Project is within 100 km of Beyond’s Ear Falls Project, where the Company recently discovered spodumene-bearing pegmatites with grab samples as high as 4.54% Li2O, plus two others averaging 3.09% Li2O. High-grade samples by themselves don’t prove much about the potential for an economic deposit, but they provide important information to follow up on.

The Company now has two assets with spodumene discoveries, plus another eight prospective plays, (Satellite, Laval, Gullwing-tot, Webb East, Webb West, Temple Bay, Ogani Lake & McKenzie Bay) within 100 km of these three regionally significant projects;

The Mavis Lake deposit owned by Critical Resources Ltd. with 8 Mt at 1.07% Li2O

The Separation Rapids resource owned by Avalon Advanced Materials, with a PEA showing a NPV of C$156M / IRR 27.1%

The Root & Seymour resources owned by Green Technologies Metals, with a combined 22.5 Mt at 1.14% Li2O.

Over the next three years Beyond will pay a total of $2.25M, issue 6.875M shares and grant the vendors a 2% NSR. If a resource of 5M tonnes grading 1.00%+ Li2O is established, a one-time $1M payment would be made, and if 20M tonnes, an additional $2M would be paid to the vendors.

The option terms offer considerable flexibility in that there are no work commitments ,and management has three years to earn a 100% stake. Since it’s an option agreement, if the Victory project doesn’t move forward in a way that management likes, it can be dropped with no further obligations.

Today’s news proves that Beyond’s team has access to some very good prospects in Ontario, exciting opportunities not controlled by companies like Frontier Lithium, Rock Tech, Green Technology Metals, Avalon Advanced Materials, Critical Resources, Brunswick Exploration or Power Metals.

Those later five are pre-PEA stage with an average market cap of C$88M vs. just C$9M for Beyond Lithium.

In my view, by 12/31/24 the Company will be in the same valuation tier that those five players sit in today. There will be equity dilution between now and then, but management has proven it can expand its prospects with modest new share issuance. There are only 29m outstanding shares.

Beyond’s expert team has been actively exploring for just six months. Initial drilling on one or a few strong projects could start before year end. I’ve been impressed with how rapidly the Company is advancing this story on a tight budget. Of 220 Canadian & Australian-listed juniors I’m tracking, I estimate just 5%-10% have had as many impactful announcements in such a short time.

As mentioned, Beyond recently discovered a new spodumene-bearing pegmatite zone on its 206 sq. km Ear Falls project. Initial grab samples assayed up to 4.54% Li2O, plus two averaging 3.09% Li2O, and a minimum 3-km long prospective trend was identified. Post discovery, management expanded the Ear Falls project from 3,375 to 20,623 hectares.

This project has very good infrastructure, including highway & logging road access, power lines, services and labor. Lawrence Tsang, VP exploration, commented,

“This spodumene discovery is significant as it occurs within a 13-km structural corridor with ample opportunities for more discoveries. We are targeting subparallel spodumene pegmatite dikes along the main structure and the major regional fault. We have already submitted an exploration plan to carry out a stripping and drilling program to further delineate spodumene pegmatite zones. Stripping & drilling is targeted to commence in October.”

To reiterate, three high-grade samples are not proof of an economic deposit, but I searched far & wide for sample results (from this year) grading higher than 4.54% and found just one in all of N. America.

Therefore, it’s reasonable to be caustiouly optimistic that more strong samples will be discovered, leading to initial drilling of promising targets as soon as this year.

Readers are encouraged to compare Beyond Lithium’s 195,000 ha Ontario-only land portfolio to that of any other junior Li company in Canada. Few have the vast blue-sky potential of this C$9M company.

Disclosures: The content of this article is for information only. Readers fully understand and agree that nothing contained herein, written by Peter Epstein of Epstein Research [ER], (together, [ER]) about Beyond Lithium, including but not limited to, commentary, opinions, views, assumptions, reported facts, calculations, etc. is not to be considered implicit or explicit investment advice. Nothing contained herein is a recommendation or solicitation to buy or sell any security. [ER] is not responsible under any circumstances for investment actions taken by the reader. [ER] has never been, and is not currently, a registered or licensed financial advisor or broker/dealer, investment advisor, stockbroker, trader, money manager, compliance or legal officer, and does not perform market making activities. [ER] is not directly employed by any company, group, organization, party or person. The shares of Beyond Lithium are highly speculative, not suitable for all investors. Readers understand and agree that investments in small cap stocks can result in a 100% loss of invested funds. It is assumed and agreed upon by readers that they will consult with their own licensed or registered financial advisors before making investment decisions.

At the time this article was posted, Beyond Lithium was an advertiser on [ER] and Peter Epstein owned shares in the company.

Readers understand and agree that they must conduct their own due diligence above and beyond reading this article. While the author believes he’s diligent in screening out companies that, for any reasons whatsoever, are unattractive investment opportunities, he cannot guarantee that his efforts will (or have been) successful. [ER] is not responsible for any perceived, or actual, errors including, but not limited to, commentary, opinions, views, assumptions, reported facts & financial calculations, or for the completeness of this article or future content. [ER] is not expected or required to subsequently follow or cover events & news, or write about any particular company or topic. [ER] is not an expert in any company, industry sector or investment topi

![Epstein Research [ER]](http://EpsteinResearch.com/wp-content/uploads/2015/03/logo-ER.jpg)