Have precious metals embarked on a new leg higher, will 2024 be a big year for silver (“Ag”) & gold (“Au”)? It sure looks that way. In fact, at Guanajuato Silver (TSX-v: GSVR) / (OTCQX: GSVRF) [“G-Silver“], CEO James Anderson authored a bullish editorial stating that precious metal prices hit an inflection point in the first week of October.

He believes there are four big reasons for higher precious metal prices, 1) monetary — “monetary tightening has made for a wild ride, but a significant hiatus is before us; this pause has already been foreshadowed by the actions of some central banks, like Canada & New Zealand…”

Second, fiscal — “The same policy makers, who back in 2008-09 assured us that their massive fiscal spending was a once in a lifetime event, have now normalized government spending that now exceeds the emergency measures taken in the Great Financial Crisis.”

With interest rates no longer moving higher, and perhaps falling in 2024, that and a weaker US$ could be a catalyst for Ag/Au. Third, social — “With wars raging in the Middle East, Ukraine, and the Sudan; can Taiwan be far behind?” Precious metals are a safe haven in volatile times.

And, fourth, technical — “Once gold re-tests the triple $2,050/oz. top of the past few years, it will drive prices $100-$150/oz. higher very quickly – like a hot knife through butter.” Gold could test $2,050/oz. this week.

Since early October, the spot Ag price is up +20.5% from $20.68/oz. to $24.92/oz. That’s a big move in just a two month period, but it’s not what Anderson and others think is the main thrust of what could be coming.

Readers of my prior articles about Ag & G-Silver know that I like to harp on three important factors.

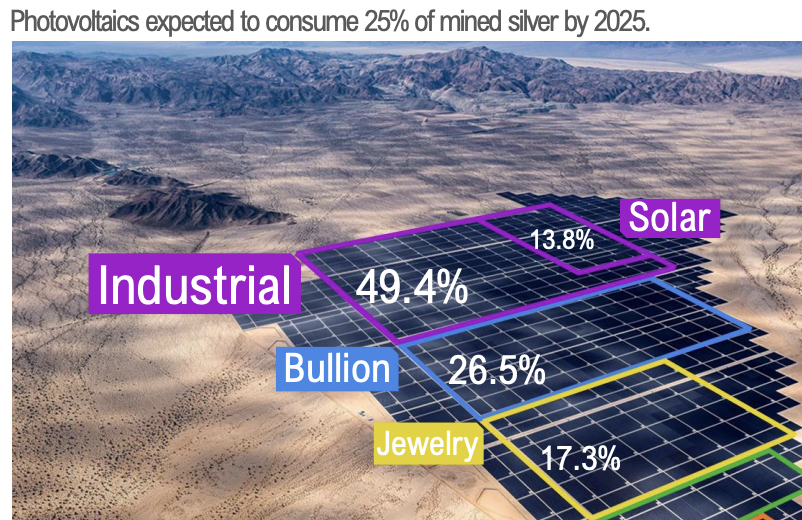

Solar power could consume 25% of mined Ag, up from 14% today…

First, the inflation-adjusted Ag price for the entire year of 1980 was ~$78/oz., meaning the current level is 67% lower. Second, silver’s use in solar panels is driving real demand in physical silver, not paper markets, which can be manipulated.

Third, the Au:Ag ratio at ~82:1 is well above the 40-yr. average of ~64:1.

If that Au:Ag ratio were to revert halfway back to its longer-term average, the price would be $27.8/oz. based on today’s $2,025/oz. Au price. The Top-5 investment bank forecasts for silver next year range from $27 to $30/oz., averaging the same $27.8/oz. (just 12% above the current level).

CEO Anderson has been talking about an incoming surge in industrial demand for Ag for nearly two years, so it’s worth checking in on that key assumption. China is the clear leader in new deployments of solar farms.

A recent Reuters article said that, according to Rystad Energy, “[China] dominates the solar panel supply chain from end to end, exceeding 80% of manufacturing capacity in every stage…” Through October, installed solar power capacity in China was up +47% from a year ago.

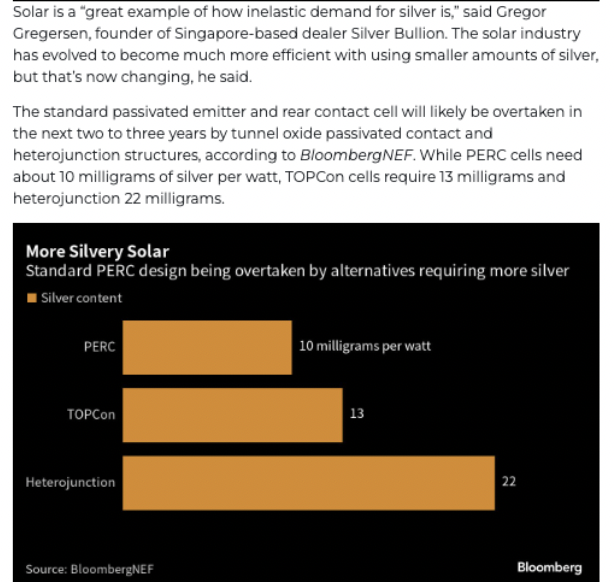

Although Ag content per solar panel has been declining for years, two new technologies are poised to increase content by +30%-120%, {see chart above}.

However, even with these new technologies, silver’s cost will remain relatively low compared to the overall panel cost. This isn’t a long-term projection that may or may not come to pass, it’s happening right now. As a quick aside, since my prior article on G-Silver something else interesting is going on.

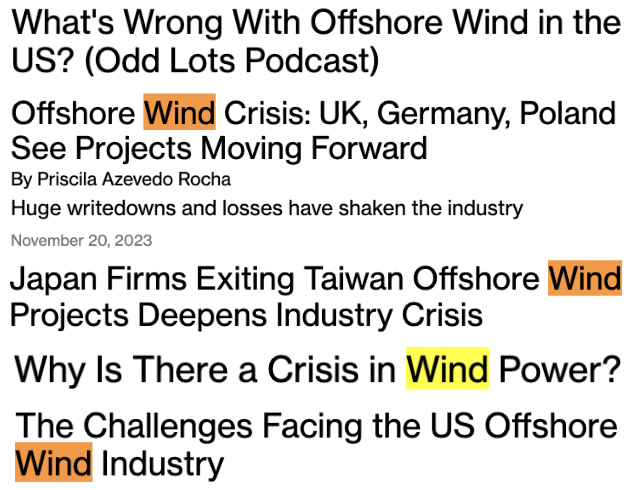

There has been a huge increase in negative articles about wind power, especially offshore wind farms in the U.S. Why mention this? The world is desperately trying to adopt BOTH wind & solar. The headwinds facing wind will nudge green energy deployments + R&D dollars towards solar.

What does this mean for G-Silver? As the fastest growing Ag producer in Mexico, every incremental dollar in the Ag price is important, especially with the Ag now above $24/oz.

Like for most precious metal producers in Mexico and around the world, cost creep has been painful over the past three years.

Management is fighting hard to contain costs, ~$22.5/oz. (AISC in 2nd qtr., but temporarily up to $26.2/oz. in 3Q), via operational enhancements, selective mining methods and logistical improvements. Recall that with multiple mines & mills, the Company has strong operating flexibility.

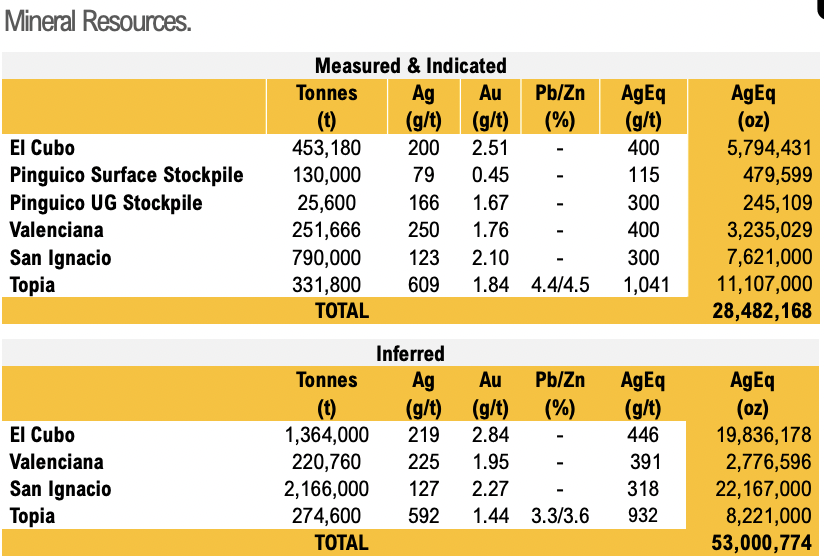

For example, two months ago management provided an update on its four 100%-owned mines; the El Cubo Mines Complex, Valenciana Mines Complex (“VMC“), San Ignacio in Guanajuato & Topia in Durango. Production is ramping up and contract miners are starting to be utilized to lower costs.

In addition, on November 27th G-Silver announced an additional 4,000 tonnes/month of already mined, third-party ore has been secured, enough to last for 6-10 months. There are several other opportunities to pick up stranded ore for toll-milling that should help lower AISC to $19/oz. by 2025.

Production guidance for 2023 is 3.4 to 3.6 million Ag Eq. ounces. With toll-milling + ramping up internal production from its four mines, production could increase to 5 or 6 million Ag Eq. ounces in 2025.

With M&A, which management is not shy about, output could rise to 6 or 7 million ounces in 2026.

Six million Ag Eq. ounces x [$28 – $19 (AISC) = a $9/oz. margin. That would be ~C$74M in EBITDA in 2026 vs. today’s enterprise value {market cap + debt – cash} of ~C$120M. As I said in my last article, below $23-$24/oz., the long-term outlook is not that exciting for G-Silver.

However, with $25/oz. Ag possibly a day or two away, and Au flirting with $2,050/oz., now could be a good time to purchase shares in G-Silver. What readers need to remember is that companies in production today are the ones that benefit most from rising prices.

And, companies growing the fastest are even better positioned. It should be noted that precious metal prices could shoot a lot higher than conservative investment banks predict. Bank analysts don’t get paid to be bullish on metal price forecasts.

They are perfectly happy to update their forecasts once or twice a year. In the next few months, we could see a wave of upward price revisions for the 2024-25 period.

That would be great news for producers like G-Silver, but even better is the free call option investors have on a blockbuster breakout in pricing.

Instead of $27-$30/oz. Ag and $2,100-$2,200/oz., why not $35-$40+/oz. and/or $2,400-$2,500+/oz.? I realize that might sound aggressive, but is it really? Those levels would remain well below inflation-adjusted highs. And, next year will be the fourth in a row of stubbornly high mining cost inflation.

I don’t believe current pricing fully captures these much higher costs. In total, including 2024, costs are up +25-30%. Pricing should eventually move higher to reflect this new normal.

Guanajuato Silver (TSX-v: GSVR) / (OTCQX: GSVRF) is attractively valued with silver approaching $25/oz., but with (let’s say) a 10%-20% chance that we see $35-$40+/oz. Ag in the next 12-18 months, that free call option on a big move higher has tangible value that should not be ignored.

Disclosures / disclaimers: The content of this article is for information only. Readers fully understand and agree that nothing contained herein, written by Peter Epstein of Epstein Research [ER], (together, [ER]) about Guanajuato Silver, including but not limited to, commentary, opinions, views, assumptions, reported facts, calculations, etc. is to be considered implicit or explicit investment advice. Nothing contained herein is a recommendation or solicitation to buy or sell any security. [ER] is not responsible for investment actions taken by the reader. [ER] has never been, and is not currently, a registered or licensed financial advisor or broker/dealer, investment advisor, stockbroker, trader, money manager, compliance or legal officer, and does not perform market making activities. [ER] is not directly employed by any company, group, organization, party or person. The shares of Guanajuato Silver are highly speculative, not suitable for all investors. Readers understand and agree that investments in small cap stocks can result in a 100% loss of invested funds. It is assumed and agreed upon by readers that they will consult with their own licensed or registered financial advisors before making any investment decisions.

At the time this article was posted, Peter Epstein owned stock in Guanajuato Silver and the Company is an advertiser on [ER].

While the author believes he’s diligent in screening out companies that, for any reasons whatsoever, are unattractive investment opportunities, he cannot guarantee that his efforts will be (or have been) successful. [ER] is not responsible for any perceived, or actual, errors including, but not limited to, commentary, opinions, views, assumptions, reported facts & financial calculations, or for the completeness of this article or future content. [ER] is not expected or required to subsequently follow or cover any specific events or news, or write about any particular company or topic. [ER] is not an expert in any company, industry sector or investment topic.

![Epstein Research [ER]](http://EpsteinResearch.com/wp-content/uploads/2015/03/logo-ER.jpg)