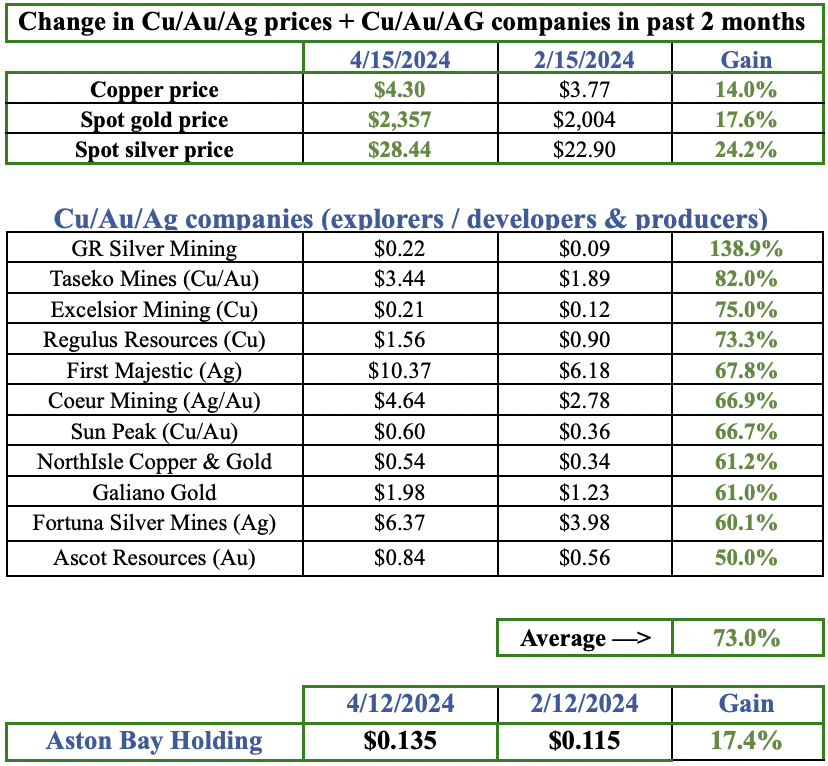

The junior metals & mining sector has been terrible for months. And, it’s not just lithium — gold, silver, copper — you name it, it’s been decimated (except uranium).

Many companies with strong projects are down > 60% from all-time highs. The Globe & Mail summed it up in a recent article,

“How Canada – and Bay Street – squandered the chance to finance the critical minerals revolution.” — “Capital has disappeared from Canada’s once-thriving junior mining industry. Badly-burned investors are scared to touch the sector, and companies are barely treading water.”

However, not all juniors are zombies — not Argentina Lithium & Energy Corp. (TSX-v: LIT) / (OTCQX: PNXLF). In early October, it received a blockbuster investment from a major Electric Vehicle (“EV“) maker.

Since then, the stock has traded between $0.32 & $0.63, most recently at $0.39, and Argentina’s runoff election was won by right wing rebel outsider Javier Milei. The market likes this outcome, a prominent Argentine stock ETF is up +29% in the past month.

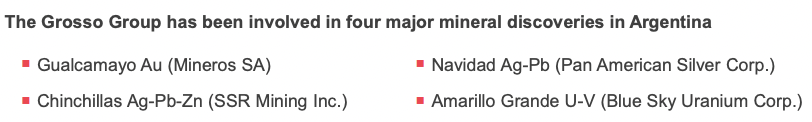

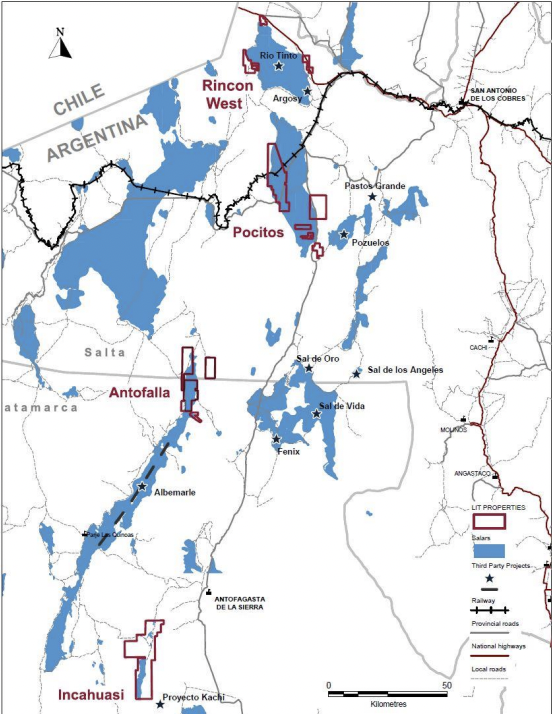

Argentina Lithium is a member of the Grosso Group, a private management company among the first to explore Argentina 30 years ago. The Grosso Group is well respected and has strong connections in Argentina & S. America.

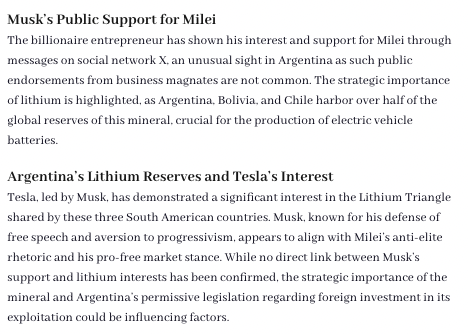

Interestingly, after years of window shopping, Elon Musk’s Tesla is thought to be close to making a move. Soon after President Elect Milei’s decisive victory, there was a wave of new commentary on Tesla’s possible plans in Argentina.

Increased excitement over Elon Musk/Tesla planning something Big in Argentina

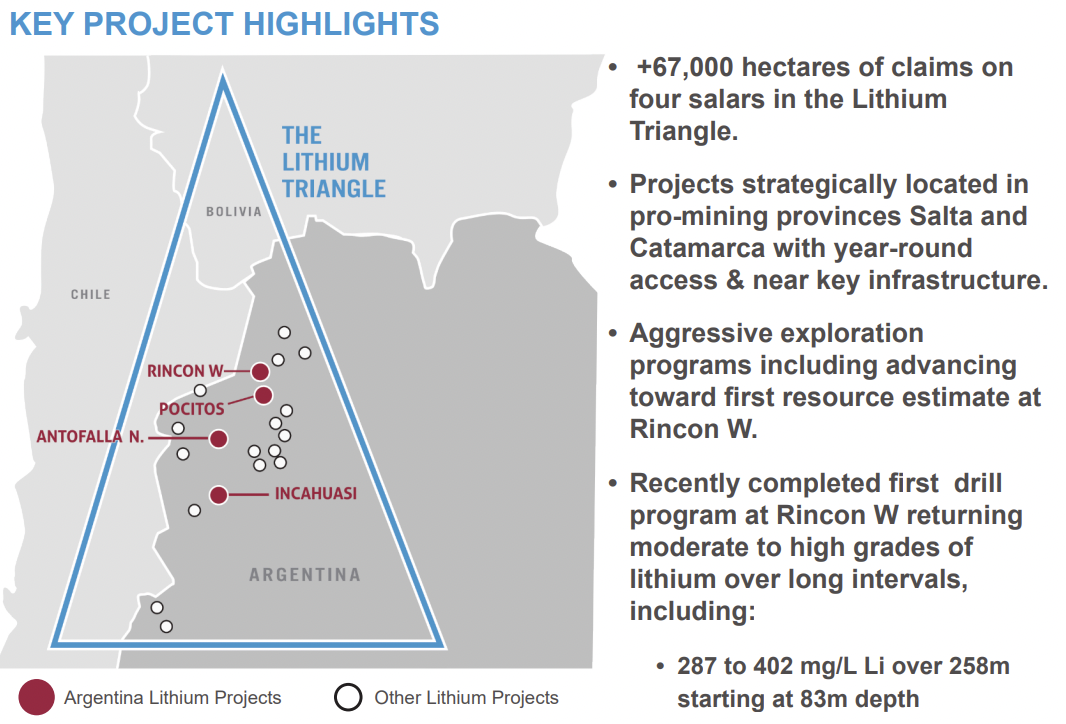

Further investments by giant OEMs would turbocharge projects like Argentina Lithium’s. As nice as promising political developments are, it’s impossible to overstate how transformative Top-4 EV maker Stellantis’ investment for a 19.9% stake in Argentina Lithium is.

No other early-stage junior in Argentina, or Chile for that matter, has landed such a meaningful partner. Stellantis had its choice of three dozen juniors, and presumably had conversations with groups like REMSa (Salta province), and JEMSA (Jujuy province), and privately-held concession holders.

It could have invested in more advanced assets, yet it chose early-stage Argentina Lithium — a major vote of confidence in the Grosso Group and the projects. The entire investment (the equiv. of US$90M in pesos) was made on October 5th.

Importantly, there are no work commitments, debt, warrants, development milestones or other stipulations. Management maintains 100% control over all its prospects.

Stellantis did extensive project, province & country-level due diligence over an 8-month period. It carefully studied precedent transactions — and the Company’s standing & reputation in Argentina. Armed with mining engineers, geologists, lawyers & consultants, it clearly liked what it saw.

An off-take agreement for 15,000 tonnes/yr. of lithium carbonate has been signed for an initial 7-yr. period staring in the late 2020s.

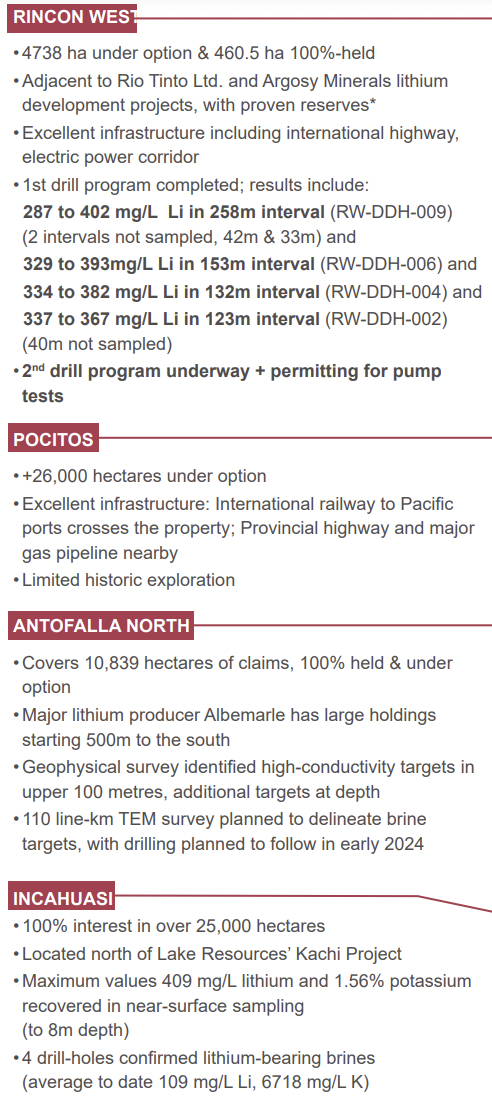

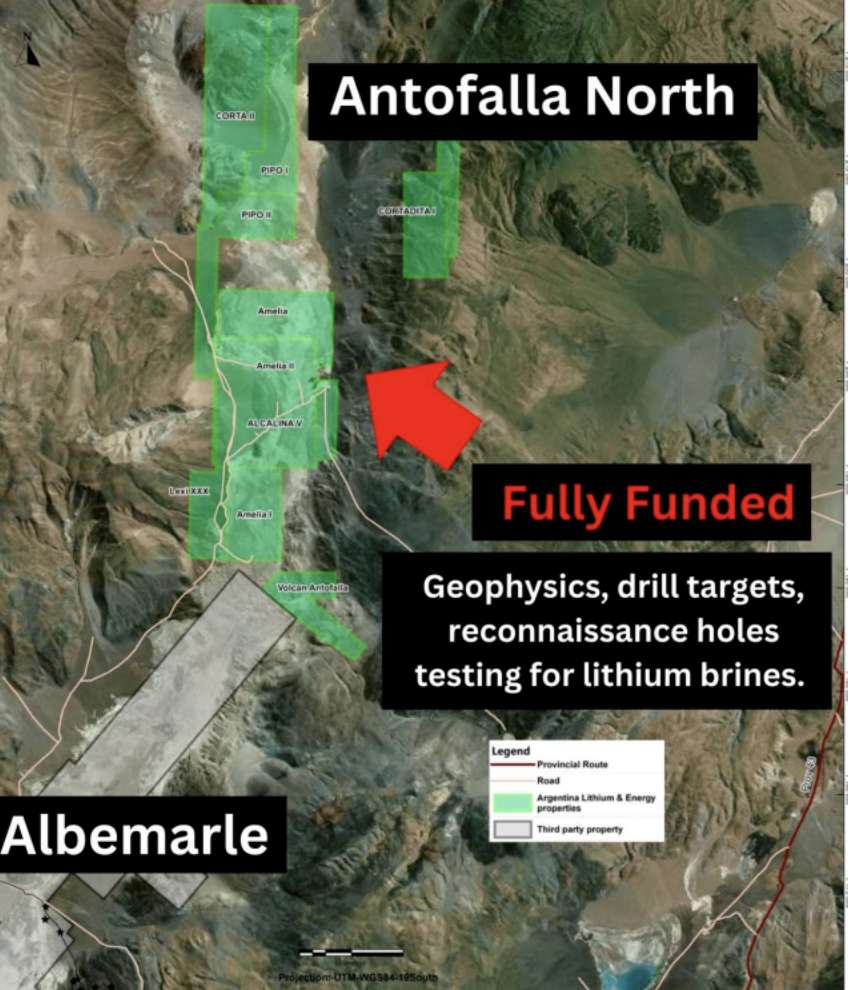

This cash injection meaningfully de-risks Argentina Lithium’s two primary projects Rincon West (“RW“) (~5,200 hectares) & Antofalla North (“AN“) (~16,620 hectares) by fully-funding exploration, property payments, permitting & development work through most, or possibly all of 2026.

If things go reasonably as planned, by 2026 Pre-Feasibility Studies on both RW & AN will have been completed, without the need of additional capital raises.

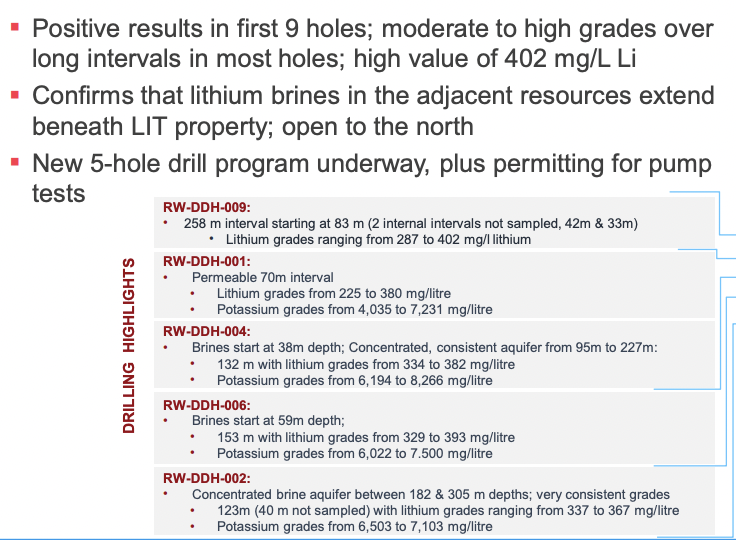

RW’s initial drill results show grades the are the same (plus/minus 75 mg/l Li) as projects held by; Argosy Minerals, Lake Resources, Alpha Lithium, Eramet’s JV with Tsingshan, Power Minerals, Lithium Chile (its Argentine project), Lithium Energy Ltd., Pursuit Minerals and Rio Tinto.

The largest interval returned 287 to 402 mg/l Li, with 183 continuous meters averaging 355 mg/l Li. Rio’s Rincon next door was purchased for US$825M. It has a grade of ~265 mg/l Li.

Ample cash liquidity will help ensure timelines progress at a rapid, but prudent, pace.

The fact that the investment was made in pesos, not dollars, caused some investor angst. However, this deal would have been a great one at US$45M, as even that figure would have valued the Company at ~$305M. The current market cap is $52M.

If all of Argentina Lithium’s stock options & warrants get exercised, and Stellantis is issued 53M shares for a 19.9% stake, the pro forma, fully-diluted share count would be ~264M, and the enterprise value {market cap + debt – cash} would be negative $22M.

Talk about a margin for error! Investors scooping up shares at $0.39 are getting the Company’s assets seemingly for free. Negative enterprise values are quite rare. It can represent a firm in severe financial distress, or a truly undervalued story.

Unlike many peers, there’s CLEARLY no financial distress at Argentina Lithium. The liquidity picture in dollars is hard to pin down, but there’s plenty of cash, zero debt and a flow of CAD$ coming in from the exercise of warrants & options.

The fact that the entire payment was made upfront, with minimal strings attached, should not be taken for granted. Argentina Lithium has banked BOTH the cash AND the Stellantis brand name, and can use both to climb to the next level of development.

I assume that three-quarters of the US$90M (in pesos) survives the conversion to dollars after associated fees, commissions, expenses, taxes and shrinkage from a few months of 130% annual inflation.

Management recently embarked on a peso spending spree, pre-paying for anything it can. Drilling equipment & consumables like PVC pipe are being prepaid.

As many as 50 holes will have been drilled by the end of 2024, (some already done) a portion of which has been partially or fully paid for. Management is mobilizing a geophysics crew to the Pocitos Salar to begin a 170 line-km TEM survey on 26,221 hectares, one of two other early-stage prospects.

In total, up to US$15M will be invested next year alone on exploration activities including; drilling, various studies & pumping tests.

Besides established producers Allkem & Livent, giant developers; Rio Tinto, POSCO, Zijin Mining & Ganfeng, and smaller, but still billion dollar players; Eramet, Tsingshan, Zangge Mining & Lithium Americas, no one is deploying anywhere near US$15M next year.

With exercises of warrants & options, management will have a robust war chest for M&A. In addition to aggressive drilling, management locked down 2,245 additional hectares around the co-flagship RW & AN projects.

One of the two properties, Don Fermin, is on the eastern flank of the Salar de Rincon, ~19 km east of the Company’s RW property block, and 1.1 km NE of Argosy Minerals’ Rincon. Importantly Argosy is expected to release an updated resource estimate that reportedly will double or triple its size.

Lexi-30, is 1.1 km NW of Albemarle Corp.’s large Antofalla property. In recent presentations Albemarle lists Antofalla as part of its development plans for 2025-2030. I’m hoping management grabs some of the brine properties coming up for sale by financially-stressed peers.

With Stellantis’ financial backing, property sellers have greater confidence in transacting with Argentina Lithium. And, recognizing that funding risk has declined, provincial agencies should be more inclined to facilitate development to kickstart the flow of taxes, royalties & high-paying jobs.

Both of the Company’s primary prospects are near projects entering commercial production next year, (Rio & Argosy) drawing a lot of attention to the area. Argosy is ramping up to a run-rate of 2,000 tonnes/yr. in 2024 and 12,000 tonnes/yr. in 2025.

The AN project has a larger land package of ~16,620 ha that could host a multiple of RW’s potential resources. While RW is next to Rio & Argosy, AN is adjacent to Albemarle’s only asset in Argentina.

Years ago when Albemarle locked up a large part of the Antofalla salar, it said the project there would be one of the biggest in the Lithium Triangle. Some believe Albemarle is sitting on > 5M tonnes LCE and is drilling, but not reporting results as it’s not material news.

Bottom line; Argentina Lithium is fully-funded (with no hurdles), into 2H 2026. Very large checks have been written by POSCO, Zijin, Ganfeng and Rio Tinto for brine projects in the area. Rio paid over $1B for its Rincon project right next door to RW.

Argentina Lithium is a long way from a $1B valuation, it may never get there, but it could be worth $100s of millions after three years of drilling, pump tests, permitting steps, [maiden resources + resource updates] and delivery of two Pre-Feasibility Studies.

Readers are encouraged to take a closer look at Argentina Lithium (TSX-v: LIT) / (OTCQX: PNXLF) while its valuation is, inexplicably, below zero! a situation that will not last forever.

Disclosures / Disclaimers: The content of this article is for information only. Readers fully understand and agree that nothing contained herein, written by Peter Epstein of Epstein Research [ER], (together, [ER]) about Argentina Lithium & Energy Corp., including but not limited to, commentary, opinions, views, assumptions, reported facts, calculations, etc. is to be considered implicit or explicit investment advice. [ER] has never been, and is not currently, a registered or licensed financial advisor or broker/dealer, investment advisor, stockbroker, trader, money manager, compliance or legal officer, and does not perform market-making activities. [ER] is not directly employed by any company, group, organization, party or person. The shares of Argentina Lithium are highly speculative, not suitable for all investors. Readers understand and agree that investments in small-cap stocks can result in a 100% loss of invested funds. It is assumed and agreed upon by readers that they will consult with licensed or registered financial advisors before making investment decisions.

At the time this article was posted, Argentina Lithium is an advertiser on [ER] and Peter Epstein owned shares in the Company.

Readers understand and agree that they must conduct their own due diligence above and beyond reading this article. While the author believes he’s diligent in screening out companies that, for any reason whatsoever, are unattractive investment opportunities, he cannot guarantee that his efforts will (or have been) successful. [ER] is not responsible for any perceived, or actual, errors including, but not limited to, commentary, opinions, views, assumptions, reported facts & financial calculations, or for the completeness of this article or future content. [ER] is not expected or required to subsequently follow or cover events & news, or write about any particular company or topic. [ER] is not an expert in any company, industry sector or investment topic.

![Epstein Research [ER]](http://EpsteinResearch.com/wp-content/uploads/2015/03/logo-ER.jpg)