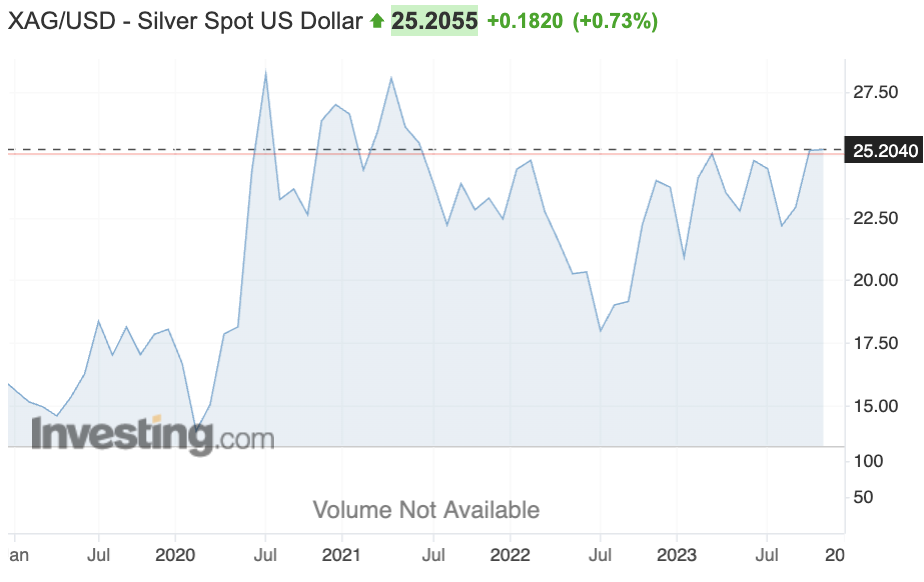

Spot Silver [$25.20/oz.] (near a 30-month high) & gold [$2,040/oz.] are having nice runs, yet most precious metal juniors have moved relatively little. Silver (“Ag“) has increased twice as much as gold (“Au“), +26% vs. +13%, from this year’s first quarter lows.

In bull markets juniors should be up a multiple of these gains. Are we in a bull market or not? Well, Au is within 2% of an all-time (nominal) high… Outcrop Silver & Gold (TSX-v: OCG) / (OTCQX: OCGSF) is up +31% to $0.21 in the past two months, yet is still down 51% from its 52-wk high.

The performance of Ag this year is interesting because pundits have been saying three things over and over. First, the Au/Ag ratio, which was in the mid-80’s:1, is too high vs. the 40-yr. avg. ratio of ~64:1. Second, Ag often outperforms Au in precious metal bull markets.

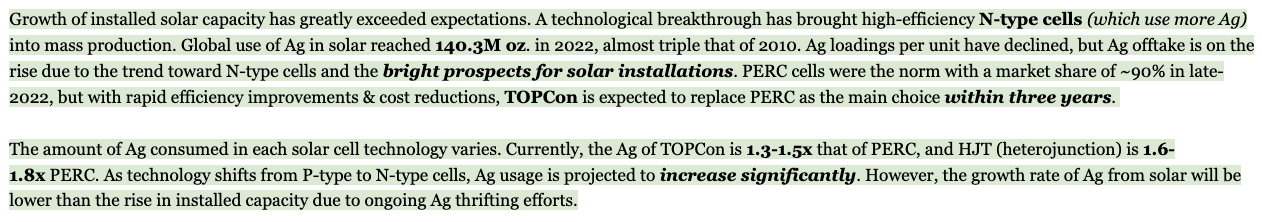

Third, industrial use of Ag, mostly in solar panels, but also in electric vehicles, is soaring. Given that the Au/Ag ratio has narrowed to ~81 from ~86:1, are we already seeing these things happen? Yes, but there’s plenty of room to run, especially as interest rates in the U.S. may have peaked.

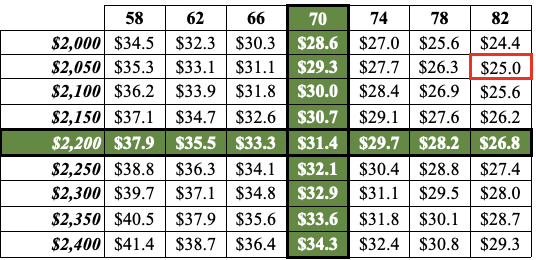

Gold is up +13% from this year’s low, even as interest rates were rising! If the U.S. Fed cuts rates, Au could presumably increase another +13%, next year. That would send it to roughly $2,300/oz. At that indicative level, and a Au/Ag ratio of 70:1, Ag would be at $32.9/oz.

I strongly believe that $30+/oz. Ag is coming next year. In the above chart, one can see Au/Ag ratios ranging from 58 to 82:1, and gold prices from $2,000 to $2,400/oz. The figures in the chart are the implied Ag prices, the red box is where we sit today.

How aggressive is a potential tightening of that ratio to 70:1? Less than 3 years ago that ratio hit 64:1, so hardly a stretch. And, it was at 64:1 when the outlook for solar was strong, but not nearly as bright as it shines today.

A recent Reuters article pointed out that, according to Rystand Energy,

“[China] dominates the solar panel supply chain from end to end, exceeding 80% of manufacturing capacity in every stage…”

Through October, installed solar power capacity in China is up +47% from a year ago. New installations + new solar panel technologies ensure strong growth in Ag demand from that sector, even after accounting for ongoing Ag thrifting. {see commentary in green above — silverinstitute.org}.

Even with new technologies, Ag’s cost will remain low compared to overall panel cost. This isn’t a long-term projection that may or may not come to pass, it’s happening right now.

Although pre-production, management has already checked several key investment boxes. Outcrop is led by CEO Ian Harris and seasoned execs & board members with boots-on-the-ground experience across S. America & Colombia. {Nov. Corp. Presentation}

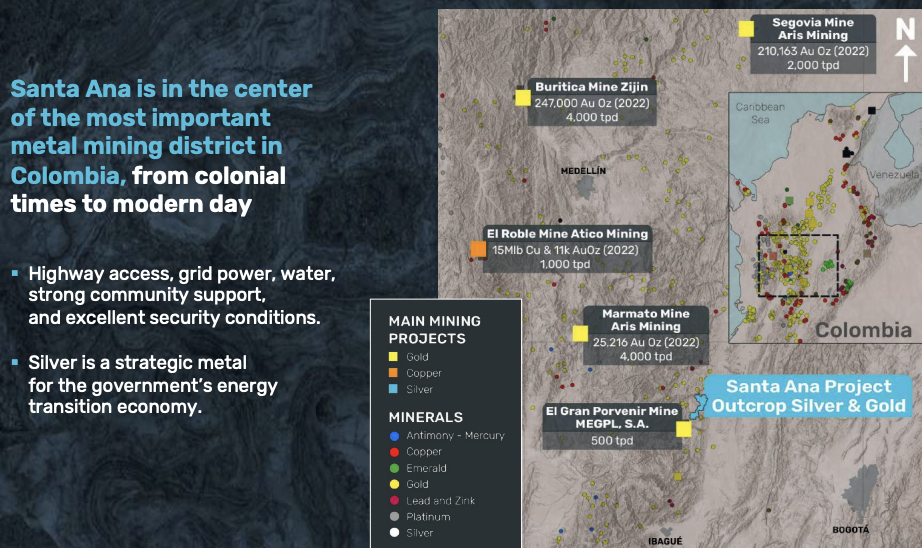

Mr. Harris has lived in S. America / Colombia for 15 of his 25-yr. (Mine Engineer) career. The Company’s 27,000+ hectare, 100%-owned, Santa Ana project in Colombia is ~190 km from the capital city of Bogota.

It hosts very high-grade Ag {see comps below}, and has a clear path to 100M Ag Equiv. ounces. Santa Ana covers a majority of the Mariquita District, the highest-grade, primary Ag district in Colombia, where mining dates back centuries.

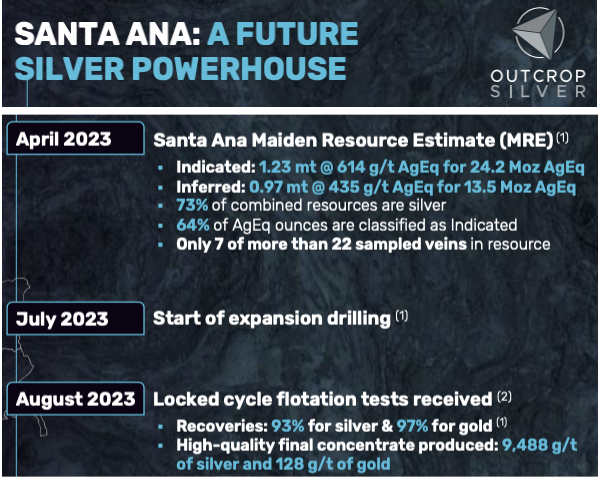

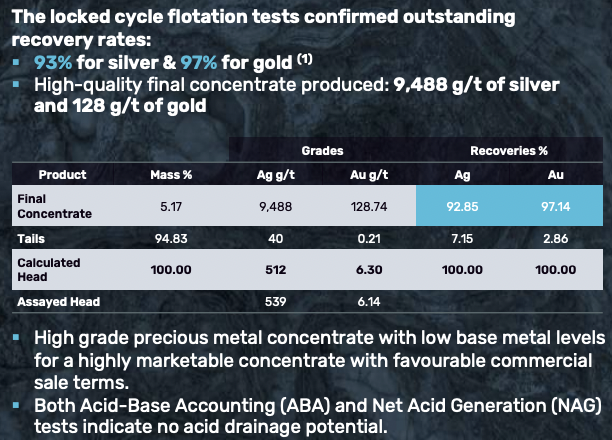

Drilling on Santa Ana to date shows mineralization extending to a depth of at least 370 m. In total, more than 46 km of mapped & inferred veins have been found. Management has reported strong preliminary metallurgical results from floatation alone, with possible upside if combined with gravity separation.

CEO Harris believes that high recoveries of ONLY Ag & Au could enable the production of doré bars onsite. If so, the Company could get paid on 98%-99% of the contained metal.

Compare that to payables on peer concentrates ranging from ~75% to 90%. Santa Ana’s preliminary 93% Ag/ 96% Au recoveries are also better than peers, averaging ~85%/90% Ag/Au.

Santa Ana surrounded by prolific mines; Buritica, El Grand Porvenir, Segovia & Marmato

Given that Outcrop’s resource is 75% Ag & 25% Au — with low impurities — tailings from a mining operation (with no leaching or cyanide) should be environmentally-friendly.

Santa Ana enjoys, “highway access, grid power, water, strong community support, and excellent security conditions.” All of these critical factors suggest permitting should be straightforward.

As can be seen in the above map, Santa Ana could be of interest to Zijin Mining, Nexa Resources & Aris Mining, all of whom have meaningful operations nearby.

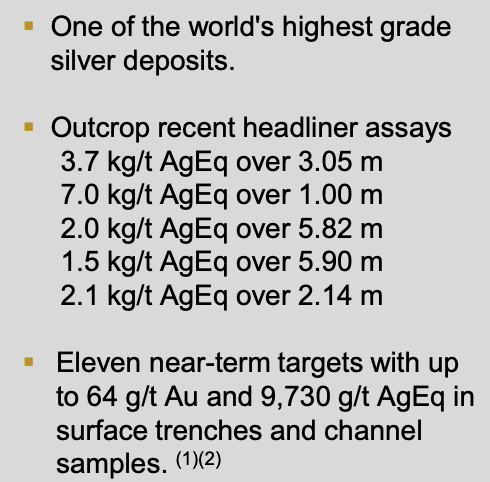

As proof of concept that its narrow high-grade veins hold together along strike and to depth, management delivered a maiden mineral resource estimate (“MRE”) of 37.7M Ag Eq. ounces, based on drill results on seven veins. A substantial 64% of the resource is in the Indicated category.

The target of 100M Ag Eq. ounces is plausible as there are 23 mapped veins (so far), 16 of which have no ounces booked on them yet, and those [7 + 16 = 23] veins are found on less than 25% of the total property package.

While it’s too soon to make estimates of resource potential, one cannot rule out blue-sky figures above 100M ounces given the size of the property, analog high-grade, narrow vein projects & mines, and the parameters of the existing resource.

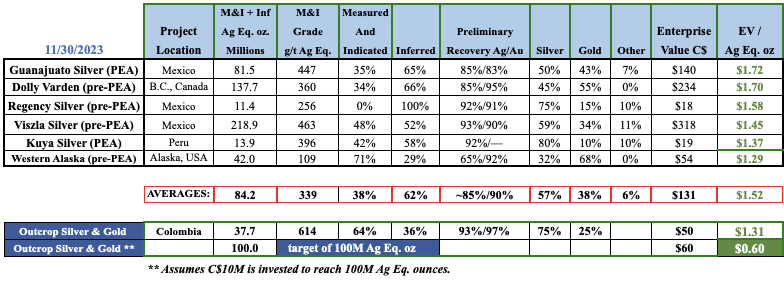

Outcrop compares favorably to other Ag-heavy juniors {see chart below}. Dolly Varden has ~138M Ag Eq. ounces and an Enterprise Value [“EV“] {market cap + debt – cash} of ~$234M.

Its flagship project is pre-PEA stage. Dolly’s $1.70/Ag Eq. oz. valuation is above Outcrop’s at $1.31/oz., and well above the $0.60/oz. level, if one gives Outcrop credit for 100M Ag Eq. ounces.

Consider that 64% of the Company’s resource is Indicated vs. 34% for Dolly, and Outcrop has better preliminary metallurgy results. Like many juniors, Dolly proposes to use cyanide, whereas Outcrop’s plans do not require it. At 75% Ag, Outcrop is a better Ag pure-play than Dolly at 45%.

Dolly is in a less risky jurisdiction, but Outcrop could reach production sooner. Labor costs are much lower in Colombia, roughly a fifth or a sixth that of Canada (Australian & U.S. labor costs are even higher).

If one assumes that the Company can reach 100M Ag Eq. ounces by spending an additional $10M on expansion drilling, its pro forma EV/oz. ratio would be $0.62/oz.

In terms of country risk, Colombia sits above Mexico, and 1 & 2 spots, respectively, behind Chile & Peru. It’s ranked above Papua New Guinea, S. Africa and the Argentine provinces of Catamarca, Jujuy & Salta. {source: Fraser Institute Mining Survey, 2022}

The avg. grade of the intervals below is ~3,260 g/t Ag Eq., equiv. to a tremendous 40 g/t Au (at spot prices). Drill results in the coming months should deliver more high-grades over narrow widths. Next year management will update the MRE with a very significant increase in ounces.

Outcrop Silver & Gold has reported strong drill intervals…

Outcrop is pursing two U.S. projects via its recently completed acquisition of Zacapa Resources, which has a sizable gold project in Nevada surrounded by AngloGold Ashanti, Kinross & Augusta Gold. AngloGold has big plans for the Beatty district where it has amassed an 8M oz. Au resource.

Zacapa also has a porphyry copper play immediately north of a past-producing mining complex in Arizona owned by BHP. Both U.S. assets are on the back burner as the main focus is Santa Ana.

Outcrop Silver & Gold (TSX-v: OCG) / (OTCQX: OCGSF) has plenty of cash to keep drilling and exploring for several more months. As investors continue to see great results, and precious metal prices rise, interest in the Company will grow. Please see the {Nov. Corp. Presentation}

Disclosures / disclaimers: The content of this article is for information only. Readers fully understand and agree that nothing contained herein, written by Peter Epstein of Epstein Research [ER], (together, [ER]) about Outcrop Silver & Gold, including but not limited to, commentary, opinions, views, assumptions, reported facts, calculations, etc. is to be considered implicit or explicit investment advice. Nothing contained herein is a recommendation or solicitation to buy or sell any security. [ER] has never been, and is not currently, a registered or licensed financial advisor or broker/dealer, investment advisor, stockbroker, trader, money manager, compliance or legal officer, and does not perform market making activities. [ER] is not directly employed by any company, group, organization, party or person. The shares of Outcrop Silver & Gold are highly speculative, not suitable for all investors. Readers understand and agree that investments in small cap stocks can result in a 100% loss of invested funds. It is assumed and agreed upon by readers that they will consult with their own financial advisors before making investment decisions.

At the time this article was posted, Peter Epstein owned stock in Outcrop Silver & Gold and the Company is an advertiser on [ER].

While [ER] believes it is diligent in screening out companies that are unattractive investment opportunities, [ER] cannot guarantee that its efforts will be, (or have been), successful. [ER] is not responsible for any perceived, or actual, errors including, but not limited to, commentary, opinions, views, assumptions, reported facts & financial calculations, or for the completeness of this article or future content. [ER] is not an expert in any company, industry sector or investment topic.

![Epstein Research [ER]](http://EpsteinResearch.com/wp-content/uploads/2015/03/logo-ER.jpg)