Will 2024 be a good, very good or great year for precious metals? Of course, it could go badly, but with interest rate cuts coming it seems unlikely gold (“Au”) & silver (“Ag”) will have a down year. The Au:Ag ratio is currently sitting at ~90:1, significantly higher than the 40-yr. average of ~64:1.

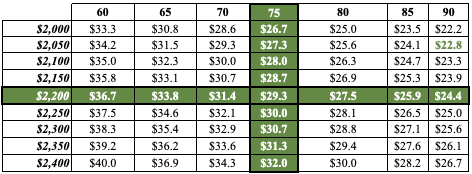

Why does this matter? When the ratio gets extended like this, Ag often outperforms. If the gold price were to rally ~7% to $2,200/oz., AND the Au:Ag ratio were to revert to 80:1, (hardly a stretch), the Ag price would be $27.50/oz.

Au:Ag ratios along top, Au prices down the side, implied Ag price…

That would be great for Outcrop Silver & Gold (TSX-v: OCG) / (OTCQX: THSGF), who’s flagship project is 75% Ag/25% Au. How likely is $2,200/oz. Au?

J.P. Morgan has one of the more bullish Au forecasts, saying it will hit $2,300/oz. next year vs. ~$2,050/oz. today. Japan’s Mitsubishi UJF thinks we could see $2,350. If U.S interest rate cuts are more aggressive than expectations, Bank of America envisions $2,400 as possible.

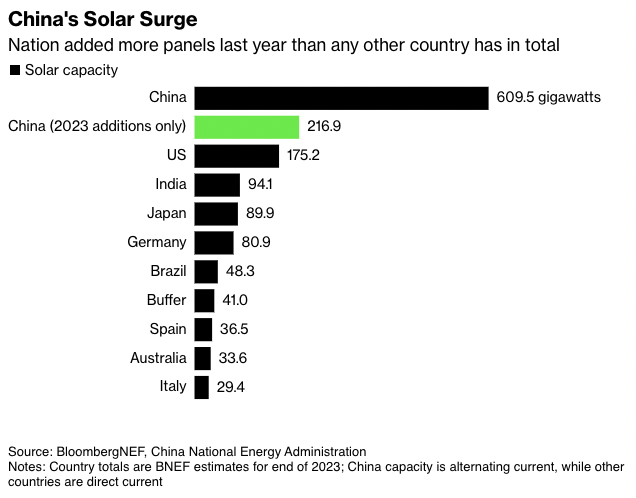

I like Au, but I love Ag. With industrial demand, increasingly from solar panels, rising, it’s becoming very difficult to manipulate the paper price of Ag. Physical shortages could be coming. This year will be the 4th in a row of a silver deficit. China dominates the solar industry.

Notice below that China added more solar capacity in 2023 alone [217 gigawatts. +148% over 2022] than any other country’s total installed capacity. Globally, renewable power increased by 50%, [95% solar + wind]. And, three quarters of that 95% came from solar.

Each gigawatt of solar = ~600k ounces of Ag. If China’s solar capacity increases +30% this year, an additional 282 gigawatts vs. 217 in 2023, it would consume ~169.2M ounces, ~14% of the world’s Ag demand!

As an aside, wind power has had a terrible 18 months due to project delays & cost blowouts. Fewer wind installations will drive incremental solar adoption.an

According to the Silver Institute, demand in 2024 will be 1.2B, vs. supply of 1.0B ounces. That assumes no delays or shortfalls from new & expansion initiatives in Mexico, Chile & Russia (Russia was the 6th largest producer of Ag in 2022, it’s struggling). This will be the 4th year in a row of an Ag deficit.

Might Ag be the next uranium? While it took longer than most expected, the U3O8 doubled over an eight month period. Ag is less urgently needed than U3O8 (no substitutes), but the supply of Ag is highly inelastic, a large increase in demand will not be met with adequate new supply in the short-term.

Does that mean the Ag price will double? No, not necessarily, but a 25% gain to ~$28.40/oz. would do wonders for Ag-heavy companies like Outcrop. Today’s Ag price is absurdly cheap at just 27% the inflation-adjusted price of ~82.70/oz. for the entire year 1980!

This makes no sense, especially as all-in-sustaining-costs for precious metal miners has been rising 10%+/yr. since 2020. Outcrop Silver & Gold continues to offer a compelling risk/reward proposition with an enterprise value, {market cap – cash + debt} of $35M at $0.14/shr.

The setup for precious metals looks good, yet prominent Ag producers Fresnillo plc, First Majestic, Coeur Mining, SSR Mining, Endeavour Silver & Hecla Mining are down from 39% to 66% from 52-wk highs. It’s brutal out there.

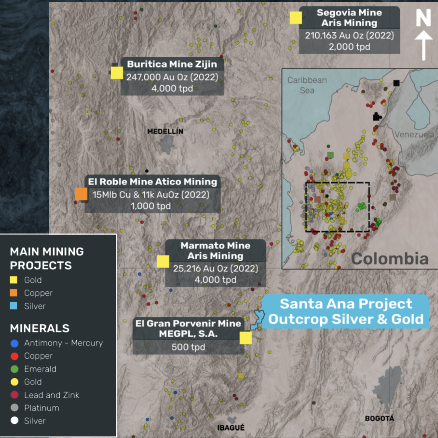

As can be seen in the map above, Outcrop’s 100% Santa Ana project could be of interest to Zijin Mining & Aris Mining, both have meaningful operations nearby. B2Gold & Collective Mining also have Au assets in Colombia.

Even if too small for Zijin, Aris B2Gold or Collective Mining could acquire Outcrop to make themselves more attractive takeover targets. I feel strongly that a tsunami of M&A is imminent in precious metals, a wave that could last a few years.

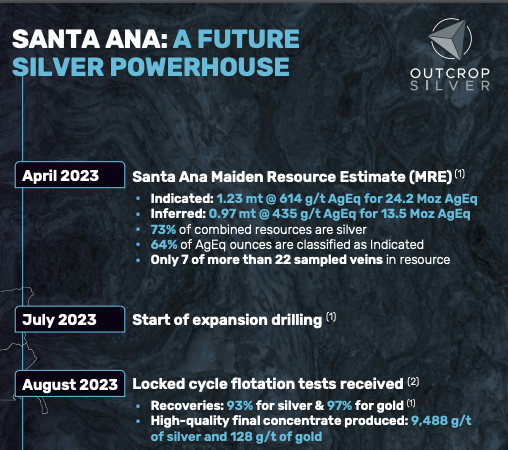

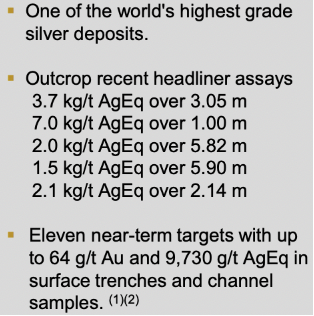

As proof of concept that Santa Ana’s narrow high-grade veins hold together along strike and to depth, management delivered a maiden mineral resource estimate (“MRE”) of 37.7M Ag Eq. ounces, based on drill results on seven veins. A substantial 64% of the resource is in the Indicated category.

Given Outcrop’s resource is 75% Ag & 25% Au — with low impurities — tailings from a mining operation (without leaching or cyanide) would be environmentally-friendly. Santa Ana enjoys, “highway access, grid power, water, strong community support, and excellent security conditions.”

This suggests permitting should be straightforward. Management’s conceptual target of 100M Ag Eq. ounces is quite plausible. There are 23 mapped veins (so far), 16 of which have no ounces booked on them. Importantly, those 23 veins are found on < 25% of the property package.

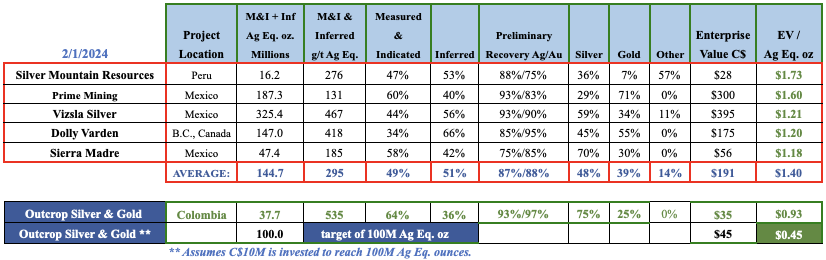

Outcrop compares favorably to other Ag-heavy juniors {see chart below}. Dolly Varden has ~138M Ag Eq. ounces and an Enterprise Value [“EV“] {market cap + debt – cash} of ~$175M.

Its flagship project is pre-PEA stage. Dolly’s $1.20/Ag Eq. oz., valuation is above Outcrop’s at $0.93/oz., and well above the $0.45/oz. level, if one gives Outcrop credit for 100M Ag Eq. ounces in the future.

Consider that 64% of the Company’s resource is Indicated vs. 34% for Dolly, and Outcrop has better preliminary metallurgy results. Like many juniors, Dolly proposes to use cyanide, whereas Outcrop’s plans do not require it.

At 75% Ag, Outcrop is a better Ag pure-play than Dolly at 45%. Labor costs are much lower in Colombia, roughly a fifth or a sixth that of Canada (Australian & U.S. labor costs are even higher). If one assumes the Company can hit 100M Ag Eq. oz. (with an estimated additional $10M of drilling), its EV/oz. ratio is $0.45.

In terms of country risk, Colombia ranks above Mexico, and next to (1 & 2 spots, respectively), behind Chile & Peru. It’s ranked above Papua New Guinea, S. Africa and the Argentine provinces of Catamarca, Jujuy & Salta. {source: Fraser Institute Mining Survey, 2022}.

The avg. grade of the intervals below is ~3,260 g/t Ag Eq., or a tremendous 37 g/t Au Eq. (at spot prices). Drill results in the coming months should deliver more high-grade over narrow widths.

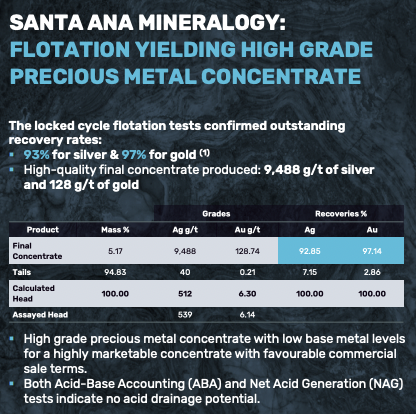

Preliminary metallurgical results show recoveries of 93%/97% Ag/Au, and the potential for a very clean, high-grade concentrate. That means not only are recoveries excellent, but payables will be strong as well. In fact, management is studying the opportunity of pouring doré bars onsite.

Compare Outcrop’s Indicated grade of g/t Ag Eq. to the average Indicated grades of peers at 295 g/t. Outcrop is double those peers. And, with the superior 93%/97% recoveries, this project stands out.

This year management will update the MRE with a very significant increase in ounces. Outcrop is also pursing two U.S. projects via its acquisition of Zacapa Resources, which had a sizable gold project in Nevada surrounded by AngloGold Ashanti, Kinross & Augusta Gold.

AngloGold has big plans for Nevada’s Beatty District, where it has amassed an 8M oz. Au resource. Zacapa also had a porphyry copper play immediately north of a past-producing mining complex in Arizona owned by BHP. Both U.S. assets are on the back burner as the main focus is Santa Ana.

Outcrop Silver & Gold (TSX-v: OCG) / (OTCQB: OCGSF) is very leveraged to strong precious metals prices this year and next, and especially well positioned if Ag outperforms Au. All else equal, a tightening of the Au:Ag ratio from 90 to 80:1 could send this Company’s shares a lot higher.

Disclosures / disclaimers: The content of this article is for information only. Readers fully understand and agree that nothing contained herein, written by Peter Epstein of Epstein Research [ER], (together, [ER]) about Outcrop Silver & Gold, including but not limited to, commentary, opinions, views, assumptions, reported facts, calculations, etc. is to be considered implicit or explicit investment advice. Nothing contained herein is a recommendation or solicitation to buy or sell any security. [ER] has never been, and is not currently, a registered or licensed financial advisor or broker/dealer, investment advisor, stockbroker, trader, money manager, compliance or legal officer, and does not perform market making activities. [ER] is not directly employed by any company, group, organization, party or person. The shares of Outcrop Silver & Gold are highly speculative, not suitable for all investors. Readers understand and agree that investments in small cap stocks can result in a 100% loss of invested funds. It is assumed and agreed upon by readers that they will consult with their own financial advisors before making investment decisions.

At the time this article was posted, Peter Epstein owned stock in Outcrop Silver & Gold and the Company is an advertiser on [ER].

While [ER] believes it is diligent in screening out companies that are unattractive investment opportunities, [ER] cannot guarantee that its efforts will be, (or have been), successful. [ER] is not responsible for any perceived, or actual, errors including, but not limited to, commentary, opinions, views, assumptions, reported facts & financial calculations, or for the completeness of this article or future content. [ER] is not an expert in any company, industry sector or investment topic.

![Epstein Research [ER]](http://EpsteinResearch.com/wp-content/uploads/2015/03/logo-ER.jpg)