Which major commodity will be this year’s uranium? Readers might know that uranium doubled in 2023. Could it be nickel or lithium, both of which sold off relentlessly last year? Could it be copper? Might it be gold or silver, each up ~7% in the past month?

All of those metals could have big-to-very-big gains, but I’m going with silver (“Ag”) as my #1 pick. No, I’m not saying that silver will double, but I think it could be up 43%-60% on the heels of a 15%-20% gain in gold.

If Au rises 15-20%, combined with an industrial demand-driven decline in the Au: Ag ratio from near 90:1 to 65-70:1, Ag would rise from +43% to +60%, see chart below. In February 2021, the Au: Ag ratio touched the low 60’s:1. While Au is at an all-time (nominal) high, Ag remains well below its ATH, and is 88% below its inflation-adjusted high.

That’s right, Ag at today’s $24.2/oz. is 88% below the inflation-adj. ATH of $196/oz.! That leaves tremendous room for Ag to rally into the $30’s-$40’s/oz. without anyone credibly saying it’s overbought. Consider that if Au rises 20% AND the Au: Ag ratio tightens to 65:1, the Ag price would be at $38.1/oz., still 81% below the ATH.

If one believes $196/oz. is an outlier, consider that for the entire year of 1980 the inflation-adj. price averaged $84/oz., decades before meaningful solar or EV demand. Since the ATH inflation-adj. prices of Au & Ag happened around the same time in Jan. 1980, it’s fair to mention that the Au: Ag ratio back then was under 20:1.

It would NOT be a black swan event, not even close, for the Au: Ag ratio to revert back to 50:1 — it was in the mid-30’s:1 in April-2011. Therefore, one simply can’t rule out $40-$50/oz.

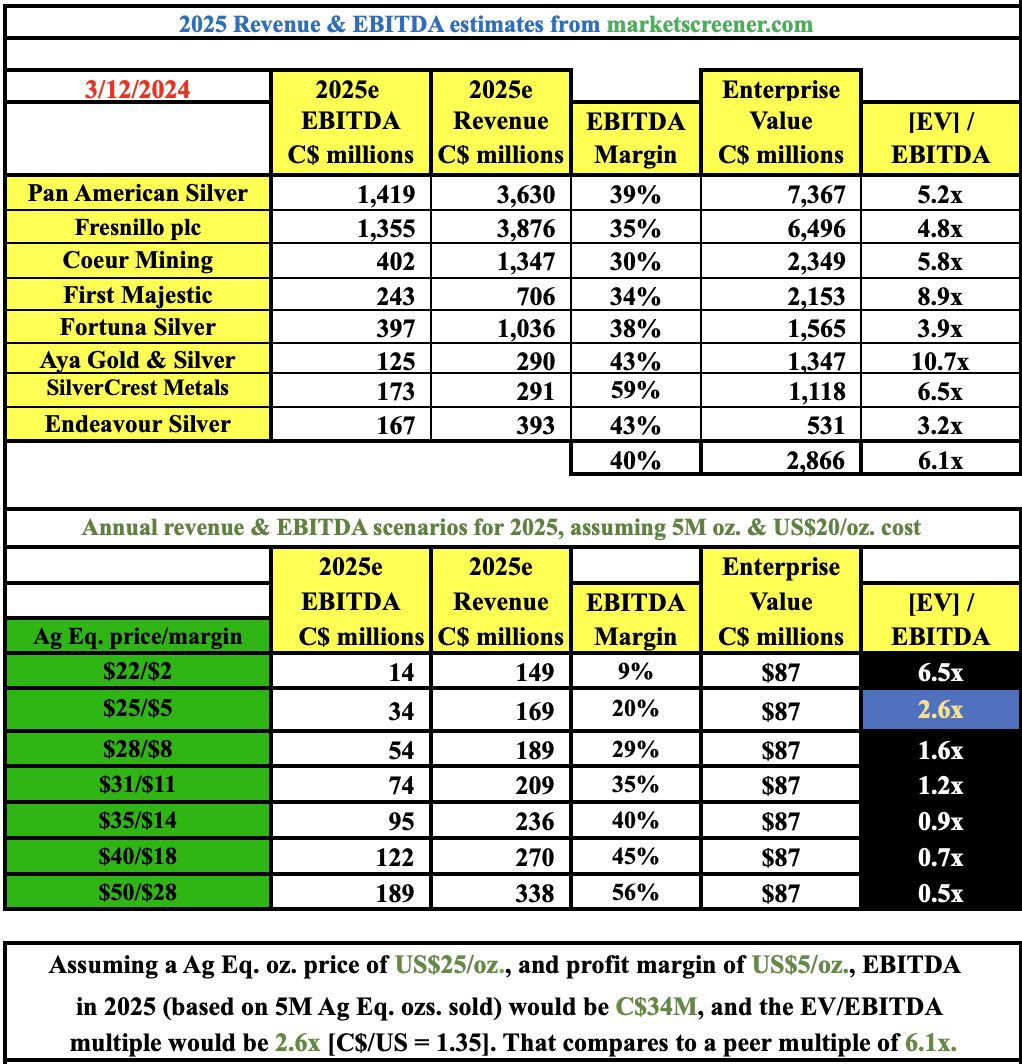

Don’t worry, I’m not basing this article on $40-50/oz. Ag, but I am counting on $25-$30/oz. In that scenario, I continue to like Mexico’s Guanajuato Silver [G-Siver] . Next year, I believe its All-in-Sustaining-Cost (AISC) could be ~$20/oz., on production of 5M ounces. If the Ag price is $25/oz., EBITDA would be [5.0M x $5.0 margin = $25M].

G-Silver has underperformed the recent Au-Ag stock bounce because its AISC is high (but slowly descending) and it has ~$21M in net debt on top of a market cap of ~$64M. So, yes this is a risky stock, but the debt is in friendly hands, mostly with Ocean Partners, to be repaid monthly over 36 months (with a six-month grace period).

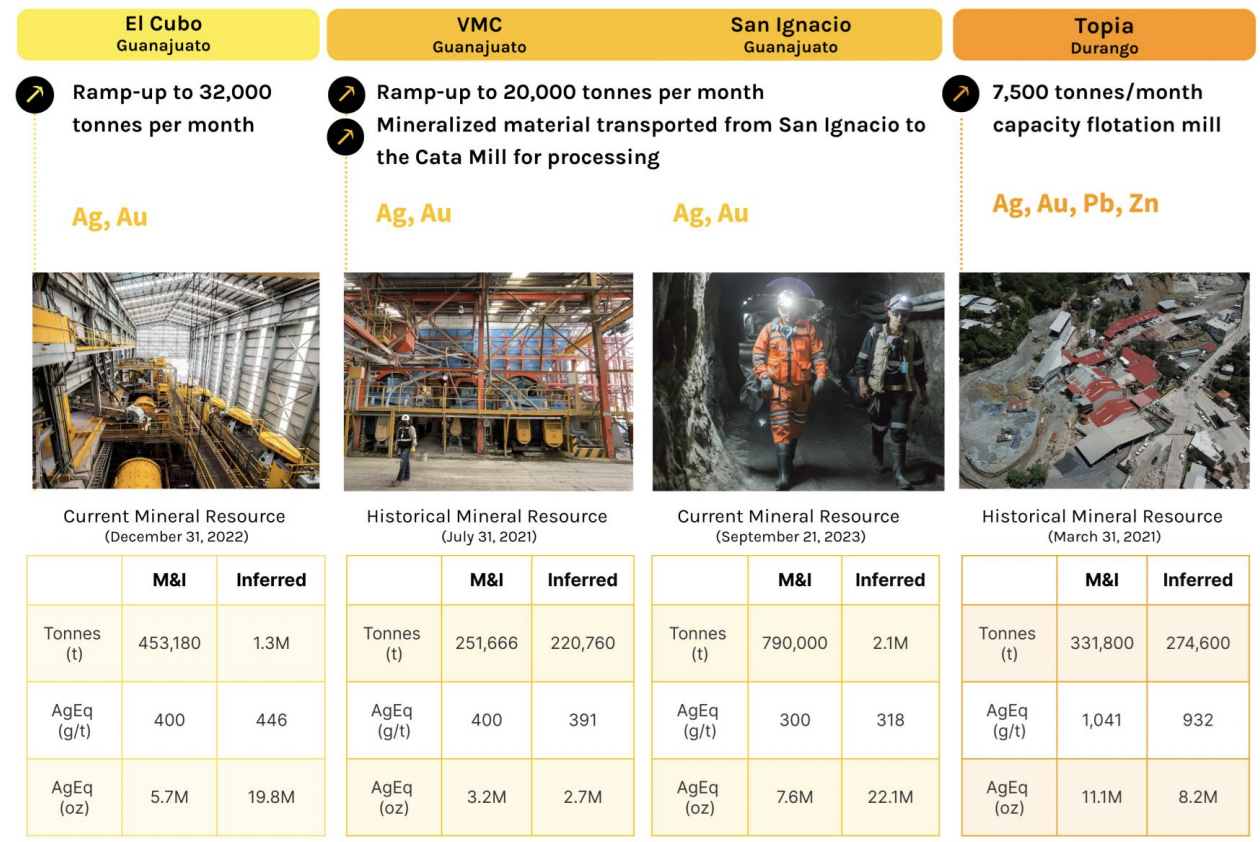

G-Silver has four operating mines + three processing facilities. This is critically important as it gives management excellent flexibility to produce plenty of gold to send to Ocean Partners (338 oz. gold/month), ~10% of Ag Eq. production. With G-Silver shares at C$0.18 today, I got ahold of CEO James Anderson, who’s headed back to Guanajuato tomorrow.

He acknowledges the challanges ahead, but is as upbeat as he has been in many months due to operational improvements, precious metal prices & ongoing production growth.

Can we please get the latest updates on G-Silver’s 4 mines & 3 processing facilities?

Production in January of ~330k Ag Eq. ounces was the 2nd highest in the Company’s history. In our first month with the new 3rd party processing agreement, we added 40,862 Ag Eq. ounces, 12% of January’s total.

Dewatering of the Villalpando area of El Cubo is opening up new zones of deeper, higher-grade material. Next month we hope to access mining blocks with historical grades > 350g/t Ag Eq.

At Topia, changes to the business model are proving successful; additional mine contractors are being retained, which could increase production by up to 20%. We continue to make securing additional 3rd party processing agreements a key focus. We hope to have new agreements to announce in the coming weeks & months.

Should investors expect an improvement in margins this year, or is that next year’s business?

Yes, our costs per ounce are coming down, Q4/23 numbers will be out next month. Those figures will demonstrate a marked improvement over Q3/23. The strength in the Mexican peso is still a drag on our earnings, but we’re making progress on the things we can control.

G-Silver is more silver than gold, but how important is the gold price knocking on the door of US$2,200/oz.?

The new 3rd party processing agreement and production from the El Horcon stockpile are primarily producing gold; these two production centers represented 15% of January’s production, a number that’s rising. In terms of value based on Ag Eq. ounces produced, gold now represents ~50% of Ag/Au revenues. We might have to change our name to Guanajuato Gold!

Importantly, 90% of cash flows come from Ag/Au. Many precious metal companies derive 20%-50% of their economics from base metals. For example, in 2023, half of Compañía de Minas Buenaventura S.A.A. [“BVN“] revenue came from lead, zinc & copper. We get 10% from lead & zinc.

4M Ag Eq. ounces of production in 2024 seems a reasonable goal. Might there be a meaningful uptick to an annual run-rate of 5M or 6M Ag Eq. ounces in 2025 or 2026?

Our production is ramping up this year. And, by year-end, we expect our mines will still be expanding. While we don’t have official guidance, we are optimistic that our growth trajectory will continue this year & next.

The silver price is back above $24, currently $24.20/oz. but nowhere near its all-time high. Are you as bullish on silver demand from solar panels as you were last year?

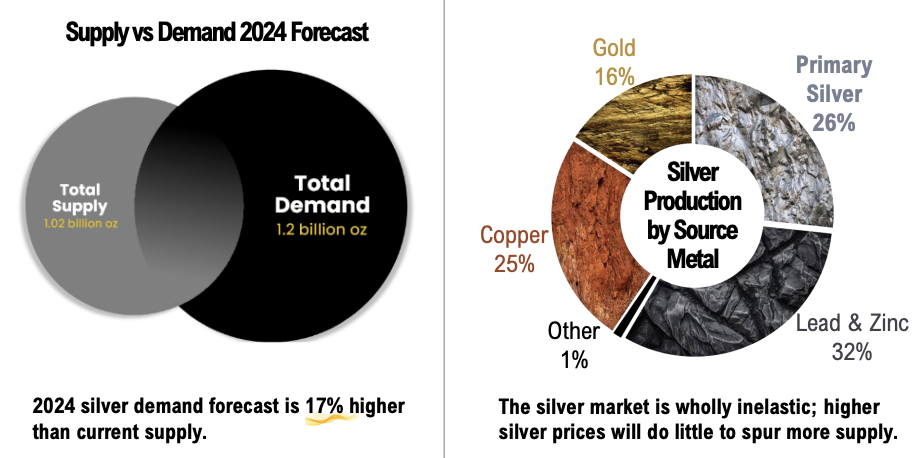

It’s not just us that remain bullish on the solar narrative, several pundits see soaring Ag demand from solar installations as pretty much a sure thing. The primary driver of industrial demand for Ag is photovoltaics. China’s increase in solar deployments in 2023 was larger than the rest of the world combined.

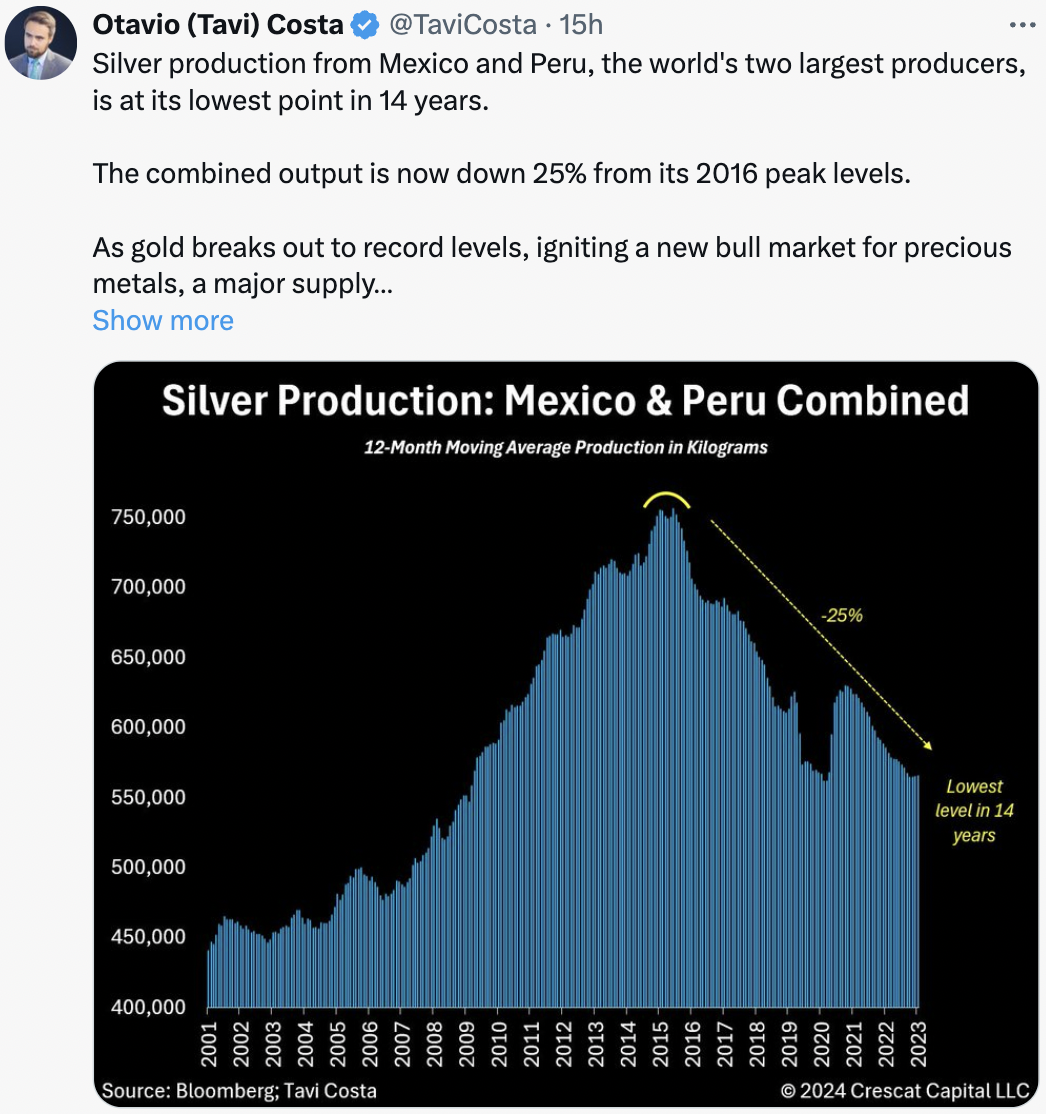

The question is, can mined Ag supply meet soaring demand? A recent tweet/X from Tavi Costa of Crescat Capital is quite telling {see above}. He points out that combined, Ag production from Mexico & Peru is down 25% from the peak of 2016.

Why should investors consider buying shares in G-Silver now vs. waiting a few quarters to watch for operating updates?

We think the worst is behind us on both silver/gold prices and the operating challenges of last year. Therefore, at $0.18 our valuation is cheap vs. many peers. Also, G-Silver is a pure-play Ag/Au producer, still expecting to grow this year & next. We have a moderate debt balance, but a strong partner in Ocean Partners.

Besides news on first-quarter production, are there other near-term catalysts for readers to look forward to?

Our latest 3rd party processing agreement has been very valuable to the Company as we look to run our facilities up to full capacity. As mentioned, we have been working on obtaining similar agreements with other local producers. We expect to conclude another agreement in the near term.

Thank you, James, enlightening as always. It sounds like things are moving in the right direction. I hope the next time we speak silver is > $27, on its way to $30+/oz.

Disclosures / disclaimers: The content of this article is for information only. Readers fully understand and agree that nothing contained herein, written by Peter Epstein of Epstein Research [ER], (together, [ER]) about Guanajuato Silver, including but not limited to, commentary, opinions, views, assumptions, reported facts, calculations, etc. is to be considered implicit or explicit investment advice. Nothing contained herein is a recommendation or solicitation to buy or sell any security. [ER] is not responsible for investment actions taken by the reader. [ER] has never been, and is not currently, a registered or licensed financial advisor or broker/dealer, investment advisor, stockbroker, trader, money manager, compliance or legal officer, and does not perform market making activities. [ER] is not directly employed by any company, group, organization, party or person. The shares of Guanajuato Silver are highly speculative, not suitable for all investors. Readers understand and agree that investments in small cap stocks can result in a 100% loss of invested funds. It is assumed and agreed upon by readers that they will consult with their own licensed or registered financial advisors before making any investment decisions.

At the time this article was posted, Peter Epstein owned stock in Guanajuato Silver. The Company was not a current, but is a recent advertiser on [ER].

While the author believes he’s diligent in screening out companies that, for any reasons whatsoever, are unattractive investment opportunities, he cannot guarantee that his efforts will be (or have been) successful. [ER] is not responsible for any perceived, or actual, errors including, but not limited to, commentary, opinions, views, assumptions, reported facts & financial calculations, or for the completeness of this article or future content. [ER] is not expected or required to subsequently follow or cover any specific events or news, or write about any particular company or topic. [ER] is not an expert in any company, industry sector or investment topic.

![Epstein Research [ER]](http://EpsteinResearch.com/wp-content/uploads/2015/03/logo-ER.jpg)