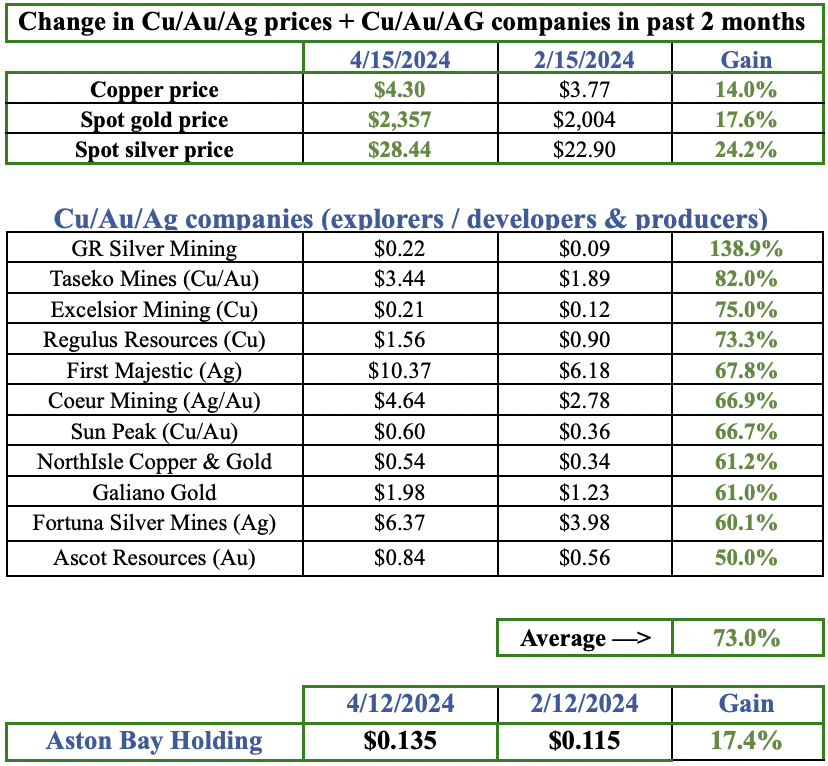

Everyone is chasing tech stocks like Nvidia, Microsoft & Amazon. To say that few people are interested in metals & mining would be a gross understatement. Gold recently hit an all-time high, yet the world’s largest producer Newmont is 36% below its 52-week high & 61% below its all-time high.

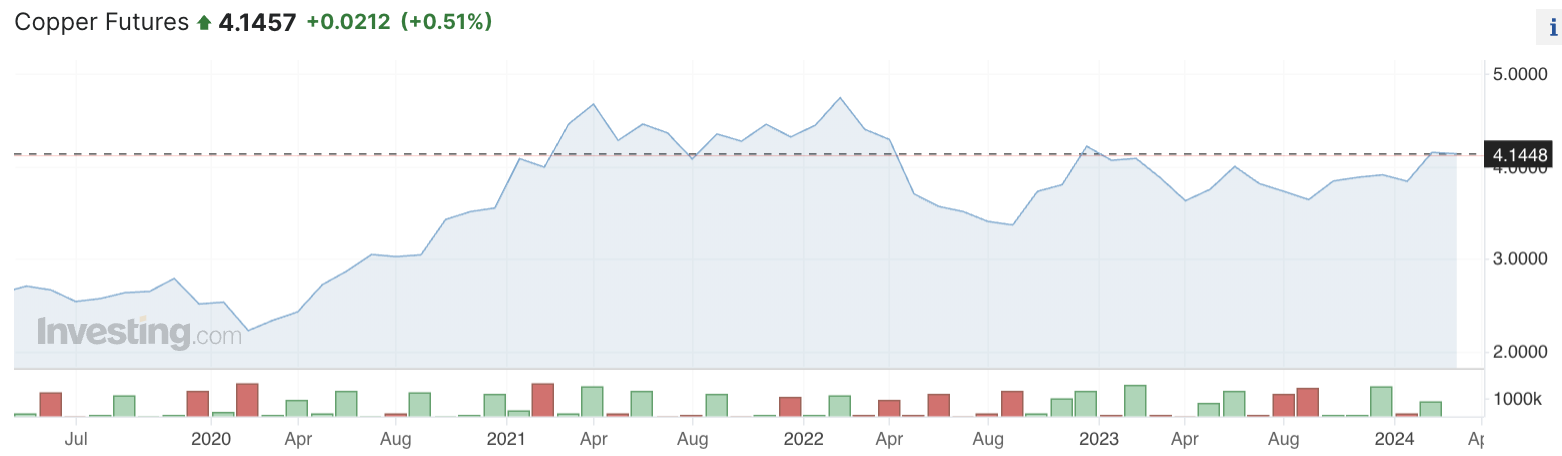

This narrative will not last, the world needs A LOT more metals. McKinsey & Company forecasts global demand for copper (“Cu“) to reach 36.6M tonnes by 2031, an 8-yr CAGR of +5.6%. That compares to ~2.5%/yr. since 2000. McKinsey expects global supply in 2031 to fall short by 6.5M tonnes.

Falcon Gold (TSX-v: FG) / (OTCQB: FGLDF) is positioned to benefit Cu at $4.15/lb., nearly a 1-yr. high, and from a strong bounce in the gold (“Au“) price, which topped $2,200/oz., before sliding back to ~$2,164/oz. (Apr-Futures price). Nickel (“Ni“) is up to almost $18k/tonne from ~$16k/t.

Sometimes companies like Falcon Gold with many properties, projects & metals, fail to receive credit for more than just a few assets. However, secondary properties take on new importance in bull markets. Management is better able to farm out, JV or spinout projects in B.C., Newfoundland & Ontario.

Falcon is a tiny company, but it packs a powerful punch. It has ample Au & Cu opportunities, but also Ni & lithium (“Li”) Simply put, Falcon has a lot of irons in the fire, including near-term drilling, yet its enterprise value {market cap + debt – cash} is just C$5M {C$0.04/shr. stockwatch 3/15/24 close}.

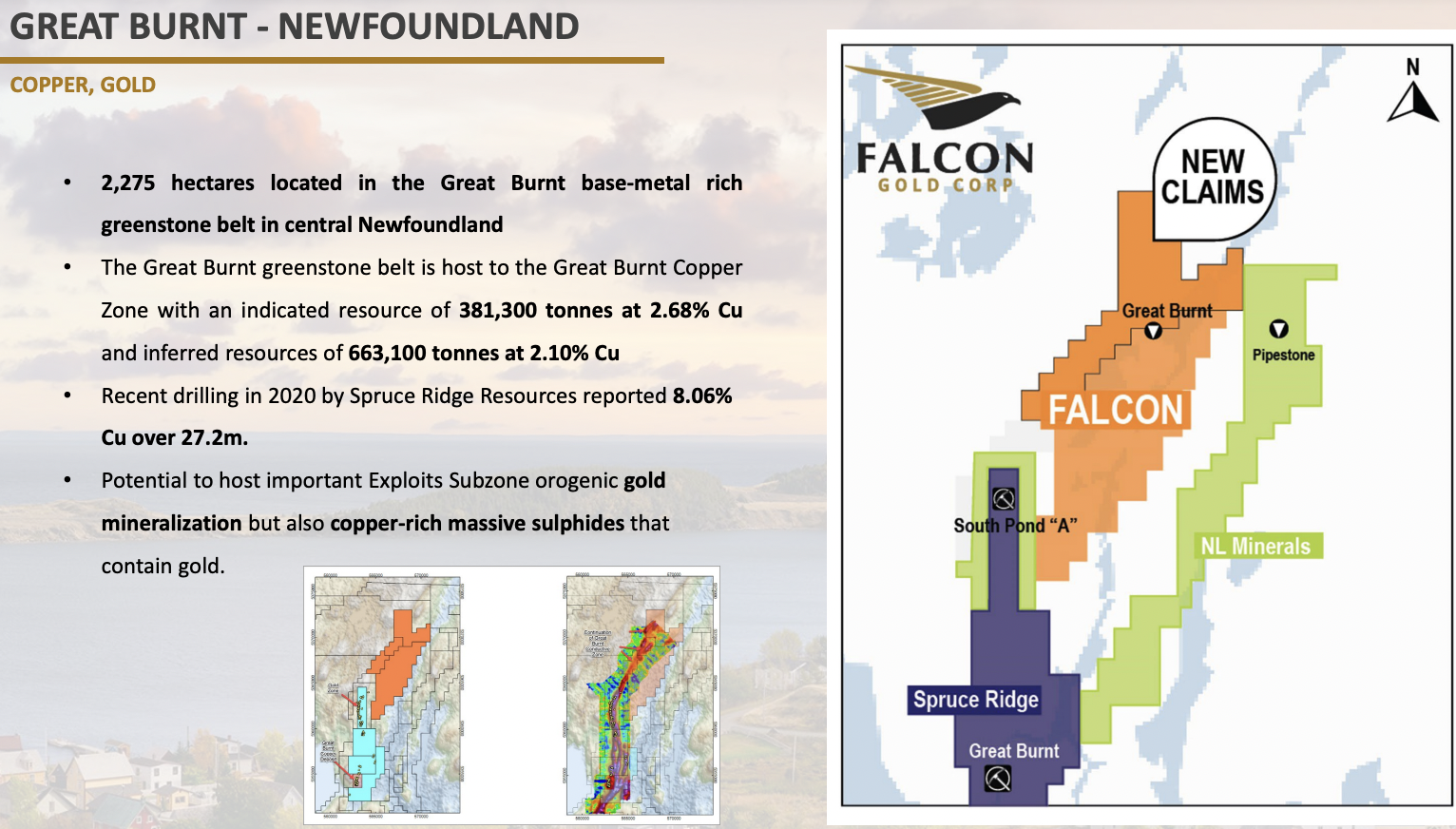

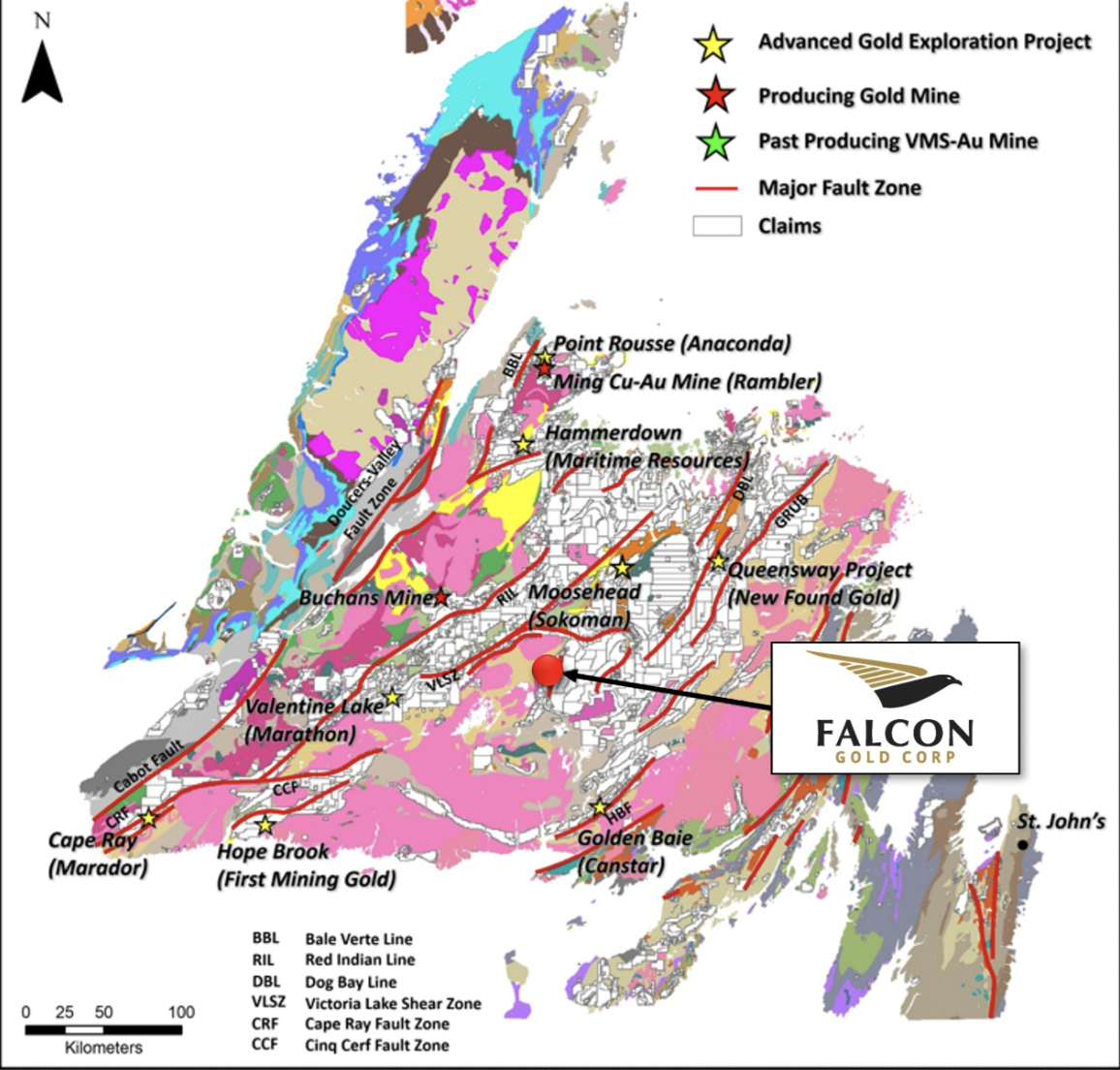

A current focus is the 100%-owned, 2,275-hectare Great Burnt [“GB“] Cu project, in Newfoundland. It is in the Great Burnt Greenstone Belt, which hosts massive sulfide lenses that can be meters thick and extend for several km.

Management has received a drilling permit to test up to 10 geophysical anomalies with ~1,100 meters. Why is this exciting?

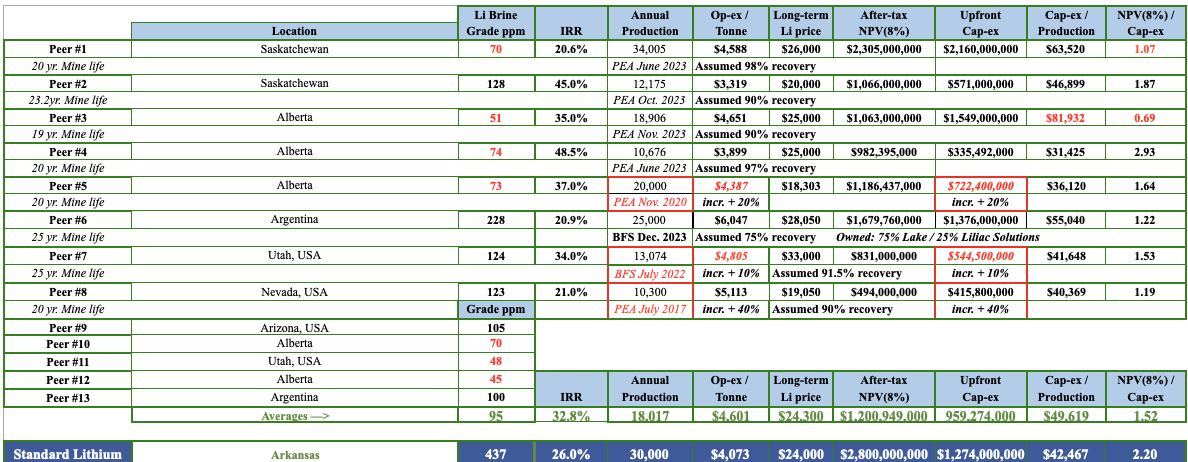

And, Benton Resources is earning a 70% interest in its (same name) Great Burnt project from Spruce Ridge. One look at Benton’s presentation & press releases is telling… It’s all about Great Burnt! If one ascribes 3/4’s of Benton’s entire valuation to its Great Burnt project, that’s $42M (on a 100% basis).

Importantly, Falcon’s claims overlie the northern continuation of the conductive trend associated with lithologies hosting the Cu-rich Great Burnt & Au-rich South Pond deposits held by Benton.

Great Burnt Project – Falcon claims in orange and Benton – Spruce Ridge JV in blue

Drilling by Benton & Spruce Ridge has returned bonanza intervals [unless indicated otherwise, true width ~70%]; 27.2 meters of 8.1% Cu, 26.9 m / 7.2% Cu, 25.4 m / 5.5% [true width ~90-95%], 22.8 m / 6.9%, 20.9 m / 6.2%, and 24.0 m / 5.8%. These grades [for widths > 10 m] are in the Top-5 globally since 1/1/23.

Benton’s Great Burnt has a NI 43-101 compliant 72M pounds of Cu at a very robust grade of 2.85%. As that resource expands, it will draw even more attention to Falcon’s bordering position. Benton’s stated goal is a 30-40M tonne deposit at its Great Burnt. Results from a 4,000-meter drill program underway by Benton should add more fireworks.

NOTE: Drill results by Benton/Spruce Ridge are not indicative of what Falcon might uncover in its drill program.

There are also interesting Au values on Benton’s footprint, incl. intercepts of 10 to 51 m of 1.3 to 2.4 g/t Au. On Falcon’s ground, airborne electromagnetic + magnetic signatures show numerous priority targets that have never been drilled.

The Company’s GB is ~4 km west of the Exploits Subzone which contains deep-seated, Au-bearing structures of the Dog Bay-Appleton Fault-GRUB Line deformation corridor.

New Found Gold’s ultra-high-grade Queensway (27.0 m @ 105 g/t + 20.5 m @ 86.2 g/t) & Sokoman Minerals’ Moosehead projects (9.0 m of 70.3 g/t Au + 11.9 m of 45 g/t Au) are in the Exploits Subzone. Look at the map, Moosehead is very close. Even if Falcon’s GB is worth just a third of Benton’s Great Burnt, that would be ~$14M vs. Falcon’s valuation of $5M.

CEO Karim Rayani commented,

“The Great Burnt camp is becoming recognized for its high-grade copper tenor. Benton’s ongoing success at Great Burnt and recent news from FireFly Metals Ltd. on its high-grade Green Bay Cu-Au project in the Rambler camp, is putting the copper potential of promising VMS deposits in Newfoundland front & center.”

Austratlian-listed Firefly Metals’ Green Bay project, ~150 km from Falcon’s GB, has booked ~1.6 billion pounds, at an impressive 1.83% Cu. Firefly has another of the Top-5 drill intercepts [of > 10 M], it booked 46 m at 4.57% Cu.

Falcon’s Golden Brook project covers > 40,000 ha in central Newfoundland and is sandwiched between Big Ridge Gold’s & Matador Mining’s 1.4M (@ ~2.4 g/t Au) & 610k (@ ~2.0 g/t Au) ounce projects. B2Gold owns 9.6% of Matador.

Calibre Mining (C$1.3B mcap) has a 5.1M oz. (@1.8 g/t Au) development project ~100 km east of Falcon’s Golden Brook. It has a Bank Feasibility Study (“BFS“) with an after-tax NPV(5%) of US$919M, and IRR of 28.6%, at a gold price of $1,900/oz.

The AISC of ~$1,050/oz. is attractive, and the ratio of NPV/cap-ex = 2.0x. This mine is starting operations in 1H 2025, which will draw a lot of attention to central Newfoundland.

Newfoundland is well-known for Au, will it soon be recognized for its Cu endowment? And, what about Ni & Li? Falcon’s Golden Brook remains a promising Au target, but is also < 10 km from the Vinland Lithium JV that Piedmont Lithium invested in at an implied valuation of ~C$20M.

Successful exploration, particularly in the Kraken zone, revealed critical & rare-earth metals including; lithium, lanthanum, tantalum, niobium, beryllium, zirconium, tungsten, molybdenite & bismuth. The best Li intercept at the Vinland JV is a solid 1.04% Li2O over 15.2 m, incl. 4.2 m of 1.48% Li2O.

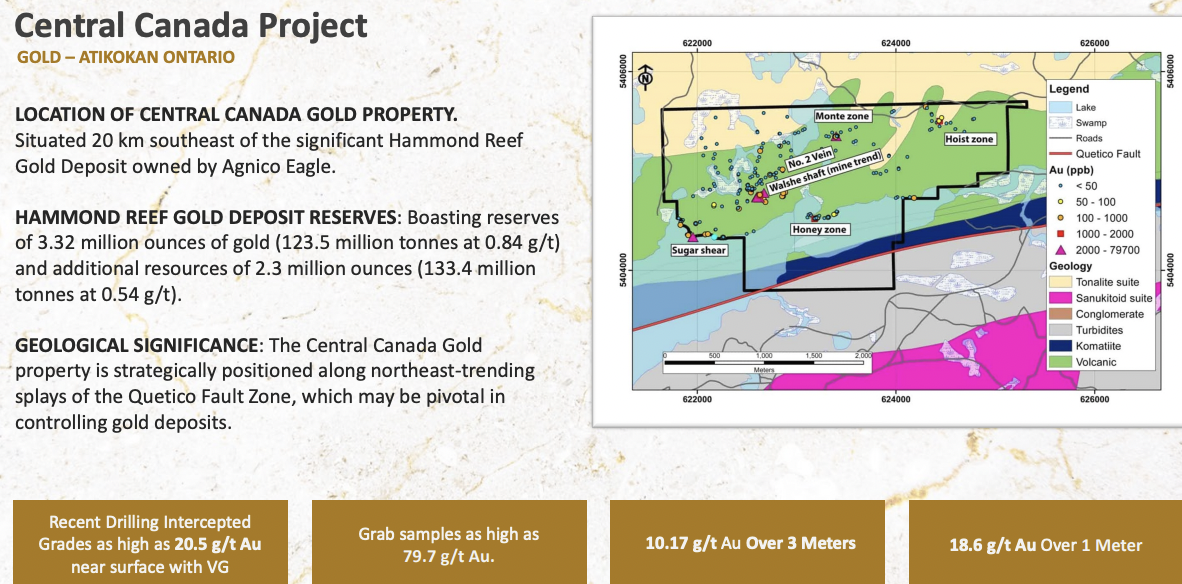

Another of the roughly dozen projects that Falcon has is the Company’s Central Canada [“CC“] project is ~20 km SE of Agnico Eagle’s Hammond Reef project with ~5.6M ounces of Au (Reserves + Measured & Indicated resources) and a forecasted All-in-Sustainable Cost (“AISC“) under US$900/oz.

CC hosts a historic producer with a shaft & mill. The project is on a parallel system to the one that the Hammond Reef deposit is tied to. In 1934, the Central Canada mine reportedly had ~230,000 ounces of 9.9 g/t Au (NOT NI 43-101 compliant).

Since 2020, Falcon has completed 17 diamond drill holes at CC totaling 2,943 m. Highlights include 10.1 g/t Au over 3.0 m from 67 m downhole, 18.6 g/t Au over 1.0 m (with visible gold) from 104 m, 2.8 g/t Au / 7.5 m from 158 m, and 1.57 g/t Au / 14.8 m from 90 m. Those are good grades for near-surface ounces.

A Phase 3 drill program of up to 2,000 m is planned for 4q 2024. It will include three holes totaling ~1,000 m at vertical depths of 200 to 300 m, potentially extending Au-bearing zones beyond the current depth of 160 m. The strike length is 275 m.

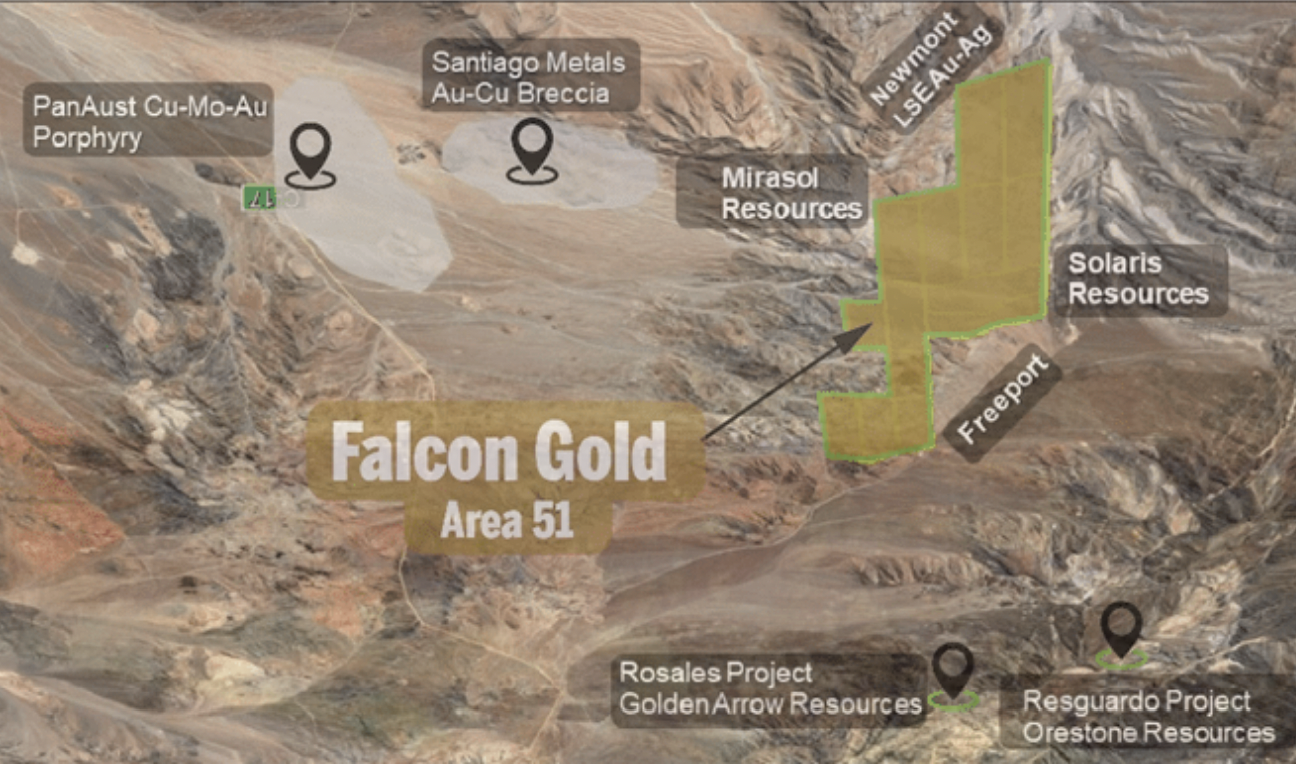

Area 51 is a 100%-owned project covering 4,000 hectares in northern Chile. The Inca Del Oro mining district is situated along Chile’s Paleocene age mineral belt hosting multiple porphyry, skarn, & epithermal deposits. The project has road access and year-round working conditions.

There are multiple mining & exploration projects in the vicinity, including the Inca de Oro porphyry Cu-Mo-Au-Ag deposit (460Mt grading 0.40% Cu). Area 51 is surrounded by exploration & mining companies including Freeport McMoran, Newmont, Solaris Resources, and Mirasol Resources.

Falcon Gold (TSX-v: FG) / (OTCQB: FGLDF) has about a dozen properties/projects covering Au, Cu, Ni & Li, mostly in Canada, but two in Chile. Au & Cu prices have been strong, while Li & Ni prices have bounced off 52-week lows.

Near-term drilling at Great Burnt could be a game-changer if high Cu grades or decent Au grades are hit over multiple meters. With several other promising projects, including the high-grade Au Central Canada in Ontario & the Li/Au prospective Golden Brook in Newfoundland, today’s valuation of $5M seems incredibly cheap.

Disclosures: The content of this article is for information only. Readers fully understand and agree that nothing contained herein, written by Peter Epstein of Epstein Research [ER], (together, [ER]) about Falcon Gold, including but not limited to, commentary, opinions, views, assumptions, reported facts, calculations, etc. is not to be considered implicit or explicit investment advice. Nothing contained herein is a recommendation or solicitation to buy or sell any security. [ER] is not responsible under any circumstances for investment actions taken by the reader. [ER] has never been, and is not currently, a registered or licensed financial advisor or broker/dealer, investment advisor, stockbroker, trader, money manager, compliance or legal officer, and does not perform market-making activities. [ER] is not directly employed by any company, group, organization, party or person. The shares of Falcon Gold are highly speculative, not suitable for all investors. Readers understand and agree that investments in small-cap stocks can result in a 100% loss of invested funds. It is assumed and agreed upon by readers that they will consult with their own licensed or registered financial advisors before making investment decisions.

At the time this article was posted, Falcon Gold was an advertiser on [ER] and Peter Epstein owned shares and/or stock options in the company.

Readers understand and agree that they must conduct their own due diligence above and beyond reading this article. While the author believes he’s diligent in screening out companies that, for any reason whatsoever, are unattractive investment opportunities, he cannot guarantee that his efforts will (or have been) successful. [ER] is not responsible for any perceived, or actual, errors including, but not limited to, commentary, opinions, views, assumptions, or reported facts.

![Epstein Research [ER]](http://EpsteinResearch.com/wp-content/uploads/2015/03/logo-ER.jpg)