In Jan./Feb. the spot price of battery-grade lithium carbonate in China reached a multi-year low of ~US$13.2k/tonne, but was it the bottom? Today, the price sits at ~$15.4k/t, down from ~$16.2k/t six weeks ago.

This is one of many spot & contract lithium (“Li“) prices for carbonate & hydroxide based on jurisdiction, quality specs & transport logistics. However, this particular price influences market sentiment more than most.

As a result of this price being down ~82% from a high in 4Q 2022 > $84k/t, many Li projects have been stalled for nearly a year due to lack of funding. To be clear, a price above $50k/t was never going to be sustainable in the long term.

While I believe Li prices will recover to the $20-$30k/t range, the best defense against a prolonged period of sub-$16k is to invest in companies that own globally-significant projects.

Yet, even companies with the best (or most advanced) hard rock Li projects on earth have been brutalized. Green Technology Metals is down -86% from its 52-wk high, Piedmont Lithium is -78%, Standard Lithium -76%, Critical Elements -71%, Sigma Lithium -67%, Frontier Lithium -61%, Liontown Resources –61% and Patriot Battery Metals [PMET] -60%.

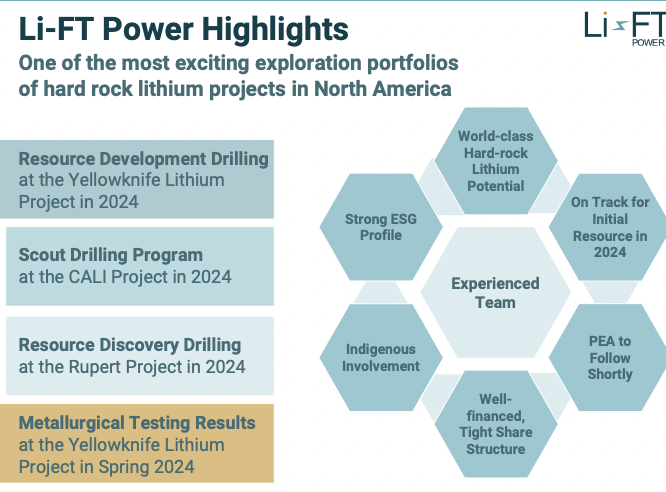

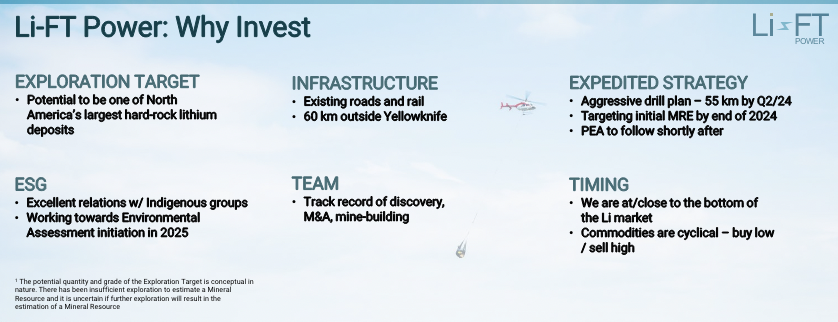

Li-FT Power (TSX-v: LIFT) / (OTCQX: LIFFF) is down –72%. It’s at an earlier stage, so there’s hesitancy in calling it the next PMET or the next Frontier Lithium. Management expects to deliver a maiden resource estimate (“MRE“) around year-end. {see new corp. presentation}

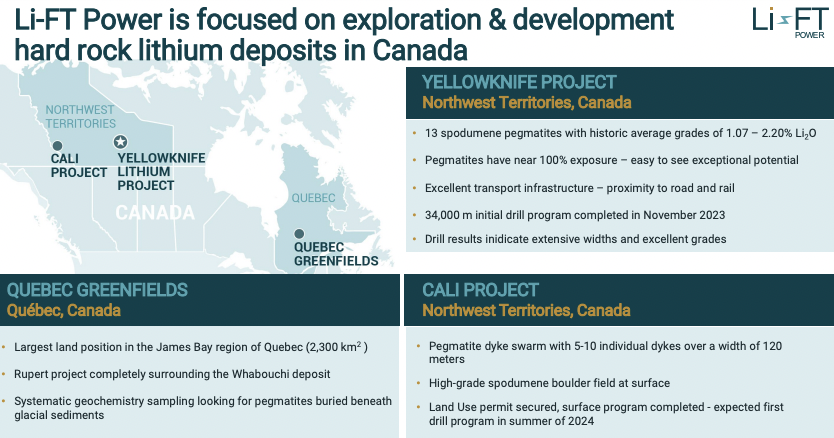

Located in the Northwest Territories (“NWT“), Li-FT’s Yellowknife project consists of 13 mineral leases covering most of the Li pegmatites making up the Yellowknife Pegmatite Province.

Analysts & market pundits have been through the Canadian hard rock maiden resource exercise several times, most notably with PMET, Frontier & Winsome Resources. They have a good grasp of what Li-FT’s drill results & geology point to. Over 50,000 meters has been completed across 8 spodumene-bearing pegmatite dikes.

Why should readers be comfortable that analysts & Li-FT’s technical team can deliver > 100M tonnes at > 1.10% Li2O? It’s a numbers game, once Li-FT has drilled ~75k meters (my estimate only), it should have 100M+ tonnes at 1.10%+. That will be PMET-like in size, but at a moderately lower grade.

Management recently closed a $10M capital raise, with no warrants, at roughly a +40% premium to market. With the overhang of a capital raise gone for now, investors should take a closer look.

PMET’s MRE was 109.2M tonnes at 1.42% Li2O, but it will grow substantially by the time Li-FT delivers its MRE. Look at the consistent drill results shown below. Management is extrapolating from 10s of thousands of meters. hopefully on the way to 75k meters drilled.

Readers are reminded that this winter has been unusually mild, which has increased costs & slowed the pace of drilling. Winter ice roads have been difficult to maintain. Several months after the MRE, a PEA is expected by mid-2025.

There have been some companies that have staged noteworthy rebounds lately. Winsome Resources is up +148% from its 52-week low, Century Lithium +124%, Frontier Lithium +110%, Lithium Americas +80%, and Latin Resources +80%.

Frontier Lithium is one of the best recent performers, but is still down –61% from its 52-week high. This shows how incredibly oversold some names are. If Li-FT’s share price were to double, it would still be -44% below its high.

In my view, Li-FT is undervalued due to investors thinking the shares are dead money until the MRE drops. I disagree. It’s possible that 1) Li market sentiment improves, benefiting the most oversold names, 2) Li-FT announces a strategic partner and/or off-take agreement.

Or, 3) the Canadian and/or NWT governments offer meaningful financial aid and/or infrastructure builds, 4) there is significant M&A in the Canadian Li space at strong valuations.

None of the above possibilities is priced into the share price, but I think the chances are > 50% that at least one of those things happen before year-end. In the meantime, Li-FT’s 100%-owned Yellowknife project is poised to become a Top-3 hard rock project in N. America.

Top-3, along with PMET’s Corvette & Arcadium Lithium’s James Bay. Sayona Mining has two, Winsome Resources one, and Frontier one significant project. {see new corp. presentation}

That’s it for this decade, 6 or 7 world-class, hard-rock Li projects in N. America can reach commercial production by 2030. I think it’s important to remind readers of that simple fact. What Li-FT has at Yellowknife is special. But wait, there’s more…

Management also has the Cali project in the NWT, a spodumene pegmatite dyke swarm occurring over a 150 m wide corridor. In 1977, the Cali area was mapped and a spodumene pegmatite was described as outcropping over 500 m, up to 100 m wide, with a vertical extent of 300 m.

Float mapping suggests that the Li-bearing dyke could be up to 1,200 meters in length. Depending on market conditions, Cali could be drilled later this year… But wait, there’s more…

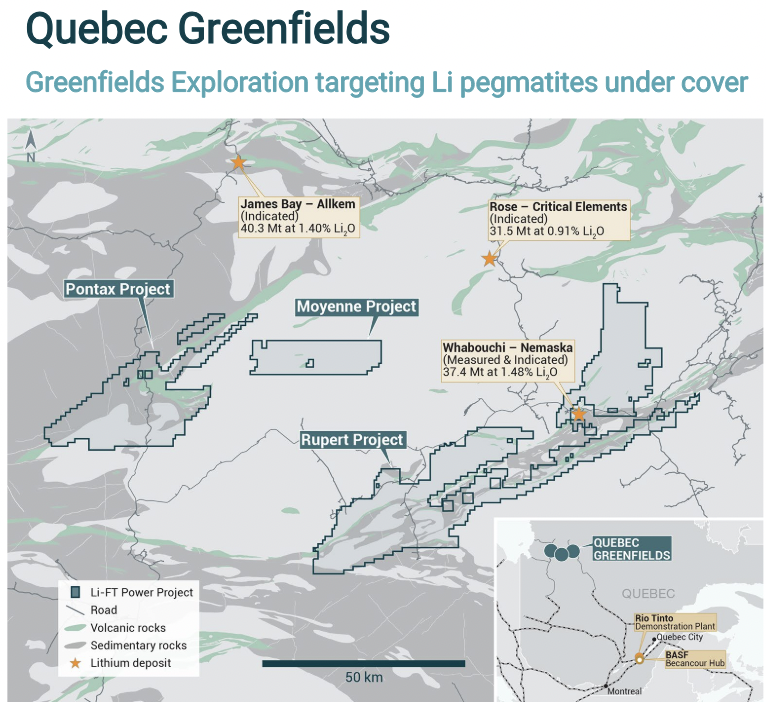

Three 100%-owned greenfield properties in Quebec, [Ruppert, Moyenne & Pontax] spanning 228,237 hectares. As Li market sentiment improves, the value of these properties will become more noticeable. Rupert (141,572 ha) surrounds Nemaska’s advanced-stage Whabouchi project {see map above}.

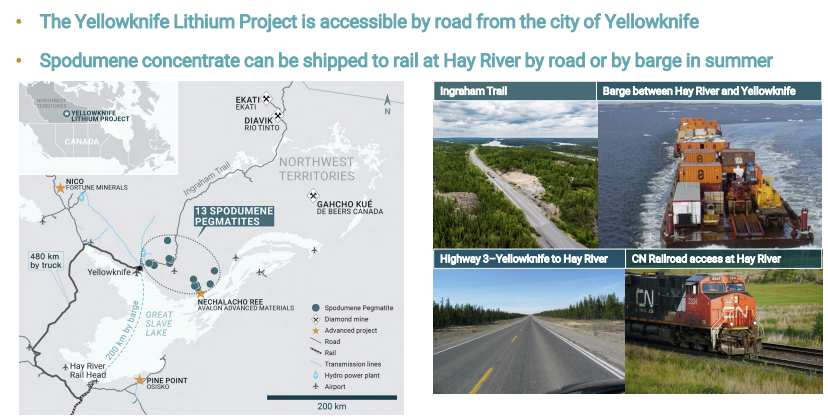

Yellowknife is one of the best-positioned of the globally significant Canadian hard rock projects in terms of regional infrastructure & product transportation routes. A paved highway from Yellowknife comes within several km of seven meaningful deposits.

Trucking around, and barging across, Great Slave Lake (barging ~4 months/yr.) to a rail line at Hay River is expected to be straightforward & reasonably low-cost. From Hay River, concentrate can be railed to a port at Prince Rupert or further south to the U.S.

Moyenne at 25,145 ha, is about the same size as the Yellowknife project, and larger than PMET’s 21,400 ha Corvette. It’s within 50-60 km of the James Bay project & Critical Elements’ Rose projects.

Pontax is 61,520 ha and has the most extensive Li anomaly of the three Quebec properties. It has highway access and is < 50 km south of the James Bay project. Any of the three Quebec prospects have the potential to be company-makers if farmed out to third parties.

To say that C$6B Arcadium Lithium, 50% owner of Whabouchi, and 100% owner of the James Bay project should care about Li-FT’s Quebec projects would be a gross understatement.

In a better market, I see no reason why the three Quebec projects couldn’t be worth a total of C$30M, which is significant compared to the Company’s enterprise value {market cap + debt – cash} of $112M (at $2.91/shr.).

Li-FT Power (TSX-v: LIFT) / (OTCQX: LIFFF) is out of favor, but on April 15th it was up as much as +17% before closing up +6%. When Li stocks move, they can move fast. I strongly believe it’s a question of when, not if, the Company’s valuation catches up to peers. At the end of the day, Li-FT has a Top-3 hard rock Li project in North America.

{see new corp. presentation}

Disclosures: The content of this article is for information only. Readers fully understand and agree that nothing contained herein, written by Peter Epstein of Epstein Research [ER], (together, [ER]) about Li-FT Power, including but not limited to, commentary, opinions, views, assumptions, reported facts, calculations, etc. is not to be considered implicit or explicit investment advice. Nothing contained herein is a recommendation or solicitation to buy or sell any security. [ER] is not responsible under any circumstances for investment actions taken by the reader. [ER] has never been, and is not currently, a registered or licensed financial advisor or broker/dealer, investment advisor, stockbroker, trader, money manager, compliance or legal officer, and does not perform market-making activities. [ER] is not directly employed by any company, group, organization, party or person. The shares of Li-FT Power are highly speculative, not suitable for all investors. Readers understand and agree that investments in small-cap stocks can result in a 100% loss of invested funds. It is assumed and agreed upon by readers that they will consult with their own licensed or registered financial advisors before making investment decisions.

At the time this article was posted, Li-FT Power was an advertiser on [ER] and Peter Epstein owned shares in the company.

Readers understand and agree that they must conduct due diligence above and beyond reading this article. While the author believes he’s diligent in screening out companies that, for any reason whatsoever, are unattractive investment opportunities, he cannot guarantee that his efforts will (or have been) successful. [ER] is not responsible for any perceived, or actual, errors including, but not limited to, commentary, opinions, views, assumptions, or reported facts.

![Epstein Research [ER]](http://EpsteinResearch.com/wp-content/uploads/2015/03/logo-ER.jpg)