Last month I wrote a well-received article about NuGen Medical Devices (TSX-v: NGMD) / (OTC: NGMDF). Readers resonated with the Company’s mission to make needle-free insulin injections for diabetics, and eventually for other medicines, vitamins, supplements, etc., commonplace. Even beloved pets are poised to benefit.

Of those who use insulin, 2 to 4 daily injections (and up to 8!) are routine. In addition, the elderly, individuals with “essential tremor” and those with Parkinson’s, have unsteady hands, making the safe handling of needles a serious challenge.

There’s a clear need for pain & anxiety-free needle-less delivery. So why is it still such a rarity? I addressed that question in my prior piece. Essentially, giant sellers of old-school needles don’t go after needle-free devices as it would simply cannibalize needle sales.

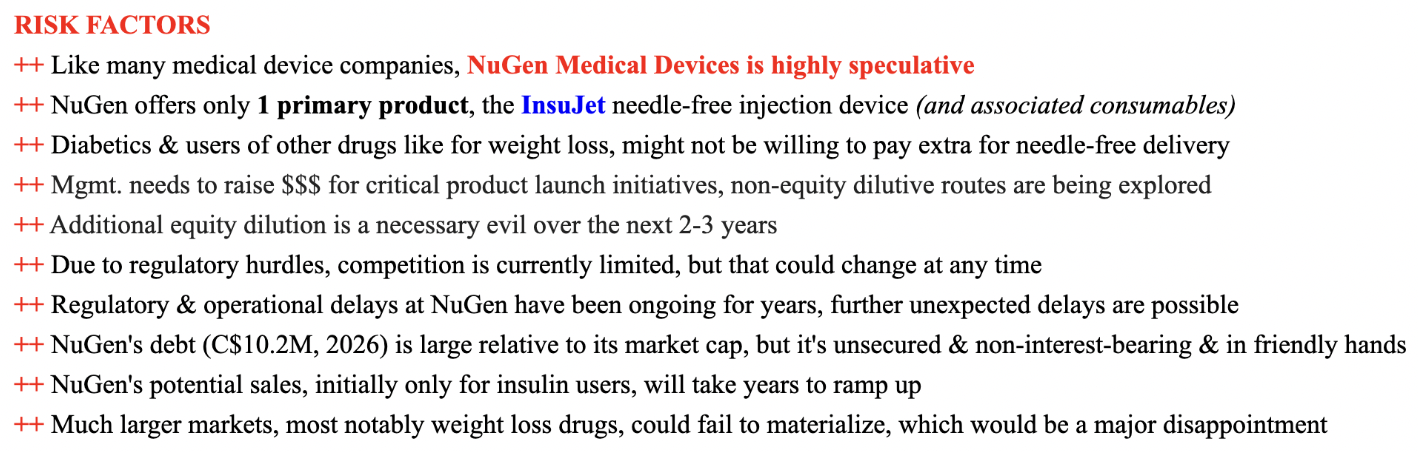

For smaller companies, several years + $10s of millions of investment to get approvals (possibly for just one drug in a few countries) is a difficult path to follow. Nugen has been down that road, and much of the heavy lifting has been done. Readers are reminded that NuGen is a highly speculative company, see RISK FACTORS below.

NuGen is selling injection devices that don’t use needles (InsuJet), are simple & painless, and are well-designed (durable). Importantly, NuGen expects to generate the majority of revenue from the sale of associated consumables including nozzles & adaptors. This recurring revenue resembles the tried & true “razor-razor blade” model.

For the past several months I have been watching the news to monitor competitors in the needle-free space. One reason I believe that NuGen has a long-term sustainable advantage is that it has not cut corners on the regulatory front. Its devices are approved in over 40 countries. This is critically important.

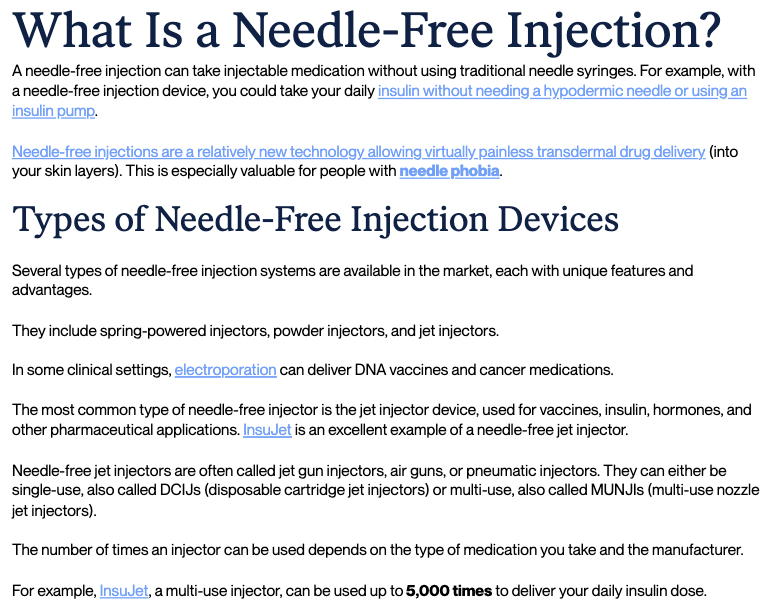

The needle-free market has been slow to develop because every drug needs to be approved for delivery via the exact injection device being sold. Therefore, regulatory approvals are required by country, product customization, and with a clinical demonstration of efficacy in one or more user trials.

Regulatory regimes provide meaningful barriers to entry for NuGen, which has already cleared a lot of hurdles. NuGen & predecessors have been at this for over a decade.

There have been false starts, and times when InsuJet sales expectations became too high, but with new management the Company is in a much better place.

When I do Google searches for “needle-free injections,” several companies pop up, but it’s unlikely they have all the approvals necessary to sell devices where I live, in the U.S.

For example, a few companies seem willing to sell me a starter kit even though management is not aware of any companies that are fully approved for the sale of needle-free injection devices in the U.S. Also, some companies that appear in searches are not direct competitors to NuGen.

Asked about Pharmajet as a competitor to NuGen. CEO Ian Heynen commented,

“Pharmajet is following a different path – they’re focused on vaccines & therapeutics delivered by health care practitioners, a different space than Nugen. We are focused on chronic community-based care with needle-free injections. Our first application is diabetes (insulin), and we see the weight-loss space as having significant potential.”

There’s room for multiple winners in the needle-free space. Especially across countries/end uses. NuGen is doing the hard, time-consuming work to not only get approvals, but also set up distribution & product support teams in key regions including the UK, Canada, Mexico & Europe.

These behind-the-scenes efforts are not sexy, but should lead to robust sales of InsuJet & consumables in the future. Importantly, NuGen doesn’t need to gain a leading market share or challenge the big boys in the conventional needles space.

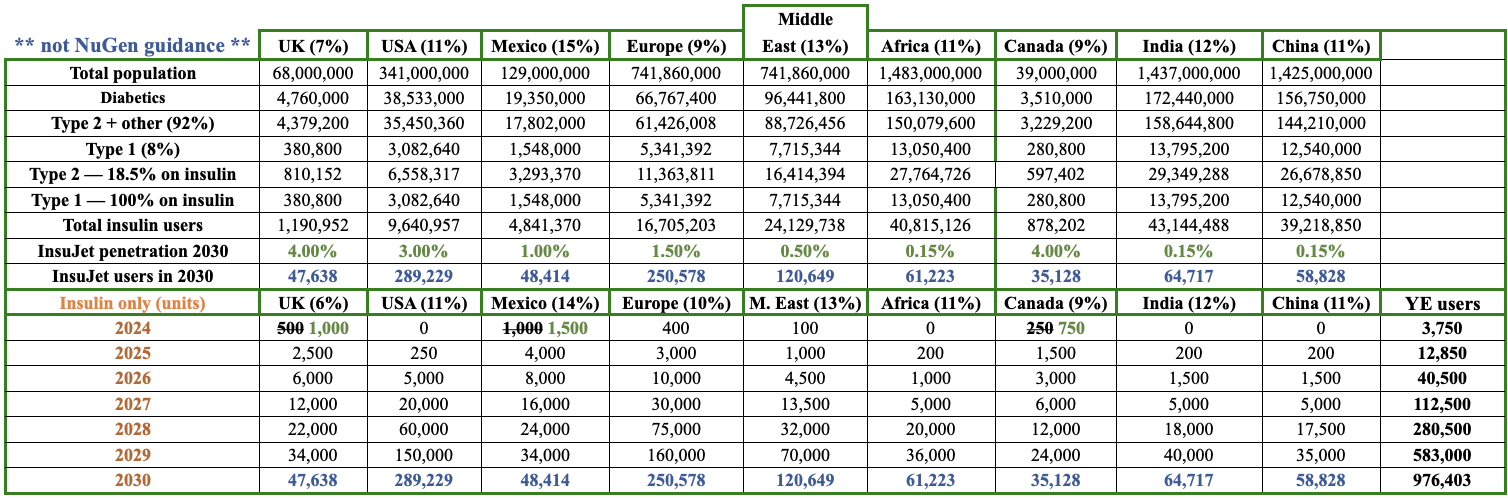

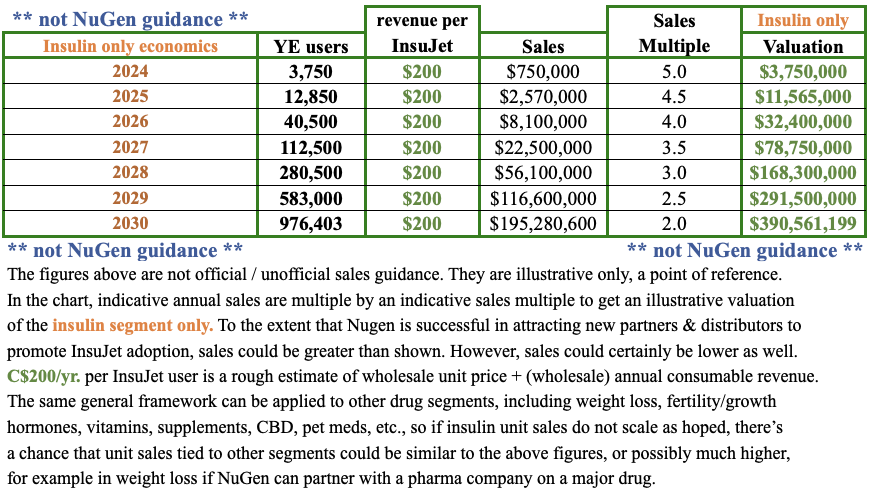

In the following chart, I show an indicative number of insulin users per region and an illustrative penetration rate of NuGen’s InsuJet units (for insulin only). These figures are NOT company guidance & should not be relied upon for investment decisions.

The purpose of the chart is to show an approximation of how big the insulin market is, i.e. the addressable market of the world’s insulin users. Estimates come from reputable sources such as the World Health Organization (WHO), and the Center for Disease Control (CDC).

In countries like the UK where NuGen’s InsuJet is thought to be the only needle-free device currently approved by the country’s free national healthcare system (NHS), there’s no cost for diabetics to switch from needles to InsuJet, and no out-of-pocket cost to use it.

Patients just need a prescription from a doctor. In 2030, I estimate InsuJet will achieve a 4% penetration of UK insulin users. This is a busy chart, but the takeaway is merely to show what could happen (the timing of penetrating markets will certainly differ).

Some markets could grow much faster than shown, others might not work out (for insulin). Notice that NuGen is not counting on rapid near-term growth in the U.S. or any one country.

Management already thinks the modest 2024 targets I set for the UK, Mexico & Canada will be surpassed. Europe could be next to “beat” 2024 expectations.

To be clear, topping such low sales figures (500, 100, 400, 250 units) is not the point. Far more important is that sales are finally happening in multiple countries, meaning that the logistics are largely in place to support sustainable growth for insulin AND new drugs from 2025 on.

As mentioned in my prior article, sales of InsuJet + associated consumables for the insulin market will not be that exciting this year or next. However, by 2026 things could look a lot different, especially if (as is likely) NuGen is selling InsuJet connected with weight loss drugs and/or other medicines, vitamins & supplements.

As evidence mounts of future robust unit sales, the market will incorporate the net present value of those opportunities. Therefore, news of collaborations with pharmaceutical companies, generic drug makers, distributors & retail network partners could be huge. Look at the chart for insulin only, prospective valuations could get pretty big.

Management expects to announce news on various initiatives in the coming months. The charts above can also be used for the rollout of InsuJet tied to other drugs, such as for weight loss. Or, growth hormones, fertility, vitamins, supplements, CBD, pet meds, etc.

In my view, several drug classes could be as large, or larger, opportunities than insulin. What better way for a weight-loss brand to compete than by offering a needle-free option?

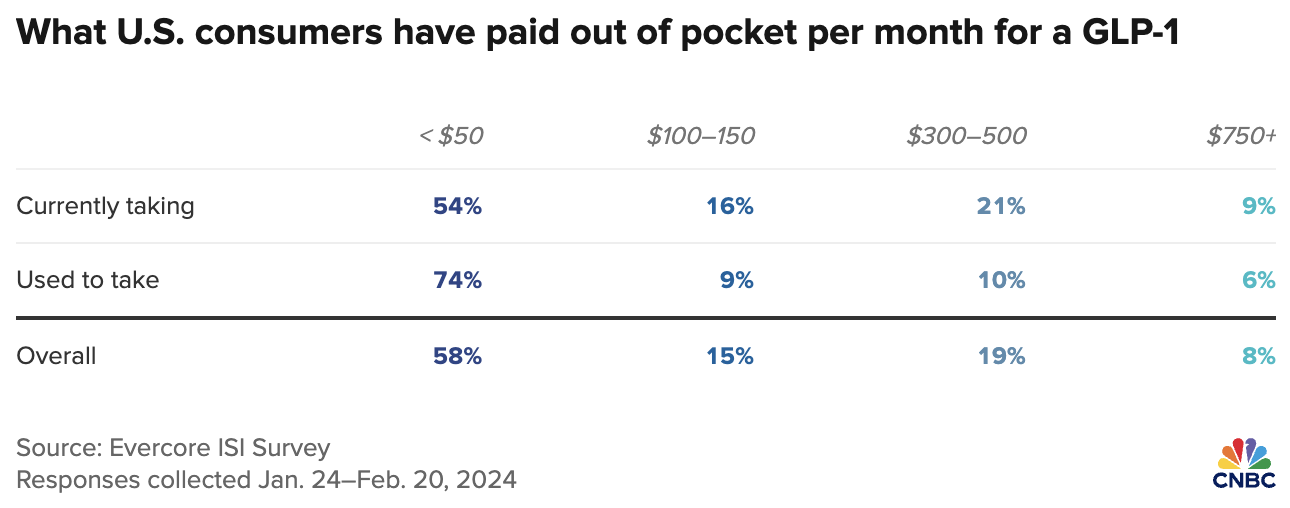

In terms of an addressable market, ~20% of adults have BMIs of 35+, vs. ~2.5% of adults using insulin, (but, weight loss drugs require fewer injections). Millions are paying US$1,000’s per year without insurance covering it. Having said that, it turns out that only a fraction of the list prices are being paid out of pocket.

In the chart below, notice that in Jan./Feb. 73% of weight-loss drug users reported paying < US$150/month. That’s great news for NuGen if they can secure one or more weight-loss drugs next year!

How many would pay an extra US$15-$20/month for needle-free delivery (incl. consumables) once insurance companies cover most or all of the cost of the drugs? If that # is 10%, that would be ~5M people in the U.S. alone (10% x [20% of U.S. adults with BMI > 35]).

It will take years (not months or quarters) for new needle-free entrants to legally enter the U.S. market. Nugen expects to be selling InsuJet units in the U.S. next year.

With massive addressable markets & relatively few [direct] competitors, it makes sense for NuGen to approach these opportunities prudently. Look again at the chart, even if InsuJet sales tied to insulin don’t scale as expected, perhaps InsuJet tied to weight-loss drug(s) will scale 2x, 3x, or 4x as fast.

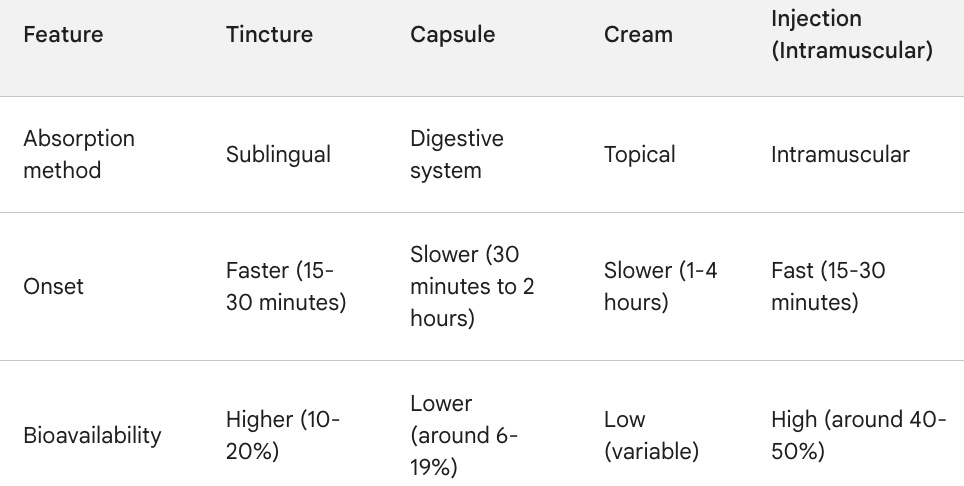

For vitamins, supplements & CBD, a big problem is bioavailability, which is low at ~6%-20% in capsules & tinctures. Subject to clinical trials, most products should demonstrate better bioavailability & faster onset of benefits if injected needle-free.

Notice below that CBD is estimated to be 2-3x more effective (40%-50%) by injection (with needles). I imagine needle-free delivery would enjoy similar efficacy. Imagine the marketing strength of a CBD brand — administered via InsuJet — clinically proven to have 100%-200% of the bioavailability of capsules/tinctures.

As I write more about NuGen, I’m reminded that the management team led by CEO Heynen continues to do a tremendous amount of work to build a long-term sustainable medical device company. Mr. Heynen commented,

“I’m delighted to see steady progress in the global expansion of our Insulin delivery opportunity. We have worked with distribution partners to enhance our clinical marketing approach to harness the enormous power of the healthcare system. The ultimate goal is for physicians to prescribe Insujet and drive delivery through pharmacy supply chains. Adding physician awareness and key clinical influencers to our needle-free insulin Injection programs can significantly catalyze growth. These efforts are starting to gain traction and I expect to see an acceleration of NuGen’s growth for years to come.“

Management is taking strategic steps that others ignore in their rush to market. If successful in scaling up InsuJet tied to insulin in just a few countries, the path will be blazed for other applications, most notably weight-loss drugs.

A strong launch of a single weight-loss drug would be a company-maker. Therefore, it’s reasonable to be excited about the blue-sky potential of NuGen before sales (potentially) take off. Readers are encouraged to take a closer look at NuGen Medical Devices (TSX-v: NGMD) / (OTC: NGMDF).

Disclosures: The content of this article is for information only. Readers fully understand and agree that nothing contained herein, written by Peter Epstein of Epstein Research [ER], (together, [ER]) about NuGen Medical Devices, including but not limited to, commentary, opinions, views, assumptions, reported facts, calculations, etc. is not to be considered implicit or explicit investment advice. Nothing contained herein is a recommendation or solicitation to buy or sell any security. [ER] is not responsible under any circumstances for investment actions taken by the reader. [ER] has never been, and is not currently, a registered or licensed financial advisor or broker/dealer, investment advisor, stockbroker, trader, money manager, compliance or legal officer, and does not perform market-making activities. [ER] is not directly employed by any company, group, organization, party or person. The shares of NuGen Medical Devices are highly speculative, not suitable for all investors. Readers understand and agree that investments in small-cap stocks can result in a 100% loss of invested funds. It is assumed and agreed upon by readers that they will consult with their own licensed or registered financial advisors before making investment decisions.

At the time this article was posted, NuGen Medical Devices was an advertiser on [ER] and Peter Epstein owned shares and/or stock options in the company.

Readers understand and agree that they must conduct due diligence above and beyond reading this article. While the author believes he’s diligent in screening out companies that, for any reasons whatsoever, are unattractive investment opportunities, he cannot guarantee that his efforts will (or have been) successful. [ER] is not responsible for any perceived, or actual, errors including, but not limited to, commentary, opinions, views, assumptions, or reported facts.

![Epstein Research [ER]](http://EpsteinResearch.com/wp-content/uploads/2015/03/logo-ER.jpg)