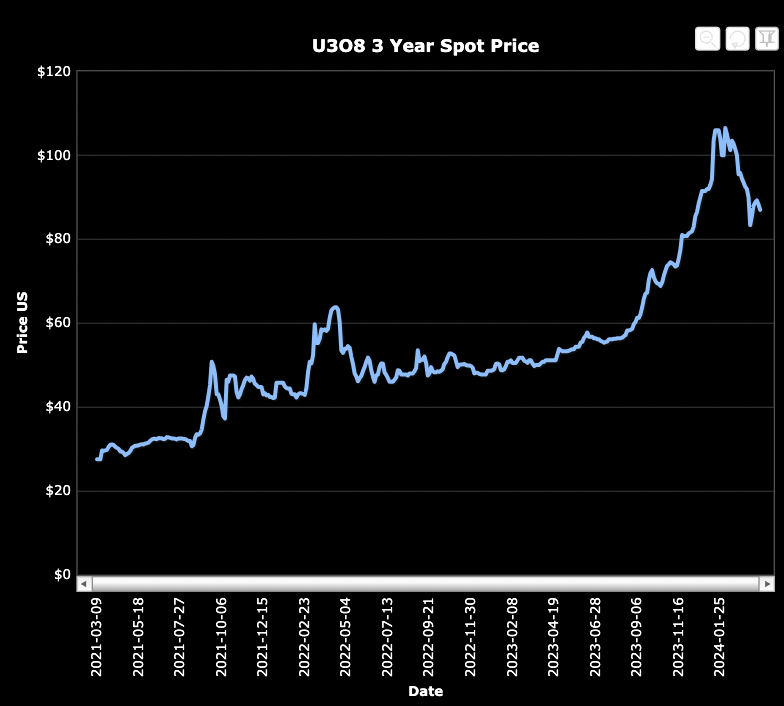

Uranium stocks have recovered from a weak monthlong period. Are we off to the races, or just treading water from here? I continue to believe the uranium spot price will remain strong for 2-3 years, not 2-3 quarters. If true, this is critically important to understand.

It means that most uranium stocks have not had big moves compared to what could be in store. Why should one believe the best is yet to come? In the last robust period of over-contracting (restocking) in 2005-07, the uranium spot price hit ~US138/lb., which adjusted for inflation is ~$211/lb.

And, 2005-07 was long before financial buyers like Yellow Cake Plc & the Sprott Physical Uranium Trust appeared on the scene, not to mention the Global X Uranium & the Sprott Uranium Miners ETFs. It’s also been reported that dozens of hedge funds are squirreling away physical U3O8.

Interestingly, the long-term contract price was pinned at $95/lb., (~$145/lb. in today’s dollars) for 10 straight months from May 2007 to March 2008. So the current $89/lb. is not an outlier, not even close.

Larger uranium companies Cameco, Kazatomprom & China’s CGN Mining, plus development companies like; Denison Mines, Nexgen Energy, Paladin, UEC, Deep Yellow & Boss Energy are up an average of +161% from 52-week lows.

By contrast, many smaller juniors have not rallied nearly as much. One such company is Skyharbour Resources (TSX-v: SYH) / (OTCQX: SYHBF). It hit highs of $0.87 in 2021, and $0.84 in 2022, but only $0.64 since then, closing at $0.53 on April 3rd. {See new April, 2024 corp. presentation}.

This might make sense if the Company had massively diluted shareholders over the past few years, but of course, as a prospect generator, it has not been overly dilutive. And, news in the uranium sector continues to be highly encouraging.

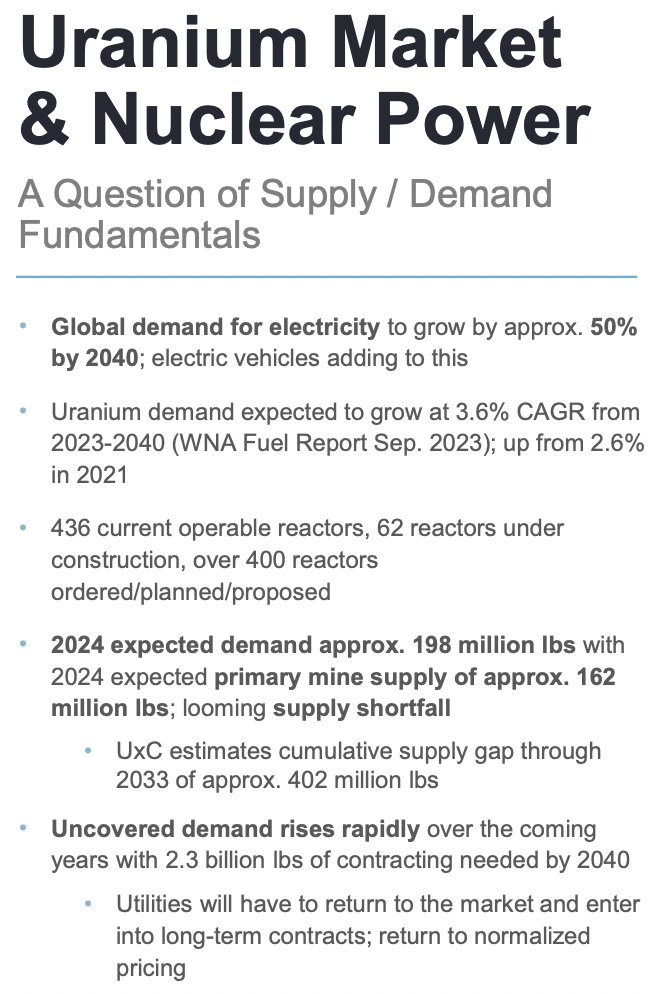

The world’s two largest uranium producers, Canada’s Cameco & Kazatomprom (in Kazakhstan) are effectively sold out for years to come. In fact, from time to time, they may have to purchase U3O8 in the spot market to satisfy sales contracts.

Kazatomprom guided its production lower for 2024. Based on the Company’s commentary and subsequent pundit analysis, some think it will come up short of revised guidance. In addition, the outlook for 2025 is clearly at risk.

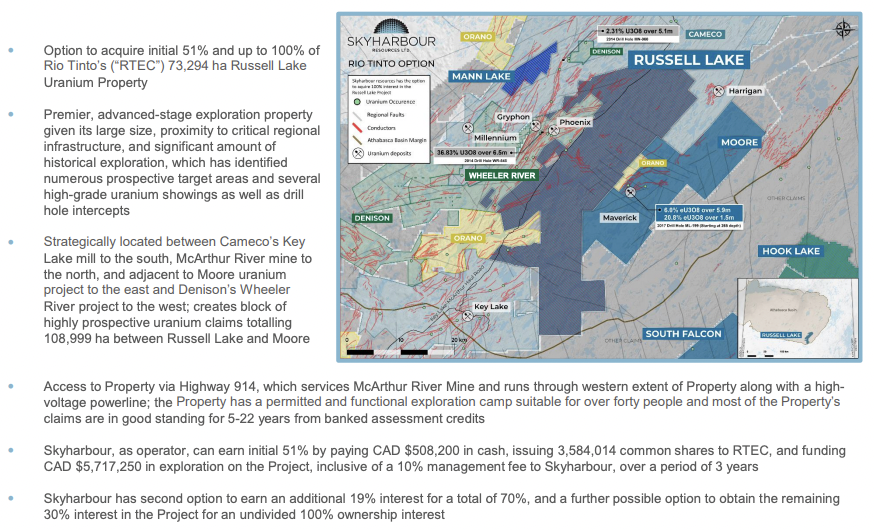

France’s Orano, a Top-5 global producer, announced a long delay in a US$1.6B deal with Mongolia to mine uranium. This news came after the privately-held company reported a 5% decline in production in 2023. Orano Canada announced an extensive field program on a project it has in a JV with Skyharbour.

This will be the first significant work done on the 49,635-hectare Preston project since 2020. Skyharbour has elected to participate in this exploration program as a minority partner.

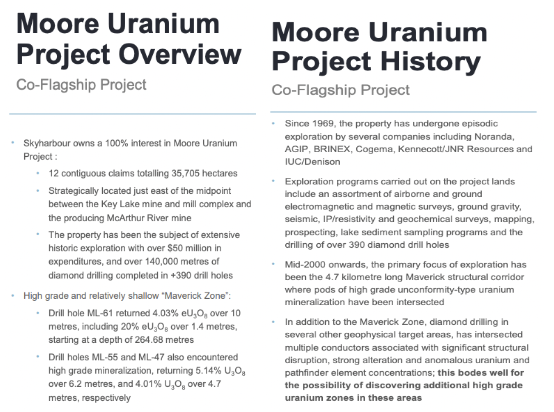

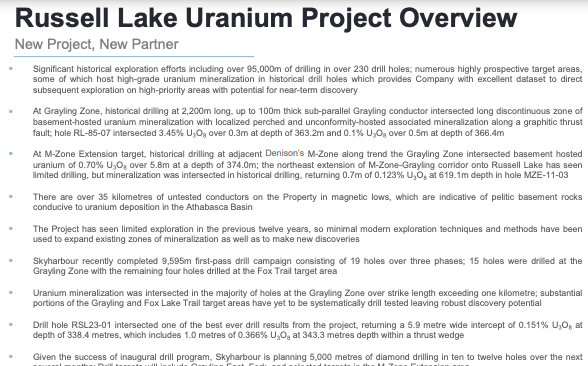

The technical team remains optimistic on this year’s initial drill program of 8k meters at co-flagship projects Russell Lake 5k + Moore Lake 3k. These promising projects are contiguous and sit within 5-10 kms of Denison’s ($2.6B market cap) world-class Wheeler River project.

An additional 8-10K meters is planned after results are assessed from the intitial program. Moore is 100%-owned, and management can earn up to 100% of Russell.

I believe Skyharbour is not getting proper credit for its assets being so close to Wheeler River, the value of which has more than tripled in the past few years. If not large enough to host a standalone mine, Moore and/or Russell could be satellite deposits.

While satellite deposit status is not as sexy, the projects would be worth well into the $10s of millions, with minimal cap-ex requirements. Of course, if significantly more uranium is discovered, the projects could be worth $100(s) of millions.

New supply of uranium to meet the growing needs of the nuclear power renaissance is highly uncertain. Especially as sources from Russia, Kazakhstan, Uzbekistan, and certain African countries increasingly flow to China. By contrast, the demand side is far more clear.

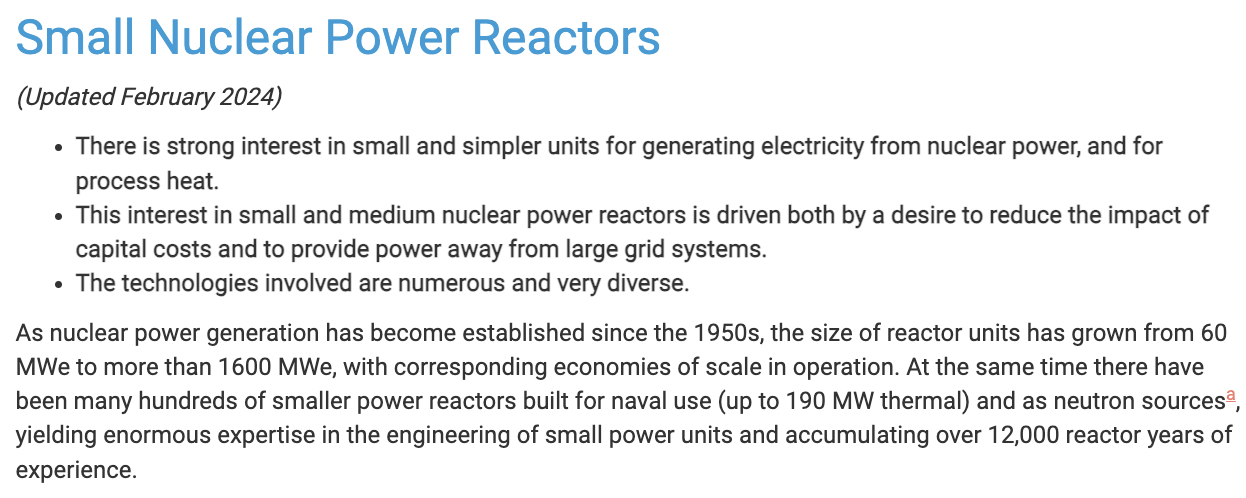

From the 2030s on, demand from Small Modular Reactors (“SMRs“) powering islands & small cities will be a significant, (and under-appreciated), demand factor for uranium.

Micro-reactors will be deployed to power desalination plants, AI / cloud / supercomputing, oil & chemical refineries, manufacturing hubs & data centers.

Amazon, Google & Microsoft have already expressed interest in nuclear power. In the past few months there have been several articles about the potential for electricity shortages in the U.S.

There’s a tremendous need for additional nuclear power plants. Mining companies could power remote mine complexes, Tesla & BYD could power giga-factories, the list goes on and on.

At a Dec. 2023 climate conference, dozens of countries agreed to triple nuclear power by 2050. China gets just 5%-6% of its power from nuclear and India 3%-4%. These two countries could see a quadrupling of nuclear power generation by 2050, with growth of 5.0-5.5% per year, for decades.

However, as mentioned, the supply side of the equation is a different story. I already discussed Kazatomprom, Cameco & Orano. Even if Kazatomprom can avoid revising next year’s production, eventually all of its output will be headed to China & Russia.

The world’s largest uranium consumer is the U.S. In 2023, it produced ~0.1% of the uranium it consumed. That’s right, the U.S. consumes 1,000 more U3O8 than it produces. With much higher prices, U.S. production is increasing.

Still, by 2030 production will almost certainly be below 16M pounds vs. roughly 50M pounds consumed. Canada was the largest supplier at 27%, a figure that will surely grow.

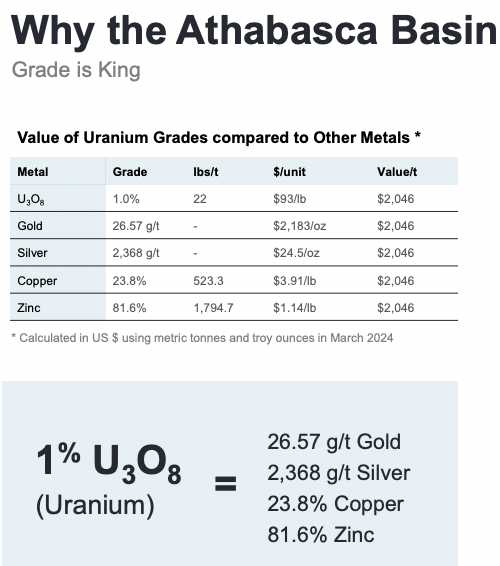

Canada’s ultra-high grade Athabasca uranium basin is ideally suited to fulfill N. American needs. How high grade you ask? Multiple % U3O8 resources are the norm.

Nearly half of the uranium the U.S. used in 2022 was from Kazakhstan, Uzbekistan & Russia. Think about it, how quickly could that change? It’s expected that the U.S. will ban imports of Russian uranium in the coming months.

There will be loopholes for U.S. utilities to continue receiving Russian material, but there’s a significant chance that Putin could respond by completely shutting down the supply of uranium to the West, which would cause the spot price to soar.

How high could the price go? From $89/lb. today, I think it would rise above the recent high of $107/lb. Some pundits think $150/lb. would be possible. In February, Cantor Fitzgerald increased its spot uranium price forecast to US$120-$150/lb. from 2024 – 2028.

Consider that the spot uranium price of $89/lb., equates to ~25 g/t gold. That means Denison’s 19.1% U3O8 resource is like a 477 g/t gold resource. It’s critically important to note that Skyharbour management acquired virtually all of its portfolio when the uranium price was half or less than today’s level. The Company has the 3rd largest land position in the basin.

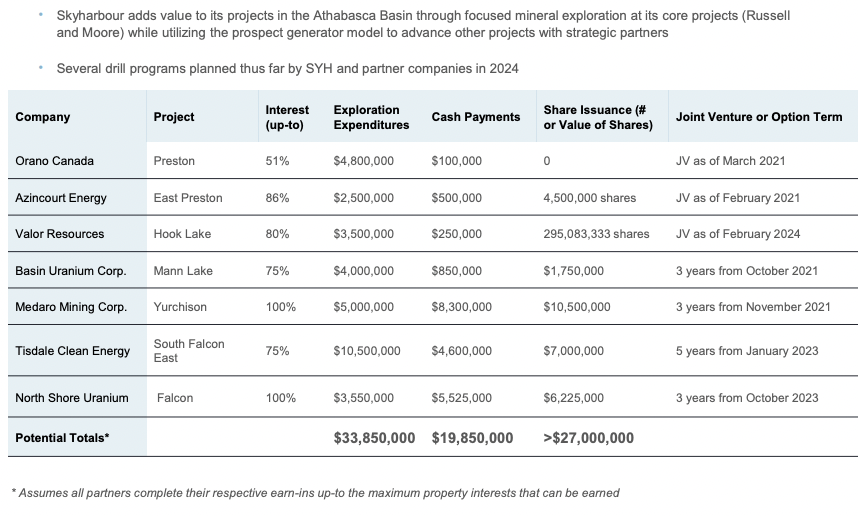

Tisdale Clean Energy provided an update on drilling at the South Falcon East (“SFE“) project, host to the Fraser Lakes B uranium deposit. Assuming a 75% interest is earned, Tisdale will have issued Skyharbour 1,111,111 shares, will finance exploration totaling $10.5M, and will pay Skyharbour $11.1M in cash over the five-year earn-in period.

The 12,464-hectare SFE project lies 18 km outside of the edge of the Athabasca basin, ~50 km east of the Key Lake uranium mill & former mine. This initial program is for up to 1,500 meters in two phases, with the priority being the confirmation of existing mineralization.

Readers are encouraged to review Skyharbour’s corporate presentation, one of the better ones in the uranium junior space, to learn more about the Company’s 29 properties spanning > 587,000 hectares.

Readers are reminded that Skyharbour’s prospect generator business has resulted (so far) in roughly C$80M of future exploration expenditures + cash payments + the value of shares in juniors. Management has another 18+ properties available to farm out. Interest is said to be high in many of them.

If one agrees that the uranium narrative will play out over years, not months or quarters, then investments into higher risk / higher return juniors like Skyharbour Resources (TSX-v: SYH) / (OTCQX: SYHBF) makes a lot of sense. Remember, the largest players are up +161% from 52-week lows. Skyharbour is up +66%.

As a final comment, readers should note that in major bull markets, many juniors will eventually outperform the blue chip names, turbo-charging the performance of prospect generators.

{See April, 2024 corp. presentation}.

Disclosures/disclaimers: The content of this article is for information only. Readers fully understand and agree that nothing contained herein, written by Peter Epstein of Epstein Research [ER], (together, [ER]) about Skyharbour Resources, including but not limited to, commentary, opinions, views, assumptions, reported facts, calculations, etc. is not to be considered implicit or explicit investment advice. Nothing contained herein is a recommendation or solicitation to buy or sell any security. [ER] is not responsible under any circumstances for investment actions taken by the reader. [ER] has never been, and is not currently, a registered or licensed financial advisor or broker/dealer, investment advisor, stockbroker, trader, money manager, compliance or legal officer, and does not perform market-making activities. [ER] is not directly employed by any company, group, organization, party, or person. The shares of Skyharbour Resources are highly speculative, and not suitable for all investors. Readers understand and agree that investments in small-cap stocks can result in a 100% loss of invested funds. It is assumed and agreed upon by readers that they will consult with their own licensed or registered financial advisors before making investment decisions.

At the time this article was posted, Skyharbour Resources was an advertiser on [ER] and Peter Epstein owned no shares in the company.

Readers understand and agree that they must conduct due diligence above and beyond reading this article. While the author believes he’s diligent in screening out companies that, for any reason whatsoever, are unattractive investment opportunities, he cannot guarantee that his efforts will (or have been) successful. [ER] is not responsible for any perceived, or actual, errors including, but not limited to, commentary, opinions, views, assumptions, reported facts & financial calculations, or for the completeness of this article or future content. [ER] is not expected or required to subsequently follow or cover events & news, or write about any particular company or topic. [ER] is not an expert in any company, industry sector or investment topic.

![Epstein Research [ER]](http://EpsteinResearch.com/wp-content/uploads/2015/03/logo-ER.jpg)