CoTec Holdings (TSX-v: CTH; OTCQB: CTHCF) is an ESG-focused company with minority interests in four disruptive technologies, any one of which could be a major Company-maker. The technologies are at advanced stages, and well-funded by third parties. Note: {on April 17th CoTec announced a non-brokered private placement for up to C$3M}

How often have readers come across a so-called disruptive technology only to find that, a) it doesn’t work as planned, b) isn’t low-cost, or c) isn’t especially environmentally friendly? In other words, not so disruptive…

Mediocre development projects seek disruptive technologies to save the day. For example, several extremely low-grade lithium brine projects in western Canada are turning to Direct Lithium Extraction (“DLE”) as their savior.

CoTec’s approach is entirely different. It’s not biased towards a single technology, it has reviewed over 300 and chosen four to date. These technologies aren’t pie-in-the-sky moon shots.

For example, management believes its HyproMag USA segment could generate US$50M in annual run-rate revenue at a 35%-40% EBITDA margin by late 2025 or early 2026. Sixty percent of those indicative economics would flow to CoTec.

Management is not chasing over-hyped, saturated markets like DLE & Li-ion battery recycling. It is a disruptive technologies company, not a mining company in search of a technology. There’s a huge difference.

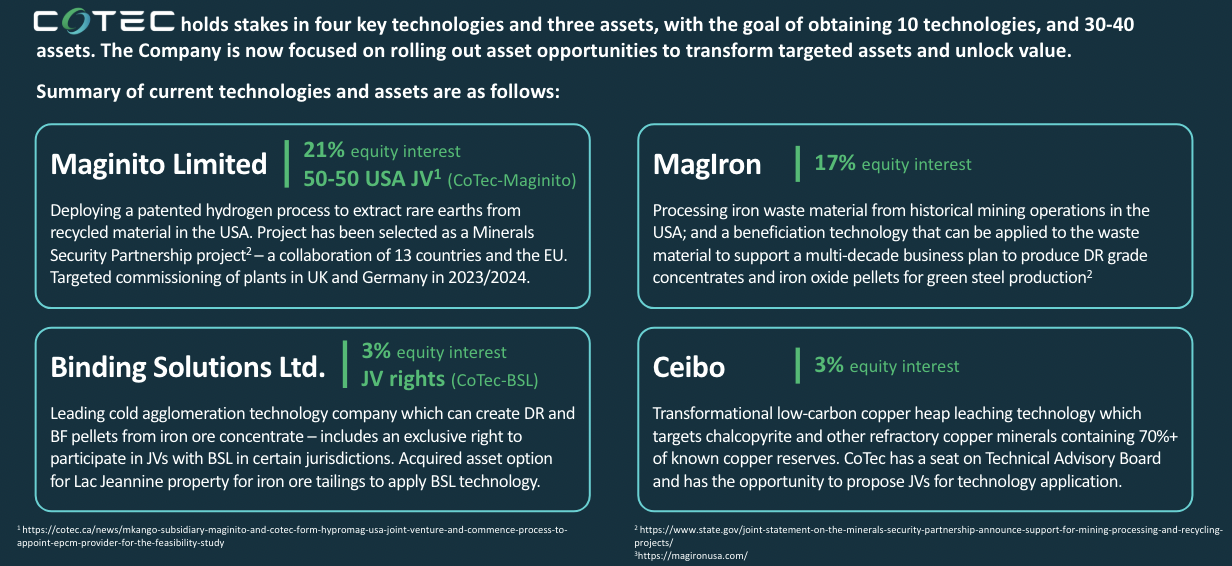

It has equity stakes in Maginito (HyproMag), Binding Solutions, Ceibo & MagIron. These technologies span critical Rare Earth Elements (“REEs”), green iron & green copper (“Cu”). Before launching into these technologies, readers are alerted to the management bios embedded in this article.

While most juniors have 2 or 3 noteworthy execs/advisors, CoTec has over seven {see bios above & below}. Although the team has strong mining & technology credentials, it retains industry-leading third-party consultants to assist in due diligence as needed.

It’s nice to see investments in the Company’s technologies from players including; BHP, Australia’s Mineral Resources (“MinRes”) & Champion Iron, and Japan’s Mitsui & Co. Strong votes of confidence that support future funding of those technologies.

Through the use of four (and eventually more) innovative technologies, CoTec plans to produce metals & minerals much faster, cheaper & greener than conventional mining. The Company’s technologies use significantly less energy & water and are logistically simpler than mining.

S&P Global reported that it takes an average of 16 years from initial discovery to commercial production. Major Cu projects often take 20+ years, some get stalled indefinitely or canceled.

Management expects to develop brownfield projects in just 3-5 years due to less permitting, more local community support (especially for reclamation), and by utilization of existing infrastructure & power. Mines typically last 15-20 years. CoTec’s portfolio of technologies could be in operation for 50+ years.

Waste streams & tailings are a major focus, which is good for the planet & attractive to government agencies who otherwise might have to fund reclamation projects on their own. Management is building low-carbon, low-cost plants to generate green steel feedstocks.

It’s already producing recycled REE magnets (mostly neodymium iron boron [“NdFeB”]) that end users are testing. In the coming months, at least one Cu project will be targeted for CoTec to deploy its Ceibo technology solution.

Ceibo has developed a process to leach low-grade primary Cu sulfides, such as chalcopyrite, and Cu waste/tailings with a high throughput inorganic methodology. Sulfide leaching technologies target 65%-75% recoveries. Without a sulfide leaching technology, recoveries decline to ~30%, the upper limit for traditional acid leaching.

Importantly, whenever possible, CoTec plans to deploy multiple technologies side-by-side to magnify ESG & operating cost benefits. Project sites can be optioned or acquired very cheaply as few others want low-grade stockpiles & waste dumps!

Green iron helps the world decarbonize. Roughly 70% of steel is made by burning coking coal in blast furnaces, vs. ~30% via greener Electric Arc Furnaces (“EAFs”). EAF usage is sometimes constrained by the availability of scrap steel as a primary feedstock.

Binding Solutions produces iron ore pellets that can be used in EAFs alongside scrap steel, and/or in blast furnaces, (reducing the amount of coking coal needed). This modular, very low-cap-ex technology converts fine materials to pellets at ambient temperatures, eliminating up to 70% of CO2e, 100% of SOx & 99% of NOx.

To deploy this disruptive technology, the Company has secured an option on the past-producing Lac Jeannine iron ore mine in Quebec. Lac Jeannine hosts ~130M tonnes of tailings.

Subject to further investigation, Lac Jeannine can potentially be remediated to produce high-grade iron concentrate, and subsequently green iron ore pellets. A maiden resource & PEA are in the works, targeted for this quarter, following the completion of metallurgical testing & flow sheet design.

Equally important to being ESG-friendly, CoTec’s business segments will be extremely useful to Western countries overly reliant on China & Russia (and countries closely tied to China & Russia) for REEs and other critical materials.

China is already flexing its muscles, last year it restricted exports of gallium & germanium. According to the U.S. Geological Survey, China accounts for up to 70% of REE mining & 90% of refined REE output. Globally, it’s estimated that less than 5% of REEs are recycled.

For the U.S., this is a serious national security threat. The U.S. Dept. of Defense (“DoD”) & Dept. of Energy (“DoE”) can’t remain strategically vulnerable.

With geopolitics in mind, the Company recently appointed Bob Harward, retired U.S. Navy Vice-Admiral (SEAL), and former Deputy Commander of the U.S. Central Command, to its board of directors to guide the Company on the negotiation of contracts, loans & grants.

A major advantage that CoTec enjoys is proactive, collaborative engagements with government bodies across the globe (a reason for potential access to grant funding & low-cost government loans).

A near-term focus is Maginito’s HyproMag, 100%-owned by Maginito Ltd, a 90%-owned subsidiary of Mkango Resources. CoTec has an effective 60% economic interest in HyproMag USA.

CoTec is funding cap-ex in the U.S., but will be reimbursed for 100% of its outlays before JV profits are distributed. This segment alone could be worth a multiple of the Company’s enterprise value {market cap + debt – cash} of ~C$37M.

In 2023, HyProMag was selected as 1 of 17 projects by the Mineral Security Partnership (“MSP“), which aims to build secure, responsible mineral supply chains to meet net zero-carbon goals.

HyproMag looks to commercialize REE magnet recycling using Hydrogen Processing of Magnet Scrap (“HPMS”) technology developed at the Univ. of Birmingham in the UK. Twenty-five years + US$100M has been invested to date.

HPMS is a hydrogen-based process used to extract NdFeB magnets from hard disk drives, electric vehicles, robotics, wind turbines, etc. The extracted NdFeB powder, in the form of an alloy, can be re-processed into different forms and sold back into the REE magnet supply chain.

CoTec & Mkango retained BBA USA Inc. & PegasusTSI Inc. for a Bankable Feasibility Study (“BFS”) on HyProMag USA to engineer & design three REE magnet recycling plants (reactors) & a magnet production facility.

Having commissioned the UK’s first REE magnet recycling pilot plant in 2022, HyProMag & the Univ. of Birmingham are developing a large-scale plant in the UK that will be a prototype for the U.S.

These firms are reviewing HyproMag plant designs & engineering specs of proposed operations in the UK & Germany. Armed with that valuable info, they will deliver a robust BFS on HyProMag USA around the 3rd qtr.

Cap-ex for the U.S. was estimated by Mkango in 2023 at ~US$30M, but between commercial interests, and government grants / low-cost loan opportunities, a substantial portion of the cap-ex could be funded without equity capital.

Although there are always logistical hiccups in ramp-ups, it’s important to note that HyproMag USA will greatly benefit from the growing pains of largely identical plants in the UK & Germany coming online before U.S. facilities are rolled out. CEO & Dir. Julian Treger commented,

“We have engaged engineering companies for both HyProMag USA & Lac Jeannine, targeting completion of a HyProMag BFS before year-end & a maiden mineral resource estimate + PEA for Lac Jeannine this quarter. The time frame for the completion of these studies & target dates for first revenue is testimony to the advantages of the CoTec strategy over traditional mining.”

Management is more adamant than most in their belief that CoTec is significantly undervalued. The Company has been buying back shares in the open market. CEO Treger & his family trust is by far the largest shareholder, but he says he plans to buy more. CFO Braam Jonker has also been acquiring shares.

Given the growing number of JVs & equity interests, there could be opportunities to spin out segments into new investment vehicles. There are multiple ways to win with CoTec Holdings (TSX-v: CTH) / (OTCQX: CTHCF) vs. seemingly limited downside in this catalyst & asset-rich opportunity.

Disclosures/disclaimers: The content of this article is for information only. Readers fully understand and agree that nothing contained herein, written by Peter Epstein of Epstein Research [ER], (together, [ER]) about CoTec Holdings, including but not limited to, commentary, opinions, views, assumptions, reported facts, calculations, etc. is not to be considered implicit or explicit investment advice. Nothing contained herein is a recommendation or solicitation to buy or sell any security. [ER] is not responsible under any circumstances for investment actions taken by the reader. [ER] has never been, and is not currently, a registered or licensed financial advisor or broker/dealer, investment advisor, stockbroker, trader, money manager, compliance or legal officer, and does not perform market-making activities. [ER] is not directly employed by any company, group, organization, party, or person. The shares of CoTec Holdings are highly speculative, and not suitable for all investors. Readers understand and agree that investments in small-cap stocks can result in a 100% loss of invested funds. It is assumed and agreed upon by readers that they will consult with their own licensed or registered financial advisors before making investment decisions.

At the time this article was posted, CoTec Holdings was an advertiser on [ER] and Peter Epstein owned no shares in the company.

Readers understand and agree that they must conduct due diligence above and beyond reading this article. While the author believes he’s diligent in screening out companies that, for any reason whatsoever, are unattractive investment opportunities, he cannot guarantee that his efforts will (or have been) successful. [ER] is not responsible for any perceived, or actual, errors including, but not limited to, commentary, opinions, views, assumptions, reported facts & financial calculations, or for the completeness of this article or future content. [ER] is not expected or required to subsequently follow or cover events & news, or write about any particular company or topic. [ER] is not an expert in any company, industry sector or investment topic.

![Epstein Research [ER]](http://EpsteinResearch.com/wp-content/uploads/2015/03/logo-ER.jpg)