Skeena Gold & Silver re-branding & re-rating underway!

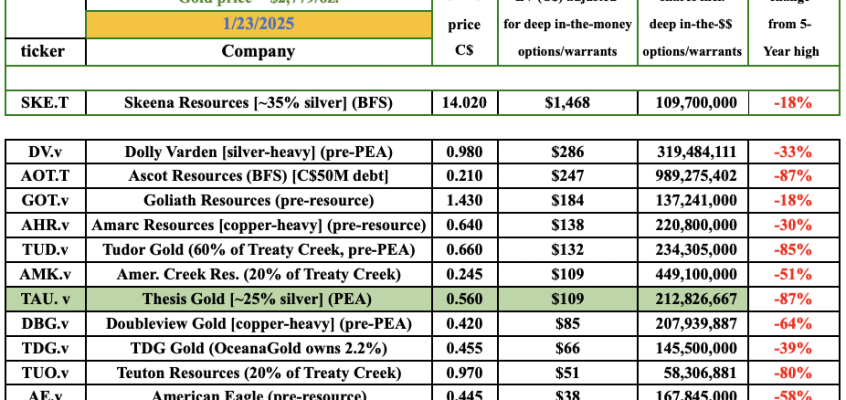

all metals prices are in US$, other figures are C$ unless indicated otherwise Gold & Silver are enjoying serious bull market gains, up over +43% in the past 12 months! The spot price is less than 2.5% from $3,000/oz… A basket of 10 better-performing precious … Continued

Thesis Gold, interest in B.C. continues to grow!

I’ve written several articles on Thesis Gold (TSX-v: TAU) / (OTCQX: THSGF). I typically name ~20 mid-tier producers & Majors who could/should want to make a meaningful strategic investment into the Company or acquire it outright. I reference gold (“Au“) & silver … Continued

Tocvan Ventures, on track for a BIG 2025

Happy New Year! Gold (“Au“) & silver (“Ag“) are off to a strong start, up 5% & 6%, respectively in January and up > 36% in the past year! Tocvan Ventures (CSE: TOC) / (OTCQB: TCVNF), with two projects in … Continued

Mawson Finland, Gold & Cobalt in Strong Location

No matter where one looks, there are supply-chain risks & uncertainties, some more serious than others, but few critical, precious, or base metal production sources are safe. Barrick Gold is in arbitration with Mali and recently suspended its mine there … Continued

Seabridge Gold, 255 Million Reasons to Love?!?

All dollar figures US$ This article concerns one of the most exciting gold/copper development stories on earth. No, it’s not in Africa, China, or Russia, it’s in B.C. Canada. Gold (“Au“) is in a bull market, up over 35% in the … Continued

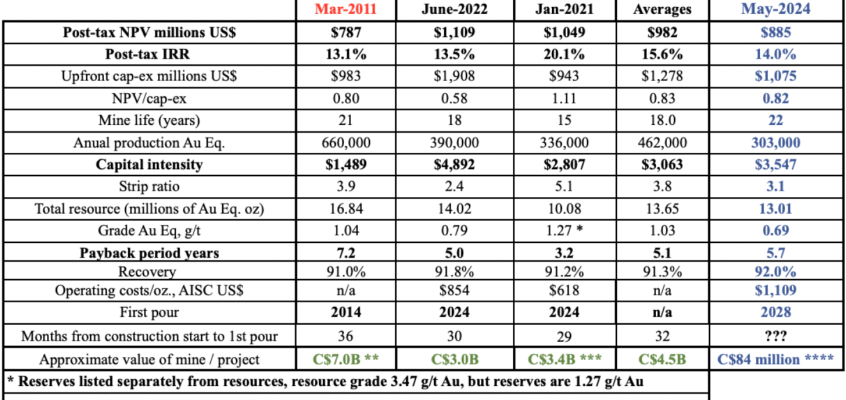

Troilus Gold, poised for an exciting year ahead!

In my opinion, Troilus Gold (TSX: TLG) / (OTCQX: CHXMF) is meaningfully undervalued due to fears of huge equity dilution needed to fund its very large, 100%-owned Troilus gold/copper project in Quebec. A new slide from the Company’s January Corp. … Continued

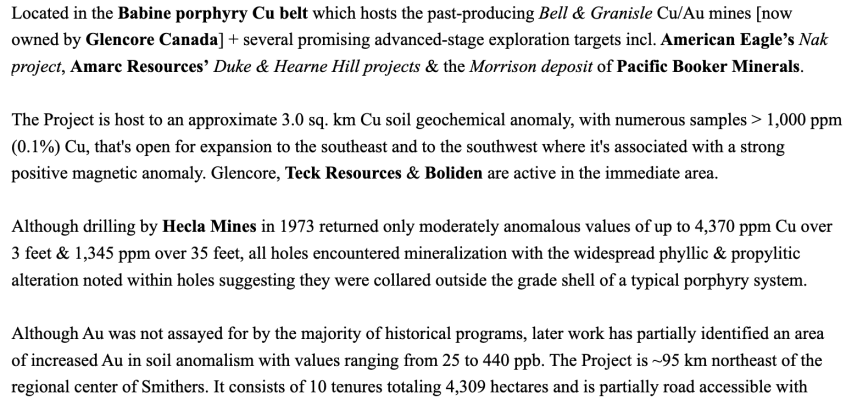

Northern Lights Resources

Readers are encouraged to always read disclosures/disclaimers at the bottom of every article. Gold & silver are grabbing the headlines — that & Bitcoin + UFOs — but copper (“Cu“) should not be ignored. M&A is kickstarting the development of long-dormant Cu … Continued

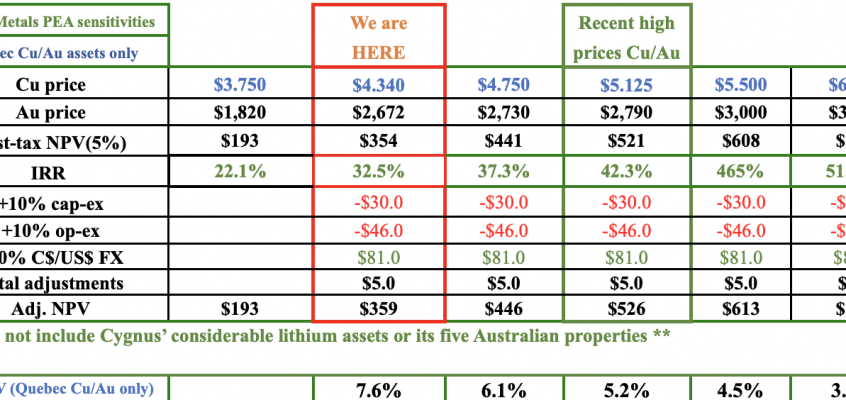

Dore Copper –> now Cygnus Metals #copper #gold #lithium in Quebec + Western Australia

Readers are encouraged to always read disclosures/disclaimers at the bottom of every article. On October 15th, Doré Copper announced a merger of equals with, and into, Australian-listed #lithium (“Li“) junior Cygnus Metals. The new tickers for Doré –> Cygnus are (TSX-v: CYG) … Continued

Silver Crown Royalties, a turbocharged Ag play

Readers are encouraged to always read disclosures/disclaimers at the bottom of every article. Silver Crown Royalties, (CBOE: SCRI) / (OTCQX: SLCRF) incorporated in August 2021, is a small, but revenue-generating silver (“Ag“)-only company focused on extracting value from Ag as by-product credits. … Continued

CoTec Holdings delivers strong NdFeB Magnet Feasiblity Study

CoTec Holdings Corp. (TSXV: CTH; OTCQB: CTHCF) & 50% JV partner Mkango Resources Ltd. delivered an independent Feasibility Study (“FS”) for HyProMag USA, a state-of-the-art rare earth magnet recycling & manufacturing operation poised to be a game-changer for the security of domestic … Continued

![Epstein Research [ER]](https://epsteinresearch.com/wp-content/uploads/2025/02/logo-ER.jpg)