Is Brazil’s Lithium Ionic the next Sigma Lithium?

all $ figures C$ unless indicated otherwise. Li prices are US$. Relative value calculations updated on 6/26/24 The lithium (“Li“) sector has had a terrible 18 months. Although Li spodumene concentrate (“SC“) prices are hovering around US$1,100/tonne, with a few … Continued

CEO Interview Thomas Ullrich, Aston Bay Holdings

After hitting $5.20/lb. on May 20th, copper pulled back to a still attractive $4.54/lb. Will we see a $3 or a $5 handle next? I believe the price is headed higher, albeit not to US$40,000/t = $18.14/lb., anytime soon — … Continued

Doré Copper –> valued at just 5% of after-tax NPV!?!

After hitting $5.20/lb. in May, copper pulled back 13% to $4.55/lb. Is it headed below $4.00/lb., or is this merely a pause that refreshes? On May 20th, copper (“Cu“) was up a remarkable +38.0% year-to-date and is still up a … Continued

Troilus Gold –> oversold on Bank Feasibility results?

Unless indicated otherwise, all $ figures are C$. Metal prices are US$. I’ve been watching Troilus Gold (TSX: TLG) / (OTCQX: CHXMF) for years as it continued to find more Gold (“Au“) & Copper (“Cu“) + some Silver (“Ag“). The … Continued

Happy Creek –> strong leverage to #Copper & #Tungsten

Despite the name sounding like a Netflix series, and having a tiny $5M market cap, Happy Creek (TSX-v: HPY) has four Canadian assets — any one of which could be a company-maker. For example, its sizable Fox property hosts a … Continued

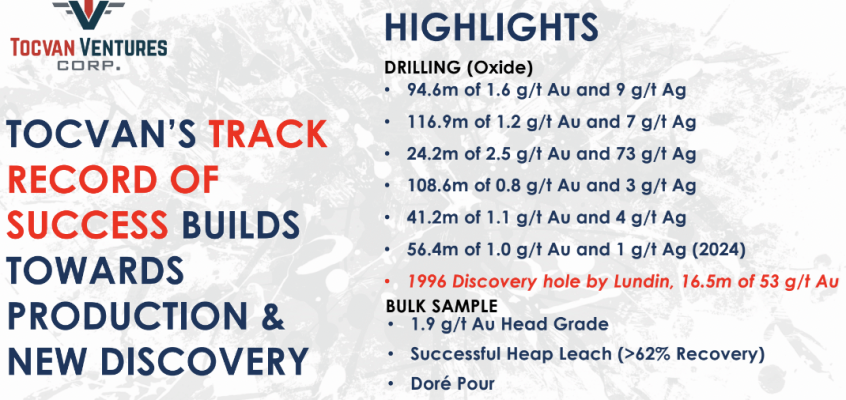

Tocvan Ventures; #Au/#Ag play in #Au/#Ag bull market

It’s amazing the runs that gold (“Au“) & silver (“Ag“) are having even before the U.S. FED has cut interest rates. Soaring prices signal a flight to safety on both geopolitical & inflationary/monetary grounds. As of May 21st, Au was … Continued

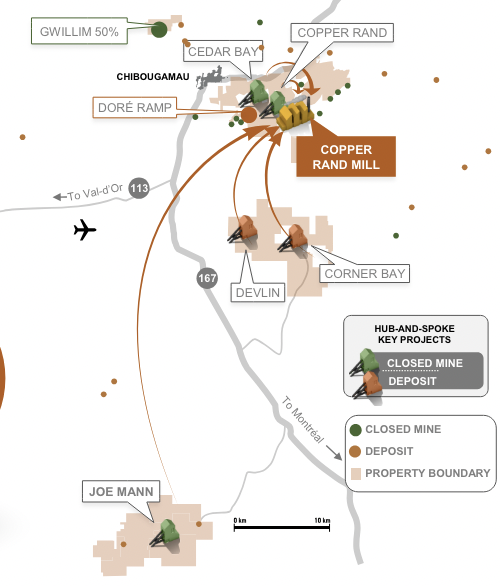

Doré Copper Mining, multiple ways to *potentially* #WIN big!

Note –> All $ figures C$ unless stated otherwise (all metal prices in US$). Copper & Gold Equiv. calculations use spot prices of $5.12/lb. & $2,430/oz. Wow! The Copper (“Cu”) price is up +34% in three months [2/19/24 = US$3.81/lb.] … Continued

How undervalued is Silver Storm Mining’s 273M Ag Eq. oz.?

Primary silver (“Ag”) mines, those that produce > 50% Ag (by volume), benefit most from higher prices. However, 75%-80% of mined Ag is a byproduct of other mining operations. Therefore, since Ag supply is highly inelastic, the price could soar … Continued

Thesis Gold delivers a strong 4.7M oz. #Gold Eq. resource estimate

It’s hard to believe the gold (“Au“) price has soared past $2,100, $2,200, $2,300, $2,400/oz., now sitting at ~$2,320/oz. Gold stock investors don’t quite believe it either. Newmont‘s & Barrick’s share prices remain 50%-55% below all-time highs. Imagine what long-term … Continued

![Epstein Research [ER]](https://epsteinresearch.com/wp-content/uploads/2025/02/logo-ER.jpg)