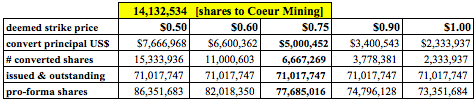

This low-coupon convertible note funding mechanism is highly attractive. Since Metalla will be generating meaningful cash flow, management will not need to raise equity capital in the market. The note will automatically convert based on the share price at the time of the next material portfolio transaction(s). As can be seen in the chart above, the higher the deemed conversion price, the lower the pro-forma # of shares.

Game-Changing Transaction, Template for Future Deals

This is a game-changer and it highlights management’s capabilities in this niche sector. Upon closing, Metalla will be robustly cash flow positive, a remarkable achievement at this stage of the Company’s short life. In 2018-2019, cash flow of roughly C$ 6 M/yr. is a reasonable expectation, bridging the gap until other promising royalties / streams start throwing off cash. On a pro-forma market cap (@C$0.60/share), the Company is trading at about 8x Enterprise Value (“EV”) to Cash Flow (“CF”) ratio. Several peers, including precious metal royalty / streaming (“R/S”) Majors Franco Nevada (~25x) and Royal Gold (~20x) are trading at or above 20x trailing 12 month CF.

Metalla has delivered a tremendous transaction that puts the Company on the radar (on both sides of the table) of precious metal companies of all shapes and sizes. The US$ 13 M acquisition is fairly complex, highlighting the skill set of Brett Heath and his expert business development / structuring teammates. Conducting business with C$2 billion, top-10 silver producer Coeur Mining opens the doors to others seeking sophisticated win-win transactions to monetize non-core assets and gain partial ownership of Metalla’s high-growth R/S platform. Equity participation in Metalla offers miners the diversification benefits of the Company’s entire portfolio. And, shares of Metalla held in lieu of divested non-core assets have tangible value that is more readily appreciated by investors.

The Endeavor Silver Stream

Metalla estimates that the Endeavor Silver Stream (“ESS”) will generate cash flow of C$ 2.5-3.0 M for the balance of 2017 and C$5.0 – 5.5 M (at an average price of US$17/oz Ag) in 2018. Based on the Endeavor mine plan delivering 987,500 ounces of Silver (“Ag”) over the next 24 months, quarterly cash flow of ~C$1.35 M is expected through mid-2019. Metalla will have the right to buy 100% of Ag production for many years from the Endeavor underground zinc-lead-silver mine in New South Wales, Australia. However, the current mine life is 24 months.

Management believes that mine life could be extended. If it is extended each quarter would generate roughly C$1.35 M in cash flow (at US$17/oz Ag) on top of C$11-$12 M expected in the stipulated 24-month period.

As evidenced by this quote from the website of Cobar Operations Pty Ltd, the operator of the Endeavor mine, there’s optimism that mine life could be extended beyond 2019,

“Extraction of some 30 M tonnes has occurred, with remaining reserves expected to support production out to 2019. The company is actively exploring with the intent of operating the site well beyond 2019, taking advantage of significant infrastructure including plant & machinery with nameplate capacity > 1 Mt/yr….. capable of supporting significantly higher production rates.”

The ESS consists of five contiguous mining leases totaling 4,096 hectares. Incremental production from new discoveries in this area would bolster cash flow to Metalla, (there’s over 12 M ounces Ag potentially deliverable before capping out under the terms of the streaming agreement).

Royalty on Pan American Joaquin Project

One of the 3 Royalties acquired is a 2% NSR payable by Pan American Silver on minerals mined from select concessions of the Joaquin project in Santa Cruz Province, Argentina, 145 km from Pan American’s Manantial Espejo silver-gold mine. Pan American purchased Joaquin from Coeur for US$25 M. The project contains an estimated resource of 65.2 M Measured & Indicated ounces Ag @128.9 g/t. Two percent of 65.2 M = 1.3 M ounces Ag attributable to Metalla. About 2/3’s of resource is understood to be near-surface, amenable to a simple open-pit operation.

Management estimates a 10-year mine life could generate about C$30 M in (gross, un-discounted) cash flow to the Company. Operations at Joaquin could commence as soon as 2h 2018, but to be conservative I assume 2020 will be the first full year of mining. A NPV(8%) on C$3 M of annual CF from 2020 to 2030 would be > C$20 M.

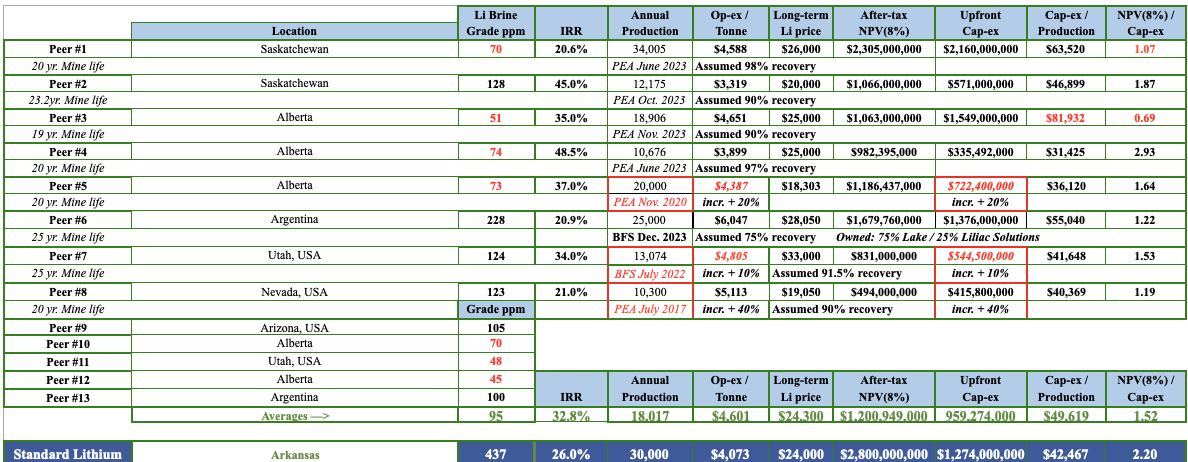

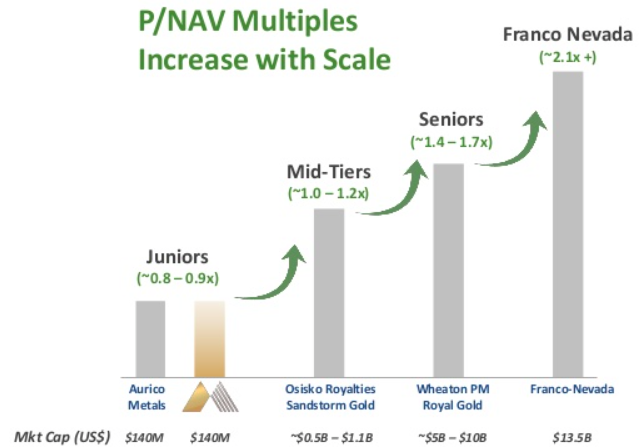

I mentioned that leading precious metal R/S companies are trading at or above a 20x EV/CF multiple. Another common industry metric is EV/Net Asset Value (“NAV”), sometimes referred to as Price “(P”)/NAV. Well established peers trade at 1.5x to 2.5x P/NAV. {See chart above from Maverix Metals’ corporate presentation}. The Joaquin NSR valuation alone at a 1.5x multiple would be worth C$30 M.

Hoyle Pond [Goldcorp] Extension Properties

Aside from the Coeur deal, the Company’s 2% NSR on the Hoyle Pond extension properties in Timmins, Ontario potential company-maker. Goldcorp is likely to move onto the extension properties in the near future, but the Royalty does not kick in until a cumulative 500k ounces of Gold (“Au”) has been produced. Management is waiting for additional data from Goldcorp regarding planned exploration / development activities on the properties subject to the NSR.

My guestimate is that the Royalty could go cash pay in 2021 or 2022. To be clear, that’s my opinion only, not necessarily that of management. The current run-rate of 160k ounces Au/yr., if maintained, would equate to 3,200 attributable ounces of gold per year, representing considerable cash flow, perhaps on the order of C$4 – 5 M/yr. Discounted back at a 10% discount factor, (no matter if it’s 4, 5 or 6 years away), an estimated NPV would be in the tens of millions (CAD$). Without much pencil work, I feel comfortable in saying that Metalla’s company-wide P/NAV is well under 1.0x.

Building a High-Growth Investment Platform

Subject to closing the deal this summer, management has pulled off a blockbuster acquisition of a valuable portfolio of assets. US$ 13 M would have been too large a check to write, so management funded it in an innovative way; roughly half & half unsecured convertible note and newly issued shares in the Company. Coeur is poised to become a 19.9% shareholder of a much larger and diversified Metalla Royalty enterprise. Moving forward, management is committed to closing at least one, and possibly two, more acquisitions by year-end.

Near-term cash flowing assets will continue to be the focus for the next few deals. If more deal(s) come to fruition, annual cash flow from 2018 on could grow to about C$8 M. Management’s stated goal is to reinvest 50% of free cash flow and pay 50% in dividends. I don’t expect to see dividends this year, but based on potential cash flow, a C$0.01 quarterly dividend commencing sometime next year seems possible (my opinion only).

Conclusion

Metalla Royalty & Streaming (CSE: MTA) (OTCQB: EXCFF) (FRANKFURT: X9CP) has made remarkable progress in a short period of time. Upon closing the Coeur transaction the Company will already compare favorably to peers on both an EV/CF and P/NAV basis. Even more impressive, Metalla’s pipeline of deals and its small relative size means it will probably be the highest growth precious metals R/S company in North America. The Company is still small and largely unknown, but that’s changing. It’s a question of when, not if, Metalla will begin to be valued inline with peers, I think that time is fast approaching.

Disclosures: The content of this article is for illustrative and informational purposes only. Readers fully understand and agree that nothing contained herein, written by Peter Epstein of Epstein Research, [ER] including but not limited to, commentary, opinions, views, assumptions, reported facts, estimates, calculations, etc. is to be considered implicit or explicit, investment advice. Further, nothing contained herein is a recommendation or solicitation to buy or sell any security. Mr. Epstein and [ER] are not responsible for investment actions taken by the reader. Mr. Epstein and [ER] have never been, and are not currently, a registered or licensed financial advisor or broker/dealer, investment advisor, stockbroker, trader, money manager, compliance or legal officer, and they do not perform market making activities. Mr. Epstein and [ER] are not directly employed by any company, group, organization, party or person. Shares of Metalla Royalty are highly speculative, not suitable for all investors. Readers understand and agree that investments in small cap stocks can result in a 100% loss of invested funds. It is assumed and agreed upon by readers that they consult with their own licensed or registered financial advisors before making investment decisions.

At the time this article was posted, Peter Epstein owned shares in Metalla Royalty and the Company was an advertiser on [ER]. By virtue of ownership of the Company’s shares and it being an advertiser on [ER], Peter Epstein could be viewed as biased in his views on the Company. Readers understand and agree that they must conduct their own research, above and beyond reading this article. While the author believes he’s diligent in screening out companies that are unattractive investment opportunities, he cannot guarantee that his efforts will (or have been) successful. Mr. Epstein & [ER] are not responsible for any perceived, or actual, errors including, but not limited to, commentary, opinions, views, assumptions, reported facts & financial calculations, or for the completeness of this article. Mr. Epstein & [ER] are not expected or required to subsequently follow or cover events & news, or write about any particular company or topic. Mr. Epstein and [ER] are not experts in any company, industry sector or investment topic.

![Epstein Research [ER]](http://EpsteinResearch.com/wp-content/uploads/2015/03/logo-ER.jpg)