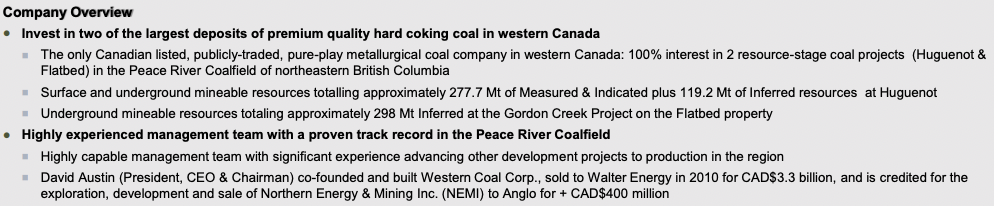

The title of this article/interview refers to the fact that Colonial Coal (TSX-v: CAD) (OTC: CCARF) has been trying to sell two premium hard coking coal (“PHCC“) projects in western Canada since late-2019.

CEO David Austin can’t comment on the names of prospective bidders, potential prices to be paid, or the timing of a possible bid. However, in my view, conditions are in place for something to happen in 1H 2024.

Shareholders hope assets can be sold for US$1.50-$2.50/resource tonne, but the market is valuing each tonne at ~$0.39/t. Personally, I think the range is more like $1.25-$2.00/t, implying a share price of ~C$5.87-$9.30, vs. the current price of $1.90.

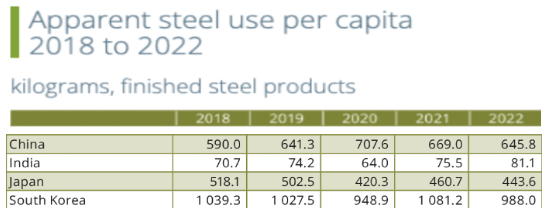

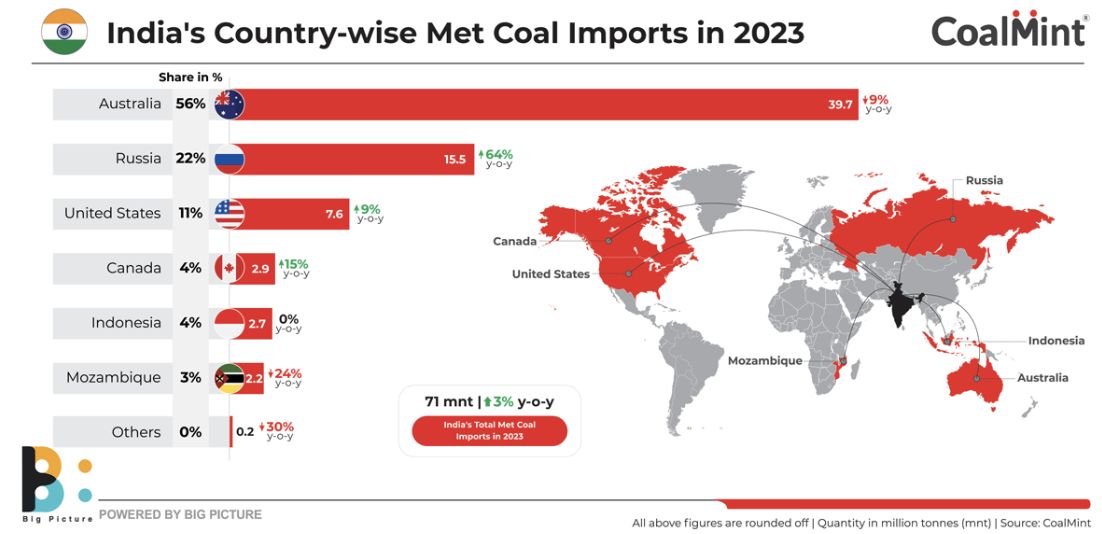

When talking about coking coal, one needs to carefully consider China & India. Combined, those countries host 35% of the world’s eight billion people. Notice the glaring difference between India’s per capita steel consumption at 81 kg vs. the average of Japan, Korea & China at 692 kg!

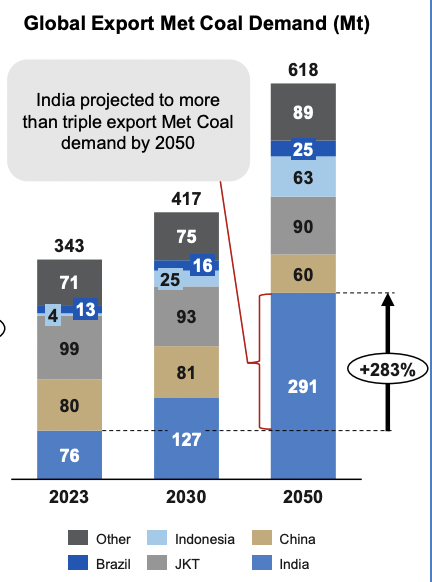

According to a recent AME Metallurgical Coal Strategic Market Study, India’s demand for imported coking coal in 2050 could more than triple to 291M tonnes. {see chart below}. The Indian Steel Association expects coking coal imports to rise to ~115M tonnes in 2030, a CAGR of 7%.

Most of the increase must come from the seaborne coking coal market, of which Australia is the largest exporter. The U.S. at ~47M tonnes/yr. is second, but not all of it is PHCC. Third is Canada at ~30M tonnes/yr. (mostly from Teck Resources).

A constraint on growth of exports out of Australia is Queensland’s coal royalty regime. The new top rate is 40%! for coal priced above $300/t. Major producers BHP & Glencore are thinking twice about expansion plans.

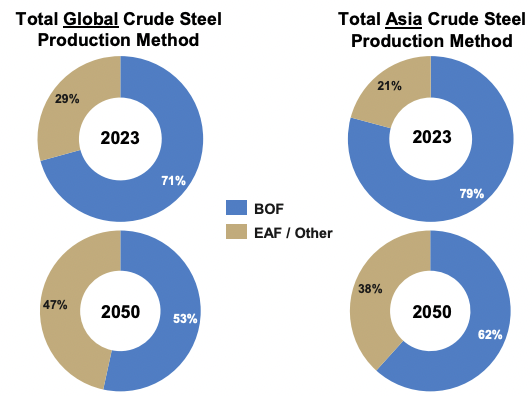

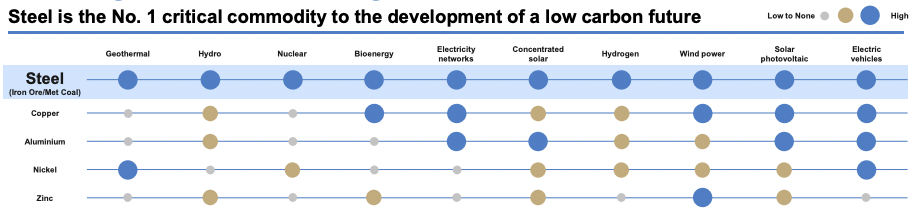

Some note a decline in steel production from blast furnaces (the main consumers of coking coal) in favor of “greener” alternatives like electric arc furnaces. However, the following chart from Wood Mackenzie shows that blast furnaces will remain dominant in Asia to the year 2050.

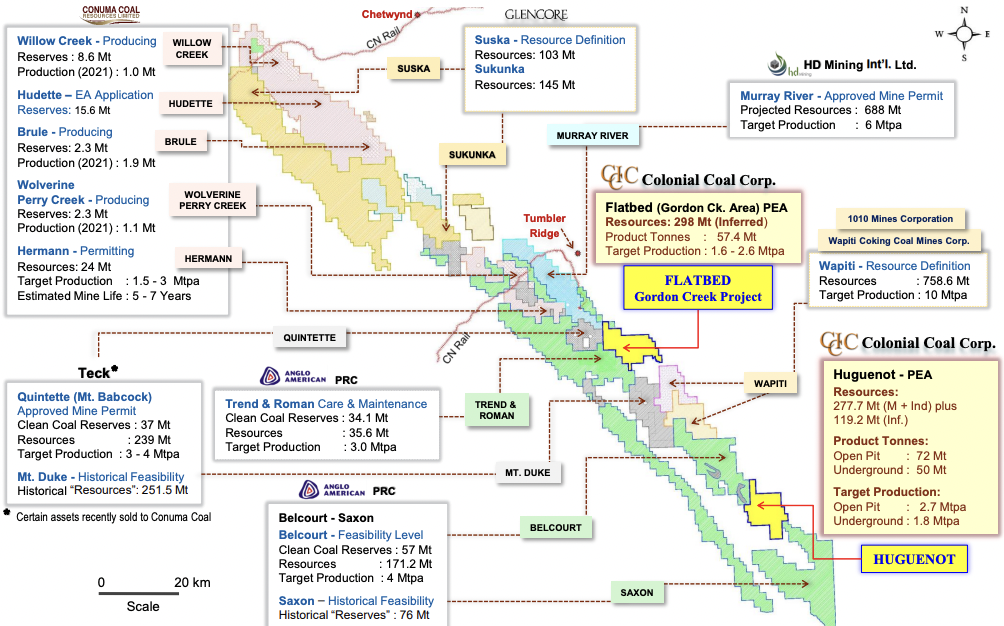

It seems only western Canada can deliver secure PHCC that could grow meaningfully with the addition of Colonial’s projects, (and others in the region). Readers are reminded that the Company has 695M tonnes of resources, (not reserves), 94% of which are PHCC.

India virtually guarantees robust demand for PHCC in the seaborne market, but that doesn’t mean an Indian group has to be the buyer of Colonial’s assets. In addition to Chinese & Indian entities, CEO Austin’s team is talking with prospective bidders from Canada, the U.S., Japan, Korea & Australia.

A few months ago, Teck & Colonial were speaking at a conference. The Teck representative said to the audience, “if you need coking coal in the near-term, call us, but if you need it for the longer-term, call Colonial Coal.” I think that statement speaks volumes…

David, thank you for your time. Can you please explain why this sales process is so complex?

Sure, COVID-19 greatly impeded our efforts through October, 2022. This international process is complex as some groups have ties to other entities or subsidiaries that need to be kept in the loop. Some are connected to their respective governments, who need to be kept in the loop.

Some are impacted by geopolitical events. If a key exec. leaves, or a group merges or splits apart, that sets things back. Some groups are looking at acquiring other coking coal / steel assets, or looking to be acquired themselves.

Each group must coordinate with, 1) domestic & international lawyers, 2) financial/tax/M&A advisors, 3) various consultants, and 4) their own and/or Canadian government agencies.

Reports, studies, legal & financial due diligence are being done and shared. Some groups request follow up reports, or legal/financial analysis.

Travel, often requiring visas & other accommodations, must be planned subject to; weather, holidays, government agency schedules, geopolitical hiccups, and the availability of key lawyers, execs & advisors.

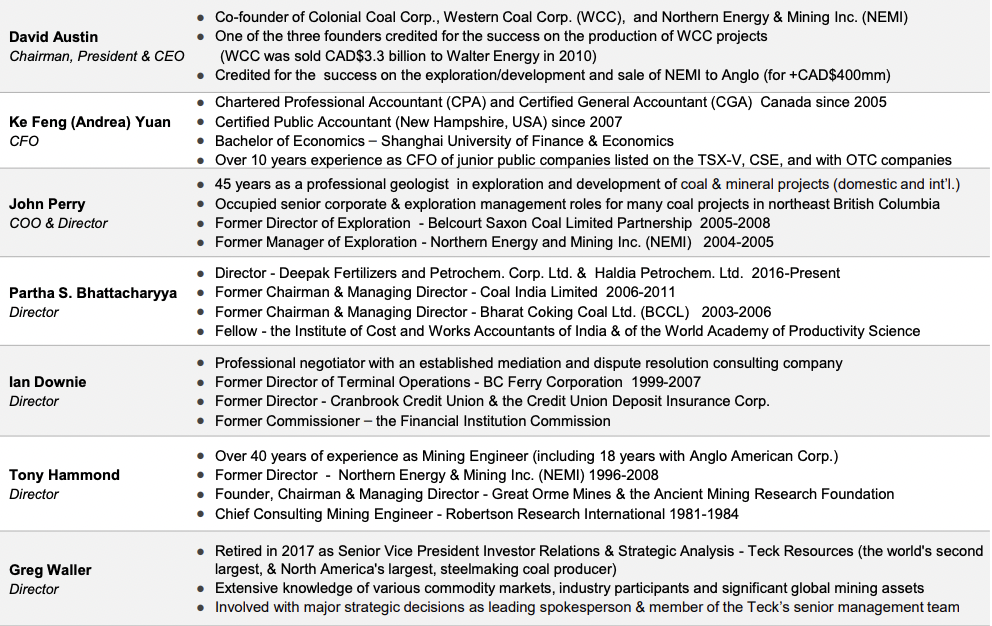

We recognize shareholders want to see a successful end to this lengthy process. Our team + trusted advisors & bankers have expertise in the coking coal & mining businesses, including permitting mines in B.C. We have considerable experience with Chinese, Indian, Korean & Japanese conglomerates + M&A.

Our team developed, permitted, funded, built and sold two significant coking coal assets in western Canada. Your readers should take a few moments to review the bios of our team. {see above}. Post the Glencore/Teck news, interest in our assets has never been higher.

Why is Colonial’s higher priced premium hard coking coal (“PHCC”) superior to lower priced, lower-quality coals?

PHCC offers substantial benefits in terms of efficiency, quality, environmental impact & operational stability. It produces coke that has higher strength so it can withstand higher furnace pressure, leading to higher steel output.

PHCC has higher energy efficiency, resulting in lower greenhouse gasses & dust, and has less ash & sulfur. Fewer impurities lead to cleaner steel with better mechanical properties.

PHCC can be blended with lower quality coals to achieve desired coke properties, enhancing operating flexibility & sustainability.

Blending utilizes a range of coals, improving overall efficiency & blast furnace economics. We believe our PHCC would sell at Australia’s Peak Downs Index price (minus US$5-$15/t). {Info on Colonial’s two PHCC projects}

Your team says the market outlook for PHCC, especially in the seaborne market, is strong. Please explain.

Peter, you mentioned China & India in your opening remarks, add Indonesia, Malaysia, Thailand, the Philippines & Vietnam to the list! Even after over a year of a weak Chinese economy, the PHCC price from Australia and in China is above US$320/t. Monthly future prices through 12/31/26 avg. ~$260/t. {source}

Asian steelmakers have most existing & planned blast furnaces near ocean ports, making them highly reliant on the seaborne market. India has no choice but to continue importing PHCC from Australia & Canada, but Australia’s PHCC growth faces serious challenges.

Locking in long-term supply of PHCC at an all-in production cost under US$150/t, vs. paying an unpredictable $200-$400/t, (with occasional spikes above $500/t), is important to the groups we’re speaking with.

Canada’s Peace River Coalfield & Australia’s Bowen Basin are among the best on earth. As the market for coking coal eventually flatlines or enters decline, lower quality coking coals will be retired first.

Major ports in China, Korea, HK, India & Japan — that’s where the blast furnaces are!

Logistically challenged, smaller, higher-cost operations will disappear before large-scale, efficient Peace River supply is impacted.

At what point does the Board announce an auction with a minimum bid of US$ X/tonne?

The problem with that, and our bankers agree, is putting a gun to the heads of prospective bidders via an arbitrary deadline is unwise. Even if a single bidder were to walk, that could hurt the prospects for obtaining maximizing value.

There are many ways to structure a deal [cash and/or stock, contingent and/or milestone payments, earn-outs, etc.], which make an auction process more difficult. I assure readers that our board is discussing various scenarios with multiple parties on a regular basis.

Our fiduciary responsibility is to maximize value received, not just liquidate the assets. Note: Each additional US$0.25/t is over a dollar per share, [C$1.16].

Can you speculate as to why there have been no reasonable bids yet?

No one wants to be first to show their cards. If a bidder were to submit a low-ball offer, it might not like the appearance of having to pay well above its opening bid. Or, they may fear looking foolish by increasing their bid, but still losing the auction.

Bidders might feel the longer the process continues, the lower the valuation will be [we obviously disagree!]. Bidders may think they can benefit from observing Colonial’s reaction to initial bids. Colonial has ~$3M in cash, enough to operate well into 2025.

Please remind readers what might happen if/when a reasonable bid comes in?

For our previous companies Western Coal & NEMI, both of which sold over a decade ago at very strong valuations, those stocks were halted. We expect to halt Colonial’s trading as well, hopefully for just a few days, but that will be up to the exchange.

In the view of the exchange, an “orderly market” must be reestablished for the stock to resume trading. Our clear preference is to sell both projects at once. We are very busy and remain confident that years of hard work will be rewarded.

Thank you David. Hopefully 2024 will be the year! I greatly appreciate the tireless efforts being made by you and your expert team.

Disclosures: The content of this article is for information only. Readers understand & agree that nothing contained herein, written by Peter Epstein of Epstein Research [ER], (together, [ER]) about Colonial Coal, incl. but not limited to, commentary, opinions, views, assumptions, reported facts, calculations, etc. is to be considered implicit or explicit investment advice. Nothing contained herein is a recommendation or solicitation to buy or sell any security. [ER] is not responsible under any circumstances for investment actions taken by the reader. [ER] has never been, and is not currently, a registered or licensed financial advisor or broker/dealer, investment advisor, stockbroker, trader, money manager, compliance or legal officer, and does not perform market-making activities. [ER] is not directly employed by any company, group, organization, party, or person. The shares of Colonial Coal are highly speculative, not suitable for all investors. Readers understand and agree that investments in small-cap stocks can result in a 100% loss of invested funds. It is assumed and agreed upon by readers that they will consult with their own licensed or registered financial advisors before making investment decisions.

At the time this article was originally posted, Peter Epstein owned shares in Colonial Coal, and the Company was an advertiser on [ER].

Readers should consider me biased in my view of the Company. Readers understand and agree that they must conduct their own due diligence above and beyond reading this article. While the author believes he’s diligent in screening out companies that, for any reason, are unattractive investment opportunities, he cannot guarantee that his efforts will (or have been) successful. [ER] is not responsible for any perceived, or actual, errors including, but not limited to, commentary, opinions, views, assumptions, reported facts & financial calculations, or for the completeness of this article or future content. [ER] is not expected or required to subsequently follow or cover events & news, or write about any particular company or topic. [ER] is not an expert in any company, industry sector, or investment topic.

![Epstein Research [ER]](http://EpsteinResearch.com/wp-content/uploads/2015/03/logo-ER.jpg)