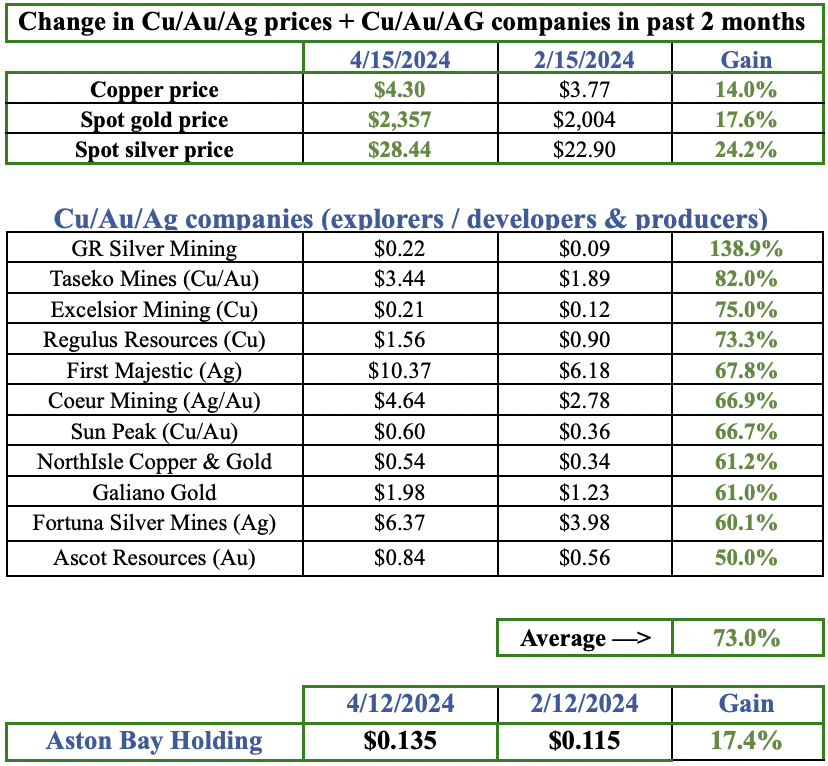

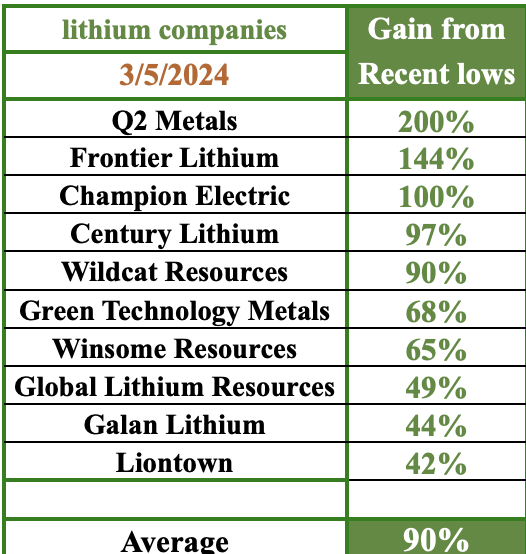

We’re seeing green shoots in the lithium (“Li“) sector. The following 10 juniors have rebounded an average of +90% from recent lows. Among larger names, Ganfeng Lithium is up +34% & Pilbara Minerals +31%. Canada’s Frontier Lithium announced a transformational investment from Mitsubishi Corp.

The spot price in China has rallied +14% from 95.5k yuan/tonne to 108.5k/t = $15.1k/t (March 5, investing.com). Spodumene concentrate (6.0%) is reportedly up to $1,006/t from under $900/t. (Lithium Price Bot, on Twitter/X).

Australia’s hard rock Li mines have been suffering with weak spodumene concentrate prices, causing a few to go on care & maintenance or slow sales.

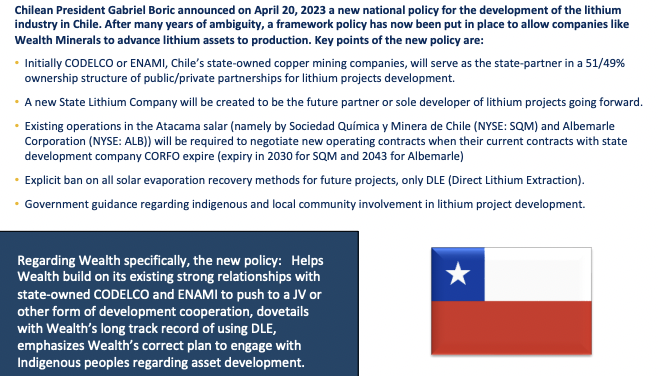

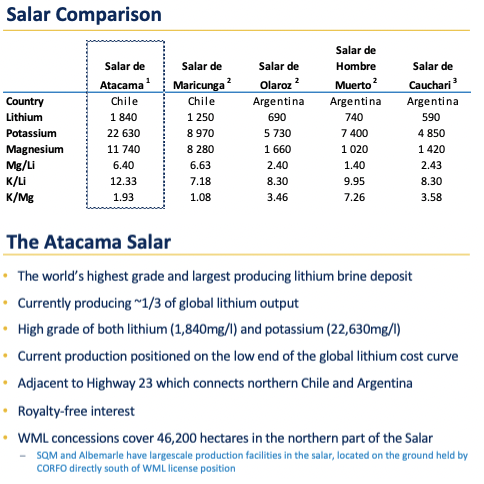

That makes Chile’s brine operations, controlled entirely by SQM & Albemarle [ALB], among the most important sources of Li units on earth. Benchmark Mineral Intelligence recently said Chile will deliver ~25% of the world’s Li, a combined 300,000 tonnes of Li Carbonate Equivalent (“LCE“), in 2024 alone.

The December SQM/CODELCO update was a win/win for Chile & President Boric, allowing SQM to operate in the Atacama through 2060 in exchange for contributing 50% of its Chilean operations to a newly formed JV from 2031 on.

That might sound harsh, but before this arrangement SQM’s lease was ending in 2030. Lately, Chilean agencies seem more motivated to make critical changes in Li policy. Why? Federal & local governments are raking in billions of dollars in taxes, royalties & economic benefits from SQM & ALB.

At the same time, cash inflows from Chilean copper producers have been largely flat since 2010. Allowing new entrants like Wealth Minerals (TSX-v: WML) / (OTCQX: WMLLF) could generate substantially more cash.

When Li carbonate prices were US$4,500-$7,500/t leading up to two spikes in early 2016 & late 2017, AND royalty rates on Li were much lower, SQM & ALB were not the massive cash printing presses they are today.

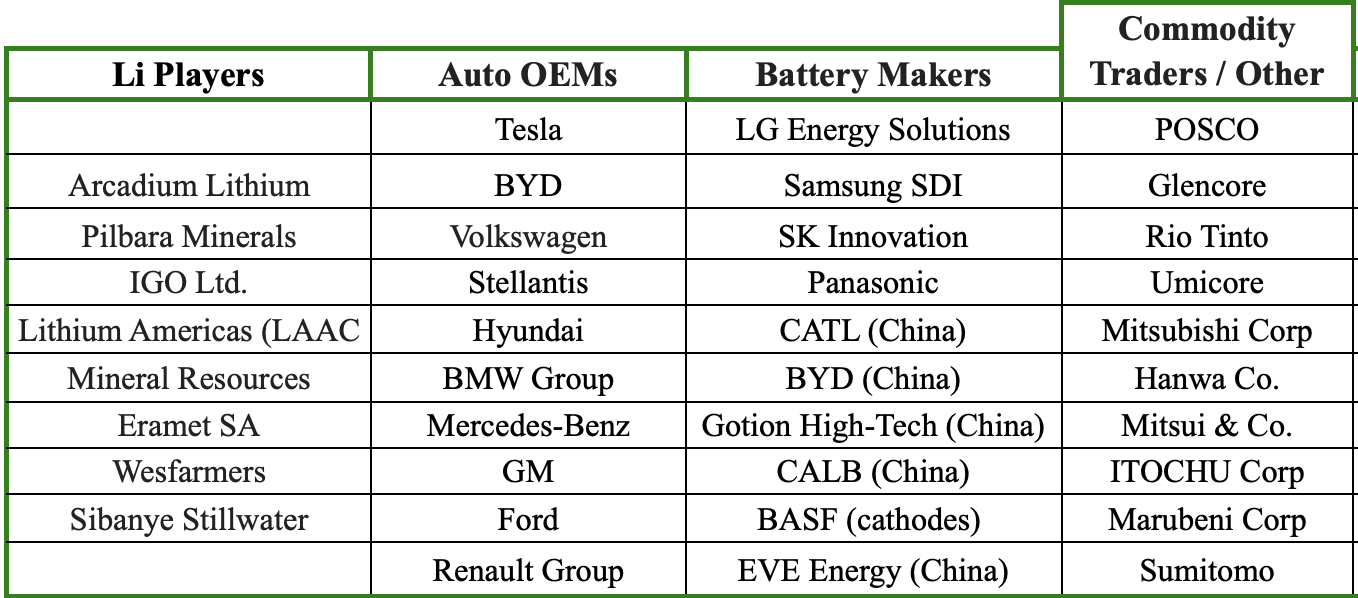

There’s a lot happening in Chile. A Bloomberg article in January described how Korean battery makers LG Energy Solution, SK On & Samsung SDI are, “keen to develop processing plants” in the country. This comes on the heels of Tesla, BYD & Stellantis expressing interest in Chile last year.

From a Feb. 28th mining.com article — “Last month, executives from Rio Tinto & China’s Tsingshan Holding Group held separate lithium discussions with Chilean authorities, and Tianqi Lithium & France’s Eramet SA are on the short list of firms showing interest in Chile’s new model.”

The same article states that decisions about ownership structures in Chile could be announced as soon as March/April. Once better clarity emerges on who Wealth will partner with at the State level, (ENAMI or CODELCO) giant auto & battery makers can engage more definitively on partnerships & off-take agreements.

In a new fireside chat, senior advisor to Wealth Minerals Tim McCutcheon points to precedent acquisitions in Argentina, (that averaged ~C$1.1 billion). He’s referring to deals by Rio Tinto, Zijin Mining, Ganfeng Lithium & Tibet Summit.

Those were on projects that pre-date DLE, so they’re proposing to use solar evaporation ponds with Li recoveries of ~45%-60%. By contrast, Wealth’s Kuska & Yapuckuta (formerly the Atacama project) are using DLE with a recovery of ~80%.

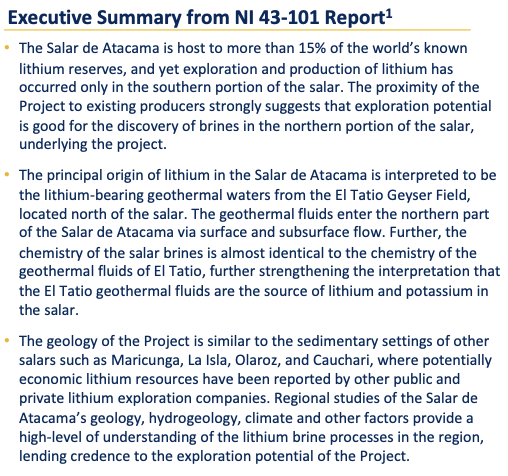

As important as increased recoveries are, is the much lower water consumption. To advance Kuska past PEA-stage, management completed a geophysical survey. Preliminary analysis suggests continuation of the main Ollague anomaly onto recently acquired licenses.

Management recently increased landholdings at Kuska by +31%, which should have a positive impact on resource size, but the Project already has a 20-yr. mine life at 20k tonnes Li carbonate/yr. and robust economics.

I believe M&A will spread to Chile, in fact it’s already picking up. In the past six months CODELCO acquired Lithium Power Intl. and Eramet is going full steam ahead into Chile, it acquired a sizable Li exploration property and announced a US$20M earn-in with a Li junior.

Wealth’s two projects, Kuska & Yapuckuta, could be of keen interest to dozens of companies shown in the chart above. The Company’s flagship 100%-owned, royalty-free Yapuckuta project could be worth more than PEA-stage Kuska, possibly a lot more.

It’s a large landholding of 46,200 hectares less than 50 km north of ALB’s & SQM’s world-famous concessions. Notice the Li grade attributable to ALB in the following chart of 1,840 ppm Li.

In ALB’s latest annual report, the Chilean grade is shown to be 2,120 ppm Li! The Yapuckuta project has yet to be drilled, so there’s no Li grade info yet, but it has the potential to host excellent grades. Even a quarter of ALB’s 2,120 ppm would be fantastic.

In Argentina, Lithium Americas (Argentina) [LAAC] & Ganfeng have a JV project [592 ppm Li, using solar ponds] ramping up to 40k tonnes Li carbonate/yr. That project’s valued at ~C$2 billion on a 100% basis. Wealth’s Atacama project is years behind LAAC, but could be larger and/or higher grade.

Referring back to prospective partners, the real reason they should want to partner with Wealth is to get an inside track on BOTH Kuska AND Yapuckuta. There have been reports that the world’s largest specialty chemical company, BASF, is interested in collaborating with Wealth.

That of course would be great, but equally impressive might be a collaboration with a company like; Stellantis, BYD, Tesla or Volkswagen. Last year, Stellantis made a 20% equity investment into a pre-resource Li junior in Argentina.

Rio Tinto, POSCO & Zijin Mining are watching closely, all three have meaningful Li investments across the border in Argentina. Management is having a lot of meetings at this year’s PDAC investment conference.

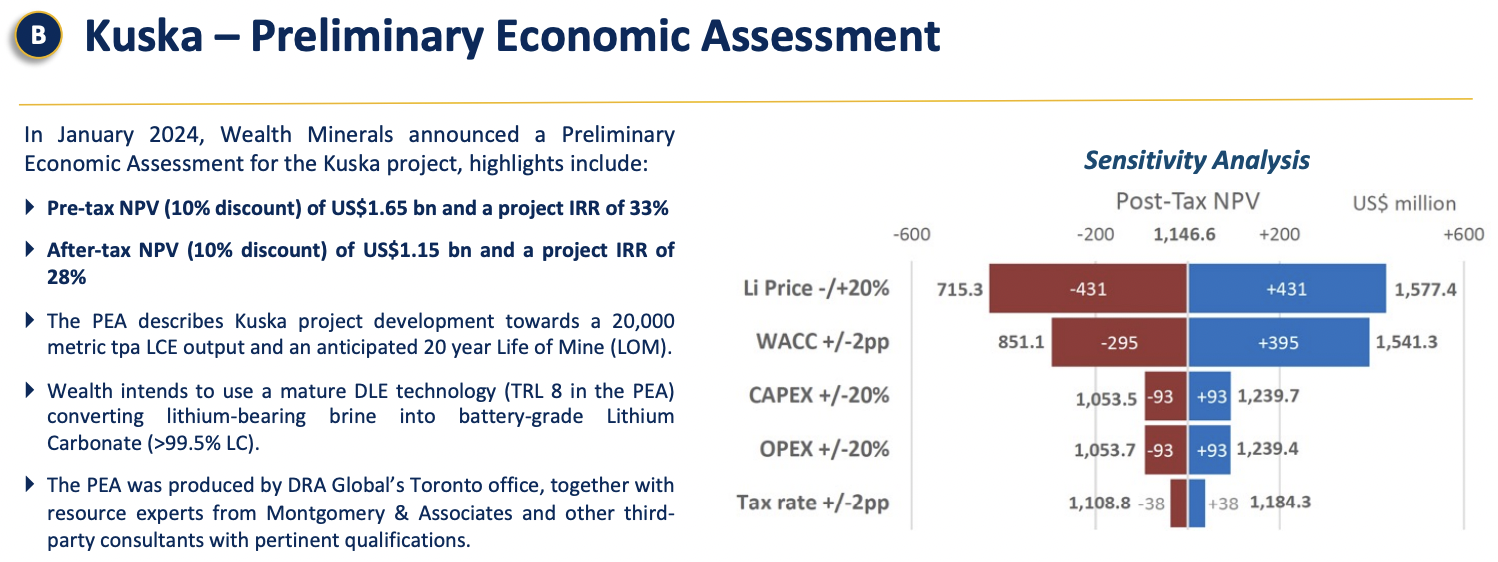

Regarding Wealth’s other main project, Kuska’s PEA was filed on Sedar, enabling investors to learn more about the economics & logistics. As a recap, the after-tax NPV(8%) came in at US$1.325B, with an IRR of 25%, at a long-term Li carbonate price of US$24,660/tonne…

Kuska compares favorably to other DLE/brine projects, especially with nearly 2x the grade. {see chart above}. Kuska’s 80% recovery from DLE is solid, but may prove to be conservative. Notice that many peers have recoveries in the 90%-98% range. All else equal, a 5%-10% gain in recoveries would materially enhance the economics.

Of eight peers with economics shown, four have brine grades < 75 ppm. The avg. grade of all 13 at 95 ppm is well below that of Kuska. Reported peer economics look good on paper, but the margin for error is very low. All else equal, 179 ppm Li brine should be more profitable & resilient to lower pricing than sub-75 ppm Li resources.

Note: I added 10%-40% to cap-ex/op-ex figures for three peers that have dated economic studies, and boosted Li price & NPV in some cases, based on sedar-filed documents.

Given positive developments underway in Chile, I think Kuska has a good chance of finding a strategic partner from among the dozens shown above active.

Unlike in Argentina, there’s only a small handful of juniors with Li projects or properties in Chile, making them stand out. Giant companies would be wise to diversify battery metal interests across Africa, Australia, Argentina, Brazil, Canada, Chile, Europe & the U.S.

Especially as some jurisdictions become overcrowded, causing local opposition & fierce competition for (power, water, labor, rail, ports). For example, in Argentina, the medium-sized Hombre Muerto salar has 6-7 projects in & around it. Locals are presumably fine with 1 or 2, but 6 or 7?

Parts of Australia are experiencing growing pains as well.

Investors in Wealth at C$0.19/shr., an enterprise value {market cap + debt – cash} of ~$63M, are buying in at a steep discount to after-tax NPV. However, more importantly, one effectively gets Wealth’s Yapuckuta project for free.

Management believes that with the right partner(s), its projects could produce 200,000 tonnes/yr., more than either ALB or SQM currently deliver. At that point, not before the early-2030s, Wealth would have less than 100% ownership.

Yet, even if it owned 25% of 200k tonnes/yr., that would be bigger than LAAC’s/Ganfeng’s 40k tonne/yr. operation. As green shoots are confirmed, and a Li rebound is underway, I believe Wealth Minerals (TSX-v: WML) / (OTCQX: WMLLF) is a name investors should go for.

Like many management teams, Wealth is fielding calls from a lot of suitors, but few companies have as powerful a combination of assets, incl. high-grade — potentially world-class — assets, in a favorable jurisdiction like Chile.

Disclosures: The content of this article is for information only. Readers understand & agree that nothing contained herein, written by Peter Epstein of Epstein Research [ER], (together, [ER]) about Wealth Minerals, incl. but not limited to, commentary, opinions, views, assumptions, reported facts, calculations, etc. is to be considered implicit or explicit investment advice. Nothing contained herein is a recommendation or solicitation to buy or sell any security. [ER] is not responsible under any circumstances for investment actions taken by the reader. [ER] has never been, and is not currently, a registered or licensed financial advisor or broker/dealer, investment advisor, stockbroker, trader, money manager, compliance or legal officer, and does not perform market-making activities. [ER] is not directly employed by any company, group, organization, party, or person. The shares of Wealth Minerals are highly speculative, not suitable for all investors. Readers understand and agree that investments in small-cap stocks can result in a 100% loss of invested funds. It is assumed and agreed upon by readers that they will consult with their own licensed or registered financial advisors before making investment decisions.

At the time this article was originally posted, Peter Epstein owned shares, options or warrants in Wealth Minerals, and the Company was an advertiser on [ER].

Readers should consider me biased in my view of the Company. Readers understand and agree that they must conduct their own due diligence above and beyond reading this article. While the author believes he’s diligent in screening out companies that, for any reason, are unattractive investment opportunities, he cannot guarantee that his efforts will (or have been) successful. [ER] is not responsible for any perceived, or actual, errors including, but not limited to, commentary, opinions, views, assumptions, reported facts & financial calculations, or for the completeness of this article or future content. [ER] is not expected or required to subsequently follow or cover events & news, or write about any particular company or topic. [ER] is not an expert in any company, industry sector, or investment topic.

![Epstein Research [ER]](http://EpsteinResearch.com/wp-content/uploads/2015/03/logo-ER.jpg)