Lithium (“Li“) juniors in Canada & Australia have been under pressure for months. The reasons given for this weakness are China’s slower than expected economy and a falling Li spot price. Regarding China, last week it announced the largest Electric Vehicle incentive program ever.

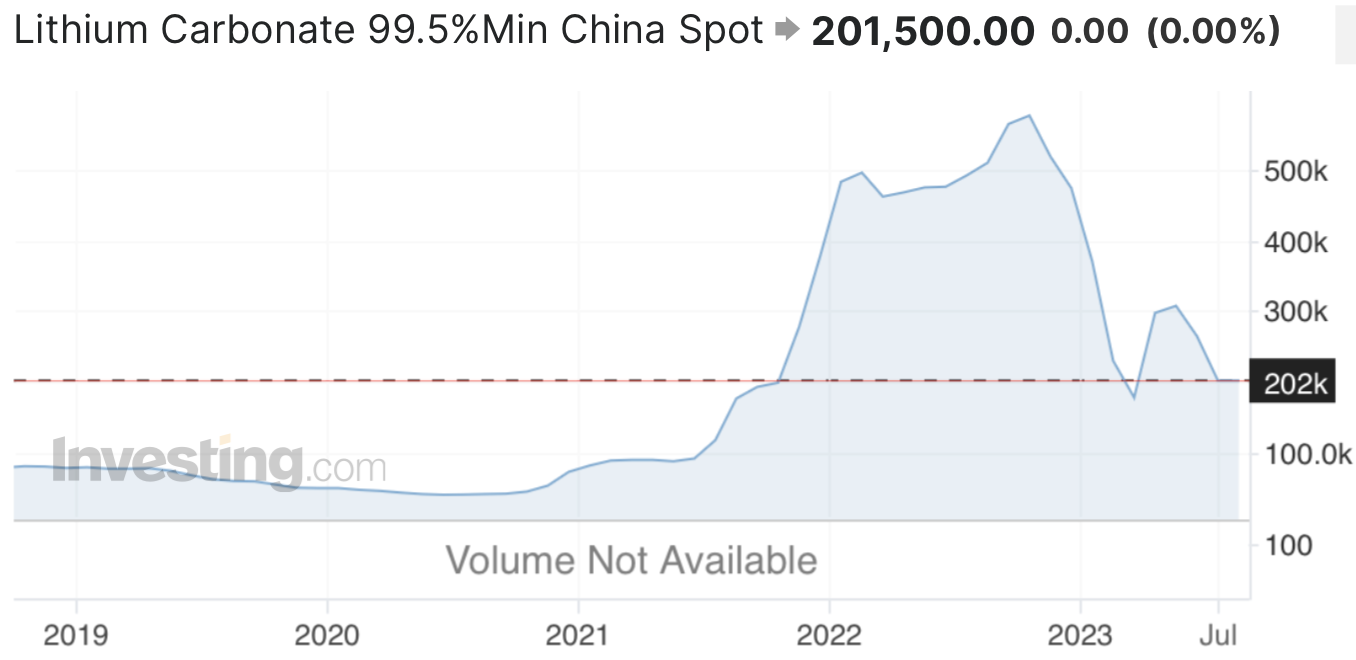

The spot price in China has been falling (an average of ) ~1%/day for the past 40 days. However, one shouldn’t look at this price indicator alone. Spot prices are not representative of the market.

Quarterly contract prices achieved by companies like Albemarle & SQM are far better. SQM’s contract price is down 42% from its peak, but the Chinese spot price is down ~70%. Earlier this year the spot price bottomed around US$23k/t and subsequently rallied over 85% before the onset of this latest contraction.

Importantly, the spot price, currently around US$27,860/tonne, is still quite strong compared to any time before mid-2021. Today’s level is above the US$20-$24k long-term price assumptions used in most company economic studies over the past few years.

While global Li demand forecasts keep moving higher — Albemarle estimates 3.7M tonnes of Li carbonate equiv. (“LCE“) will be needed in 2030 [nearly 5x current consumption] — supply is highly uncertain. New brine projects in Argentina are taking way longer to reach production than anyone expected.

Direct Lithium Extraction (“DLE“) projects offer no silver bullet. No DLE technology has reached meaningful commercial scale yet. DLE is coming, but each project will have case-specific logistical, permitting & ESG challenges taking years to work out.

Likewise, sedimentary deposits, most notably clay-hosted Li projects in the western U.S., are being de-risked, but none have reached commercial scale yet.

Only conventional hard rock Li projects offer good visibility, with the most certainty coming from Canada & Australia. There have been setbacks in the African hard rock Li world. Two days ago Leo Lithium’s shares fell 50% as Mali’s government suspended its Li export plans. AVZ Minerals’ stock has been halted for over a year.

Ontario & Quebec are emerging as world-class EV & Li-ion battery hubs. Canada is a safe-haven, free from growing conflicts with China. Canada has one of the greenest & lowest cost electricity grids due to abundant hydroelectric & nuclear power.

Ontario borders the Top-3 EV market (USA) and is closer to most European markets than Africa, Brazil, S. America & Australia.

The provincial & Federal governments are pledging financial & logistical support to Li developers and to global OEMs & battery makers. So far, Ontario & Quebec have attracted; Ford, Volkswagen, Stellantis, GM, Honda, Toyota, Umicore, LG Energy Solution, SK On, POSCO, Northvolt and BASF.

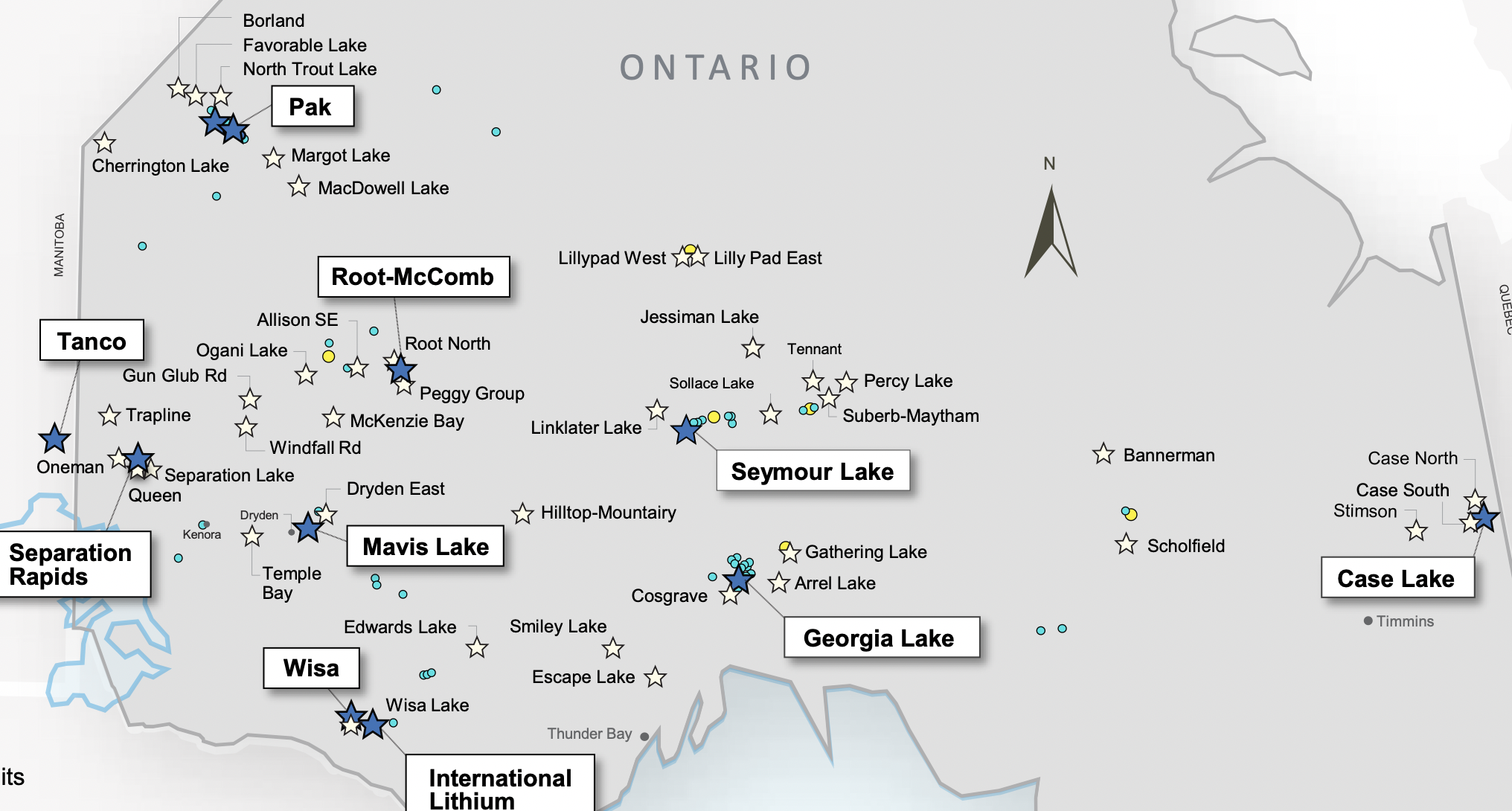

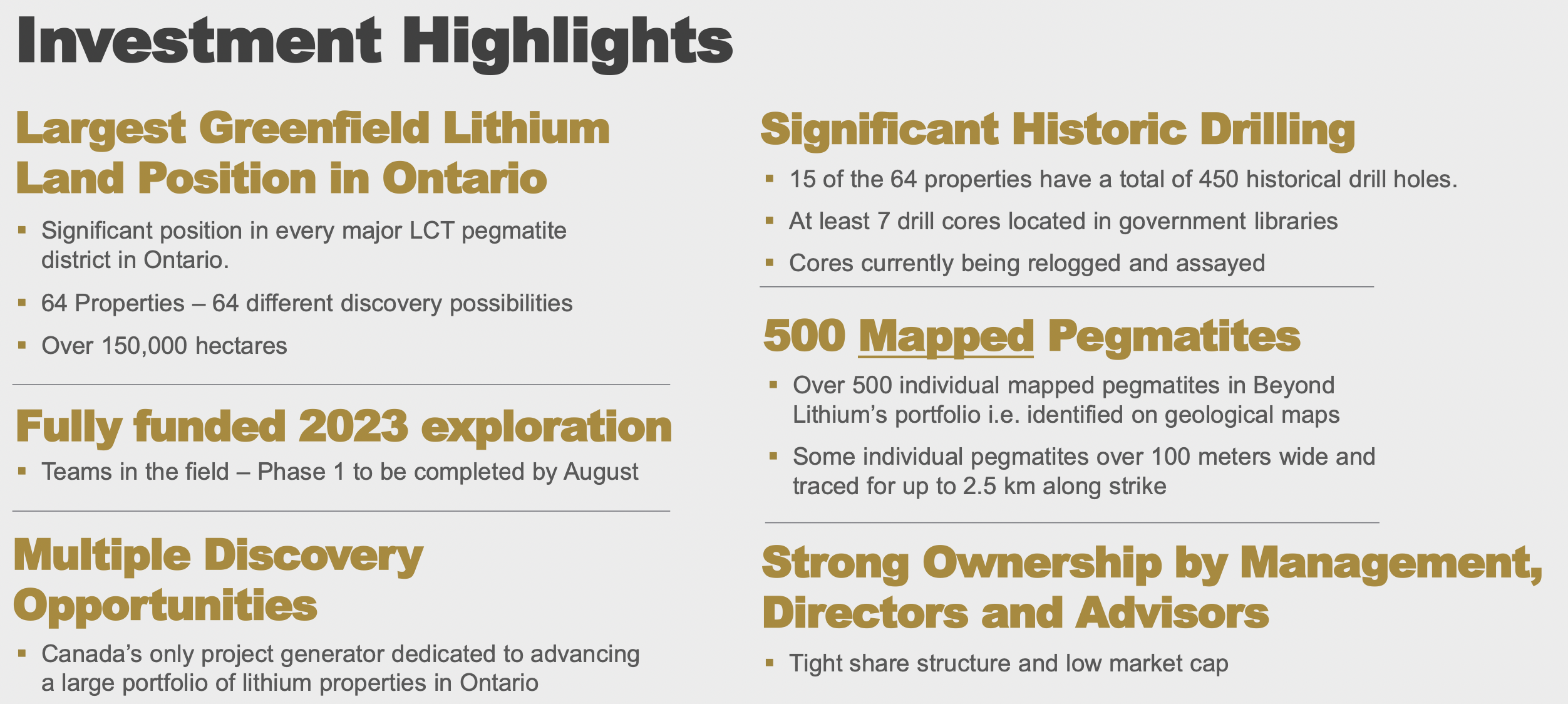

If one believes that Li prices will remain strong for years to come, a great way to play that theme is with high-risk, small cap Li juniors like Beyond Lithium (CSE: BY) / (OTCQB: BYDMF), a company 100% focused on Ontario with over 60 properties ( > 150,000 hectares) of Li-prospective prospects.

To date, over 40 properties have undergone boots-on-the-ground Phase 1 prospecting consisting mostly of mapping & surface sampling. More properties could have been visited by Beyond’s expert field teams, but this Summer’s forest fires across Canada and the availability of helicopters was a constraint.

Of the 40+ properties explored, 10 have already advanced to the more extensive & comprehensive Phase 2 exploration stage and a handful of drill holes should be expected by year end on one or more targets. It seems likely that 5-10 additional properties will eventually move to Phase 2.

Beyond has authored a few detailed press releases that contain ample geological jargon. Terms including; muscovite, batholith, peraluminous…

No, I don’t understand all the jargon, but Beyond’s technical team & advisors DO understand this language. VP Exploration Lawrence Tsang is a PGeo & a QP with > 15 years’ experience in N. America on grassroots & advanced projects. He serves as Senior Geologist of Ascot Resources.

Mr. Tsang has discovered a number of projects and successfully advanced the Premier Gold Project in B.C. from early exploration stage to development.

Graeme Evans, PGeo has > 40 years’ experience working throughout N. America exploring for porphyries, sedex, VMS, skarns, mesothermal & epithermal gold systems for companies including; Hudson Bay Mining, B.P. Selco, Inmet and more recently Teck Resources. While with Teck Graeme worked on generative and Au & Ni projects for several years in Ontario.

Technical advisor, exploration geologist Paul Baxter worked with Ascot, Teck, Skeena Resources, Inmet Mining and others. He has 35+ years’ experience.

Duties included; core logging, data interpretation, report writing, creation of geologic models, running geology & geochemical field programs, designing, organizing & supervising geological, geochemical, geophysical & drill programs. That’s just three of a larger team that is remarkable given Beyond’s tiny market cap.

Some investors are questioning Beyond’s progress because they haven’t come out with a flashy PR touting big Li2O numbers. To that complaint, management simply says that they are very happy with the data from the field. Logical & prudent steps are being taken to advance each property.

I’m tracking 210 companies with Li properties in Canada. Year-to-date, only about a dozen have reported actual drill results. Exploration takes time, and doing it right takes even longer. As prominent Li juniors in Ontario make discoveries and advance projects, that news will benefit Beyond as well.

Significant Ontario players include Lithium Royalty Corp., Frontier Lithium, Rock Tech Lithium, Brunswick Exploration, Green Technology Metals, Avalon Advanced Materials, Critical Resources Ltd. & Power Metals. Beyond has properties near most, if not all, of these companies.

If/when important discoveries are made, management intends to stake or option additional property before word gets out. This is exactly what was done around the Cosgrave Lake project. Another concern investors bring up is, “why hasn’t Beyond partnered with larger companies?”

Again, there’s a simple answer. As long as the Company is funded to continue advancing properties, it doesn’t need the help. Readers may or may not agree with this approach, but rest assured there are a number of Canadian & Australian groups interested in partnering with Beyond.

The more data that management can compile, the more evidence for the potential of Li-bearing pegmatites, the better the deals that can be made.

Beyond Lithium appears to be undervalued. Options have real tangible value, and Beyond has tremendous optionality embedded in its 150,000+ hectares. If the Company were valued at say $30-$40M at this early stage, then upside would be muted. However, today’s enterprise value {market cap + debt – cash} is just $9M.

Clearly, management will need to find some 1%+ Li2O samples and then drill multiple targets — hopefully starting later this year.

The difference between Beyond and many other Li juniors is that its technical team & advisors are trying to accurately log and truly understand geological settings in order to focus on the best parts of each prospect. This approach promises to save time & money in the long run.

As management advances 15-20 prospects, stakes and/or options new ground and farms out some holdings, the strength of the prospect generator model will come to light. The number of properties will decline but the quality, value (and in some cases size) of each remaining project will increase.

Staking new ground around prospects that have demonstrated meaningful potential delivers considerable bang for the buck as the cost of staking is so low. If a a third of 15-20 prospects can be farmed out for cash/shares + work commitments, that would eliminate much of Beyond’s cash burn.

It might take 6-9 months before partnerships begin to make a difference, but the Company had ~$1M in cash at 6/30/23, enough to last until tear-end. Several companies are active nearby Beyond’s holdings. For example, Power Metals has drilled 15,700 m between 2017 and 2022 and is fully-funded for a 15,000 m drill program in 2023.

This week Green Technology Metals (“GTM“) executed a 5-yr. off-take agreement with Korea’s LG Energy Solution on its Seymour Lithium project. This is very interesting because Seymour is pre-PEA stage. Beyond could have one or more prospects at a similar stage in the next year or two.

Lithium Royalty Corp. has provided royalty funding packages on Canadian-based projects owned by Allkem, Power Metals, GTM, Grid Metals, ACME Lithium, Winsome & Sayona Mining.

Frontier Lithium recently delivered a blockbuster Pre-Feasibility Study (“PFS“) and is expected to announce the final plans of a permitted, 135 km road & bridge development project (mostly funded by gov’t). This road/bridge will benefit several Li juniors in Northern Ontario.

Beyond Lithium (CSE: BY) / (OTCQB: BYDMF) has a lot of irons in the fire in a world-class jurisdiction. It has prospects near not just one or two substantial third-party projects, more like eight. Even one successful prospect from the 15-20 that are being actively advanced would justify the current $9M valuation.

Once Li prices stop falling, and potentially rebound, and seasonally-strong 4th qtr. Electric Vehicle sales #s start to come out, sentiment in the Li sector can only get better.

Disclosures: The content of this article is for information only. Readers fully understand and agree that nothing contained herein, written by Peter Epstein of Epstein Research [ER], (together, [ER]) about Beyond Lithium, including but not limited to, commentary, opinions, views, assumptions, reported facts, calculations, etc. is not to be considered implicit or explicit investment advice. Nothing contained herein is a recommendation or solicitation to buy or sell any security. [ER] is not responsible under any circumstances for investment actions taken by the reader. [ER] has never been, and is not currently, a registered or licensed financial advisor or broker/dealer, investment advisor, stockbroker, trader, money manager, compliance or legal officer, and does not perform market making activities. [ER] is not directly employed by any company, group, organization, party or person. The shares of Beyond Lithium are highly speculative, not suitable for all investors. Readers understand and agree that investments in small cap stocks can result in a 100% loss of invested funds. It is assumed and agreed upon by readers that they will consult with their own licensed or registered financial advisors before making investment decisions.

At the time this article was posted, Beyond Lithium was an advertiser on [ER] and Peter Epstein owned shares in the company.

Readers understand and agree that they must conduct their own due diligence above and beyond reading this article. While the author believes he’s diligent in screening out companies that, for any reasons whatsoever, are unattractive investment opportunities, he cannot guarantee that his efforts will (or have been) successful. [ER] is not responsible for any perceived, or actual, errors including, but not limited to, commentary, opinions, views, assumptions, reported facts & financial calculations, or for the completeness of this article or future content. [ER] is not expected or required to subsequently follow or cover events & news, or write about any particular company or topic. [ER] is not an expert in any company, industry sector or investment topi

![Epstein Research [ER]](http://EpsteinResearch.com/wp-content/uploads/2015/03/logo-ER.jpg)