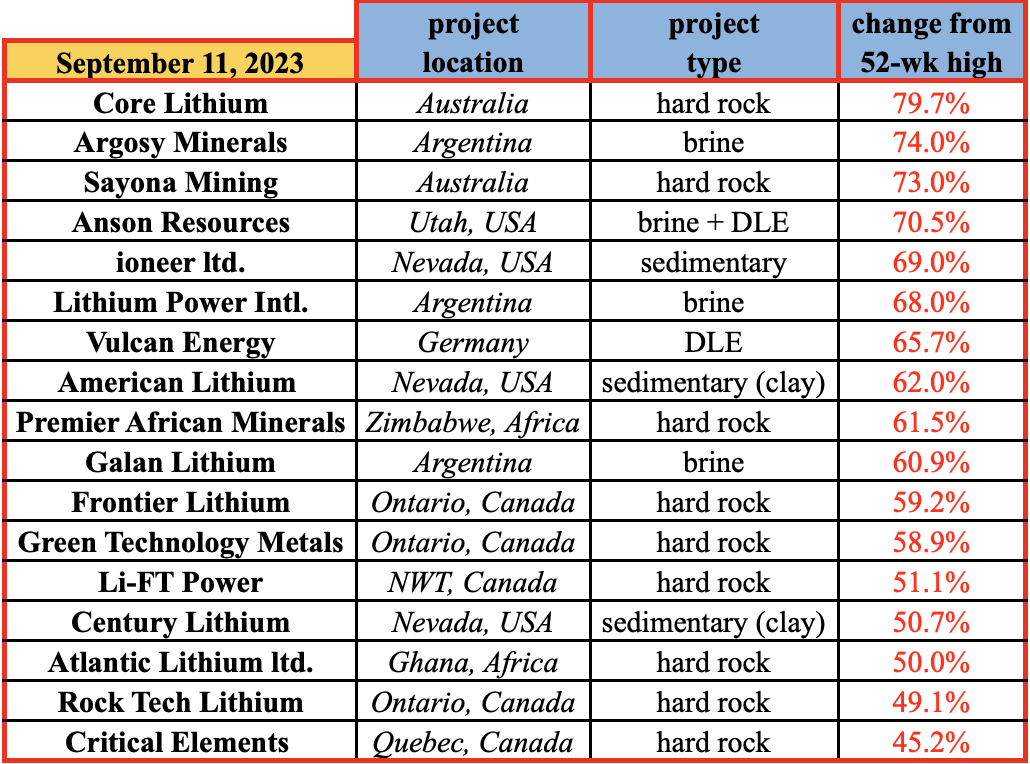

Lithium (“Li“) juniors have been under pressure all summer. Many notable companies are down > 50% from 52-week highs {see chart below}. Notice that all types of companies are down; hard rock, sedimentary (clay) & brine/DLE project developers, explorers… It’s brutal out there!

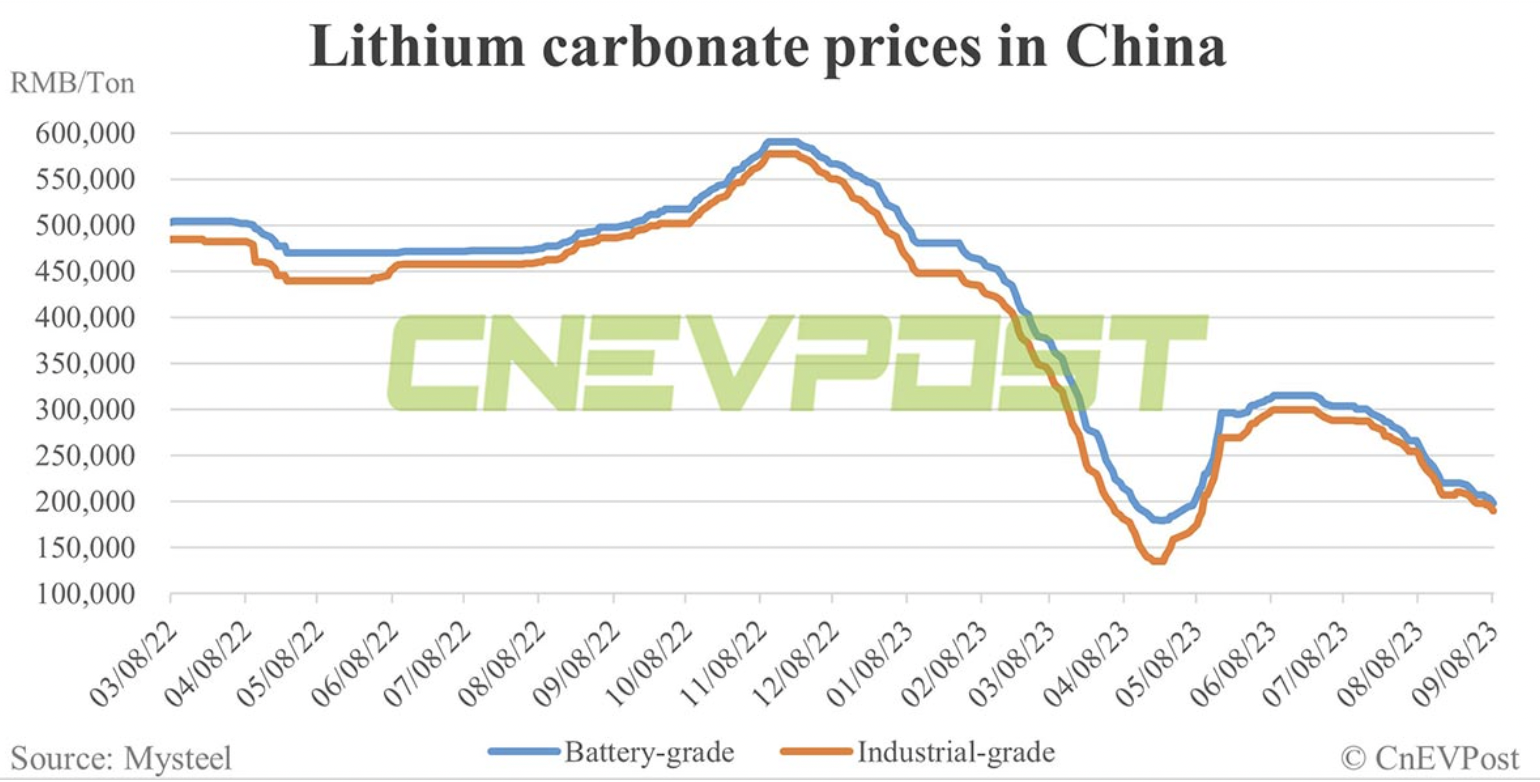

The main reasons given for this carnage are a weak Chinese economy and a falling Li carbonate spot price. The spot price in China has been down nearly every day for the past six weeks.

However, this six week sell-off could be coming to an end. Back in April a similar dramatic decline bottomed at ~US$23,000/t vs. today’s $26,889/t. The price subsequently rallied over 80% before the current contraction. Readers should understand that the Li spot price in China is just one of several global prices to consider.

A better indicator is quarterly contract prices achieved by companies like Albemarle Corp. & SQM. In US$, SQM’s contract price is down –42% from its peak, vs. the China spot price down -72%. To put today’s mid-to-high US$20,000s/tonne levels into context, it remains at or above any price prior to mid-2021. For most of the past few decades the Li price was below $10,000/t.

Supporting a Li price bounce is the recent news that China is enacting its most aggressive Electric Vehicle (“EV“) incentive program ever, a 4-yr, US$72 billion effort. If one believes that Li investor sentiment will recover, buying low-valued companies with substantial upside potential makes sense.

One such company is Portofino Resources (TSX-v: POR) / (OTCQB: PFFOF). Portofino controls 100% of the 2,932 ha Yergo brine project in Catamarca province, Argentina. The Company also has a 2-yr. relationship with REMSa. S.A., an important entity that, “manages & articulates mining investment policies & projects” in Salta province.

CEO David Tafel and his in-country team have been working with REMSa on various Li properties. Recently, a public auction was held in which Portofino bid on two concessions in the Arizaro salar. The bidding process was complex and time consuming, involving many factors besides just $$$. Management awaits news on the winners and is,“cautiously optimistic” on securing a concession.

If Portofino wins a concession, that would be a strong vote of confidence in the management & technical teams, and the in-country connections that the Company has built with REMSa and other Salta-based agencies & officials.

I could say more about the Salta bidding process and the compelling opportunity it represents, but we don’t know if Portofino has won either of the two properties it bid on. Instead, I turn back to the Yergo project in Catamarca province, a project that was tied up in a dispute with the vendor that has been resolved in Portofino’s favor.

The Company will pay the vendor $600k in cash for 100% full & clear ownership. Yergo covers the entire Aparejos salar, located ~15 km from the 3Q project developed by Neo Lithium Corp. and acquired by Zijin Mining in 2022 or $960M.

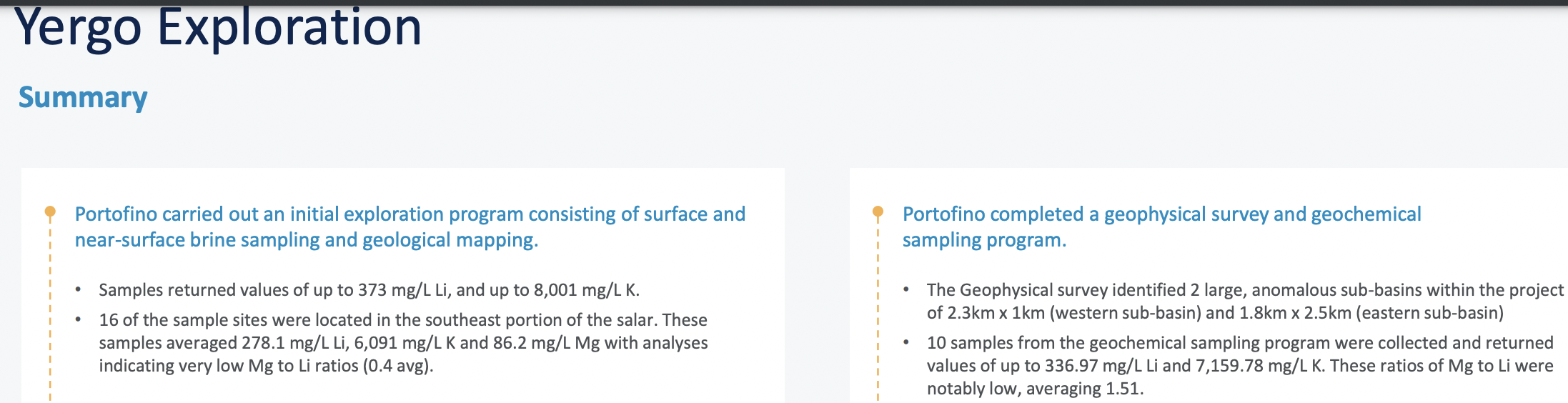

Two large aquifers measuring ~2.3 x 1.0 km, and 1.8 x 2.5 km have been identified. Surface sampling returned up to 373 ppm Li, with an average of 278 ppm. Four drill targets have been finalized for a total of up to ~400 meters.

If a drill permit is received in due course, drilling could start by late November. With Direct Lithium Extraction (“DLE“) companies all over Argentina trying to prove their technologies, a minimum Li grade of ~150 ppm is all that’s needed.

Based on surface results, management believes that Yergo’s grade could be a solid 300-400 ppm Li. However, one can not rule out higher grades. Yergo is quite close to Zijin’s billion dollar 3Q project hosting 900+ ppm Li.

The Company’s technical team thinks that 3Q & Yergo probably, “share a common evaporitic climate and local geology (within the same volcanic package and likely exposure to the same Li source rocks.)”.

Yergo sits 15 km from Neo Lithium’s –> (Zijin Mining’s ) world-class 3Q project

3Q starting production next year will draw a lot of attention to that corner of Catamarca province. Zijin might want to acquire Yergo simply to prevent a competitor from gaining a nearby foothold.

Rio Tinto, Ganfeng Lithium, POSCO, Tibet Summit & Zijin have made acquisitions of Argentinian brine projects with price tags ranging from US$280 to $962M, Lithium Americas acquired two projects for > US$600M, and Tsingshan invested US$375M for 50% of Eramet’s project.

Does this suggest Yergo could be worth hundreds of millions? No, probably not, but could it be worth ten(s) of millions to the right buyer, especially if we get decent drill results? Absolutely.

POSCO plans to spend US$4B on its Hombre Muerto project to initially produce 25k tonnes of Li carbonate. In May, Tibet Summit said it will invest US$1.7B on two projects in Salta. Livent Corp. & Allkem Ltd. have the country’s only active brine operations (Livent & Allkem are in the midst of merging).

A JV between Ganfeng & Lithium Americas started production this year, but has not yet reached commercial scale. Eramet, Zijin & POSCO have large brine projects ramping up in 2024-25.

Oil companies Pluspetrol & YPF Sociedad Anónima are looking to expand their budding Li interests in Argentina. That’s 10 multi-billion dollar companies that could be interested in Yergo and/or an Arizaro project (if Portofino wins a concession).

In addition to these 10 large-to-very-large companies, Argentinian Li plays with market caps > $100M are; Galan Lithium, Argosy Minerals, Lake Resources, Alpha Lithium & Lithium Chile. Might any of those players want to partner with Portofino? Numerous discussions are ongoing with potential strategic partners to capitalize on current & future opportunities.

Alex Molyneux & Blake Steele, living full time in Taiwan & Hong Kong, respectively, were recently appointed to Portofino’s advisory board specifically to help find investment groups from Asia & Europe. Please take a moment to review the bios of Portofino’s management & technical team, and advisory board members.

Yet, despite the 15 groups I’ve mentioned, it’s the potential new entrants to Argentina that could spark a bidding war for brine assets. There are probably a dozen EV OEMs + a handful of Li-ion battery makers that are ready, willing & able to invest globally to secure Li supply.

Commodity traders like; Glencore, Mitsui & Co., Traxys, Hanwa Co., and Trafigura are investing in Li or looking to start. And, as mentioned, DLE companies like Lilac Solutions, Sunresin New Materials & Summit Nanotech would appreciate the advantages of operating on a salar with no competing companies.

Yergo’s footprint is small, but by no means tiny. Lithium South Development has booked an impressive 1.6M tonnes of high-grade (700 ppm +) Lithium Carbonate Equiv. (“LCE“) on 1,542 hectares of its 5,000+ ha land package. I believe there’s potential for Yergo to host over two million tonnes LCE (depending on grade & depth of a potential resource).

Unlike the Hombre Muerto area, Yergo covers an entire salar. Why is this important? Consider the potential for legal disputes as possibly more than five well-funded companies try to ramp up operations in and around Hombre Muerto at roughly the same time.

Even if legal disputes are avoided, competition for water, workers, construction teams, mining services & equipment could become heated. Local communities can live with 1 or 2 major Li projects in their backyards, but five!?! Companies with a lot of eggs in their Hombre Muerto baskets would greatly benefit by diversifying with a project like Yergo.

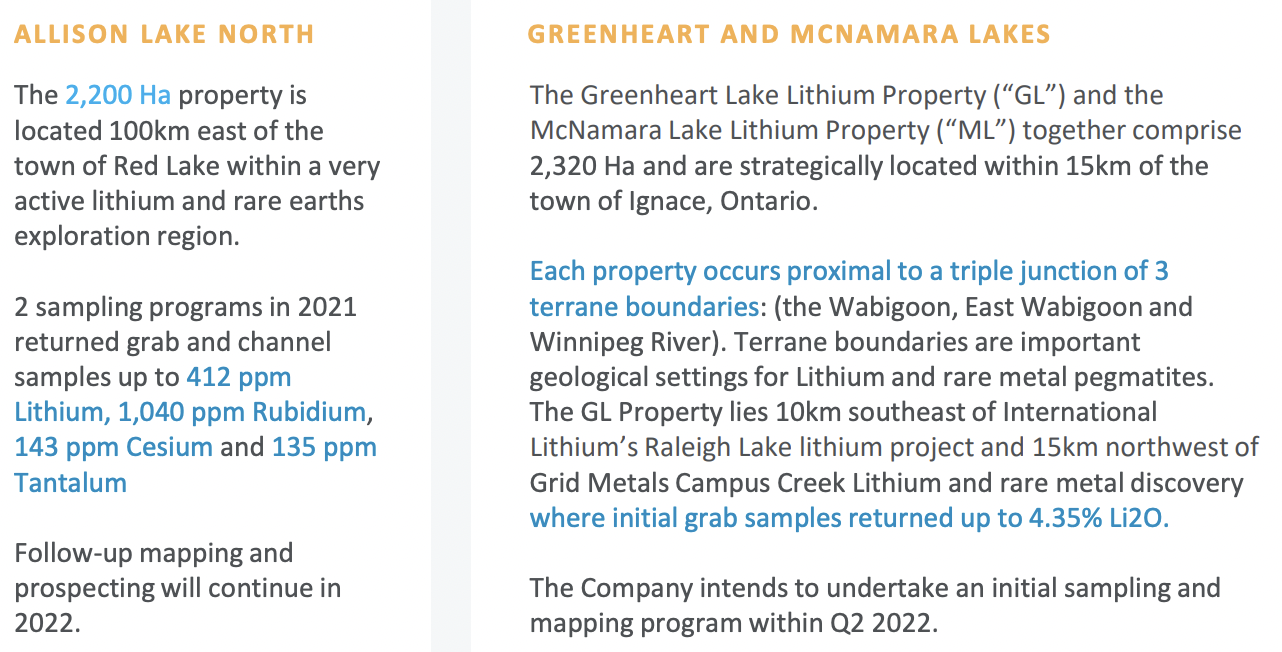

In addition to Yergo in Catamarca and potential prospects in Salta, (some tied to REMSa, others not), Portofino has five gold & three Li properties in Ontario, Canada. Several of these properties could be attractive farm out or JV candidates, albeit subject to improved investment sentiment.

In the meantime, all eyes are on Portofino’s Argentinian brine plays Yergo & (hopefully) Arizaro. With a current market cap of ~$13M, and Yergo alone (in my opinion) worth well more than that, Portofino Resources (TSX-v: POR) / (OTCQB: PFFOF) offers a compelling risk/reward proposition.

Please take a moment to review the bios of Portofino’s management & technical team, and advisory board members. Remember, crazy acquisition prices have been paid for brine assets in the recent past, hundreds of millions — all the way up to nearly US$1 billion — for pre-construction projects.

As 3-5 brine projects come online in Argentina in the next several years, more and more Li-hungry companies will want to partner with, or acquire, companies with high-quality projects.

Disclosures / Disclaimers: The content of this article is for information only. Readers fully understand and agree that nothing contained herein, written by Peter Epstein of Epstein Research [ER], (together, [ER]) about Portofino Resources, including but not limited to, commentary, opinions, views, assumptions, reported facts, calculations, etc. is to be considered implicit or explicit investment advice. Nothing contained herein is a recommendation or solicitation to buy or sell any security. [ER] is not responsible under any circumstances for investment actions taken by the reader. [ER] has never been, and is not currently, a registered or licensed financial advisor or broker/dealer, investment advisor, stockbroker, trader, money manager, compliance or legal officer, and does not perform market making activities. [ER] is not directly employed by any company, group, organization, party or person. The shares of Portofino Resources are highly speculative, not suitable for all investors. Readers understand and agree that investments in small cap stocks can result in a 100% loss of invested funds. It is assumed and agreed upon by readers that they will consult with their own licensed or registered financial advisors before making any investment decisions.

At the time this article was posted, Portofino Resources is an advertiser on [ER] and Peter Epstein owned shares in the Company.

Readers understand and agree that they must conduct their own due diligence above and beyond reading this article. While the author believes he’s diligent in screening out companies that, for any reasons whatsoever, are unattractive investment opportunities, he cannot guarantee that his efforts will (or have been) successful. [ER] is not responsible for any perceived, or actual, errors including, but not limited to, commentary, opinions, views, assumptions, reported facts & financial calculations, or for the completeness of this article or future content. [ER] is not expected or required to subsequently follow or cover events & news, or write about any particular company or topic. [ER] is not an expert in any company, industry sector or investment topic.

![Epstein Research [ER]](http://EpsteinResearch.com/wp-content/uploads/2015/03/logo-ER.jpg)