Skyharbour Resources has one of the best corporate presentations among uranium juniors.

The website Trading Economics has a succinct summary of the recent uranium market, quote,

“Uranium rose past $58/lb. [$58.70 — Aug. 28th], extending gains for a sixth week to levels last seen in April, 2022 amid persistent supply risks & bullish long-term demand. Western utilities continue to take measures against an eventual supply halt from Russia amid risks of sanctions against its nuclear fuel supply.”

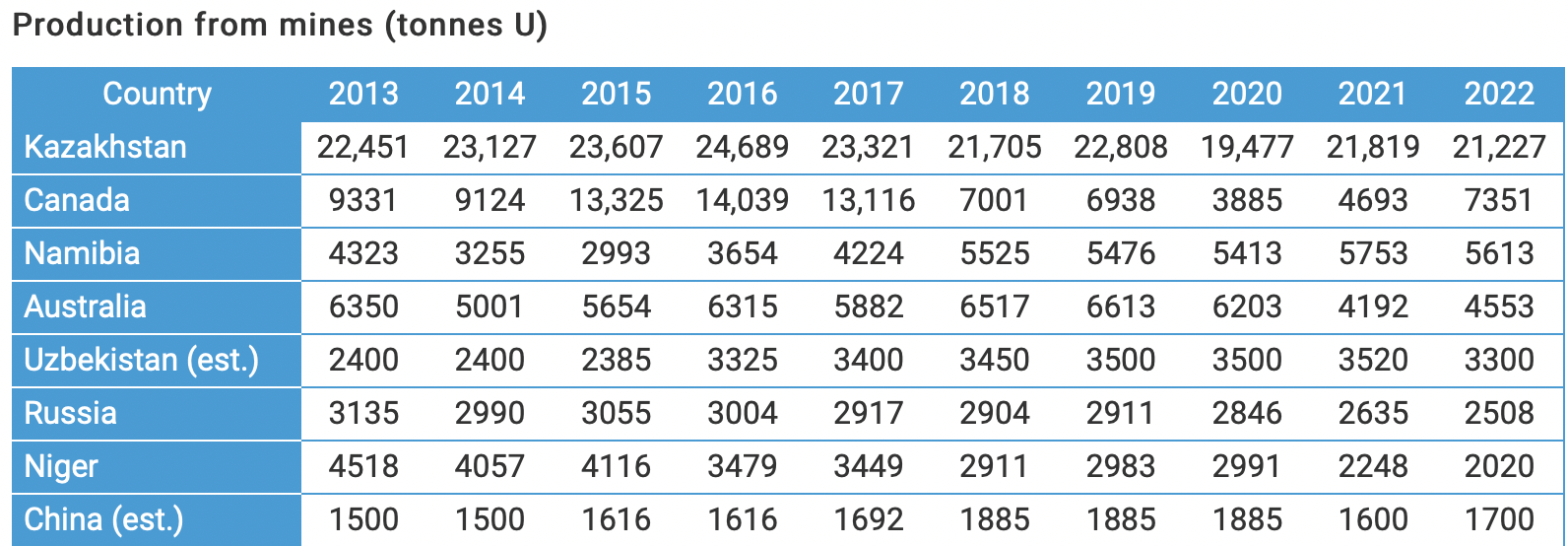

The former Soviet republic of Kazakhstan, by far the world’s largest uranium producer, has close ties to Russia, it shares a 4,750 mile border. If Putin demanded it halt uranium exports to the U.S./Europe, Could Kazakhstan say no?

Former Soviet republic Uzbekistan has been moving away from Russia’s embrace, but into the open arms of China! China & Russia are scrambling for natural resources in Africa as they’re increasingly shut out of N. America, Australia & Europe.

Earlier this year there was a military coup in 7th largest producer Niger (Europe gets 20% of its U3O8 from Niger), a country that Russia has been courting for years. From a recent Bloomberg article, quote,

“If Niger falls into the Russian orbit, the world would depend even more on Moscow – and its allies – for atomic energy. Kazakhstan and Uzbekistan, two former Soviet republics, are among the world’s top uranium producers, accounting for about 50% of the world’s mined supply. Add Russia and Niger to that, and the share jumps to just above 60%…”

All roads are leading to [Russia/Kazakhstan/Uzbekistan/China/Africa/the middle east] as a geopolitical block, an East vs. West dynamic. If true, the U.S. & Europe will need to source a lot more uranium domestically, from Australia, and especially from Canada.

Most agree that uranium supply is highly uncertain. And, global demand is understated as it does not fully incorporate Small Modular Reactors (“SMRs“) or the truly soaring demand from India from 2040 on, (India does not report its nuclear plans as far out as China does).

The Nuclear Energy Institute anticipates that 300 SMRs will come online by 2050. I believe the number will be higher as trillion dollar corporations like Apple, Google & Microsoft announce plans to utilize SMRs to power giant manufacturing complexes.

TradeTech believes those 300 SMRs alone would increase uranium demand by 100M pounds/yr., roughly half current global consumption. The World Nuclear Assoc. increased its view of uranium demand in 2040. The mid-point of its base & upside cases is a 4.2% CAGR, up from ~2.5%-3.0% in the 2000-2021 period.

Uranium prices have to rise, the only questions are; how much and how soon. Bull markets can last a long time. Over the 7.5 year period from December 2000 to June 2007 the uranium price rose +1,872% from $7.10 to $140/lb.

Adjusted for inflation, (in today’s dollars) that $140 is ~$200/lb. Although short-lived, the contract price was pinned at $95 for nine months in 2007-08, an inflation-adjusted ~$140-$145/lb. Will the uranium price surpass $100/lb. again?

Evidence of investor interest can be seen in the strong performance of industry leader Cameco, up +73%! from its 52-wk low. That’s an incredible gain for a company with a market cap of $21.5 billion.

Admittedly, I and several uranium bulls have been expecting the price to move considerably higher for years, and it has, but not nearly as much as many pundits believe is coming.

The best time to invest in smaller, higher risk plays like Skyharbour Resources (TSX-V: SYH) / (OTCQX: SYHBF) is in the early stages of a uranium bull market.

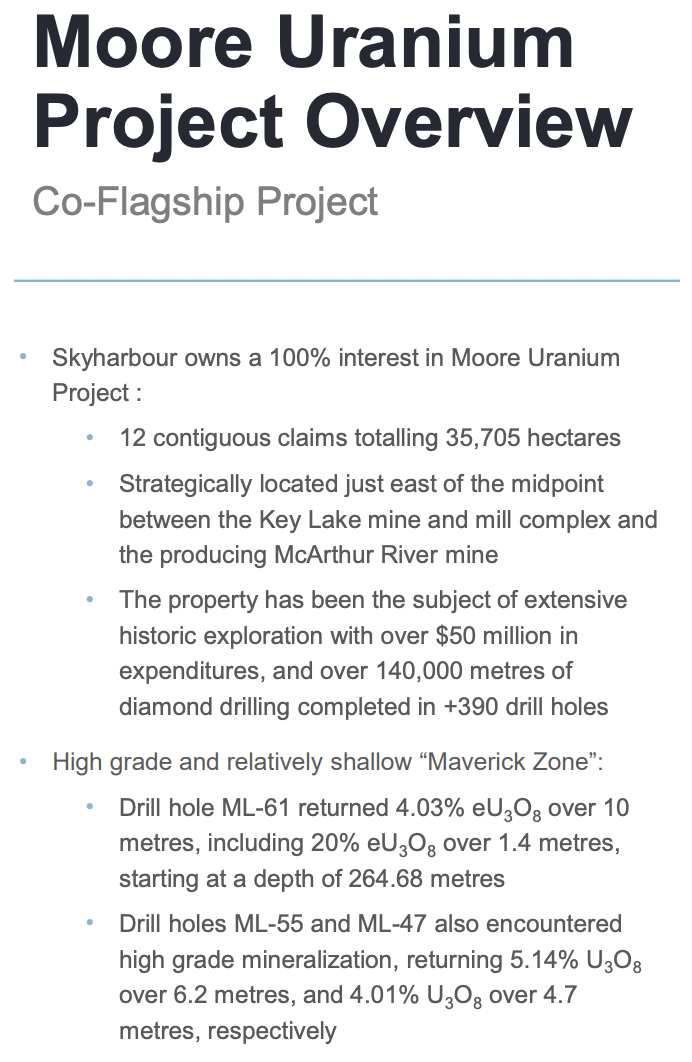

Not only is Skyharbour well positioned in the world’s top uranium district — the ultra-high-grade Athabasca basin in northern Saskatchewan Canada — it has amassed the third largest land holdings at nearly 520,000 hectares.

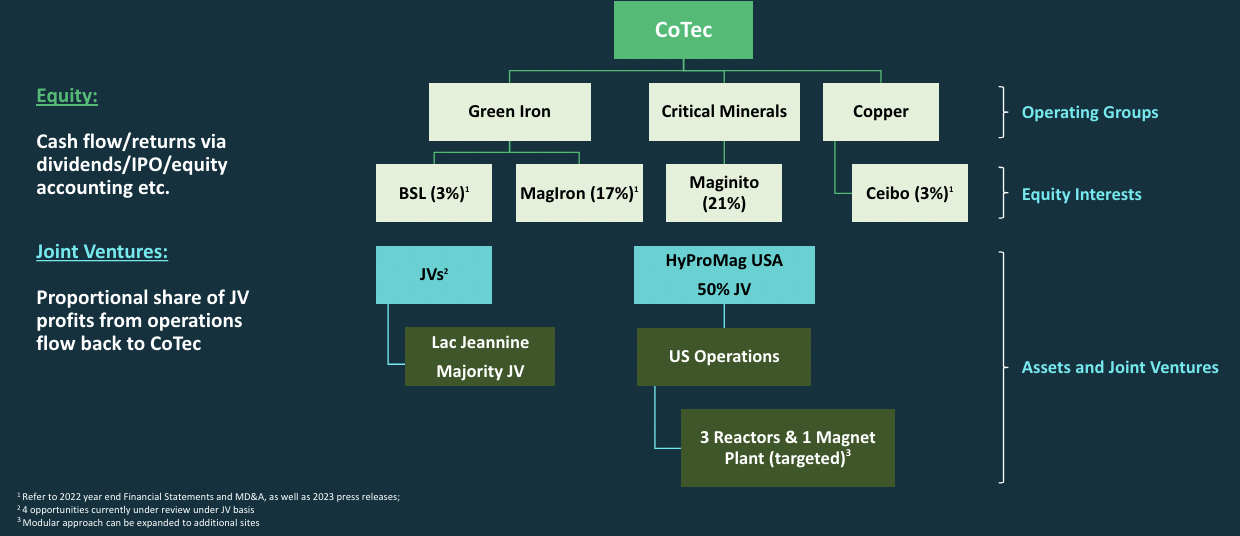

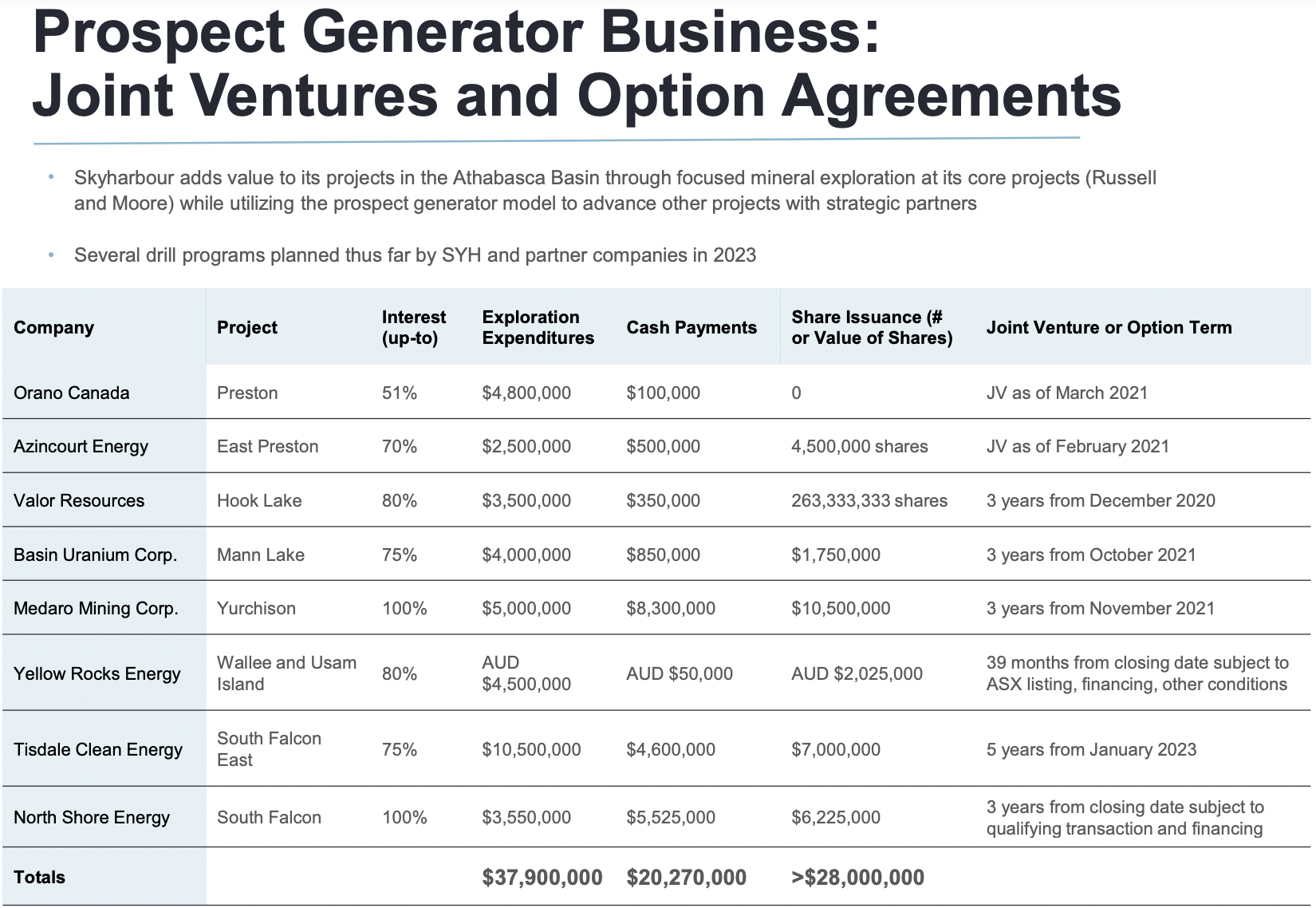

Skyharbour has co-flagship projects in Moore Lake (“ML“) & Russell Lake (“RL“) as well as 22 prospects, of which nine are farmed out or in a JV, and 13 remain available for new partnerships. In a bull market the value of these 22 prospects should increase substantially.

I mentioned that Cameco is up +73%, but Uranium Energy Corp. (“UEC“), Denison Mines & Nexgen are up +87%, +51% & +50%, respectively (all at/near 52-wk highs). The average market cap of these three is $2.2 billion. F3 Uranium & IsoEnergy are not near highs, but are up an average of +275% from 52-wk lows. What do all six have in common?

They’re focused on — or newly investing in the case of UEC — the Athabasca basin. By contrast, Skyharbour is valued at ~$60M ($0.37/shr.). This seems very low given that the Company will receive up to $10M over the next 24 months in [cash + shares] from its partners.

As exciting as Skyharbour’s prospect generator model is in terms of the blue-sky potential on 100’s of thousands of hectares + low cash burn / share issuances + millions of dollars of partner-funded exploration, the Company’s ML & RL projects are potentially more valuable & compelling.

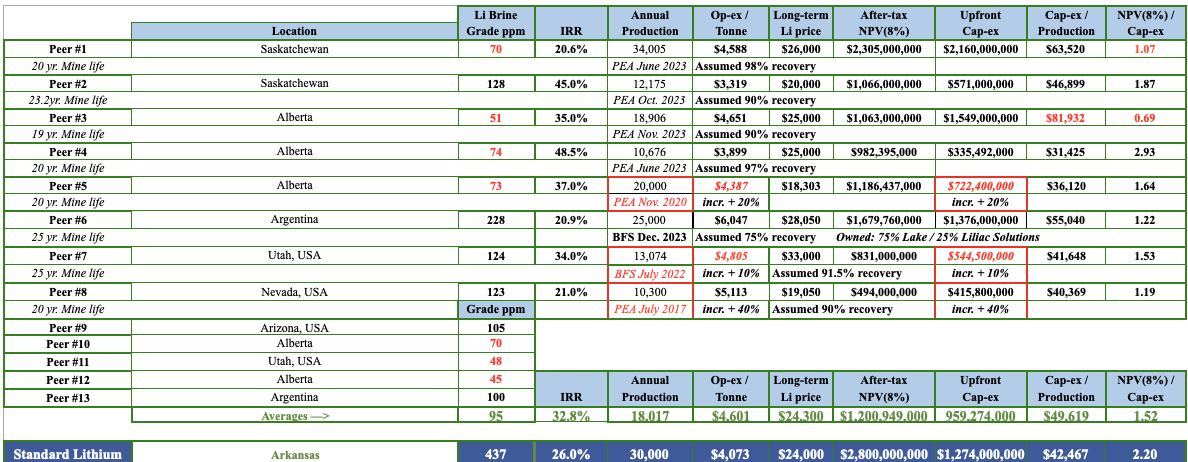

Before diving into ML & RL, readers are reminded that ISR is being advanced for the first time in the Athabasca basin right next door to ML & RL. Denison’s blockbuster Wheeler River project is going to be an ISR mine. It recently delivered a Feasibility Study (“FS“) with an after-tax IRR of 90% & NPV(8%) of $1.6 billion.

Large footprint of Russell Lake + Moore Lake surrounded by Cameco, Orano, Denison…

That 90% IRR is incredibly strong, especially as it includes the past few years of decades-high inflationary pressures not captured in other projects with economic study prior to mid-2021. Compare Wheeler River’s IRR to the 27% IRR from Fission Uranium’s recent FS.

Skyharbour is a prime beneficiary of the many years & $10s of millions invested in ISR testing by neighbors Denison & Orano Canada. Denison is a meaningful shareholder in Skyharbour and its CEO David Cates is a board member.

Not all of the Company’s properties will be amenable to ISR, but if a few are it would be impactful. Resources could become satellite deposits for existing & upcoming processing facilities owned by Cameco, Orano, Denison, Nexgen & Fission.

The most advanced project, (and 100%-owned), is Moore Lake. Its best intercepts; 4.0% U3O8 over 10.0 m, (incl. 20.0% / 1.4 m), 0.72% U3O8 / 17.5 m, 2.5% / 6.0 m, (incl. 6.8% / 2.0 m), 5.1% / 6.2 m, 4.0% / 4.7 m, 20.8% / 1.5 m (within 6.0% / 5.9 m), 9.1% / 1.4 m and 4.2% / 4.5 m.

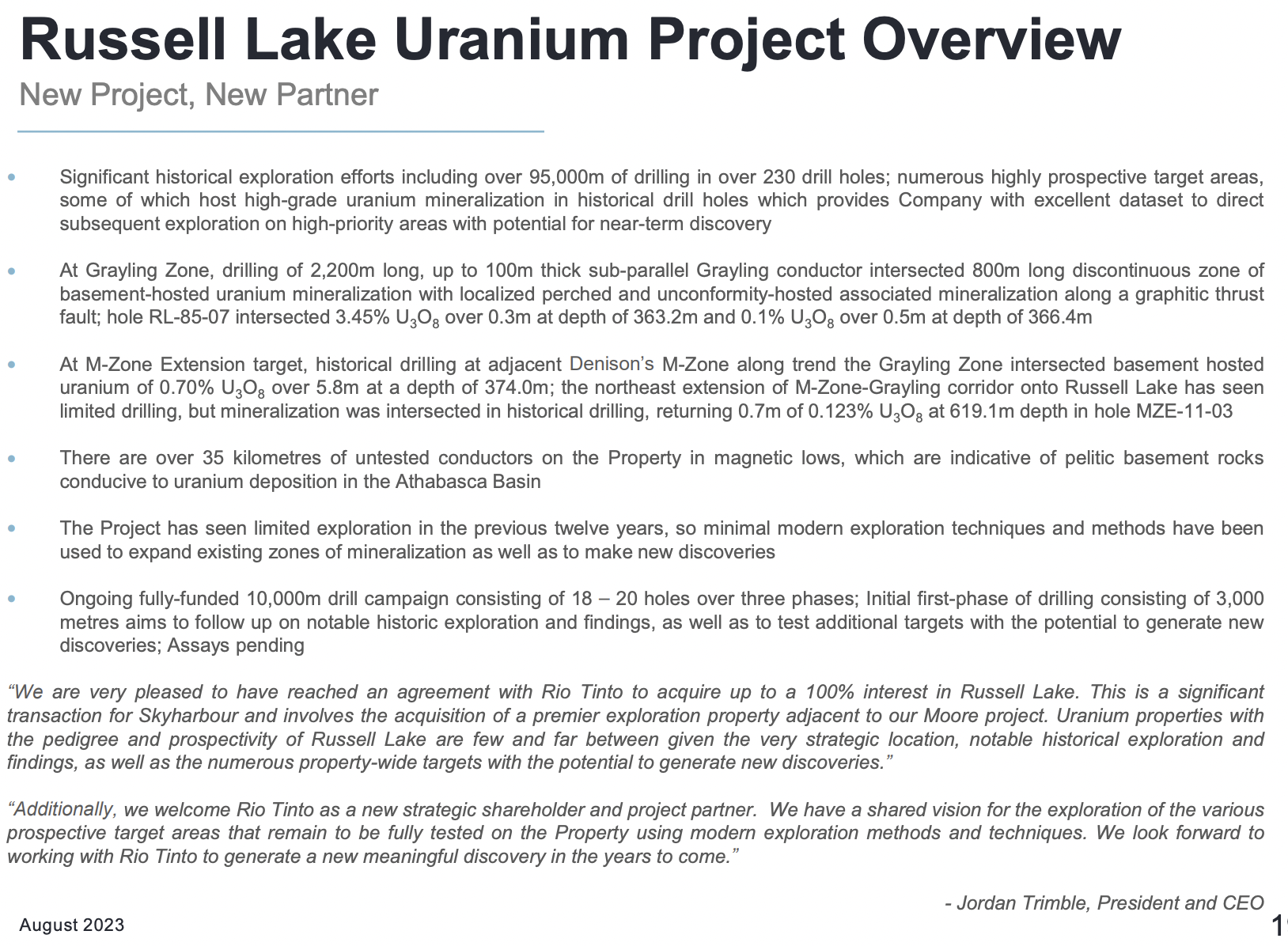

Complimenting & expanding ML is an earn-in to initially acquire 51% of Rio Tinto’s 73,294 ha Russell Lake project, with a path to eventual 100% ownership if warranted. Like ML, RL has seen significant exploration, incl. > 95,000 meters of drilling.

Adjusted for inflation, as much as $100M has been invested into the ML & RL projects alone. It would take several years to replicate that work.

$87M of exploration + share & cash payments from these 8 companies (some already incurred)…

The combined footprint of ML & RL is quite sizable at ~8x that of Wheeler River (~12,000 ha). Importantly, Wheeler has booked 135M Indicated + Inferred pounds (so far).

Skyharbour has drilled a number of holes at RL over the past few months. CEO Jordan Trimble has said in interviews that the core looks very good. Drill results will be coming soon. In addition, a maiden mineral resource estimate is planned at ML by year end.

Skyharbour Resources (TSX-V: SYH) / (OTCQX: SYHBF) has a lot going for it and a very cheap valuation for the 3rd largest land holder in the Athabasca Basin. A 20% gain in the price would breach the $70/lb. level. If/when Russian sanctions are enacted, U.S. utilities might need to pay a premium for friendly Canadian & U.S. produced U3O8.

However, U.S. supply growth is coming almost entirely from ISR mines that typically are good for 1-2M lbs./yr. So, how many pounds might the U.S. be producing by 2030? My guess is 12-16M/yr., with 40-50M/yr. pounds sourced mostly from countries that are not China, Russia, Kazakhstan/Uzbekistan, and probably not that much from Africa.

Canada is in the driver’s seat. The Athabasca basin is the place to be, making Skyharbour a potentially attractive takeout target by many of the companies listed in this article. Please take a look at the Company’s latest corporate presentation.

Disclosures / Disclaimers: The content of this article is for information only. Readers fully understand and agree that nothing contained herein, written by Peter Epstein of Epstein Research [ER], (together, [ER]) about Skyharbour Resources, including but not limited to, commentary, opinions, views, assumptions, reported facts, calculations, etc. is to be considered implicit or explicit investment advice. Nothing contained herein is a recommendation or solicitation to buy or sell any security. [ER] is not responsible under any circumstances for investment actions taken by the reader. [ER] has never been, and is not currently, a registered or licensed financial advisor or broker/dealer, investment advisor, stockbroker, trader, money manager, compliance or legal officer, and does not perform market-making activities. [ER] is not directly employed by any company, group, organization, party or person. The shares of Skyharbour Resources are highly speculative, not suitable for all investors. Readers understand and agree that investments in small-cap stocks can result in a 100% loss of invested funds. It is assumed and agreed upon by readers that they will consult with their own licensed or registered financial advisors before making any investment decisions.

At the time this article was posted, Skyharbour Resources is an advertiser on [ER] and Peter Epstein owned shares in the Company.

Readers understand and agree that they must conduct their own due diligence above and beyond reading this article. While the author believes he’s diligent in screening out companies that, for any reason whatsoever, are unattractive investment opportunities, he cannot guarantee that his efforts will (or have been) successful. [ER] is not responsible for any perceived, or actual, errors including, but not limited to, commentary, opinions, views, assumptions, reported facts & financial calculations, or for the completeness of this article or future content. [ER] is not expected or required to subsequently follow or cover events & news, or write about any particular company or topic. [ER] is not an expert in any company, industry sector or investment topic.

![Epstein Research [ER]](http://EpsteinResearch.com/wp-content/uploads/2015/03/logo-ER.jpg)