All references to tonnes = Lithium Carbonate Equiv. (“LCE”) tonnes, all dollars are C$, unless indicated US$.

In mid-September I wrote a bullish article on Frontier Lithium (TSX-v: FL) / (OTCQX: LITOF) on Seeking Alpha, when the share price was substantially higher. Please check out the article, it has a lot of details that I don’t repeat herein… NOTE: I have no prior or existing relationship with Frontier Lithium, but I do own shares in the Company.

In that piece, I lamented that the enterprise value {market cap + debt – cash} was just 10.5% of the $2.4B after-tax NPV(8%) in its Pre-Feasibility Study (“PFS“). Now, it’s trading at more like 7.0% of NPV!

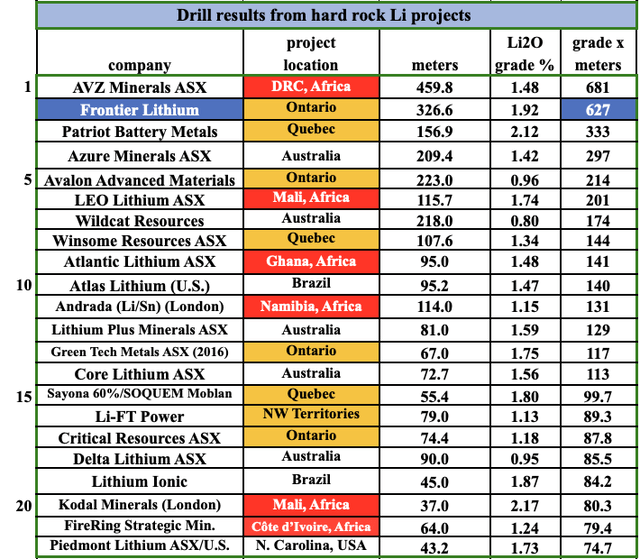

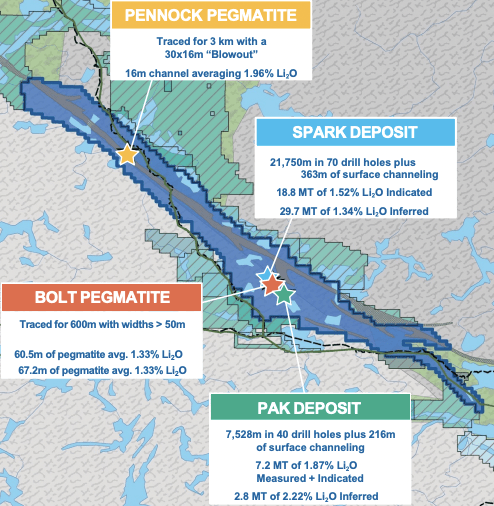

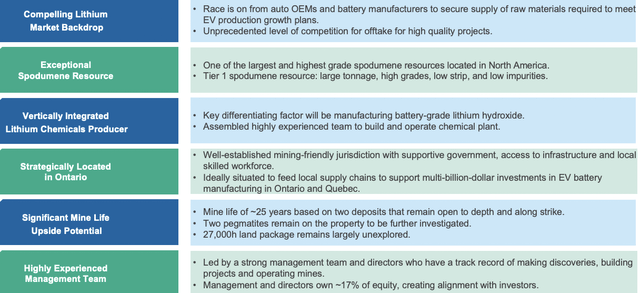

This is a company that has 58.6M tonnes at a very high grade of 1.50% Li2O, equal to 2.2M tonnes of lithium, a globally significant resource. The 100%-owned PAK/Spark project is in a Tier-1 jurisdiction (Ontario, Canada). This chart shows the best hard rock lithium drill results, globally, as measured by [Li2O grade x core interval width].

See latest corporate presentation

Frontier is head & shoulders above the rest, ~4x the average of the next seven Canadian-based projects. And, readers are reminded that Ontario is a hell of a lot closer to the U.S. EV market than Africa!

The share price topped $3 bucks in February, months prior to the release of a robust PFS. This morning it sits at $0.80. Frontier had ~$22M in cash on June 30th & zero debt. Its enterprise value is ~$170M, on 228 million shares outstanding.

Management is done drilling, so monthly cash burn is now under $600k. The Company does not NEED to raise capital before mid-2024 at the earliest. The main reasons for the decline in Frontier’s valuation are; lower lithium prices from a perceived pause in EV adoption, a weak Chinese economy, higher interest rates and poor investor sentiment / tax loss selling.

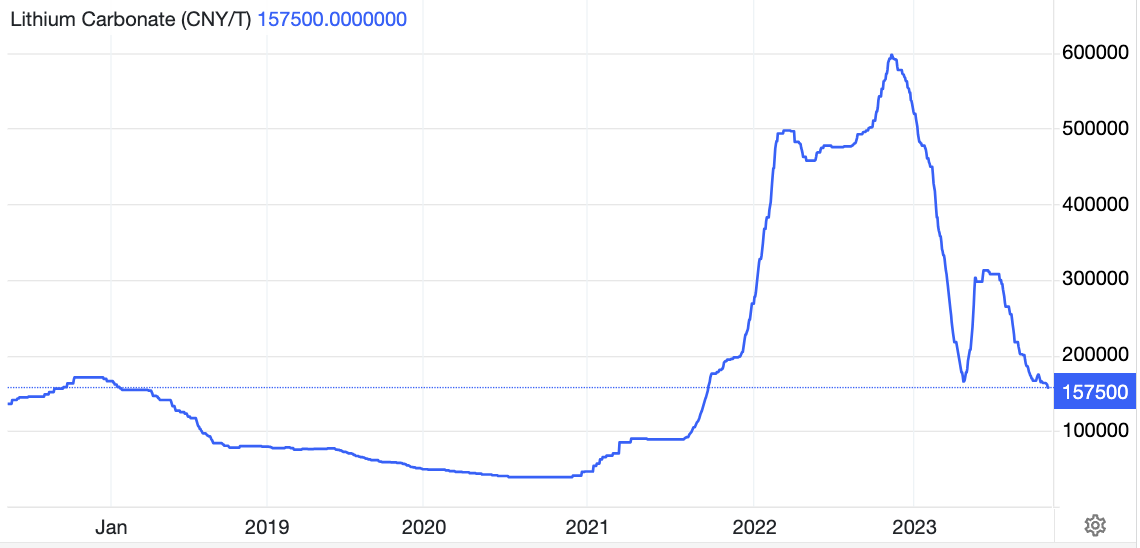

In looking at the following Trading Economics chart, (in Chinese yuan/tonne) as bad the spot price has been, it’s only a bit below the lows of late April, albeit still falling. Notice the rapid, temporary rebound after April. Will we see another bounce?

This chart is of spot prices in China, but quarterly contract prices signed with Majors producers are far less volatile and more representative of the market. In 4Q/22, SQM’s quarterly contract price peaked at $59k/t. It averaged $48k/t in the six quarters 1Q/22 to 2Q/23, and in the most quarter, SQM booked $34k/t.

I believe the mid-$20k’s/t seems like a reasonable long-term assumption. Periods below $20k/t, should be offset by spans above $30k/t. In addition to lower prices, there has been a plethora of negative articles about EV adoption rates lately.

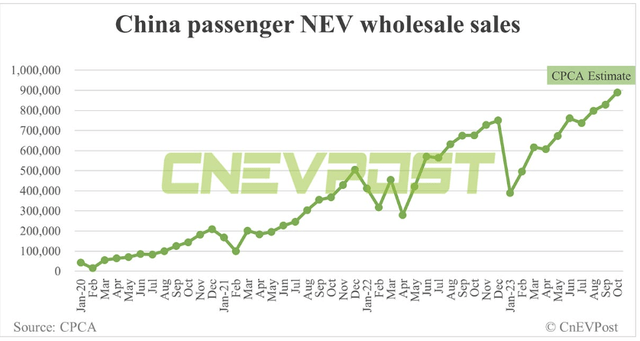

However, it’s too early to know if a sluggish Sept./Oct. will continue through Nov./Dec. or into 2024. Economic growth is slowing, and interest rates make monthly payments on ALL new vehicles $100s higher. Growth certainly hasn’t ebbed in China. The graph below shows volumes remain quite strong.

October’s sales were more than double January’s. Yes, Ford, GM & Volkswagen are struggling, but that doesn’t mean the paradigm shift to EVs has been derailed. For every U.S. or European OEM that falters, Tesla and China’s BYD Co. are happy to pick up the slack, not to mention rumored new entrants including; Google, Apple & Foxconn.

Bearish analysts point to 2020-21 when SQM’s contract prices were mostly between $5 to $15k/t as evidence that prices are headed back below $15k/t from the current $21.8k/t.

I disagree. Reasons for contract prices to average in the mid-$20k’s, not the mid-teens, include; 1) the law of large numbers, 2) new producer dynamics, and 3) Direct Lithium Extraction (“DLE”) scale-ups.

The law of large numbers… Albemarle Corp. forecasts demand of 3.7M tonnes/yr. in 2030, roughly 4x current levels. That would mean annual increases of ~600k tonnes just six years from now. Even if 3.7M tonnes is not achieved until 2032, ~500k additional tonnes would be needed in 2032 over 2031.

That’s 10 new 50k tonne/yr. mines, yet fewer than five large mines have debuted this decade, none of which are currently producing 50k tonnes/yr.

Regarding new producer dynamics — some analysts forecasting supply / demand are placing too much faith in the ability of lithium hopefuls to reach production. Small companies face enormous challenges in funding, infrastructure, First Nation & local community relations, permitting, construction, commissioning, reclamation, etc.

There have been zero meaningful new mines in Argentina or Chile since Allkem’s Olaroz in 2015, although Lithium Americas & Ganfeng Lithium are ramping up a JV project to an annual run-rate of 40,000 tonnes by mid-2024.

Yet, citing oversupply, several banks have lowered their lithium price forecasts. Industry pundits say that at spot prices under $25k/t, Chinese facilities that convert spodumene concentrate to carbonate or hydroxide are unprofitable and stop producing.

However, companies sometimes operate at a loss to retain workforces & service customers, which might explain why the spot price is still falling.

A third reason prices will likely be above bearish forecasts is Direct Lithium Extraction [‘”DLE“]. Yes, DLE is a game-changer, but all proposed DLE projects will require years, not months, of extra time to get them across the finish line.

Each DLE solution is a complex specialty chemicals / mine engineering challenge. What works at one project, might not work next door. Assuming one agrees that lithium is not headed below $15k/t for extended periods, one should take a closer look at Frontier Lithium.

It delivered a strong PFS with all-in cash costs of US$7,433/t. At reasonable pricing levels of $20,500 & $22,000/t, for carbonate & hydroxide, respectively, the after-tax NPV(8%) is US$1.74 billion.

On paper this is a great project, meaningfully de-risked, and undervalued. So, why are investors remaining on the sidelines? Here are five possible reasons.

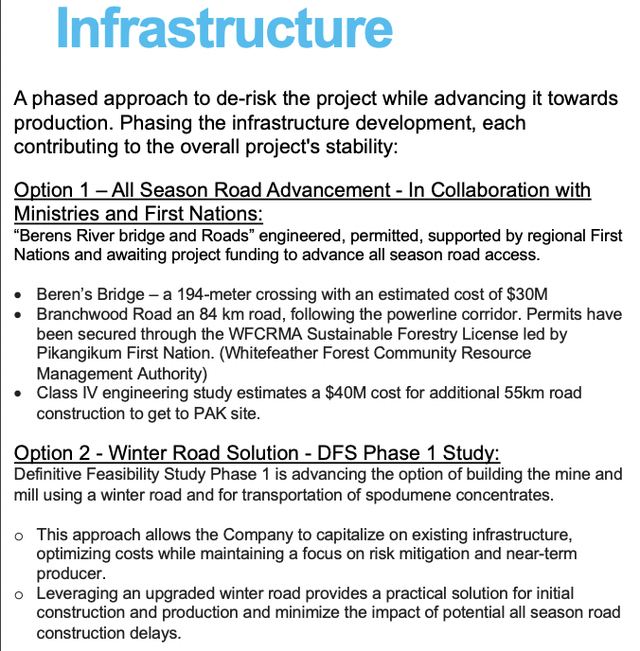

First, if one thinks lithium prices are headed below $15k/t, there’s little reason to be excited about lithium stocks. Second, is a perceived lack of nearby infrastructure. I addressed this in my last article. Also, pages 16-17 of the corp. presentation are very helpful.

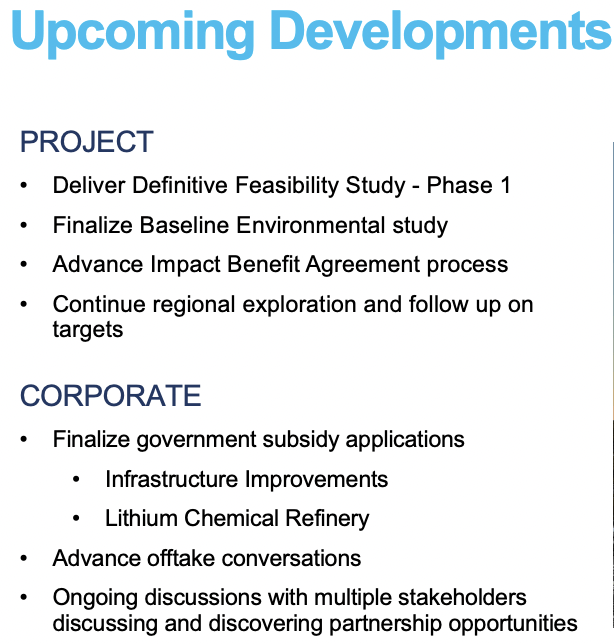

The Canadian government recently announced a Critical Minerals Infrastructure Fund of up to C$1.5 billion. According to analysts at Desjardins,

“…we believe the CMIF could be a particularly exciting de-risking opportunity for Frontier Lithium given the limited existing road transportation infrastructure around its 100%-owned PAK project in NW Ontario. The Berens bridge & road (60% of the way to PAK) is a First Nations led project believed to be nearing completion of permitting, and awaiting funding… We view the federal government’s CMIF as a strong option for a significant part of the infrastructure funding…”

Importantly, an existing winter road will be upgraded and used until an all-season road & bridge are built. No major cash outlays for infrastructure are required anytime soon.

Third, Frontier has not secured a strategic partner or off-take agreement. Is this a red flag? No. As milestones are achieved and sentiment in the lithium sector improves, a higher valuation will prevail from which to land a strategic partner next year.

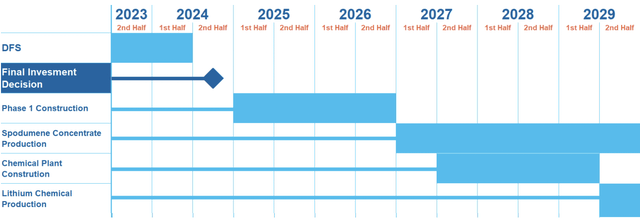

Yet another reason for the dreadful share price is speed to market. Phase 1 calls for up to 100k tonnes/yr. of spodumene concentrate, but it’s four years away.

However, the first full year of 100k tonnes could generate operating cash flow of > $140M {assumes op-ex < US$1,000/t & spod. concentrate price of US$2,000/t} vs. the current enterprise value of ~$170 million.

A final concern regards upfront cap-ex as Phase 1 requires US$468M in the next 3-4 years. A possible solution would be to sell an interest in the PAK project to a company like; Albemarle, Rio Tinto, Allkem + Livent, SQM, IGO Ltd. Glencore, POSCO, Mineral Resources, Wesfarmers or Pilbara Minerals.

Readers are reminded that Stellantis, Ford, GM, Honda, Volkswagen, Hyundai, BMW, Toyota, Umicore, LG Energy Solution, SK On, POSCO, Northvolt & BASF have announced big EV / Li-ion battery plans across Canada.

Other prospective non-equity sources of capital include; 1) the sale of a royalty or stream, 2) government and/or institutional loans / debt packages, 3) free-money grants, and 4) upfront payments for a portion of initial production via off-take agreements.

Once Frontier is selling spodumene concentrate, hopefully in 2027, profits can be reinvested to expand into a fully-integrated mine & refinery producing carbonate and/or hydroxide.

Frontier Lithium (TSX-v: FL) / (OTCQX: LITOF) has checked a lot of investment boxes. Lithium companies, and junior mining stocks in general, are out of favor. Many are down more than 50-60-70% from 52-week highs.

However, buying companies that are oversold, that have strong projects and management teams, solid cash liquidity, no debt, and operate in top jurisdictions, can generate attractive returns for patient long-term investors.

![Epstein Research [ER]](http://EpsteinResearch.com/wp-content/uploads/2015/03/logo-ER.jpg)