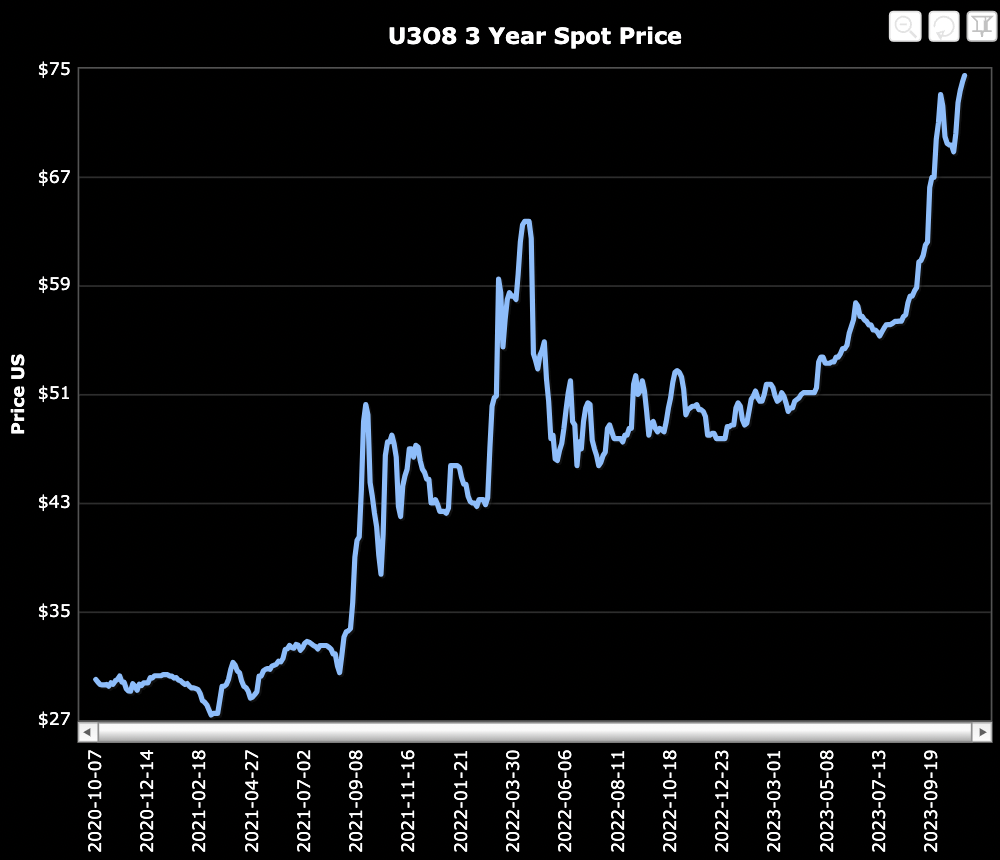

Will 2023 be remembered as the year of URANIUM ?!? Given that it’s up +54% through October, it sure seems that way. Despite this impressive gain, there’s no obvious fundamental reason for it to stop climbing.

Yesterday, Cameco, the world’s largest western-friendly uranium producer, delivered the most bullish conference call I’ve heard in years, driving its valuation up by C$2.1 billion — enough to acquire Skyharbour Resources (TSX-v: SYH) / (OTCQX: SYHBF) 24 times!

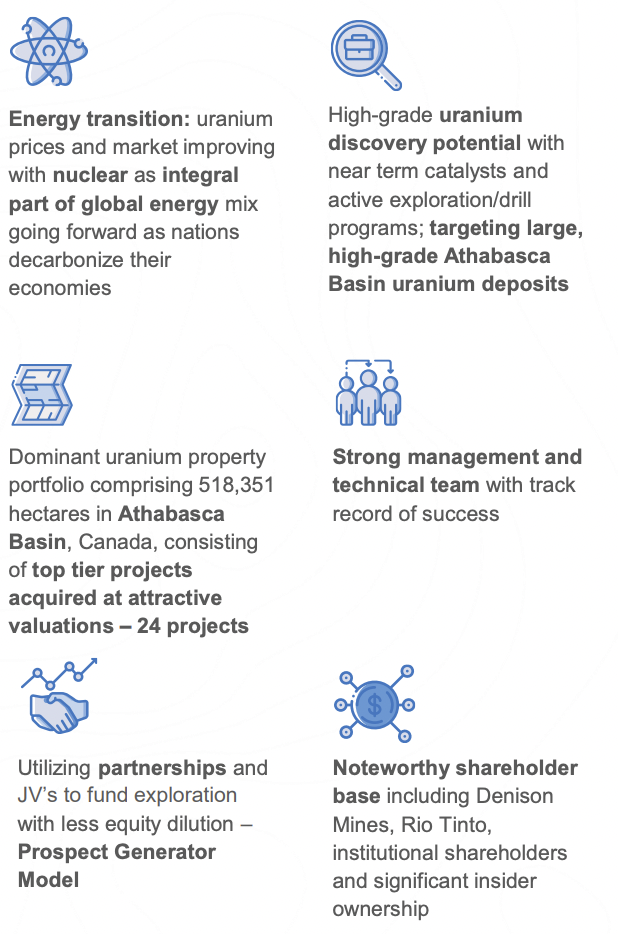

Management, led by CEO Jordan Trimble, should be applauded for amassing > 518,000 hectares of uranium-prospective properties, including two contiguous co-flagship projects, in the heart of the world-famous Athabasca basin. It’s crucial to recognize that these properties were all locked down when the uranium price was $20/lb. to $55/lb., vs. $74.75/lb. today.

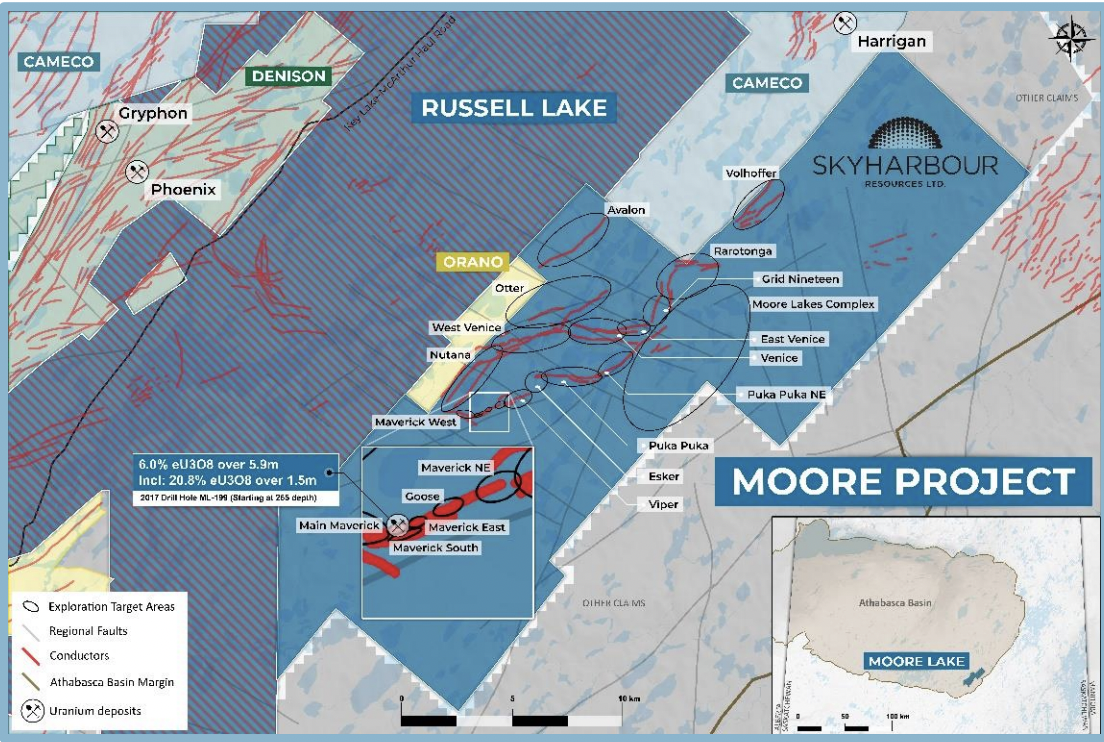

Since 2016, management, the board & advisors have been working hard on the 100%-owned, 35,705 hectare Moore Lake (“ML“) project in the eastern part of the Athabasca Basin.

ML shows great promise, with high-grade hits extending into the basement rocks. The best results include; 4.03% eU3O8 over 10 m, incl. 20.8% eU3O8 over 1.5 m, and another interval of 9.12% U3O8 over 1.4 m and 5.29% over 2.5 m.

How high grade are those results? As a frame of reference, at spot prices 1.00% U3O8 equates to 26 g/t gold. Skyharbour is post-discovery at ML & RL, it knows there’s very high grade uranium on its projects. It’s now a question of finding more of it.

Complimenting, enhancing & expanding upon the ML opportunity is an earn-in agreement to acquire 51%, then 70%, and up to 100% of Rio Tinto’s 73,294 hectare Russell Lake (“RL“) project.

RL has been the subject of significant historic exploration, with over 95,000 meters of drilling. Adjusted for inflation, I estimate up to a combined $100M has been invested into ML & RL.

Uranium from Canada is incredibly important to the U.S., which can no longer rely on Chinese or Russian controlled sources for long-term supply. Last year the U.S. produced <1% of what it consumed. Some now believe a premium over the global U3O8 price might have to be paid to secure long-term commitments from safe, stable jurisdictions.

In looking at the first map, (above), imagine how nicely the large, contiguous ML + RL projects [109k combined hectares] would fit into the portfolios of Cameco, NexGen Energy, Denison Mines, Fission Uranium, UEC or France’s privately-held Orano Canada.

Those five publicly-traded names have an average enterprise value [“EV“] {market cap + debt – cash} of $6.7 billion [$2.5 billion excluding Cameco] By contrast, Skyharbour’s EV is ~$88M ($0.55/shr.). The Top-6 performing uranium players (among names with market caps > C$20M) have, on average, more than tripled — +255% from 52-wk lows.

At the risk of sounding like a broken record, I’m compelled to play Skyharbour Resources’ greatest hits over and over. This is a company who’s stock traded as high as $0.84 in March of last year when the spot price touched $64.5/lb. Yet, with spot uranium now ten bucks higher, the share price sits at $0.55.

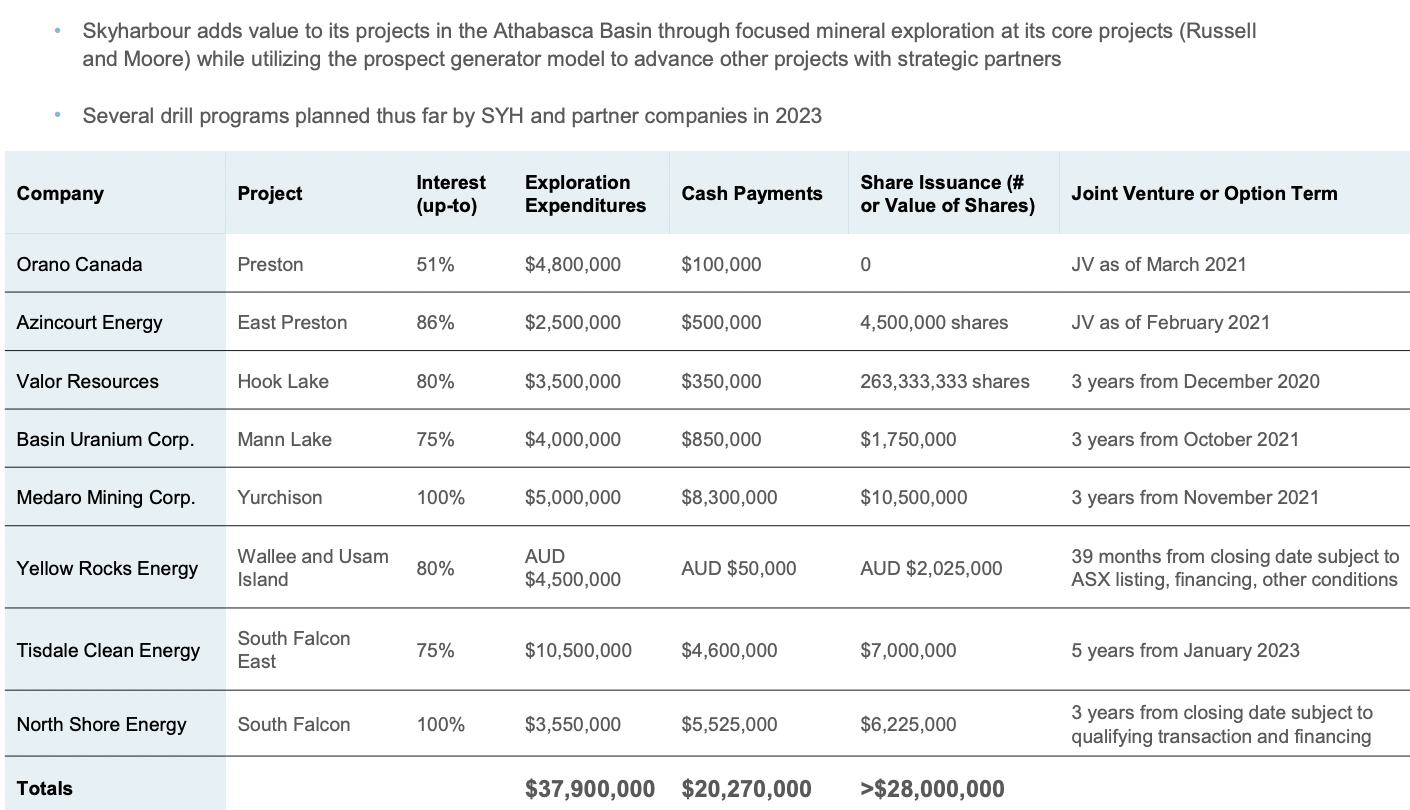

Has there been a large number of new shares issued since then? No, the Company’s prospect generator model minimizes the need for excess equity dilution. Prospect generators are turbocharged in bull markets. {see new corp. presentation}

Through its partnerships, Skyharbour owns shares in several companies that could appreciate. More importantly, with stronger sentiment, those partners are more able to fund aggressive drill campaigns to make new discoveries.

Uranium is a critically important material that, adjusted for inflation, traded at the equivalent of ~$210/lb. in mid-2007, and averaged ~$145/lb. {in today’s dollars} for a nine month period in 2007-2008.

Viewed in that context, the current spot price of $74.75/lb. [TradeTech, 10/31/23], or higher in the coming months, need not be considered overbought as market fundamentals are as strong as they’ve ever been.

After years of contracting less than replacement levels, utilities are now flocking back to the market to restock. Notably, except for Kazatomprom, there has been virtually no announcements of meaningful new supply. And, it’s likely that before long, almost all of Kazatomprom’s supply will be headed to China.

Utility buyers are in the early stages of this restocking process. Industry expert Justin Huhn of Uranium Insider believes over-contracting needs to continue into 2026 or 2027. Uranium prices typically overshoot to the downside/upside…

Guess which direction we’re headed now? Importantly, unlike the last major bull market, this cycle has two significant demand catalysts that represent a paradigm shift.

First, Small Modular Reactors (“SMRs“), plus smaller micro-reactors, will take the world by storm from the 2030s on. Microsoft recently announced plans to utilize SMRs and/or micro-reactors to power its data center & AI initiatives. How long before (Google/Alphabet, Nvidia, Meta, Samsung, Intel, etc.) announce similar plans?

The NEI expects 300 SMRs to come online by 2050. TradeTech believes those 300 SMRs alone would increase uranium demand by 100M pounds/yr., roughly half current global consumption. The WNA increased its view of uranium demand in 2040. The mid-point of its base & upside cases now calls for a 4.2% CAGR, vs. ~2%-2.5%/yr. from 2000-2022.

Second, an entirely new class of uranium buyer has appeared on the scene — financial buyers — who collectively, at the margin, could propel the spot price higher & faster than ever before.

Financial buyers like the Sprott Physical Uranium Trust & Yellow Cake PLC will soon be joined by new Funds –with $100s of millions of dry powder — competing for the same spot pounds. Giant producers Cameco, Katatomprom & Rosatom reportedly have minimal excess capacity. In fact, they periodically buy in the open market.

Notice also that China, Russia, India & the U.S. are stockpiling uranium {or expected to start soon} to support their domestic nuclear industries. With so much near-term demand, pullbacks in the spot price might be short-lived, and of lesser magnitude, than usual.

For example, a month ago uranium hit $72/lb., then retraced ~$3/lb. through mid-October. Two weeks later, it’s at a new 15-yr. high, but hardly a stretched level compared to prior inflation-adjusted prices well over $100/lb.

The Sprott Trust alone has enough cash to buy > 600k pounds @ $74.75/lb., assuming they could find that much inventory without nudging the price up. The monthly futures curve for uranium shows the Feb-2026 price at $85lb.! At that price, Dension’s recent Feasibility Study shows an after-tax NPV(8%) of C$2.8 billion.

In my opinion, Denison is one of the two or three most likely acquirers of Skyharbour. Its CEO sits on Skyharbour’s board and it’s a meaningful shareholder in the Company. Think about it, a C$2.8B project, next door to a company with 518,000+ hectares, including a large, contiguous land package hosting two promising projects, all valued at just ~C$88M ($0.55/shr.).

To reiterate, Cameco is too large to care about tiny Skyharbour, but Denison, NexGen, Fission, UEC & IsoEnergy would benefit from acquiring it to make themselves more attractive targets.

Even if a takeover is not imminent, in the meantime management is not burning a lot of cash, as its partner companies are paying for millions of dollars in exploration.

It can sit back and watch the uranium price move higher. Of course, management is not idle, they’re drilling RL with drill results expected shortly. If futures prices prove to be reasonably accurate, there will be an EPIC binge of M&A in the Athabasca basin. In my view, few companies are better positioned than Skyharbour Resources (TSX-v: SYH) / (OTCQX: SYHBF).

{see new corp. presentation}

Disclosures / Disclaimers: The content of this article is for information only. Readers fully understand and agree that nothing contained herein, written by Peter Epstein of Epstein Research [ER], (together, [ER]) about Skyharbour Resources, including but not limited to, commentary, opinions, views, assumptions, reported facts, calculations, etc. is to be considered implicit or explicit investment advice. Nothing contained herein is a recommendation or solicitation to buy or sell any security. [ER] is not responsible under any circumstances for investment actions taken by the reader. [ER] has never been, and is not currently, a registered or licensed financial advisor or broker/dealer, investment advisor, stockbroker, trader, money manager, compliance or legal officer, and does not perform market-making activities. [ER] is not directly employed by any company, group, organization, party or person. The shares of Skyharbour Resources are highly speculative, not suitable for all investors. Readers understand and agree that investments in small-cap stocks can result in a 100% loss of invested funds. It is assumed and agreed upon by readers that they will consult with their own licensed or registered financial advisors before making any investment decisions.

At the time this article was posted, Skyharbour Resources is an advertiser on [ER] and Peter Epstein owned shares in the Company.

Readers understand and agree that they must conduct their own due diligence above and beyond reading this article. While the author believes he’s diligent in screening out companies that, for any reason whatsoever, are unattractive investment opportunities, he cannot guarantee that his efforts will (or have been) successful. [ER] is not responsible for any perceived, or actual, errors including, but not limited to, commentary, opinions, views, assumptions, reported facts & financial calculations, or for the completeness of this article or future content. [ER] is not expected or required to subsequently follow or cover events & news, or write about any particular company or topic. [ER] is not an expert in any company, industry sector or investment topic.

![Epstein Research [ER]](http://EpsteinResearch.com/wp-content/uploads/2015/03/logo-ER.jpg)