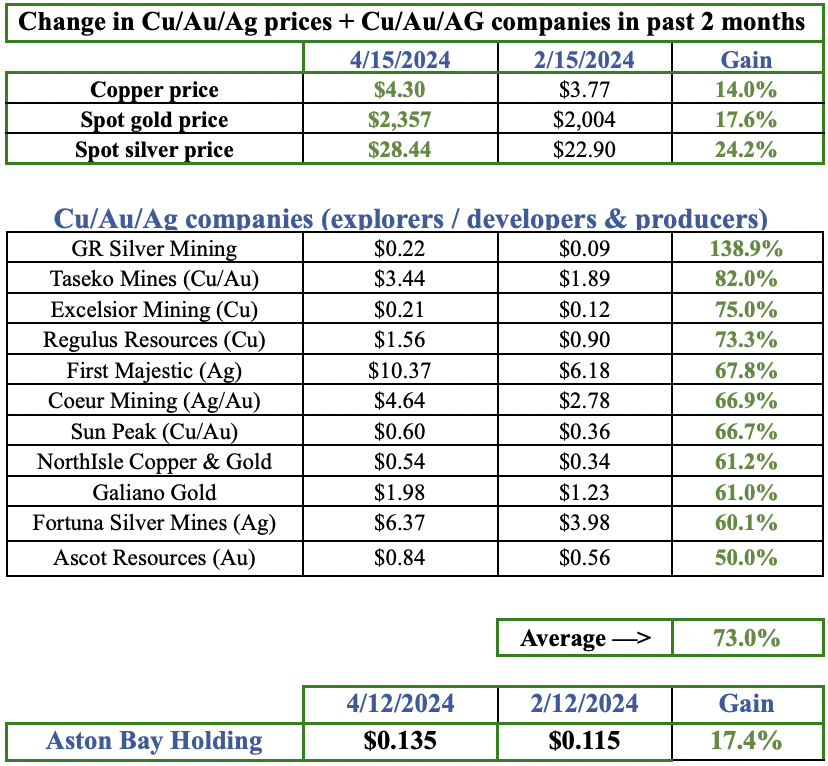

Earlier this month, the U.S. 10-yr. treasury yield touched 5.02%, the highest since 2007. Inflation & interest rates are expected to remain elevated. This spells trouble for the U.S. dollar. Add to that, growing geopolitical tensions [Russia / Ukraine — China — Hamas & Iran / U.S. & Israel ]. Could this be a perfect storm for Gold/Silver (“Au“)/(“Ag“)?

Gold is up +9% from its October low to US$1,990/oz., within 4.5% of its all-time (nominal) high of ~$2,081/oz. {investing.com}. In C$, the gold price is at an all-time high, which is great news for Canadian-domiciled companies.

Gold priced in C$ is up 73% in the past 5 years…

The inflation-adjusted peak price of a commodity is an interesting frame of reference on how strong a commodity is. For gold, it hit ~$3,300/oz. (in today’s dollars) back in 1980.

To those who think $3,300/oz. is an outlier, consider that in the entire year of 1980 the average inflation-adj. price was ~$2,432/oz. Therefore, a meaningful move higher would hardly be a surprise, $2,400/oz. gold would NOT be a black swan event.

For silver, the inflation-adj. price averaged $83/oz. It topped out at $195/oz.! Compare that to the current level of roughly $23/oz.

What types of companies benefit most from precious metal bull markets? Of course, existing producers, but juniors have even more upside potential (and commensurate risk). To justify venturing out on the risk spectrum, juniors must have excellent projects in safe, prolific jurisdictions, and be led by experienced teams.

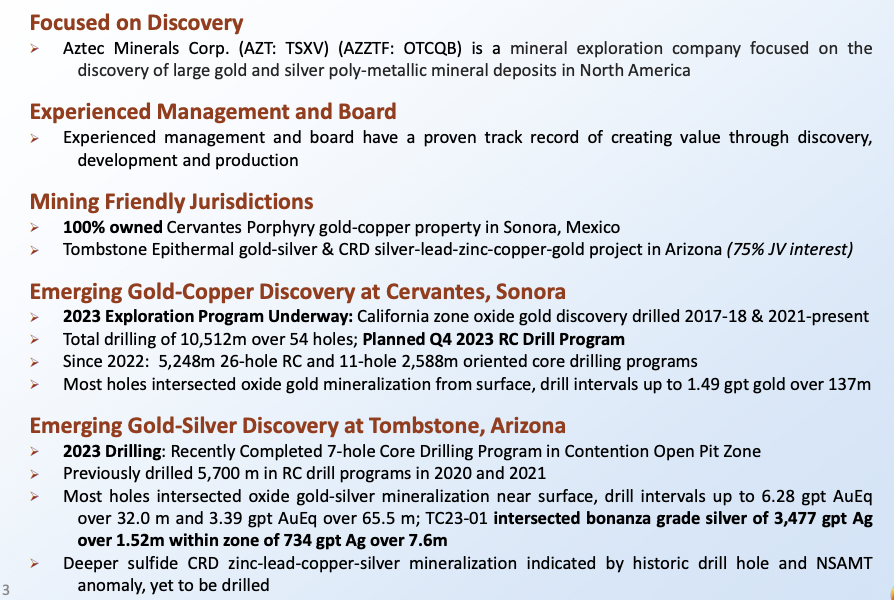

A company that meets these criteria is Aztec Minerals (TSX-v: AZT) (OTCQX: AZZTF). It has two potential company-making projects, one in Mexico, the other in the U.S., both having shallow oxide deposits, plus blue-sky potential for deeper mineralized systems. {See October Corp. Presentation}

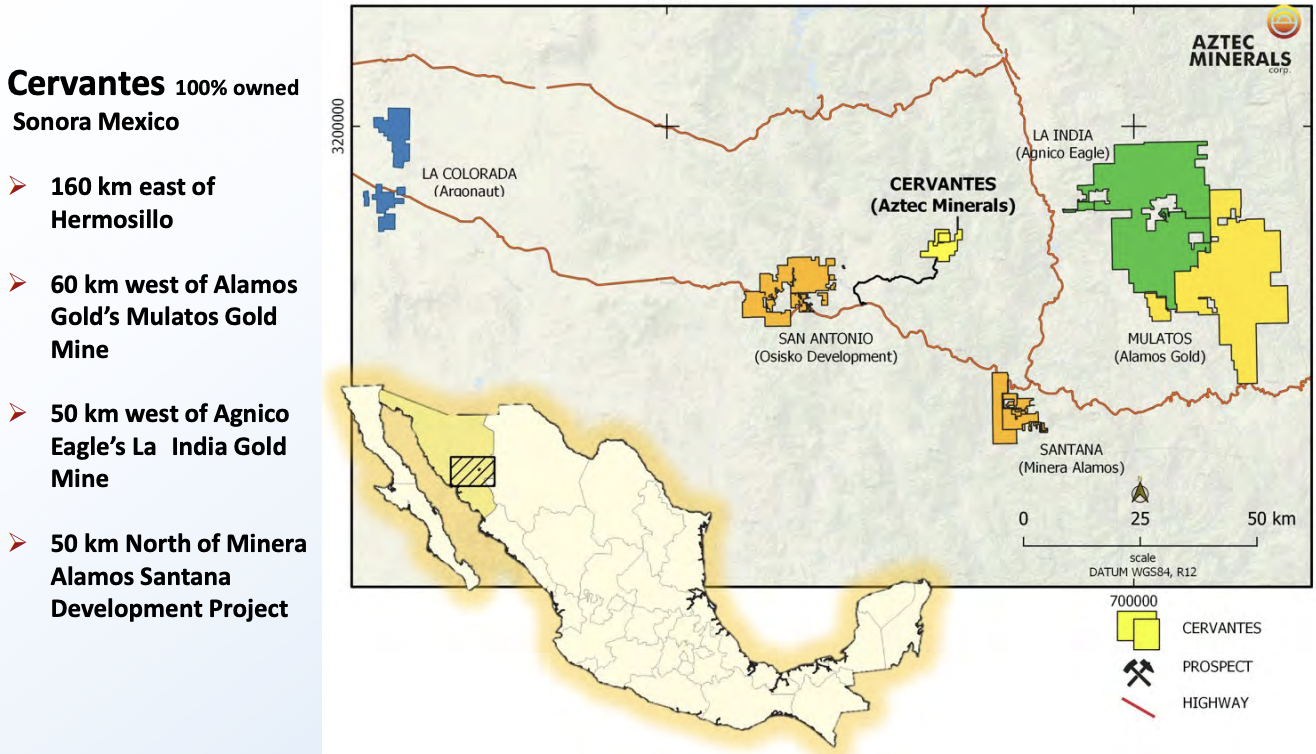

Its 100%-owned Cervantes porphyry Au/copper (“Cu“) project is in Sonora, Mexico and sits within 35-60 km of robust gold mines/projects owned by $35B Agnico Eagle, $6.6B Alamos Gold, $300M Osisko Development and $132M Minera Alamos. By contrast, Aztec’s valuation is $17M.

At least nine much larger mining companies surround Aztec in Sonora, Mexico…

$800M Argonaut Gold has a mine ~120 km to the west, and $5.6B Fresnilo, $1.1B First Majestic & $925M Silvercrest Metals are a few hundred kms away. Mexican giant Grupo Mexico has multiple projects moving forward in Sonora as well.

That’s nine companies that could be interested in acquiring Aztec or investing in the Cervantes project. Agnico has the La Linda mine in Sonora, a modestly larger mine 70 km to the south, Pinos Altos, and the Santa Gertrudis development-stage project.

Alamos’ Mulatos mine is an open-pit, heap leach operation in production since 2005. The mine has impressive All-in-Sustaining Costs of $950-$1,000/oz. Alamos owns ~10% of Aztec, having invested in three of the Company’s capital raises. Azetc’s & Alamos’ technical teams meet regularly to discuss geology & drill targeting.

Osisko’s 750k Au Eq. oz. San Antonio project is 35 km from Cervantes, and Minera Alamos has three mines/projects, one of which is the 301k oz. Santana mine in Sonora. Notice that it doesn’t take a large resource to host a viable heap leach operation.

The four nearest operations are very similar to each other and to Cervantes. In fact, most of the dozens of gold/silver assets in Sonora are open-pit, heap leach mines or projects. This mining method is technically simple, low-risk & easy to permit as it does not require complicated tailings management & mine reclamation plans.

Projects can be commercialized relatively quickly, ramped up in stages to minimize upfront cap-ex, and op-ex is routinely in the bottom quartile of the industry cost curve.

Heap leach offers, low technical risk, low cap-ex + low op-ex & easier permitting

Those four projects / mines have AISC figures under $1,150/oz. compared to a recent average $1,380/oz. among gold Majors + mid-tier producers. Newmont just reported a 3Q AISC of $1,426/oz.

If Aztec can book a sizable resource at Cervantes, with a low strip ratio, it will have a winner on its hands. For heap leach the grade often ranges from 0.40 to 0.70 g/t Au. That’s low-grade, but at $1,990/oz., low op-ex/cap-ex projects can be quite valuable. Subject to further drilling, Cervantes could host a higher grade deposit than peer heap leach assets in Sonora.

If a prospective mine could stack 0.75 g/t material onto its pads, that would be twice the value {per tonne of rock} as Teck Resources’ Highland Valley copper mine in B.C., Canada.

Based on a sq. km surface area, Cervantes could potentially host a resource of up to 1M Au Eq. ounces. The best four intervals average 137 m at a weighted-average grade of 1.09 g/t Au. Preliminary metallurgy work has demonstrated solid gold recoveries from 74% (mixed oxide sulphide group) to 87% (oxide group), averaging 83.6%.

Importantly, reverse circulation drilling just recently commenced. Management plans ~11 holes / ~1,600 meters over the next two months to expand and better understand the California zone.

Last year’s drilling found extensive oxide porphyry Au/Cu mineralization with drill intercepts up to 1.5 g/t Au over 137 m, and 1.0 g/t over 165 m. See highlights above. How much might 1M heap leachable ounces be worth to an acquirer? A lot more than Aztec’s valuation of $17M.

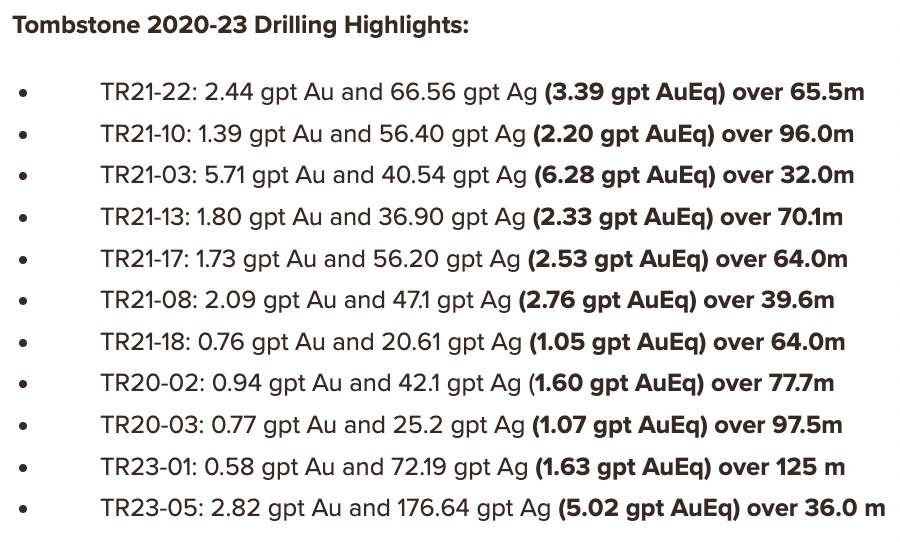

As exciting as Cervantes is, it’s only half the story, albeit the main focus this year. Another potential company-maker is in the western U.S. From 1879 to 1939 the Tombstone gold-silver district in Arizona produced 32M oz. Ag, 240K oz. Au, 65M lbs. Lead, and 1.1M lbs. Zinc. At spot prices, that equates to an Au Eq. grade of ~13 g/t.

Aztec’s Ag/Au Tombstone project in Arizona is a second potential company-maker

Aztec’s Tombstone project covers much of the historic district. Management doesn’t see a near-term opportunity for a high-grade resource, but considering some of the drill results including; 65.5 meters at 3.39 g/t Au, [96 m / 2.20 g/t], [32 m / 6.28 g/t], [36 m / 5.02 g/t] and [125 m / 1.63 g/t] the Company is off to a great start.

Drilling by Aztec from 2020-23 demonstrated that the Contention zone has significant oxidized Au-Ag mineralization open in all directions. Due to limitations of de-watering technology, nearly all prior mining ended at a depth of ~190 meters.

Ten of 11 intervals above have [gram x meter] figures > 100 Au Eq. Aztec’s focus at Tombstone is discovering new zones of shallow, open pit-able, oxidized mineralization around the Contention pit. Importantly, higher-grade, carbonate replacement deposits (“CRD“), could lie beneath the underlying Paleozoic limestones.

While the low-hanging fruit is in the top several hundred meters, there could be a huge prize hundreds of meters below that. Management believes deeper limestones units have similar geology to Arizona Mining’s Hermosa-Taylor CRD project ~60 km to the SW.

Arizona Mining’s deposit was one of the largest primary zinc discoveries in decades. Last year it was acquired by South32 for ~$1.8 billion. I imagine that South32 is watching for updates on the Tombstone project. Freeport McMoRan has not 1, not 2, but 5 operating mines — Morenci, Bagdad, Safford, Sierrita & Miami — in Arizona.

BHP & Rio Tinto are joint-ventured on the major Resolution copper project in Arizona, which has been tied up by legal & environmental challenges, but could reach initial production in the late 2020’s. Hudbay Minerals has the Copper World Complex in Arizona, and Capstone Copper has been operating an open-pit mine since the mid-1970s.

Major companies around Tombstone should care if deep drilling hits something BIG

That’s a lot of major companies that could care about Aztec’s Tombstone. Only one deep hole was drilled under the main Tombstone zone prior to Aztec taking over, and it hit 9.1% combined lead / zinc, + 0.61% Cu + 32 g/t Ag over 7.2 meters.

If the technical team can find one-tenth of the next Hemosa-Taylor deposit at depth, that alone would be worth 10x the entire Company’s valuation. Drilling at Tombstone resumes next year.

Aztec Minerals (TSX-v: AZT) / (OTCQX: AZZTF) has two exciting projects located in world-class, safe, prolific jurisdictions, surrounded by significant mining companies.

Although the projects are early-stage, they’re fairly low-risk and have massive upside potential at depth. Drilling is underway in Sonora with drill results expected in December.

In a bull market for gold & silver, Aztec Minerals is a name one should be looking at. It’s post-discovery, so we know it has precious metals, but new discoveries & expanded zones over the next 12 months could drive the share price higher.

{See October Corp. Presentation}

Disclosures: The content of this article is for information only. Readers understand & agree that nothing contained herein, written by Peter Epstein of Epstein Research [ER], (together, [ER]) about Aztec Minerals, incl. but not limited to, commentary, opinions, views, assumptions, reported facts, calculations, etc. is to be considered implicit or explicit investment advice. Nothing contained herein is a recommendation or solicitation to buy or sell any security. [ER] is not responsible under any circumstances for investment actions taken by the reader. [ER] has never been, and is not currently, a registered or licensed financial advisor or broker/dealer, investment advisor, stockbroker, trader, money manager, compliance or legal officer, and does not perform market-making activities. [ER] is not directly employed by any company, group, organization, party, or person. The shares of Aztec Minerals are highly speculative, not suitable for all investors. Readers understand and agree that investments in small-cap stocks can result in a 100% loss of invested funds. It is assumed and agreed upon by readers that they will consult with their own licensed or registered financial advisors before making investment decisions.

At the time this article was originally posted, Peter Epstein owned no shares, options or warrants in Aztec Minerals. As of October, 2023, the Company was an advertiser on [ER].

Readers should consider me biased in my view of the Company. Readers understand and agree that they must conduct their own due diligence above and beyond reading this article. While the author believes he’s diligent in screening out companies that, for any reason, are unattractive investment opportunities, he cannot guarantee that his efforts will (or have been) successful. [ER] is not responsible for any perceived, or actual, errors including, but not limited to, commentary, opinions, views, assumptions, reported facts & financial calculations, or for the completeness of this article or future content. [ER] is not expected or required to subsequently follow or cover events & news, or write about any particular company or topic. [ER] is not an expert in any company, industry sector, or investment topic.

![Epstein Research [ER]](http://EpsteinResearch.com/wp-content/uploads/2015/03/logo-ER.jpg)