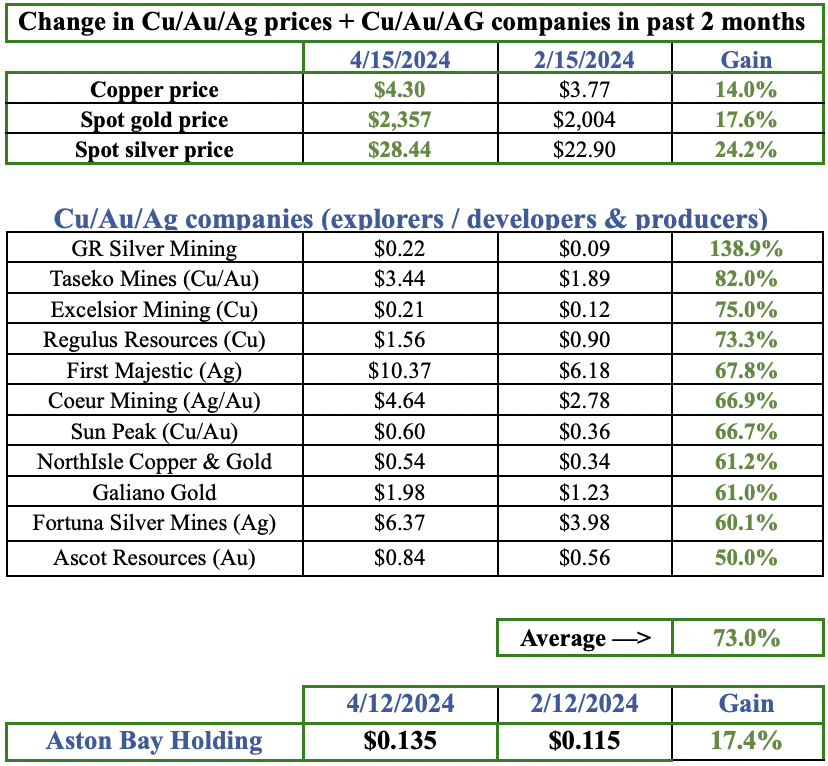

Is it just me, or does it feel like the gold price is itching to move a lot higher? It’s within 4% of an all-time (nominal) high. In fact, in many currencies it’s at ATHs. That’s great news for companies with strong Canadian projects like Thesis Gold (TSX-V: TAU) / (OTCQX: THSGF).

Yet, given how gold juniors are trading lately, one might think the spot price was in the $1,700’s/oz., not $2,000/oz.

Is this time different? Gold feels poised to launch higher…

Gold bugs are now calling for a November to remember — a meaningful move higher — possibly to > $2,200/oz. I don’t know where the price is headed, but I do know that Thesis Gold would thrive at lower prices.

Yes, $2,200/oz. sounds like a wildly bullish call, but it’s merely 10% higher than today. And, it’s 8% below the inflation-adjusted price of nearly $2,400/oz. for the entire year of 1980.

We could be on the verge of a bull market in precious metals. Yet, last week Thesis Gold announced a blockbuster drill hole interval of 4.1 meters grading 119.5 g/t Gold (“Au“), incl. 2.0 m at 231 g/t Au., and the market yawned. As strong as this [gram x meter] figure is, [4.1 x 119.5 = 484 g-m], two holes from 2021 returned g-m intervals averaging 622!

Year-to-date, 231 g/t Au is a Top-4 Au-only grade in N. America (among intervals > 1.0 meter). Rest assured, this Company will not fly under the radar forever. The enterprise value {market cap + debt – cash} of $70M could represent an excellent entry point.

Newmont’s acquisition of Newcrest is closing in November. Will this set off a tsunami of M&A in mining-friendly jurisdictions? The next few years could see an epic acquisition spree for three simple reasons. First, alarming geopolitical developments are forcing producers to pick a side.

Will they do deals and work with companies in (or closely aligned with) China & Russia? Or, will they double-down in Western-friendly jurisdictions? Of the Top-3 gold producing countries in 2022, #1 was China, and Russia was tied with Australia for the #2 spot.

China has already begun flexing its natural resource muscles by imposing export constraints on Rare Earth Elements gallium & germanium and battery material graphite. Significant regions of Africa are increasingly controlled by Chinese & Russian interests, making it difficult to operate in some (but not all) countries.

Geopolitical risks, soaring costs & anemic growth pipelines point to robust M&A

The second reason for an incoming surge in M&A is operating costs. We’re exiting year two of double-digit increases of All-in-Sustaining-Costs. Newmont’s 2023 guidance for AISC at $1,400/oz. would be +15.6% over 2022, which was up +14.0% on 2021! Companies can reign in soaring AISCs by acquiring lower-cost projects, thereby spreading G&A over a larger base of operations.

The third reason is the growth pipelines of companies like Newmont, Barrick, Agnico Eagle, Kinross, AngloGold Ashanti, etc. In addition to geopolitical risks & inflationary pressures, internal (organic) growth is taking too long to generate the consistent, robust expansions that shareholders are demanding.

Due to ESG mandates and more capable & frequent opposition by local communities, the time from discovery to commercial production is growing by years, not months. Elevated costs + longer timelines = higher risk. All of these factors point to an M&A boom in stable, prolific countries like Canada.

Canada is a safe-haven and a highly desirable clean, green mining jurisdiction with nearly 100% low-cost hydro-electric & nuclear power. Teck Resources is selling its coking coal operations for $10B+, giving it a war chest to potentially acquire additional Canadian mining assets. It already has JVs on two world-class projects in B.C., Galore Creek (50%) & Shaft Creek (75%).

In addition to Newmont & Teck, Boliden AB, Kinross, Centerra Gold, Seabridge and Hecla Mining are also active in B.C. BHP acquired a 19.9% stake in Brixton Metals, Freeport McMoRan is invested in Amarc Resources, and privately-held, Peruvian Ccori Apu’s recently delivered a critical cash injection to Ascot Resources.

Why is Thesis Gold a prime takeover target?

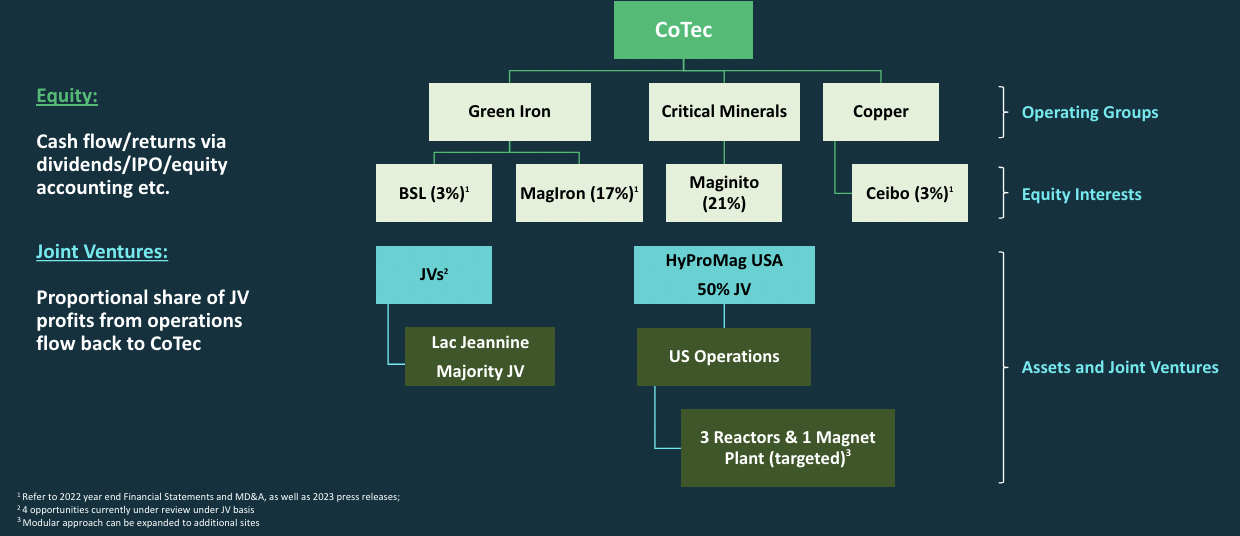

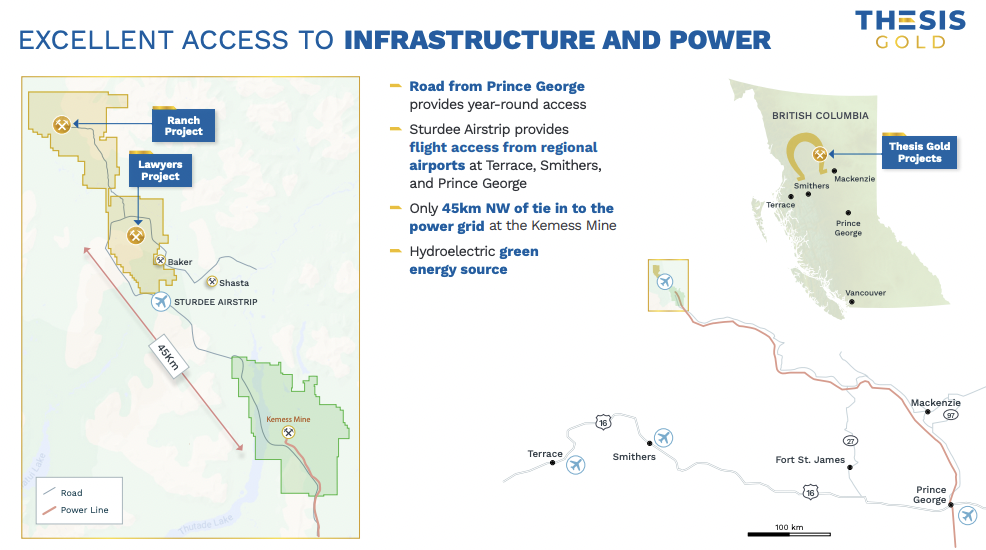

Thesis has a sizable, PEA-stage, contiguous land package in the heart of northwestern B.C. near (or in) the Golden Triangle / Golden Horseshoe / Toodoggone camps.

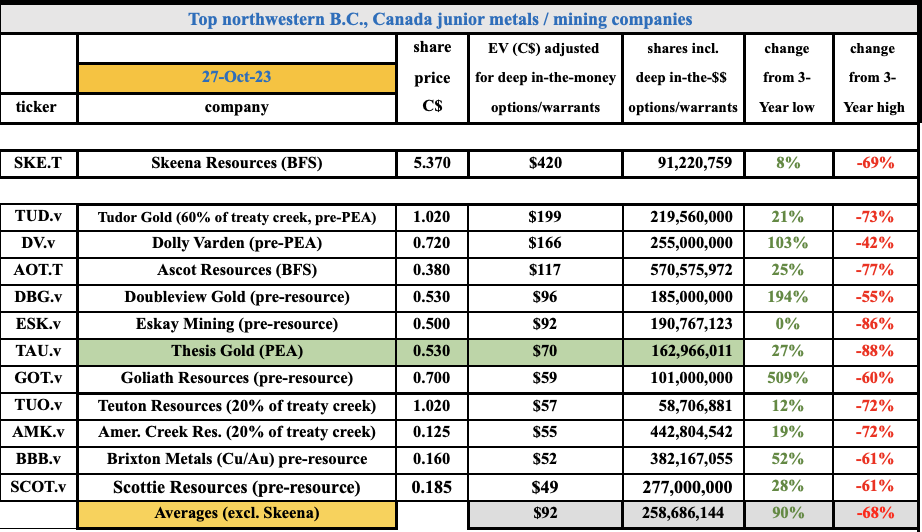

The Company is more advanced than B.C. peers Tudor Gold, Eskay Resources, Dolly Varden, Goliath Resources & Doubleview Gold, none of whom have delivered a PEA. In fact, Eskay, Doubleview & Goliath are pre-maiden resource.

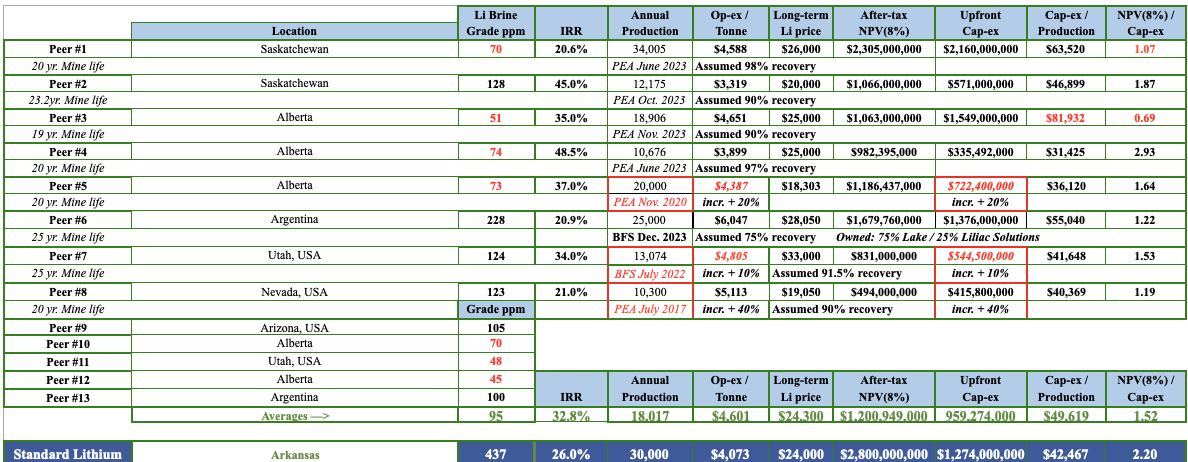

It has an enterprise value [EV] {market cap + debt – cash} of just $70M, a 40% discount to the average valuations of Dolly, Doubleview & Eskay. {see chart below}. Skeena Resources & Ascot Resources each have Bank Feasibility Studies on their flagship projects. Ascot’s first gold pour is expected in 1q 2024, which will attract a lot of attention to northern B.C.

Not only is Thesis more advanced than many of its B.C. peers, the combined Ranch/Lawyers has better access to regional infrastructure than projects that are more remote. And, a few well-known developers suffer much harsher winters compared to the temperate climate around Ranch/Lawyers.

I firmly believe that Thesis will be acquired in 2024 or 2025. Newmont, Teck, Freeport & Centerra Gold have assets closest to Thesis, but the Company is a compelling target to others as well, especially after release of a new PEA in the next 9-12 months.

The Company expects to have around 5M ounces booked along with a new PEA in 2H 2024. Substantial exploration targets could, over time, add millions more ounces, especially if/when a larger company takes over.

Strong infrastructure, mild winters, year-round operations

Thesis could be a good fit for Agnico Eagle Mines, who does not have operations in B.C., but has a giant presence in eastern Canada. Speaking of a new PEA, in by view, the AISC should come in near a very attractive $1,000/oz., and the after-tax NPV could reach C$1 billion.

Compare that prospective C$1B to the current enterprise value of C$70M. Readers are encouraged to watch this compelling corporate video update from the Beaver Creek conference in mid-September.

In it, COO Ian Harris says that each 1 g/t Au Eq. increase in grade, [per year], in the early years of the mine plan would add ~C$200M to after-tax NPV. Note that the grade in the existing PEA is 1.4 g/t.

Incorporating an anticipated 400k new high-grade, underground ounces, the average grade could potentially climb by 0.5 g/t. Therefore, if the new mine plan can deliver five early years at 1.9 g/t instead of 1.4 g/t, that alone could add up to C$500M to the NPV, which could propel it towards C$1B.

A $70M valuation for a potential $1B NPV project with an AISC of just $1,000/oz.!?!

No one can predict the future, but we could be entering both a strong period for gold prices, and an elevated level of M&A. If we see just one of those events, Thesis Gold (TSX-V: TAU) / (OTCQX: THSGF) could meaningfully outperform the broader stock market.

Even if neither event transpires anytime soon, the Company’s valuation has been beaten down to a point where I don’t see much downside. The share price at $0.53 seems to offer a very compelling risk/reward proposition.

Disclosures: The content of this article is for information only. Readers understand & agree that nothing contained herein, written by Peter Epstein of Epstein Research [ER], (together, [ER]) about Thesis Gold, incl. but not limited to, commentary, opinions, views, assumptions, reported facts, calculations, etc. is to be considered implicit or explicit investment advice. Nothing contained herein is a recommendation or solicitation to buy or sell any security. [ER] is not responsible under any circumstances for investment actions taken by the reader. [ER] has never been, and is not currently, a registered or licensed financial advisor or broker/dealer, investment advisor, stockbroker, trader, money manager, compliance or legal officer, and does not perform market-making activities. [ER] is not directly employed by any company, group, organization, party, or person. The shares of Thesis Gold are highly speculative, not suitable for all investors. Readers understand and agree that investments in small-cap stocks can result in a 100% loss of invested funds. It is assumed and agreed upon by readers that they will consult with their own licensed or registered financial advisors before making investment decisions.

At the time this article was originally posted, Peter Epstein owned shares of Thesis Gold and the Company was an advertiser on [ER].

Readers should consider me biased in my view of the Company. Readers understand and agree that they must conduct their own due diligence above and beyond reading this article. While the author believes he’s diligent in screening out companies that, for any reason, are unattractive investment opportunities, he cannot guarantee that his efforts will (or have been) successful. [ER] is not responsible for any perceived, or actual, errors including, but not limited to, commentary, opinions, views, assumptions, reported facts & financial calculations, or for the completeness of this article or future content. [ER] is not expected or required to subsequently follow or cover events & news, or write about any particular company or topic. [ER] is not an expert in any company, industry sector, or investment topic.

![Epstein Research [ER]](http://EpsteinResearch.com/wp-content/uploads/2015/03/logo-ER.jpg)