The ups & downs in the lithium sector have been wild, and I’m not just talking about carbonate, hydroxide & spodumene concentrate pricing. Extraction methods, deposit types & mining jurisdictions come in & out of favor.

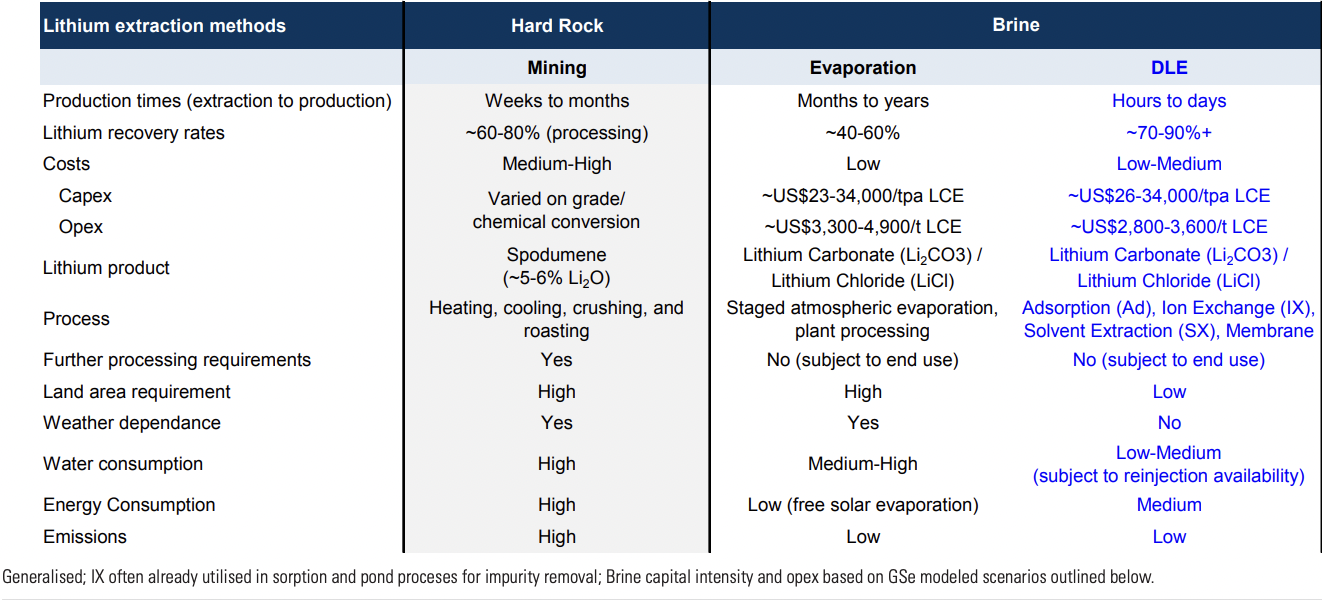

Solar evaporation ponds were cheap, low-risk and well liked… until they weren’t. ESG mandates caught up with this water-intensive, low-yielding method. In Chile, new mines will not be allowed to use evaporation ponds. Direct Lithium Extraction (“DLE“) will be required.

Several countries in Africa host high-grade, hard rock lithium (“Li“) projects, but the legal framework in the DRC, and stakeholder infighting, tripped up African poster boy AVZ Minerals. Its stock has been halted for 18 months, and the DRC canceled its mining license. Leo Lithium’s stock is also halted, it has a significant project in Mali.

Largest Li producer Australia will struggle to maintain rapid growth due to labor shortages, wage pressures and rail / port bottlenecks. Asia is more about processing battery materials than mining them.

The U.S. has great promise, but mainly in clay-hosted Li projects. The first commercial-scale clay project is expected in 2H 2026. Canada’s hard rock mines and green power grid are great, but it currently produces close to zero Li, it can’t satisfy the world’s needs.

In Mexico, Bacanora sold out to Ganfeng Lithium, only to have its mining license revoked. Brazil is like Canada — but a bit less developed — and 1-2 years behind. Finally, we arrive in the famous Lithium Triangle covering parts of Bolivia, Chile & Argentina.

Nearly 40 companies have at least one Li prospect in Argentina. One might assume 5 or 10 operations are up & running there. No, only Livent & Allkem are producing > 5,000 tonnes/yr. Argentina faces stiff macroeconomic headwinds, and inflation is running at > 130%.

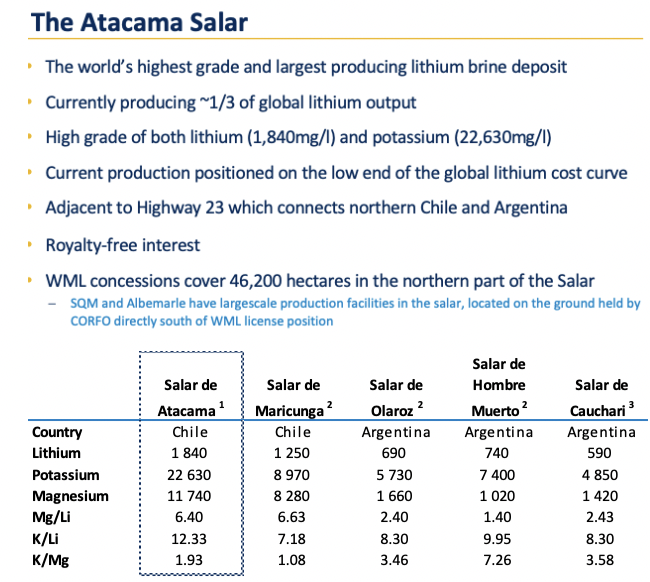

Chile is the future of lithium. At least that’s what I’ve been told since the mid-2010s. The last time a new player opened a Li mine in Chile was…. checks notes…never! Only SQM & Albemarle (“ALB“) are in production. This, despite Chile hosting the highest grade brine deposits on the planet.

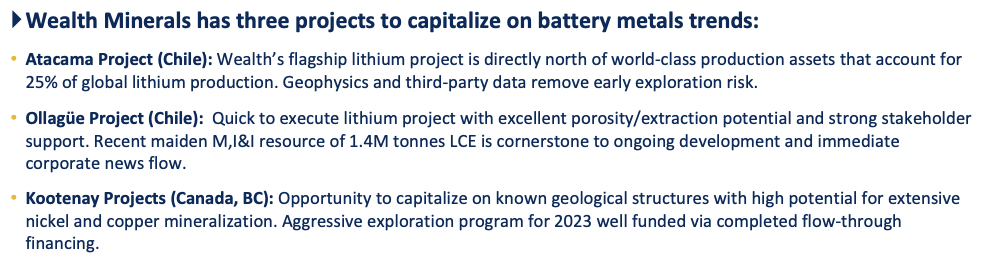

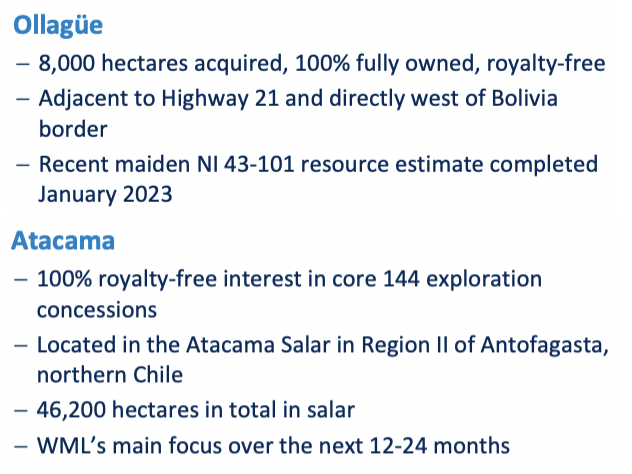

I believe Wealth Minerals (TSX-v: WML) / (OTC: WMLLF) could finally get a seat at the table. Wealth has a strong mgmt. team, board & senior advisors set to be unleashed as a clearer picture develops in Chile. CEO/Dir. Henk van Alphen has very extensive relationships in Europe, Scandinavia & Chile in both investment & industry circles.

Exec. Dir. of Wealth Minerals Chile Marcelo Awad is literally a mining legend in S. America. He’s backed by Drobe & Foot. Newly hired CEO of Wealth Minerals Chile — Francisco Lepeley — held leading roles at Chilean companies incl. Antofagasta PLC and CAP S.A., a prominent Chilean iron ore & steel producer.

Long-time strategic advisor Tim McCutcheon is Henk’s right hand man in finding & vetting prospective partners, formulating off-take agreements & negotiating complex deals.

Advisor Gessinger has German / European OEMs & battery makers covered. Advisor Jil is a leading expert in DLE technologies, with direct experience at ALB’s operations in the Atacama salar.

Chile’s economy is stalled, but inflation is reasonably under control and the central bank has cut interest rates twice to spur business activity. Good things are happening in Chile. For example, officials are courting Japan, a country with over a dozen major OEMS + battery makers + commodity trading giants (Hanwa, Mitsui, Mitsubishi), etc.

SQM issued a US$750M, 10-yr., investment-grade, “green” bond. Teck Resources is finishing up the funding of its giant Chilean, 60%/40% Teck/Sumitomo Quebrada Blanca copper project. BYD, Tesla & Rio Tinto have all announced new initiatives in Chile.

In another sign that lithium is front & center, Codelco, acquired Lithium Power Intl. to consolidate the promising Maricunga salar. This deal could have been done years ago, but only recently did Codelco gain the confidence to proceed. French mining conglomerate Eramet just announced a $144M lithium deal in Chile.

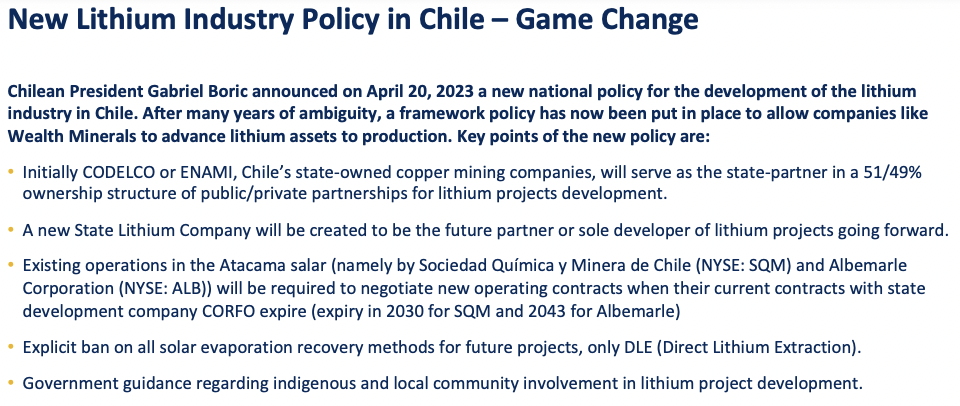

What sparked this improved sentiment? Boric announced a politically bold plan to move lithium development forward. The proposed policy seeks “majority control” of production. Bloomberg & Reuters wasted no time in declaring, Chile is looking to nationalize its lithium sector!! {corp. video on Chile’s Lithium news}

However, it’s clearly not nationalism. Chile already controls all lithium production by owning the mining licenses that ALB & SQM operate under. Those companies are contract miners hired by State-owned agency CORFO.

In order to benefit Chile (and his administration), more lithium mines have to open, but to placate populist constituents, he needs to sound tough on mining companies, especially foreign ones.

These new developments could enable Wealth to break the ALB/SQM lithium duopoly. Partnerships will be formed between juniors like Wealth & State-sponsored companies like ENAMI (National Mining Company of Chile).

Once tied to a State-approved company, Wealth can partner with an industry leader, most likely a significant auto or Li-ion battery maker.

OEMs active in sourcing their own raw materials include; Tesla, BYD, Volkswagen, Stellantis, GM, Ford, Nio, Honda, Mercedes-Benz, Renault Group and BMW, plus battery makers; CATL, LG Energy Solution, Panasonic, SK On and Samsung SDI.

Others investing directly into battery materials include; Umicore, POSCO, Glencore, BASF, Hanwa and Mitsui.

This exciting opportunity presents itself because ALB & SQM are becoming production constrained. SQM’s license under CORFO expires in 2030, and both are prohibited from increasing the rate at which they pump brines from the Atacama salar.

Therefore, recoveries need to increase, but that doesn’t come easy or cheap. Will Wealth hand over a 51% interest in its projects? Even it does, it will remain the operator and retain the lion’s share of profits. Partnerships can be structured to achieve any desired outcome.

Perhaps Wealth could claw back some of the economics by charging the newly-formed partnership an 16% operating fee, [49%+16% = 65%]. That, and other negotiated mechanisms, could boost Wealth’s true economic participation to 80%-90%.

In 2018, a MOU for a 90%/10% Wealth Minerals Chile/ENAMI JV was announced. Politics derailed the initiative, but the proposed 10% ENAMI free-carried interest could be indicative of things to come.

Wealth maintains substantial leverage in negotiations because, unlike ALB/SQM, the Company owns its licenses outright. How much might Wealth’s Atacama project be worth?

As senior advisor McCutcheon says, this project is a valuable call option on long-term demand for lithium. A call option on a project that could eventually be worth billions of dollars.

Readers are reminded that next door in Argentina, five lithium brine transactions since 2018 ranged from $500M to over $1 billion. Wealth’s valued at $70M.

Admittedly, it’s bold to look at such tremendous peer grade comparisons, {see below} but those figures are the closest analog, both geologically & geographically. If drill results show lithium values half as strong, that would be a Top-5% (brine) grade anywhere else in the world.

The Atacama project, at 46,200 hectares, within ~50 km (north) of ALB/SQM, is larger than several entire salars hosting peer prospects in Chile & Argentina, roughly the size of Edmonton or Winnipeg.

I see no reason why Wealth’s Atacama project could not be worth $3 billion like Ganfeng’s/Lithium Americas’ Cauchari-Olaroz recently started operation in Argentina.

In fact, if Wealth’s Atacama hosts very high grade like its big neighbors to the south, a valuation above $3 billion late this decade can’t be ruled out. In the meantime, it’s arguably worth a multiple of Wealth’s entire valuation of $70M. Especially if/when lithium juniors come back in favor and if/when Wealth secures a strategic partner.

In recent years, with progress on the lithium front stalled in Chile, no one was thinking about the potential value of Wealth’s Atacama project. That could change in a heartbeat. A recent Bloomberg article reported that more than 50 firms want in on new lithium opportunities post President Boric’s April proclamation.

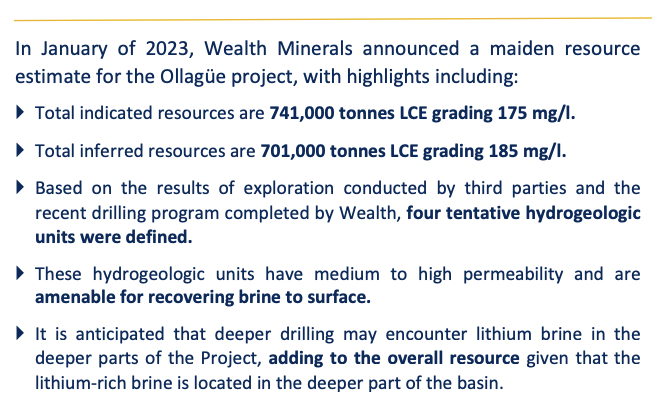

Lithium Chile confirmed that it has received numerous indications of interest from third parties on a number of its Chilean properties. With respect to Ollagüe’s potential valuation, Lithium Power Intl. (“LPI“) was recently acquired by Codelco for $340M. That company’s Maricunga project has an after-tax NPV of $1.8B.

LPI’s Maricunga was transacted at ~19% of its after-tax NPV. Is [19% of $1.8B = $340M] a good comp for Wealth’s Ollagüe project? Both are in Chile facing similar permitting, regulatory, funding & infrastructure risks, but LPI’s project is years ahead.

To make the comparison more palatable, I discount the $340M figure back three years at 8%/yr. to get $270M and divide that by two to account for equity dilution along the way — bringing the read-through valuation to $135M.

Another recently acquired brine project company is Alpha Lithium, which was taken out for ~$300M by Tecpetrol. Alpha’s project in Argentina has a PEA with a NPV of $2.4B. The takeout valuation was ~13% of NPV. The average takeout valuation, as it relates to NPV, for LPI (19%) & Alpha (13%) = 16%.

A PEA on Ollagüe is expected next quarter. If one multiplies the after-tax NPV in the upcoming PEA by 16%, that could be a reasonable read on Ollagüe’s valuation. As a rough estimate of what the PEA might look like, consider Grounded Lithium’s NPV of $1.35B @ 9,685 tonnes/yr. over 20 years.

Standard Lithium’s $756M NPV @ 5,700 tonnes, 25 years (Phase 1). Lithium Chile announced a $1.6B NPV for 19 years @ 25,000 tonnes/yr. LithiumBank Resources a $2.3B NPV, 31,350 tonnes/yr. for 20 years. Ollagüe is targeting 20,000 tonnes/yr.

Based on these four comps, I believe it’s reasonable to think that Ollagüe’s after-tax NPV will be at least $1.0B. If true, 16% of that figure would be $160M. Investors in Wealth Minerals (TSX-v: WML) / (OTCQX: WMLLF), valued at ~$70M, are covered two times over by Ollagüe alone, and get the 46,200 hectare Atacama project for free.

The timing of major milestones like drilling the Atacama project and securing a strategic partner remains uncertain. However, the past six months have provided a number of positive signals for investors in Chile’s massive lithium sector.

2024 should be a transformative year for Chile and for Wealth Minerals. Investor fatigue is a powerful force, but it offers a compelling risk/reward opportunity at $0.22.

{corp. video on Chile’s Lithium news}

Disclosures: The content of this article is for information only. Readers understand & agree that nothing contained herein, written by Peter Epstein of Epstein Research [ER], (together, [ER]) about Wealth Minerals, incl. but not limited to, commentary, opinions, views, assumptions, reported facts, calculations, etc. is to be considered implicit or explicit investment advice. Nothing contained herein is a recommendation or solicitation to buy or sell any security. [ER] is not responsible under any circumstances for investment actions taken by the reader. [ER] has never been, and is not currently, a registered or licensed financial advisor or broker/dealer, investment advisor, stockbroker, trader, money manager, compliance or legal officer, and does not perform market-making activities. [ER] is not directly employed by any company, group, organization, party, or person. The shares of Wealth Minerals are highly speculative, not suitable for all investors. Readers understand and agree that investments in small-cap stocks can result in a 100% loss of invested funds. It is assumed and agreed upon by readers that they will consult with their own licensed or registered financial advisors before making investment decisions.

At the time this article was originally posted, Peter Epstein owned shares, options or warrants in Wealth Minerals, and the Company was an advertiser on [ER].

Readers should consider me biased in my view of the Company. Readers understand and agree that they must conduct their own due diligence above and beyond reading this article. While the author believes he’s diligent in screening out companies that, for any reason, are unattractive investment opportunities, he cannot guarantee that his efforts will (or have been) successful. [ER] is not responsible for any perceived, or actual, errors including, but not limited to, commentary, opinions, views, assumptions, reported facts & financial calculations, or for the completeness of this article or future content. [ER] is not expected or required to subsequently follow or cover events & news, or write about any particular company or topic. [ER] is not an expert in any company, industry sector, or investment topic.

![Epstein Research [ER]](http://EpsteinResearch.com/wp-content/uploads/2015/03/logo-ER.jpg)