The lithium (“Li“) spot price in China (for battery-quality Li carbonate) is up +21% from a low of 95,500 yuan/tonne =~US$13.2k/t, to 115,500 yuan/t = ~$16k, (investing.com, 3/18/24). In 4th qtr. 2022, this spot price soared above $83k/t. Have we bottomed? It seems likely, but who knows? March has delivered some promising headlines…

Last week, the Chairman of Ganfeng Lithium said that US$17-$32k/t might be a sweet spot for both producers & end users. I believe the average price over the next 10 years could be between $20-$30k/t, as periods below $20k/t are offset by periods above $25-30k/t.

SQM has reported average quarterly contract prices for its battery-quality Li carbonate from Chile for many years. SQM’s trailing 1-yr., 3-yr., 5-yr. & 7-yr. averages are $32.5k, $31.0k & $22.1k/t & $20.0k/t. Those levels are a lot less volatile.

Lithium bears might point to SQM’s average price in 2017-18 of $14,650/t as a sign of things to come, but cumulative mining cost inflation has been +50% since then (World Gold Council as a proxy). Most Li projects have been slowed or outright stalled for the past 6-9 months due to lack of funding. This means less supply and higher prices down the road.

There has been a lot of concern over EV demand, has it stalled? No, its rate of growth is slowing. Demand for higher-priced EVs is under pressure, but lower-priced models are still doing quite well. In 2023, Tesla sold 8x as many EVs as Ford & GM combined. China’s BYD, Li Auto & SAIC, and Tesla, are the ones to watch.

Even if EV sales disappoint, Li demand from grid-scale energy storage systems is robust. The IEA forecasts a major increase to ~530k tonnes Li carbonate equiv (“LCE“) per year in 2030, ~15-16% of total market demand for LCE. Not all analysts are tracking this segment as closely as they should.

Beyond Lithium (CSE: BY) / (OTCQB: BYDMF) has accomplished more in the past 7-8 months than most Li peers, and on a very small budget. It has just 36.7M shares outstanding and no warrant/option overhang. Yes, like most junior miners, Beyond needs to raise capital to drill. That could come from a conventional “hard dollar” equity raise.

It could also come as a flow-through or charity flow-through private placement, which is typically less dilutive. It’s also possible that management raises a few million dollars at the project level on one or more projects. There would be no new shares issued in that scenario.

After meeting with CEO Allan Frame, Co-Founder & Capital Markets Advisor Alain Lambert & VP of Exploration Lawrence Tsang at PDAC, I’m as bullish as ever. To say that they were busy at the annual metals & mining conference would be a gross understatement.

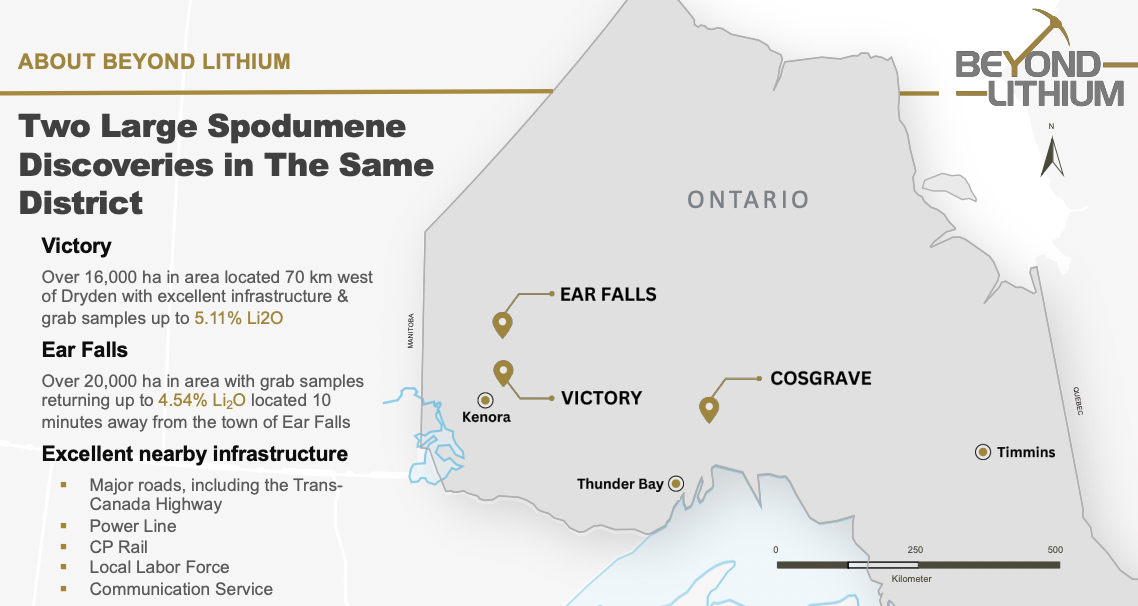

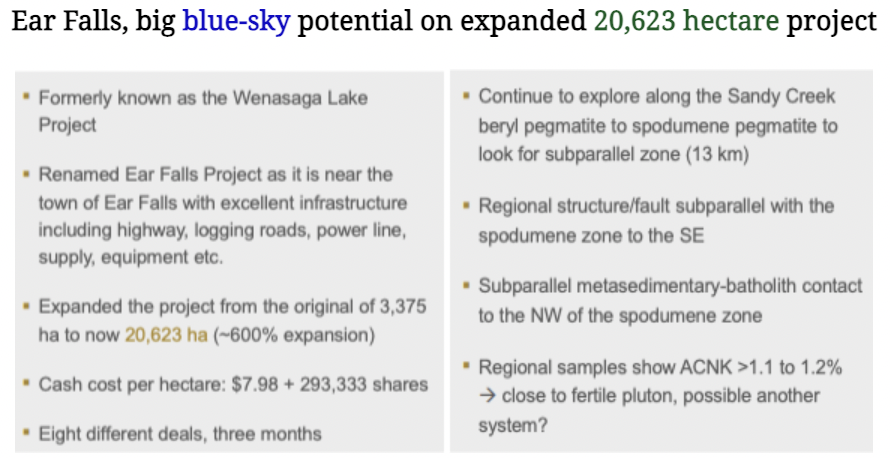

In a recent press release, management explained plans to advance four primary projects; Ear Falls Spodumene (20,623 ha), Victory Spodumene (16,682 ha), Cosgrave Lake (8,993 ha), and Wisa Lake (6,666 ha). The fact that there are (so far) four promising projects and the valuation is just $5.5M is insane.

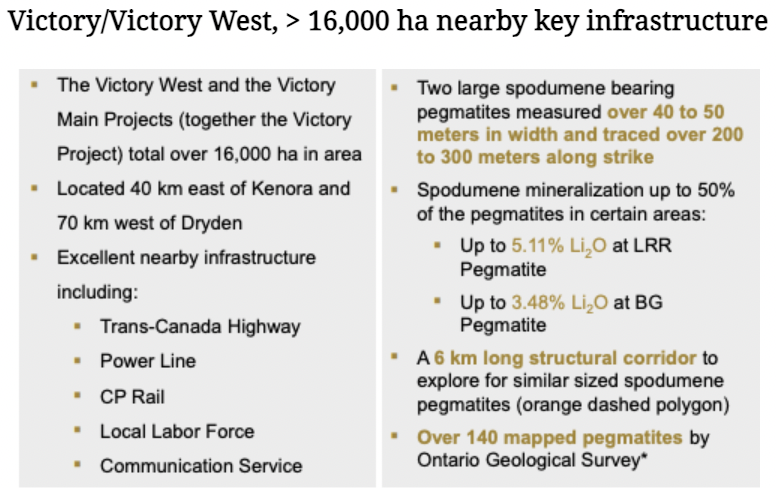

Its Victory & Ear Falls projects host high-grade grab samples including up to 5.11% Li2O at Victory and 4.54% Li2O at Ear Falls. Ear Falls has 13 km of prospective strike length, and Victory 6 km.

The primary projects are near infrastructure including; roads, the trans-Canada highway & railway, a powerline, and a nearby town with a workforce, services & equipment.

As discussed in Company podcasts, due to a combination of limited accessibility, unfavorable geological setting for lithium-cesium-tantalum (“LCT“) pegmatites, and lack of elevated background geochemical signature, 15 properties, and probably more over time, are being dropped.

Importantly, many properties are still being evaluated. And, the Company could stake or option entirely new properties. Multiple JV, farm-out, or divestiture discussions with interested parties have been underway for several months.

As an example, Australian-listed Patriot Lithium signed a deal for ~$130k (current value) in shares + a $2.5M earn-out to Beyond if Patriot delineates 20M tonnes at 1.00%+ Li20. In addition, management is talking with larger and MUCH larger companies about funding one or more of the four main projects.

The submission of exploration permits for Ear Falls & Victory has been made. Each application is for 30 drilling sites & 20 stripping locations. Each drill site is designed to drill multiple holes.

Subject to raising just $1 or $2M, drilling could start in May. Management pointed out that cash payments due on March 30th for the Ear Falls, Cosgrave & Wisa projects total just ~$97,900, and the next option payment for Victory is not due until October.

The spodumene-bearing pegmatites at Victory are five km apart along a six km exploration corridor. They measure 40-50 m wide by 200-300 m long. In addition to further drilling at Ear Falls, a maiden drill program at Victory is planned. The property includes two spodumene-bearing pegmatites, Bounty Gold & Last Resort.

A rail line, highway & power line run east/west along the southern border of Victory. In certain areas, spodumene has been observed to cover up to 50% of the pegmatite. The Dryden-Ear Falls region is emerging as a Li hub, with a favorable geological setting for Li, Cesium, and Tantalum (“LCT”) pegmatites.

Ear Falls also has good infrastructure including highway & logging roads, power lines, services & local labor. The technical team has confirmed a 13-km exploration corridor with Li mineralization. A total of 205 individual pegmatite outcrops have been mapped along the main exploration corridor.

Seven shallow drill holes at Ear Falls (done with a small, mobile drill rig) delivered encouraging results. They averaged only 47.1 m in length, testing 200 m of the strike of an initial 1,500 m of trend (on 13 km of overall strike length), but 6 of 7 returned Li values & ended in mineralization.

The best interval was 9.77 m @ 1.06% Li2O, incl. 3.84 m @ 2.30% Li2O. There’s potential for numerous subparallel pegmatite dykes, as drilling to date has barely scratched the surface. The program at Ear Falls this Spring will target a few holes to depths of ~300 m. And, there’s still potential to find additional outcropping pegmatites at Ear Falls.

The team now has a good initial understanding of the Ear Falls & Victory systems in terms of, “geochemistry, structure, lithology, mineralogy, size & potential”

In a recent PR, CEO Frame commented, “We plan to advance our four priority projects; Ear Falls, Victory, Cosgrave Lake, and Wisa Lake through diamond drilling + detailed mapping & sampling programs to delineate more targets for mechanical stripping & further drilling.”

It might be that Ear Falls & Victory will be drilled this year, and then all four in 2025 (plus others). VP of Exploration Tsang added, “We continue to evaluate promising lithium projects in prolific districts like the Superb Lake, Gathering Lake, Case Lake District, and Mavis Lake districts.”

Beyond Lithium (CSE: BY) / (OTCQB: BYDMF) has a tremendous technical team, a large land position in Ontario, four exciting projects (so far), and two drill programs expected this year. Management is in numerous discussions on ways to move forward. Even in a terrible junior miners market, interest in Beyond’s projects is high.

At a valuation of just $5.5M (C$0.155/shr.) on 36.7M shares, this week could be a good entry point. Granted, I’ve been bullish on this company at higher prices, but it’s impossible to call a bottom. Averaging down could be an attractive option for those who understand & accept the high level of risk and have a favorable longer-term view on Li demand.

Disclosures: The content of this article is for information only. Readers fully understand and agree that nothing contained herein, written by Peter Epstein of Epstein Research [ER], (together, [ER]) about Beyond Lithium, including but not limited to, commentary, opinions, views, assumptions, reported facts, calculations, etc. is not to be considered implicit or explicit investment advice. Nothing contained herein is a recommendation or solicitation to buy or sell any security. [ER] is not responsible under any circumstances for investment actions taken by the reader. [ER] has never been, and is not currently, a registered or licensed financial advisor or broker/dealer, investment advisor, stockbroker, trader, money manager, compliance or legal officer, and does not perform market-making activities. [ER] is not directly employed by any company, group, organization, party or person. The shares of Beyond Lithium are highly speculative, not suitable for all investors. Readers understand and agree that investments in small-cap stocks can result in a 100% loss of invested funds. It is assumed and agreed upon by readers that they will consult with their own licensed or registered financial advisors before making investment decisions.

At the time this article was posted, Beyond Lithium was an advertiser on [ER] and Peter Epstein owned shares and/or stock options in the company.

Readers understand and agree that they must conduct diligence above and beyond reading this article. While the author believes he’s diligent in screening out companies that, for any reason whatsoever, are unattractive investment opportunities, he cannot guarantee that his efforts will (or have been) successful. [ER] is not responsible for any perceived, or actual, errors including, but not limited to, commentary, opinions, views, assumptions, or reported facts.

![Epstein Research [ER]](http://EpsteinResearch.com/wp-content/uploads/2015/03/logo-ER.jpg)