In my last article on Outcrop Silver & Gold (TSX-v: OCG) / (OTCQX: OCGSF), I discussed the possibility of a significant move higher in the gold (“Au“) price, and a larger gain in the silver (“Ag”) price due to a reversion of the gold: silver ratio from an elevated 90:1 towards the longer-term average of 65:1. I asked, how likely is $2,200/oz. Au?

Six weeks later, the April futures contracted briefly topped $2,200/oz. before falling back ~$50/oz. It’s hardly a shock that we have reached this level, and investment banks are starting to change their thinking. Importantly, there’s a reason for a tightening in the Au: Ag ratio (which hasn’t happened yet).

China added more solar capacity in 2023 alone [217 gigawatts. +148% over 2022] than any other country’s total installed capacity. Globally, renewable power increased by 50%, [95% solar + wind]. And, three-quarters of that 95% figure came from solar.

Each gigawatt of solar requires ~600k ounces of Ag. If China’s solar capacity increases +30% this year, an additional 282 gigawatts vs. 217 in 2023, it would consume ~170M ounces, ~14% of the world’s Ag demand!

Wind power has had a terrible 18 months due to project delays & cost blowouts. At the margin, fewer wind installations will drive incremental solar adoption.

According to the Silver Institute, demand in 2024 will be 1.2B, vs. supply of 1.0B ounces. That assumes no delays or shortfalls from new & expansion initiatives in Mexico, Chile & Russia (Russia was the 6th largest producer of Ag in 2022, it’s struggling).

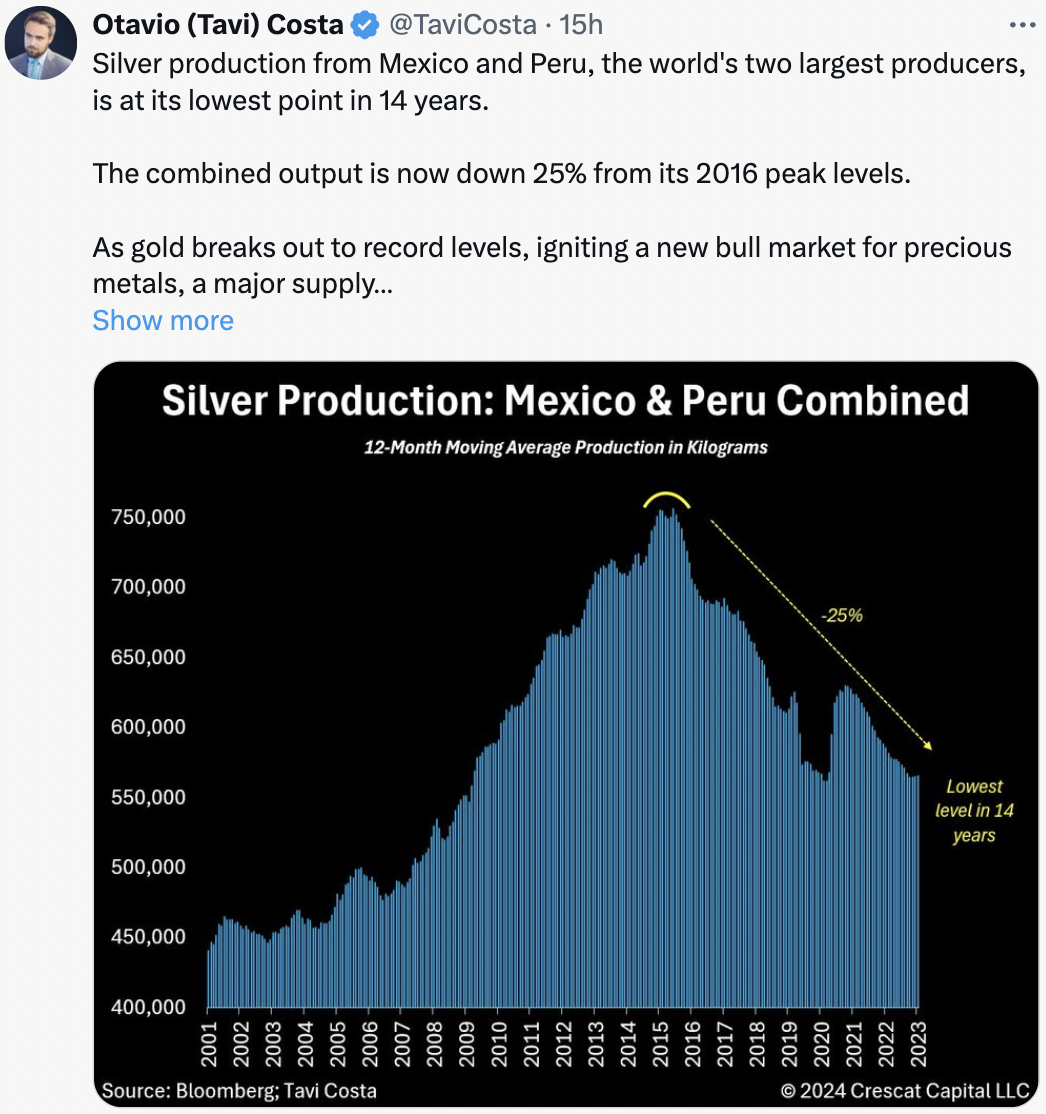

How has supply been lately? This post on X/Twitter {above} shows that for Mexico & Peru, (combined) the two largest Ag producers on Earth, the 12-month moving average of Ag production is down 25% from its 2016 peak. That’s a staggering statistic. It’s no wonder that we are in year #4 of a mined Ag deficit.

Astute readers are no doubt wondering why, after years of deficit, more Ag hasn’t come online. The problem is that ~80% of mined silver comes as a byproduct of gold or base metals. Therefore, a rise in the price of Ag doesn’t make an otherwise unprofitable Au mine profitable.

Few, if any, companies are holding back Ag waiting for a higher price… they are producing it. This is critically important to understand as it means even a rise in the Ag price from today’s ~$25/oz. to $40/oz. would not necessarily result in a large wave of Ag supply.

Therefore, since the supply of silver is highly inelastic, primary Ag projects benefit most from an increase in the Ag price. Today’s Ag price of ~$25/oz. is absurdly cheap vs. the inflation-adjusted price of ~$84/oz. for the entire year of 1980. This makes no sense, especially as all-in-sustaining costs for precious metal miners have been rising 10%+/yr. since 2020.

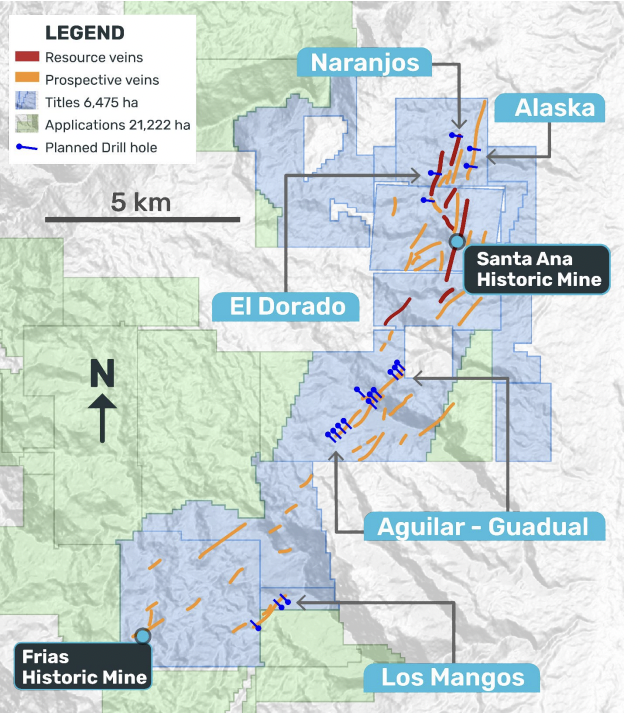

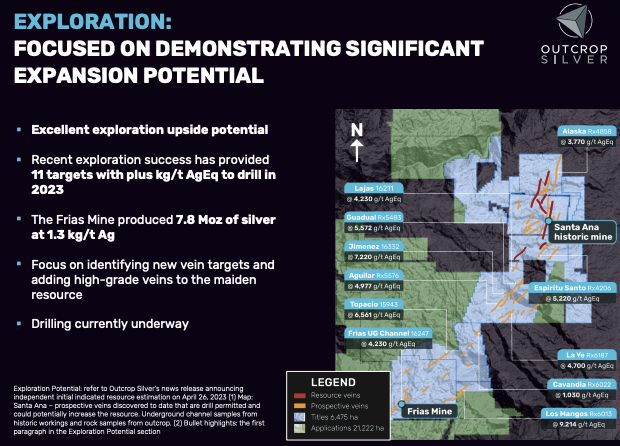

Outcrop Siver & Gold offers an attractive risk/reward proposition with an enterprise value, {market cap – cash + debt} of $44M at $0.17/shr. {see new corp. presentation}. As seen in the map above, Outcrop’s 100% Santa Ana project could be of keen interest to Zijin Mining & Aris Mining, both have meaningful operations nearby.

B2Gold & Collective Mining also have Au assets in Colombia. Even if too small for Zijin, perhaps Aris, B2Gold, or Collective Mining could acquire Outcrop to make them more attractive takeover targets. I feel strongly that a tsunami of M&A is coming in precious metals, a wave that could last years.

As proof of concept that Santa Ana’s narrow high-grade veins hold together along strike and to depth, management delivered a maiden mineral resource estimate (“MRE”) of 37.7M Ag Eq. ounces, based on drill results on seven veins. A substantial 64% of the resource is in the Indicated category.

This year’s extensive drilling is, “designed to not only expand resources in areas previously identified for their potential but also drill new targets along the 18.5 km of drill-permitted strike. The program will focus on extending mineralization along strike & down dip at El Dorado, incl. veins not in the 2023 resource estimate due to insufficient drill density. Additionally, we will explore untested veins, such as the promising Aguilar-Guadual target & Los Mangos area to the southwest, identified by numerous high-grade channel samples. This comprehensive approach aims to underscore the scalability of the Santa Ana project and its potential for substantial resource growth.

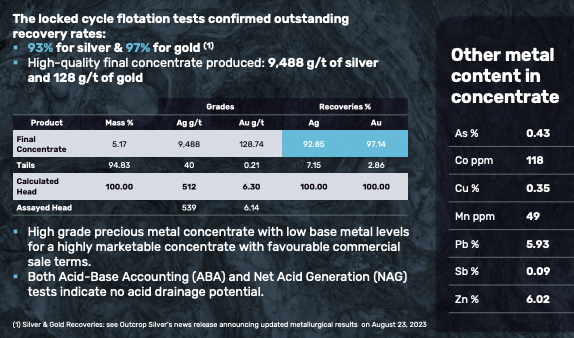

Given Outcrop’s resource is 75% Ag & 25% Au — with very low impurities — tailings from a mining operation (without leaching or cyanide) would be environmentally friendly. Santa Ana enjoys, “highway access, grid power, water, strong community support, and excellent security conditions.” This suggests permitting should be straightforward.

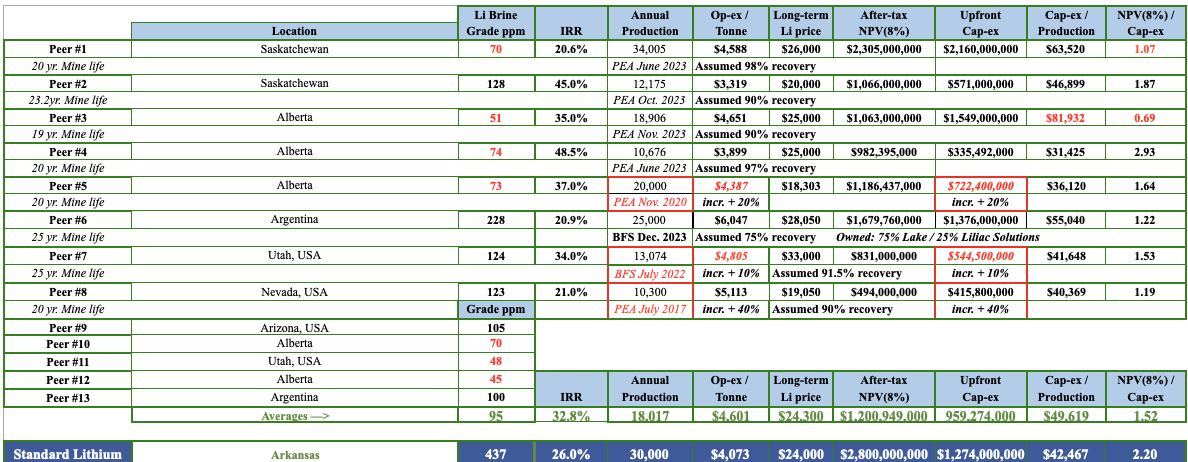

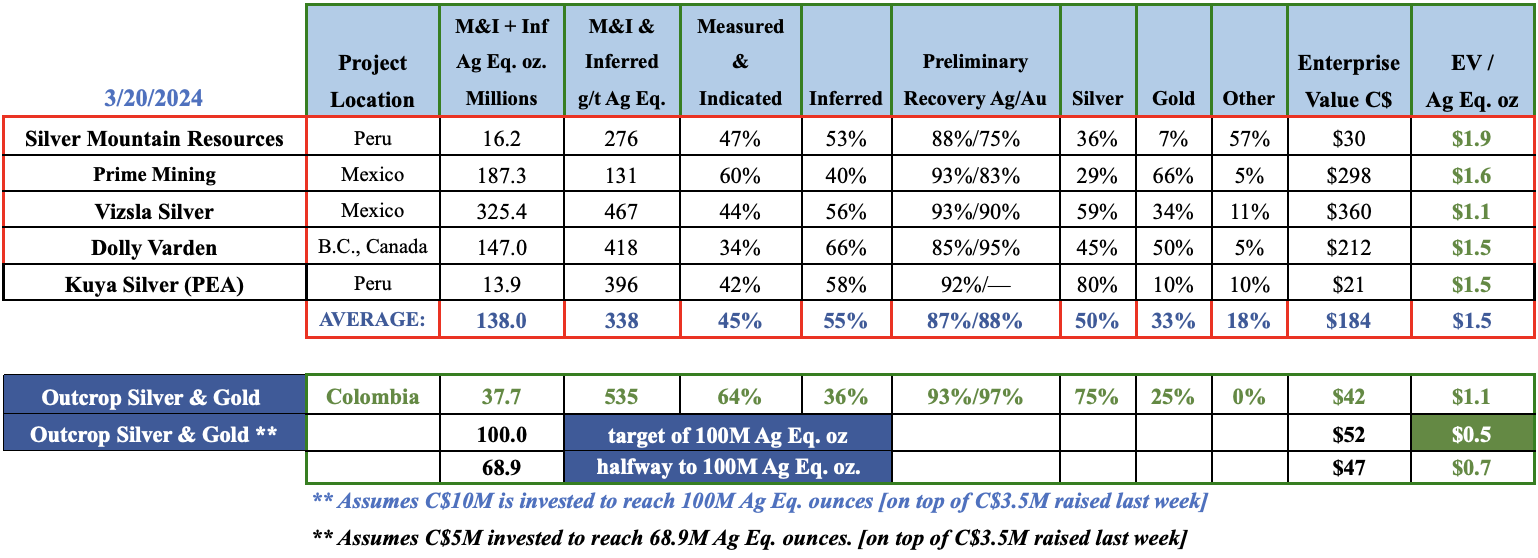

Management’s conceptual target of 100M Ag Eq. ounces is quite plausible. There are 23 mapped veins (so far), 16 of which have no ounces booked on them. Importantly, those 23 veins are found on < 25% of the entire property package. Outcrop compares favorably to other Ag-heavy juniors {see chart below}.

Dolly Varden has ~138M Ag Eq. ounces and an Enterprise Value [“EV“] {market cap + debt – cash} of ~$212M. Its flagship project is pre-PEA stage. Dolly’s $1.5/Ag Eq. oz., valuation is above Outcrop’s at $1.2/oz., or well above the $0.7/oz. level, if one gives Outcrop credit for getting halfway (68.9M Ag Eq. ounces) to 100M Ag Eq. ounces next year.

Consider that 64% of the Company’s resource is Indicated vs. 34% for Dolly, and Outcrop has better preliminary metallurgy results. Like many juniors, Dolly proposes to use cyanide, whereas Outcrop’s plans do not require it.

At 75% Ag, Outcrop is a better Ag pure-play than Dolly at 45%. Labor costs are much lower in Colombia, roughly a fifth or a sixth that of Canada (Australian & U.S. labor costs are even higher). If one assumes the Company can eventually reach 100M Ag Eq. oz. (with an estimated additional $10M worth of drilling), its EV/oz. ratio would be $0.50.

Based on the geology, structure, and geometry of the sizable Santa Ana land package, management can’t rule out an Ag Eq. resource meaningfully above 100M Ag Eq., ounces, but the initial goal is 100M Ag Eq. ounces. The timing of reaching this goal depends largely on market conditions. President & CEO Ian Harris has plenty of drill targets.

In a better market, management could step up the pace of drilling at Santa Ana. In Addition, the Company’s three other assets could be of interest. These three are 100%-owned. Could they be worth up to C$5M each next year if Au & Ag continue to climb higher?

Mallama project — Systematic sampling demonstrates that in situ mining grades in the largest accessible working of the Bombona zone show a weighted average grade of 23.3 g Au/t and 182 g Ag/t with a mean grade of 22 g Au/t.

Oribella project — A gold anomaly of ~500 m by 250 m, open in two directions. Limited hand-trenching within the soil anomaly shows 11 m @ 1.1 g Au/t in the subsurface. Argelia project — has a long mining tradition. Public records show that a private British mining company mined and produced gold on the project before 1950.

Outcrop Silver & Gold (TSX-v: OCG) / (OTCQX: OCGSF) has a lot going for it. It recently raised a few million dollars, so drilling this year is funded. Its flagship asset not only benefits from being a primary Ag project, but is also expected to produce a very clean & valuable Ag-Au concentrate.

CEO Harris calls it the trifecta — high-grade Ag Eq. with {the expectation of} high recoveries & high payables. That’s what makes Santa Ana stand out in the crowd and could make the Company a prime takeover candidate.

Disclosures: The content of this article is for information only. Readers understand & agree that nothing contained herein, written by Peter Epstein of Epstein Research [ER], (together, [ER]) about Outcrop Silver & Gold, incl. but not limited to, commentary, opinions, views, assumptions, reported facts, calculations, etc. is to be considered implicit or explicit investment advice. Nothing contained herein is a recommendation or solicitation to buy or sell any security. [ER] is not responsible under any circumstances for investment actions taken by the reader. [ER] has never been, and is not currently, a registered or licensed financial advisor or broker/dealer, investment advisor, stockbroker, trader, money manager, compliance or legal officer, and does not perform market-making activities. [ER] is not directly employed by any company, group, organization, party, or person. The shares of Outcrop Silver & Gold are highly speculative, not suitable for all investors. Readers understand and agree that investments in small-cap stocks can result in a 100% loss of invested funds. It is assumed and agreed upon by readers that they will consult with their own licensed or registered financial advisors before making investment decisions.

At the time this article was originally posted, Peter Epstein owned shares in Outcrop Silver & Gold, and the Company was an advertiser on [ER].

Readers should consider me biased in my view of the Company. Readers understand and agree that they must conduct due diligence above and beyond reading this article. While the author believes he’s diligent in screening out companies that, for any reason, are unattractive investment opportunities, he cannot guarantee that his efforts will (or have been) successful. [ER] is not responsible for any perceived, or actual, errors including, but not limited to, commentary, opinions, views, assumptions, reported facts & financial calculations, or for the completeness of this article or future content. [ER] is not expected or required to subsequently follow or cover events & news, or write about any particular company or topic. [ER] is not an expert in any company, industry sector, or investment topic.

![Epstein Research [ER]](http://EpsteinResearch.com/wp-content/uploads/2015/03/logo-ER.jpg)