Coking Coal prices have been under pressure lately, which gave me the impetus to revisit Colonial Coal (TSX-v: CAD) / (OTC: CCARF). The title of this article refers to the fact that no one seems to want to marry (acquire) or even date (make an initial bid) for Colonial’s two high-quality, hard-coking coal (“HCC“) projects in B.C. Canada!

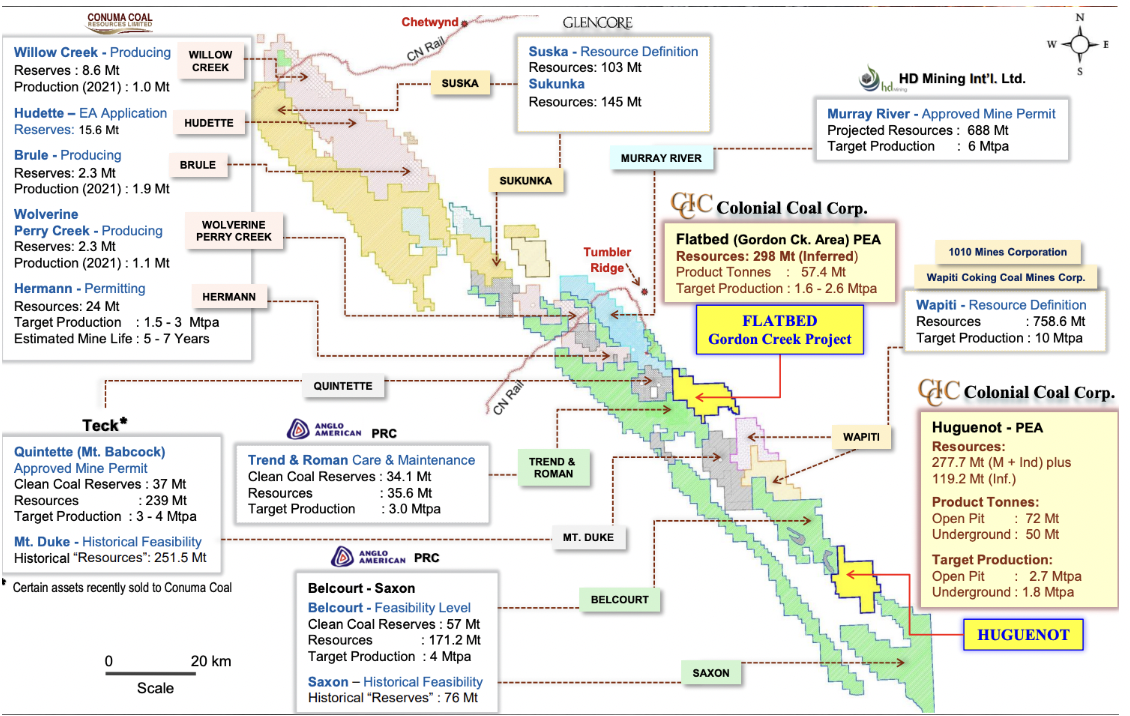

While Colonial’s projects are not permitted, and they are only at PEA-stage, the Peace River Basin is well known for its HCC quality. I’m often asked about the risk factors — environmental, permitting, caribou migration, geopolitical factors, coking coal prices, hydrogen replacement, etc. YES, there are many risks.

However, these risks are very well known to each of the roughly 20 large-to-giant companies looking at Colonial’s assets. Why would so many groups STILL be going through the data room, having meetings with management & site visits if they were not seriously interested in a possible bid? {Please see excellent CEO interview}

KEY TAKEAWAYS from CEO interview — an initial bid could come at any time, American groups in the lead, Colonial’s Board would entertain an opening bid of US$1/tonne, there are ~20 prospective bidders, nearly all have finished due diligence, the Board is close to getting a timeline in place to force bidding to commence, many interested parties are hiring consultants, (signaling serious interest), failed bidders for Teck’s assets now looking at Colonial Coal, the Premier of B.C., David Eby, has recently made public statements in favor of coking coal in B.C….

I don’t mean to minimize the risks, but I strongly believe that prospective bidders would greatly prefer dealing with these mine development challenges in western Canada rather than coking coal regions like China, Mongolia, Africa, Colombia & Russia.

A major transaction, the sale of Teck Resources’ B.C. coking coal assets & liabilities is nearing a final closing. CEO/Chairman David Austin explicitly stated in this week’s interview that companies that did not prevail in acquiring Teck’s operations are now looking at Colonial Coal.

This is hugely significant as those groups are presumably comfortable with B.C. mining risks. Importantly, CEO/Chairman David Austin has agreed to help the acquirer(s) go through permitting & maintain strong First Nation relations.

Austin has maintained strong relationships with key First Nation communities for over a decade. He & his team speak with key groups multiple times a month. First Nations are in favor of developing Flatbed & Huguenot.

This is a management team with very extensive experience. They are specialists in M&A, with strong contacts in China, India, Korea, the U.S., Canada & Australia, and ties to many major companies around the world. CEO Austin sold Western Coal & NEMI at the top of the market in 2011 for over US$3B.

Few, if any, know more about the B.C. coking coal market than Mr. Austin & COO/Dir. John Perry. Meanwhile, Dir. Partha Bhattacharyya is former Chairman of Coal of India, the largest coal company on earth, and Dir. Greg Waller worked for Teck Resources for > 20 years, retiring as SVP.

Each tonne in the ground is valued by the market at ~US$0.45. Yet, shareholders believe a transaction could happen at US$1.50-$2.50/t. In the bull market of 2010-11, many groups in the data room today watched properties trade hands at US$2-$4/t.

Even if stakeholders are very disappointed with a transaction at US$1.00/t, that would still result in a double in the valuation. In my view, the shares of Colonial Coal have tremendous upside COMBINED WITH minimal downside. And, this investment has exhibited a very low correlation to overall stock markets.

Coking coal prices remained at fairly strong levels last year, between ~$200-400/tonne out of Australia, and in China. 2023 was less volatile than in 2021-22, when prices topped $600/t in China and soared above $650/t FOB in Australia. The lows of 2021-2022 were sub-$200/t.

Steel companies operating blast furnaces in China, India, Japan, South East Asia, Korea, Europe & Brazil hate wild price swings in coking coal & iron ore. That’s why they lock in long-term contracts with companies in Australia, Canada & the U.S.

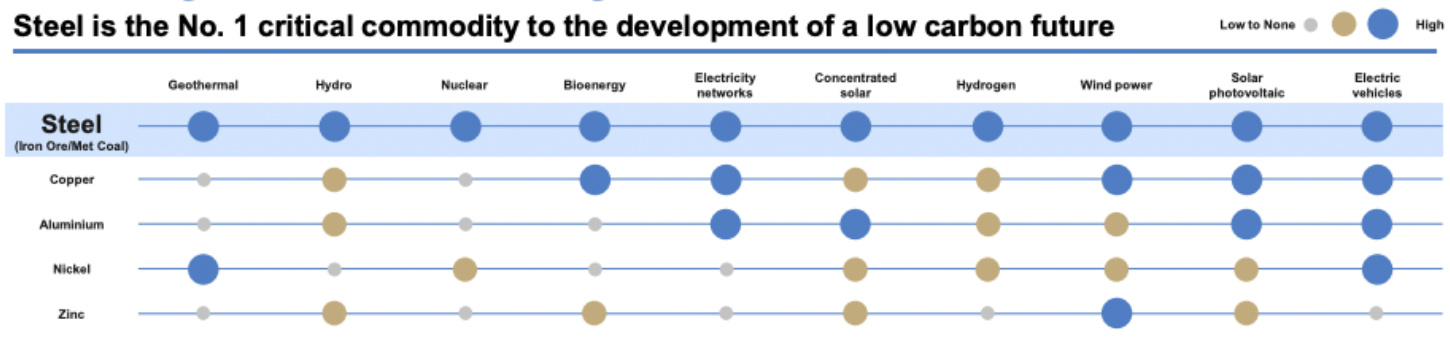

Importantly, the world’s largest steelmakers are highly reliant on two things 1) consistent, high-quality HCC, and 2) secure delivery of said coal via the seaborne coking coal market. There are several varieties of coking coal including; premium hard (“PHCC“), hard, semi-soft & PCI. Ninety-four percent of Colonial Coal’s endowment is either HCC or PHCC.

This is critically important because HCC & PHCC are needed for optimal blending capabilities with lesser-quality coals. HCC offers substantial benefits in terms of efficiency, quality, environmental impact & operational stability. It produces coke that has higher strength so it can withstand higher furnace pressure, leading to higher steel output.

HCC has higher energy efficiency, resulting in lower greenhouse gasses & dust, and HCC has less ash & sulfur. Fewer impurities lead to cleaner steel with better mechanical properties. HCC is what everyone wants, so mine producing HCC will be the last to shut down.

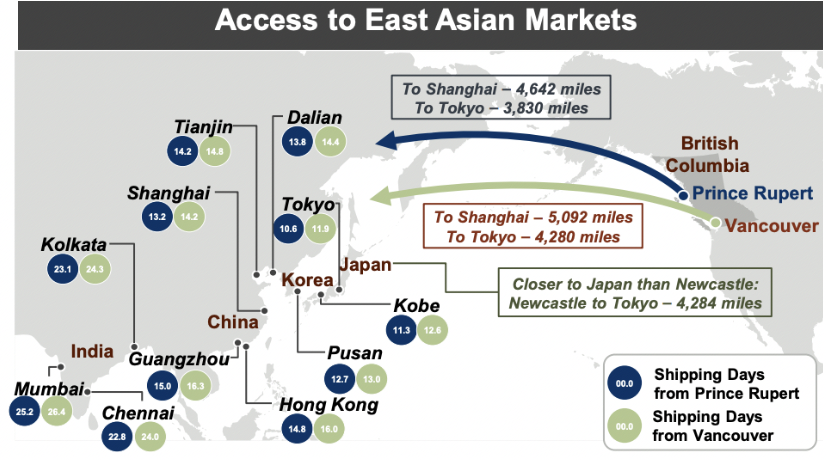

Major ports in China, Korea, HK, India & Japan — that’s where the blast furnaces are!

Blending utilizes a wider range of coals, improving overall efficiency & blast furnace economics. Management believes its HCC would sell at Australia’s Peak Downs Index price (minus US$5-$15/t).

I mentioned earlier that the seaborne market is critically important for HCC delivery to steel mills. One look at the map above shows why, all the blast furnaces are located near seaports (to receive iron ore & HCC). In most cases, it’s cost and/or logistics-prohibitive to get HCC overland, so Asian steelmakers have no other choice.

Australia is by far the largest exporter of HCC, but its exports have been flat to down for years, largely due to supply disruptions caused by bad weather in Queensland, but also cost inflation, labor shortages, rail/port bottlenecks & onerous royalties.

A new top royalty rate of 40% for coal priced > $300/t is making producers BHP & Glencore think twice about expansion plans. In the U.S., coal production (both thermal & coking) is frowned upon by “coastal elites.”

The U.S. has always been considered a swing producer, only exporting meaningful tonnage when prices are high. Neither America’s east coast coking coal giants, nor Queensland’s, are likely to expand production robustly.

If Big names in coking coal can’t or won’t grow, imagine what it must be like for mid-tier & small producers — saddled with high regulatory, safety & compliance burdens — spread across fewer tonnes sold… Queensland’s Bowen Basin and Canada’s Peace River basins will be the very last to shut down.

It seems that only western Canada can deliver long-term, secure HCC supply that could grow very meaningfully with the addition of Colonial’s two projects, (and others in B.C.). Readers are reminded that the Company has 695M tonnes of resources (not reserves).

In recent months India, with the same 1.4 billion population as China, has significantly stepped up its buildout plans for nuclear power plants. India’s GDP per capita is 1/5 that of China’s and India strives to close that gap. In addition to more power, India needs extraordinary amounts of steel.

India imports ~70-75M tonne of HCC per year, and that’s expected to grow by 5%+/yr. for decades. While 5% might not seem like much, remember that Australia & the U.S. are not growing anywhere near that fast, if they are growing at all.

India virtually guarantees robust demand for HCC in the seaborne market into the 2040’s-50’s, but that doesn’t mean an Indian group will be the buyer of Colonial’s assets. In addition to Chinese & Indian entities, CEO Austin’s team is talking with prospective bidders from Canada, the U.S., Japan, Korea & Australia.

Interestingly, in a recent video interview, CEO Austin said that American groups were leading the way in terms of interest in Colonial’s assets. I find that interesting because of all countries India needs HCC the most.

China already owns a few private HCC assets in B.C., but India does not. And, no Indian groups were involved in the acquisition of Teck’s coking coal operations. Given India’s considerable HCC needs, and the stated interest from American groups, the possibility of a competitive bidding process is reasonably good.

If one believes that Colonial has a truly expert team, that the Company’s assets are high-quality (94% HCC/PHCC) & large (695M tonnes of resources), that demand for top-quality HCC via the seaborne market will remain strong, that ~20 prospective bidders are NOT having meetings, site visits, etc. for the fun of it, and that the fundamental downside is very limited — then an investment in Colonial Coal (TSX-v: CAD) / (OTC: CCARF) offers a compelling risk/reward proposition.

{Please see excellent CEO interview}

Disclosures: The content of this article is for information only. Readers understand & agree that nothing contained herein, written by Peter Epstein of Epstein Research [ER], (together, [ER]) about Colonial Coal, incl. but not limited to, commentary, opinions, views, assumptions, reported facts, calculations, etc. is to be considered implicit or explicit investment advice. Nothing contained herein is a recommendation or solicitation to buy or sell any security. [ER] is not responsible under any circumstances for investment actions taken by the reader. [ER] has never been, and is not currently, a registered or licensed financial advisor or broker/dealer, investment advisor, stockbroker, trader, money manager, compliance or legal officer, and does not perform market-making activities. [ER] is not directly employed by any company, group, organization, party, or person. The shares of Colonial Coal are highly speculative, not suitable for all investors. Readers understand and agree that investments in small-cap stocks can result in a 100% loss of invested funds. It is assumed and agreed upon by readers that they will consult with their own licensed or registered financial advisors before making investment decisions.

At the time this article was originally posted, Peter Epstein owned shares in Colonial Coal, and the Company was an advertiser on [ER].

Readers should consider me biased in my view of the Company. Readers understand and agree that they must conduct their own due diligence above and beyond reading this article. While the author believes he’s diligent in screening out companies that, for any reason, are unattractive investment opportunities, he cannot guarantee that his efforts will (or have been) successful. [ER] is not responsible for any perceived, or actual, errors including, but not limited to, commentary, opinions, views, assumptions, reported facts & financial calculations, or for the completeness of this article or future content. [ER] is not expected or required to subsequently follow or cover events & news, or write about any particular company or topic. [ER] is not an expert in any company, industry sector, or investment topic.

![Epstein Research [ER]](http://EpsteinResearch.com/wp-content/uploads/2015/03/logo-ER.jpg)